please help with excel and formulas with explanations please.

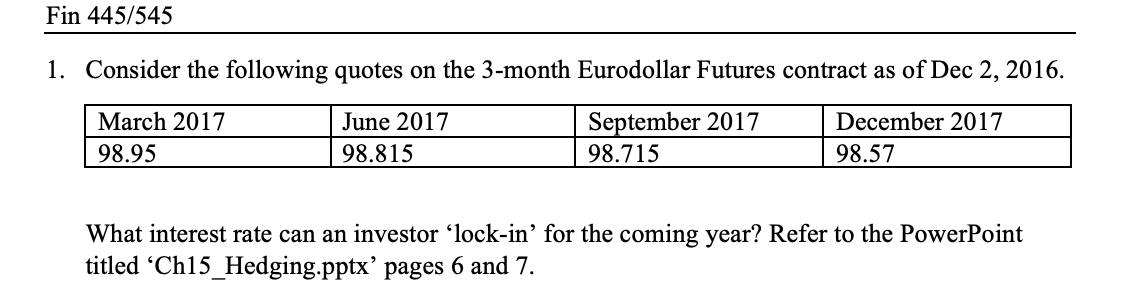

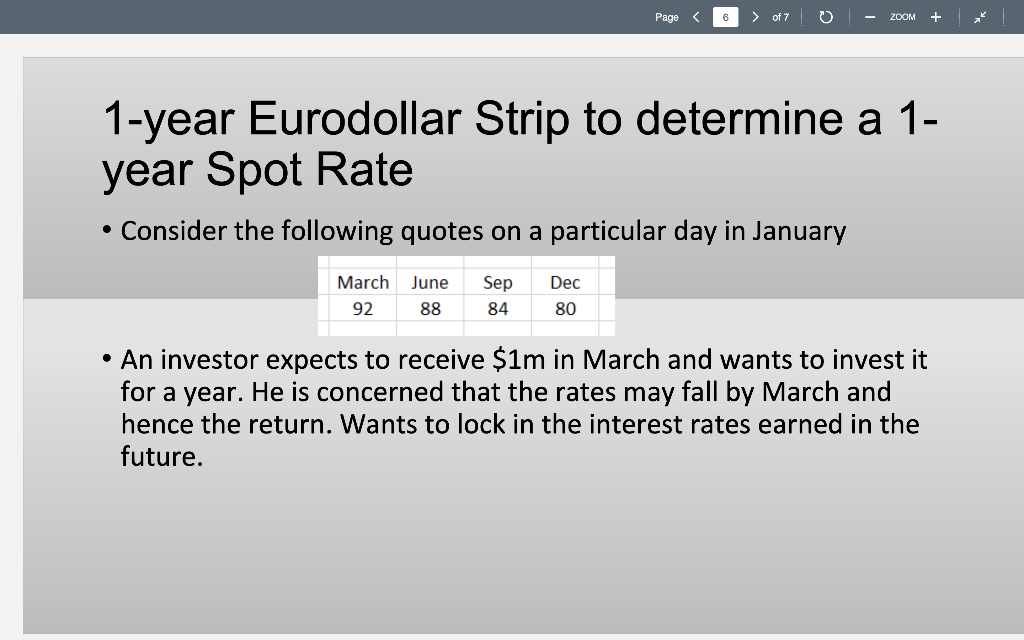

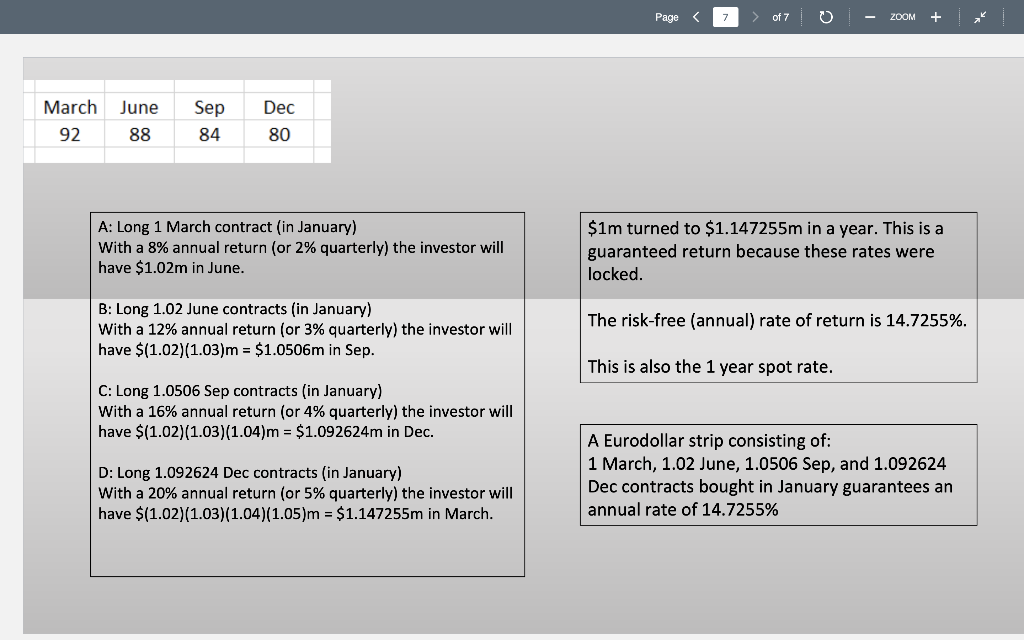

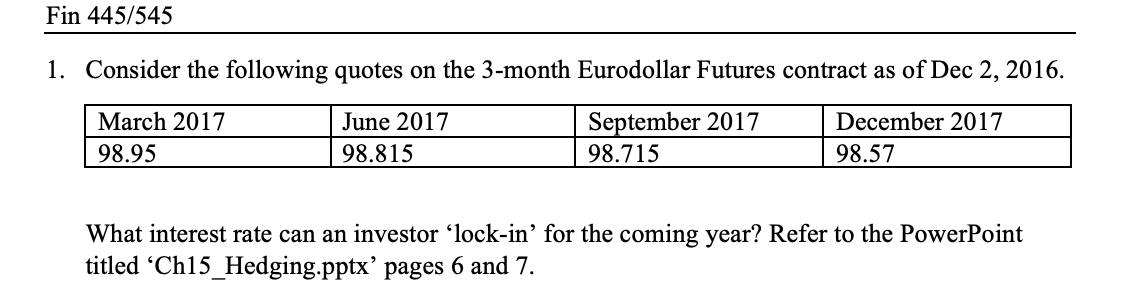

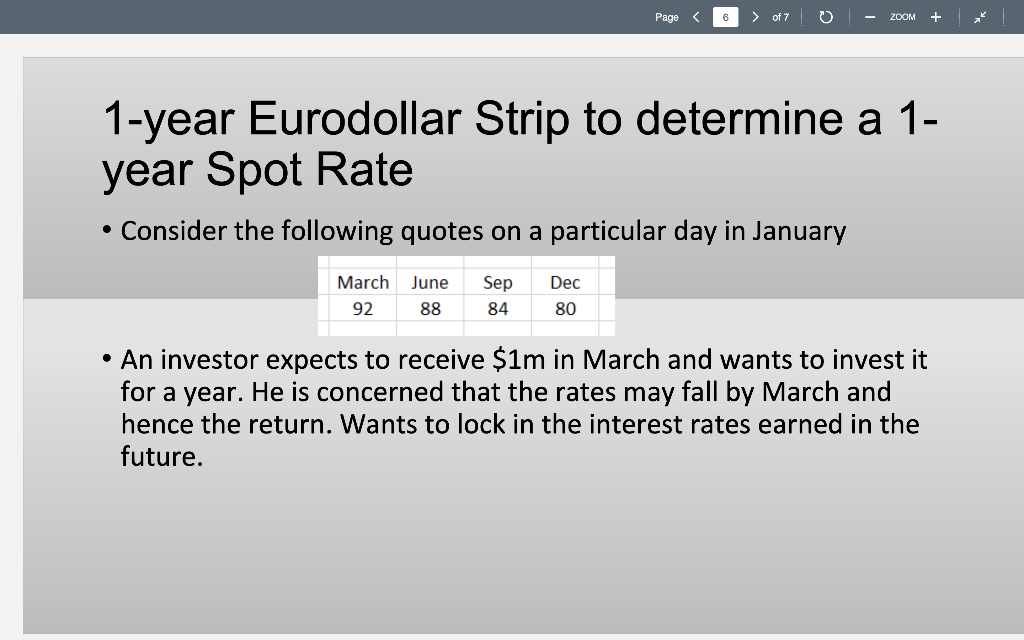

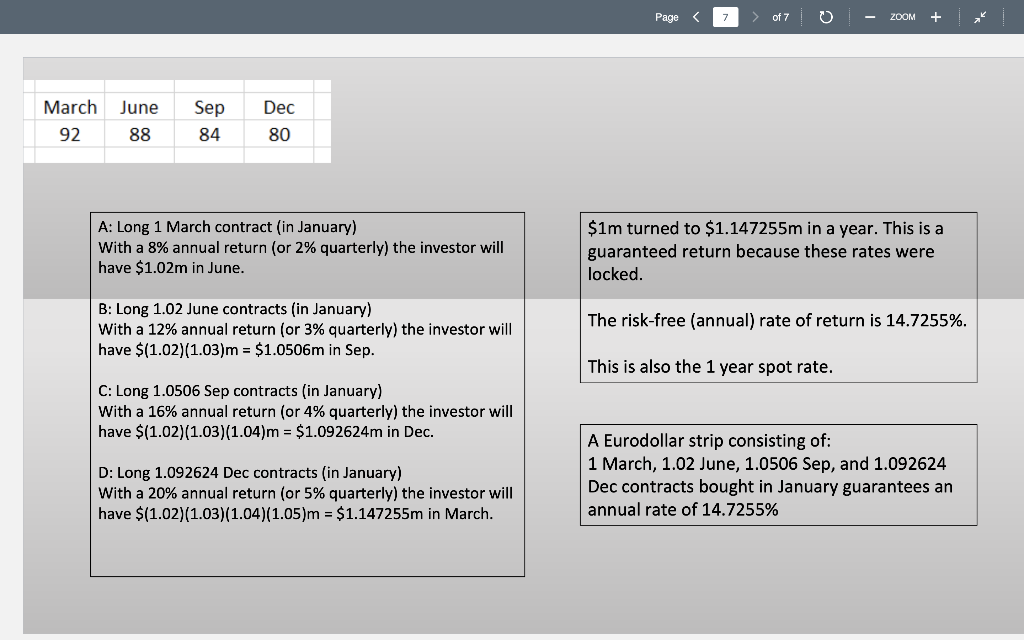

Consider the following quotes on the 3-month Eurodollar Futures contract as of Dec 2,2016 [ What interest rate can an investor 'lock-in' for the coming year? Refer to the PowerPoint titled 'Ch15_Hedging.pptx' pages 6 and 7. 1-year Eurodollar Strip to determine a 1year Spot Rate - Consider the following quotes on a particular day in January - An investor expects to receive $1m in March and wants to invest it for a year. He is concerned that the rates may fall by March and hence the return. Wants to lock in the interest rates earned in the future. \begin{tabular}{|c|c|c|c|} \hline March & June & Sep & Dec \\ \hline 92 & 88 & 84 & 80 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline A: Long 1 March contract (in January) With a 8% annual return (or 2% quarterly) the