please help with charts circled red!!!!!

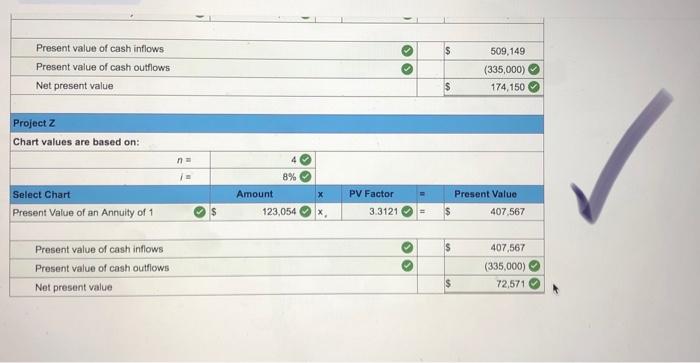

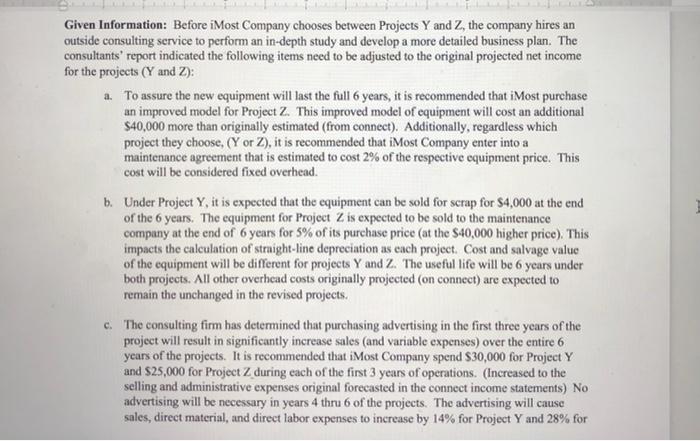

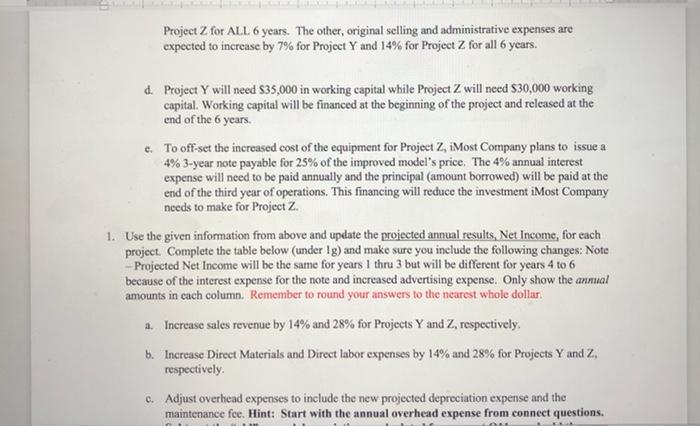

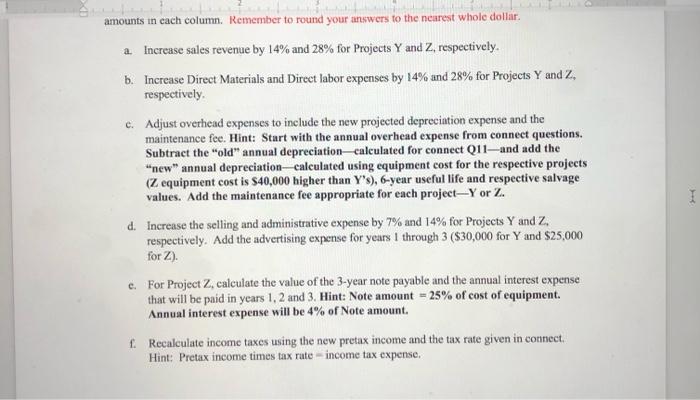

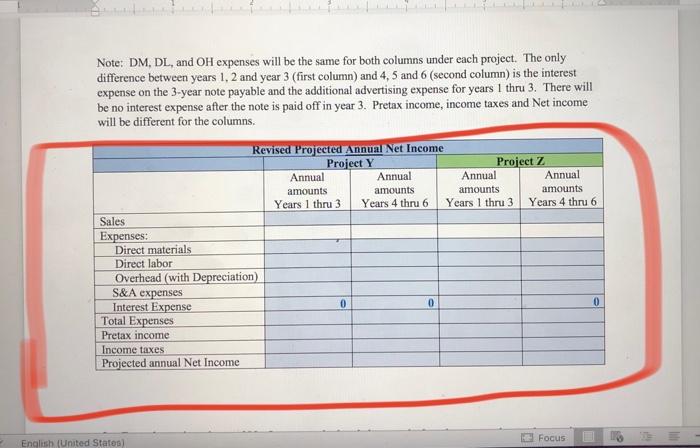

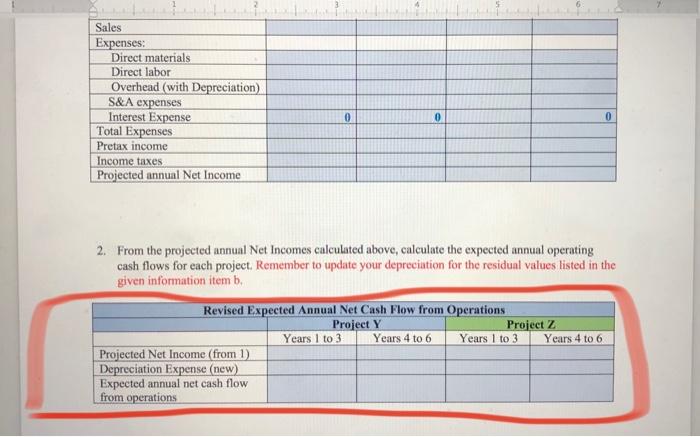

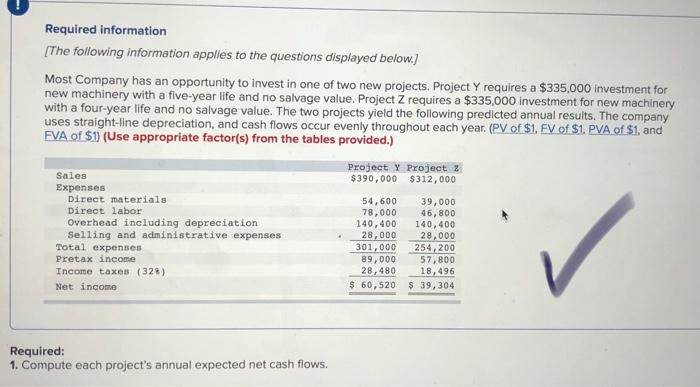

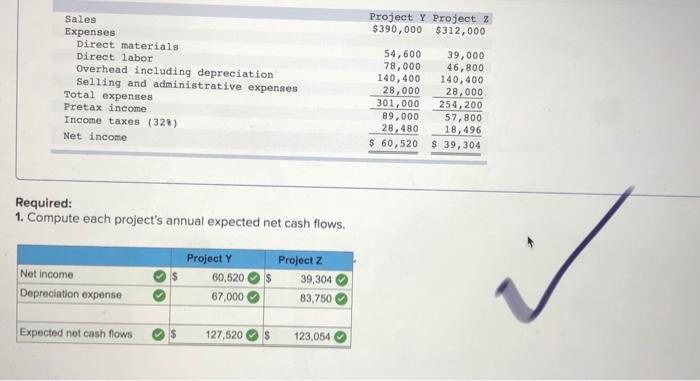

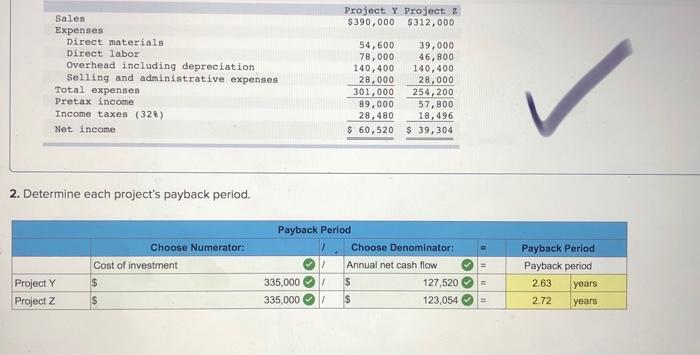

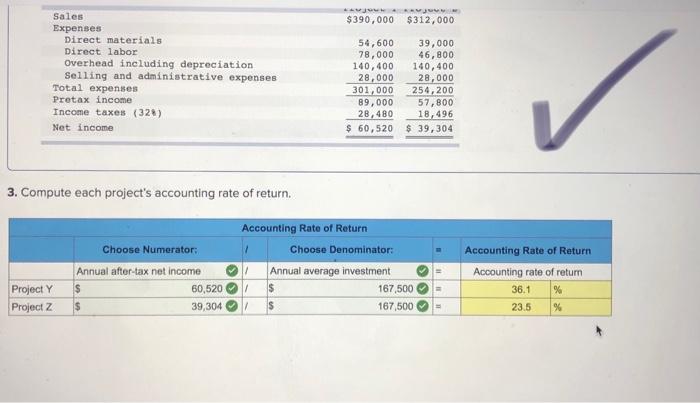

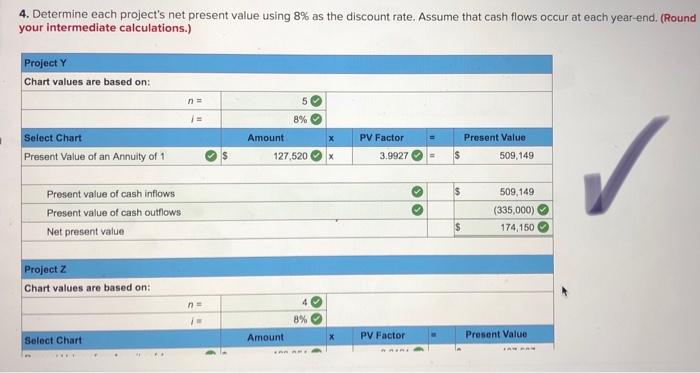

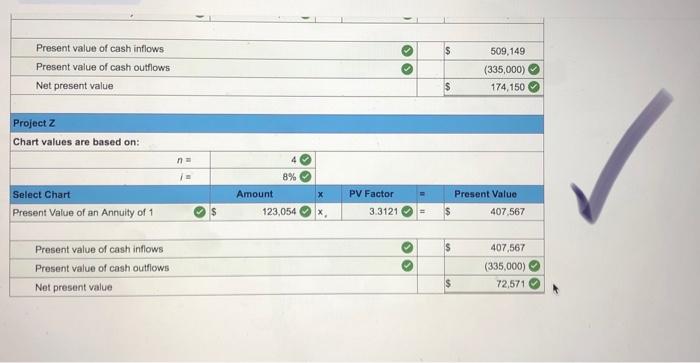

Given Information: Before i Most Company chooses between Projects Y and Z, the company hires an outside consulting service to perform an in-depth study and develop a more detailed business plan. The consultants' report indicated the following items need to be adjusted to the original projected net income for the projects (Y and Z): a. To assure the new equipment will last the full 6 years, it is recommended that iMost purchase an improved model for Project 2. This improved model of equipment will cost an additional $40,000 more than originally estimated (from connect). Additionally, regardless which project they choose, (Yor Z), it is recommended that iMost Company enter into a maintenance agreement that is estimated to cost 2% of the respective equipment price. This cost will be considered fixed overhead. b. Under Project Y, it is expected that the equipment can be sold for scrap for $4,000 at the end of the 6 years. The equipment for Project Z is expected to be sold to the maintenance company at the end of 6 years for 5% of its purchase price (at the $40,000 higher price). This impacts the calculation of straight-line depreciation as each project. Cost and salvage value of the equipment will be different for projects Y and Z. The useful life will be 6 years under both projects. All other overhead costs originally projected (on connect) are expected to remain the unchanged in the revised projects. c. The consulting firm has determined that purchasing advertising in the first three years of the project will result in significantly