Question

Please help with everything! The first 2 drop down boxes give the option for neither, project A, project B, or projects both A and A.

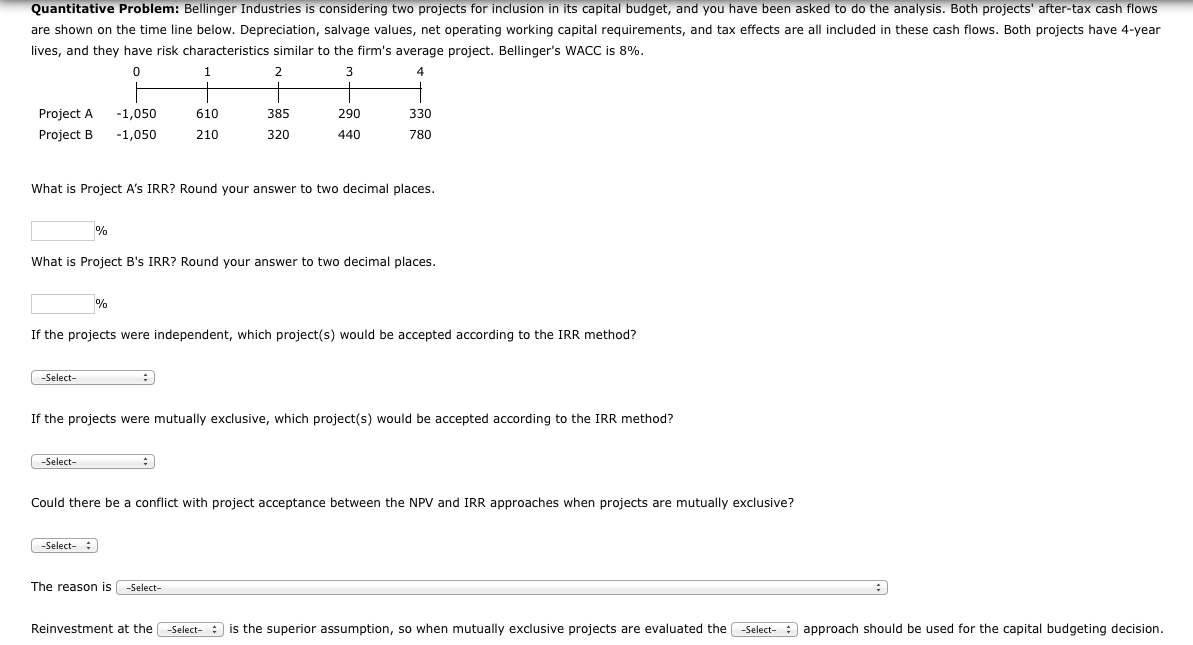

Please help with everything! The first 2 drop down boxes give the option for neither, project A, project B, or projects both A and A. The third drop down box gives the options yes or no. The 4th gives the options the NVP and IRR apporachs use the same reinvestment rate assumption so both approaches reach the same project acceptance when mutually projects are considers or the NVP and IRR approaches use different reinvestment rate assumptions so there can be a conflict in project acceptance when mutually exculsive projects are. The fifth drop box box gives the option for IRR or WACC and the last drop down box give the options of NVP or IRR. Please again help on this whole problem!

Please help with everything! The first 2 drop down boxes give the option for neither, project A, project B, or projects both A and A. The third drop down box gives the options yes or no. The 4th gives the options the NVP and IRR apporachs use the same reinvestment rate assumption so both approaches reach the same project acceptance when mutually projects are considers or the NVP and IRR approaches use different reinvestment rate assumptions so there can be a conflict in project acceptance when mutually exculsive projects are. The fifth drop box box gives the option for IRR or WACC and the last drop down box give the options of NVP or IRR. Please again help on this whole problem!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started