investor will have $1.02m in June. & $1m turned to $1.147255m in a year. This is a guaranteed return because these rates were locked. \\ B: Long 1.02 June contracts (in January) With a 12% annual return (or 3% quarterly) the investor will have $(1.02)(1.03)m=$1.0506m in Sep. & The risk-free (annual) rate of return is 14.7255%. \\ C: Long 1.0506 Sep contracts (in January) With a 16% annual return (or 4% quarterly) the investor will have $(1.02)(1.03)(1.04)m=$1.092624m in Dec. \\ D: Long 1.092624 Dec contracts (in January) With a 20% annual return (or 5% quarterly) the investor will have $(1.02)(1.03)(1.04)(1.05)m=$1.147255m in March. & This is also the 1 year spot rate. \\ \hline \end{tabular} Consider the following quotes on the 3-month Eurodollar Futures contract as of Dec 2,2016 [ What interest rate can an investor 'lock-in' for the coming year? Refer to the PowerPoint titled 'Ch15_Hedging.pptx' pages 6 and 7. 1-year Eurodollar Strip to determine a 1year Spot Rate - Consider the following quotes on a particular day in January - An investor expects to receive $1m in March and wants to invest it for a year. He is concerned that the rates may fall by March and hence the return. Wants to lock in the interest rates earned in the future. \begin{tabular}{|c|c|c|c|} \hline March & June & Sep & Dec \\ \hline 92 & 88 & 84 & 80 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline A: Long 1 March contract (in January) With a 8% annual return (or 2% quarterly) the investor will have $1.02m in June. & $1m turned to $1.147255m in a year. This is a guaranteed return because these rates were locked. \\ B: Long 1.02 June contracts (in January) With a 12% annual return (or 3% quarterly) the investor will have $(1.02)(1.03)m=$1.0506m in Sep. & The risk-free (annual) rate of return is 14.7255%. \\ C: Long 1.0506 Sep contracts (in January) With a 16% annual return (or 4% quarterly) the investor will have $(1.02)(1.03)(1.04)m=$1.092624m in Dec. \\ D: Long 1.092624 Dec contracts (in January) With a 20% annual return (or 5% quarterly) the investor will have $(1.02)(1.03)(1.04)(1.05)m=$1.147255m in March. & This is also the 1 year spot rate. \\ \hline \end{tabular}