increase sales and variable expenses) over the entire 6 years of the projects. It is recommended that iMost Company spend $30,000 for Project Y and $25,000 for Project Z during each of the first 3 years of operations. Increased to the selling and administrative expenses original forecasted in the connect income statements) No advertising will be necessary in years 4 thru 6 of the projects. The advertising will cause sales, direct material, and direct labor expenses to increase by 14% for Project Y and 28% for Project Z for ALL 6 years. The other, original selling and administrative expenses are expected to increase by 7% for Project Y and 14% for Project Z for all 6 years. d. Project Y will need $35,000 in working capital while Project Z will need $30,000 working capital. Working capital will be financed at the beginning of the project and released at the end of the 6 years. c. To off-set the increased cost of the equipment for Project Z, iMost Company plans to issue a 4% 3-year note payable for 25% of the improved model's price. The 4% annual interest expense will need to be paid annually and the principal (amount borrowed) will be paid at the end of the third year of operations. This financing will reduce the investment iMost Company needs to make for Project Z. 1. Use the given information from above and update the projected annual results. Net Income, for each project . Complete the table below (under 1g) and make sure you include the following changes: Note - Projected Net Income will be the same for years 1 thru 3 but will be different for years 4 to 6 because of the interest expense for the note and increased advertising expense. Only show the annual amounts in each column. Remember to round your answers to the nearest whole dollar 4. Increase sales revenue by 14% and 28% for Projects Y and Z, respectively, b. Increase Direct Materials and Direct labor expenses by 14% and 28% for Projects Y and Z. respectively c. Adjust overhead expenses to include the new projected depreciation expense and the maintenance fee. Hint: Start with the annual overhead expense from connect questions. amounts in each column. Remember to round your answers to the nearest whole dollar a. Increase sales revenue by 14% and 28% for Projects Y and 2, respectively. b. Increase Direct Materials and Direct labor expenses by 14% and 28% for Projects Y and Z, respectively c. Adjust overhead expenses to include the new projected depreciation expense and the maintenance fee. Hint: Start with the annual overhead expense from connect questions. Subtract the "old" annual depreciation calculated for connect Q11--and add the "new" annual depreciation calculated using equipment cost for the respective projects (Z equipment cost is $40,000 higher than Y's), 6-year useful life and respective salvage values. Add the maintenance fee appropriate for each project-Yor Z. d. Increase the selling and administrative expense by 7% and 14% for Projects Y and Z. respectively. Add the advertising expense for years I through 3 ($30,000 for Y and $25,000 for Z). e. For Project Z, calculate the value of the 3-year note payable and the annual interest expense that will be paid in years 1, 2 and 3. Hint: Note amount - 25% of cost of equipment. Annual interest expense will be 4% of Note amount 1 Recalculate income taxes using the new pretax income and the tax rate given in connect Hint: Pretax income times tax rate-income tax expense. 1 amounts Note: DM, DL, and OH expenses will be the same for both columns under each project. The only difference between years 1, 2 and year 3 (first column) and 4, 5 and 6 (second column) is the interest expense on the 3-year note payable and the additional advertising expense for years I thru 3. There will be no interest expense after the note is paid off in year 3. Pretax income, income taxes and Net income will be different for the columns Revised Projected Annual Net Income Project Y Project Z Annual Annual Annual Annual amounts amounts amounts Years 1 thru 3 Years 4 thru 6 Years 1 thru 3 Years 4 thru 6 Sales Expenses: Direct materials Direct labor Overhead (with Depreciation) S&A expenses Interest Expense 0 Total Expenses Pretax income Income taxes Projected annual Net Income 0 0 Focus English (United States) Sales Expenses: Direct materials Direct labor Overhead (with Depreciation) S&A expenses Interest Expense Total Expenses Pretax income Income taxes Projected annual Net Income 0 0 0 2. From the projected annual Net Incomes calculated above, calculate the expected annual operating cash flows for each project. Remember to update your depreciation for the residual values listed in the given information item b. Revised Expected Annual Net Cash Flow from Operations Project Y Project Z Years 1 to 3 Years 4 to 6 Years 1 to 3 Years 4 to 6 Projected Net Income (from 1). Depreciation Expense (new) Expected annual net cash flow from operations Required information [The following information applies to the questions displayed below.) Most Company has an opportunity to invest in one of two new projects. Project Y requires a $335,000 investment for new machinery with a five-year life and no salvage value. Project Z requires a $335,000 investment for new machinery with a four-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1. EV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project X Project 2 $390,000 $312,000 Sales Expenses Direct materials Direct labor Overhead including depreciation Selling and administrative expenses Total expenses Pretax income Income taxes (32) Net income 54,600 78,000 140,400 28,000 301,000 89,000 28,480 $ 60,520 39,000 46,800 140,400 28,000 254,200 57,800 18,496 $ 39, 304 Required: 1. Compute each project's annual expected net cash flows. Project Y Project 2 $390,000 $312,000 Sales Expenses Direct materials Direct labor Overhead including depreciation Selling and administrative expenses Total expenses Pretax income Income taxes (328) Net income 54,600 39,000 78,000 46,800 140,400 140,400 28,000 28,000 301,000 254,200 89,000 57,800 28,480 18,496 $ 60,520 $ 39, 304 Required: 1. Compute each project's annual expected net cash flows. Net Income Depreciation expense Project Y 60,520 67,000 Project z 39,304 83,750 Expected not cash flows 127,520 123,054 Project Y Project z $390,000 $312,000 Sales Expenses Direct materials Direct labor Overhead including depreciation Selling and administrative expenses Total expenses Pretax income Income taxes (328) Net income 54,600 78,000 140,400 28,000 301,000 89,000 28, 480 $ 60,520 39,000 46,800 140,400 28,000 254,200 57,800 18,496 $ 39,304 2. Determine each project's payback period. Choose Numerator: Cost of investment $ Payback Period Choose Denominator: Annual net cash flow 335,000 / $ 127,520 335,000 1 $ 123,054 Payback Period Payback period 2.63 years 2.72 years Project Y Project z $ AVO $390,000 $312,000 Sales Expenses Direct materials Direct labor Overhead including depreciation Selling and administrative expenses Total expenses Pretax income Income taxes (32) Net income 54,600 39,000 78,000 46,800 140,400 140,400 28,000 28,000 301,000 254,200 89,000 57,800 28,480 18,496 $ 60,520 $ 39,304 3. Compute each project's accounting rate of return Choose Numerator: Accounting Rate of Return Choose Denominator: Annual average investment 167,500 167,500 Annual after-tax net income $ 60,520 $ 39,304 Accounting Rate of Return Accounting rate of return 36.1 % % Project Y Project Z s 23.5 4. Determine each project's net present value using 8% as the discount rate. Assume that cash flows occur at each year-end. (Round your intermediate calculations.) Project Y Chart values are based on: 5 1 = 8% Amount X Select Chart Present Value of an Annuity of 1 PV Factor 3.9927 Present Value 509,149 127,520 $ $ Present value of cash inflows Present value of cash outflows Net present value 509,149 (335,000) 174,150 $ Project z Chart values are based on: n 8% Amount Select Chart X PV Factor Present Value - $ Present value of cash inflows Present value of cash outflows Net present value 509,149 (335,000) 174,150 $ Project z Chart values are based on: n 8% Amount 123,054 Select Chart Present Value of an Annuity of 1 PV Factor 3.3121 Present Value 407,567 $ $ Present value of cash inflows Present value of cash outflows Net present value 407,567 (335,000) 72,571 $

please help with charts circled red!!!!!

please help with charts circled red!!!!!