Please help with explanation. Thank you!

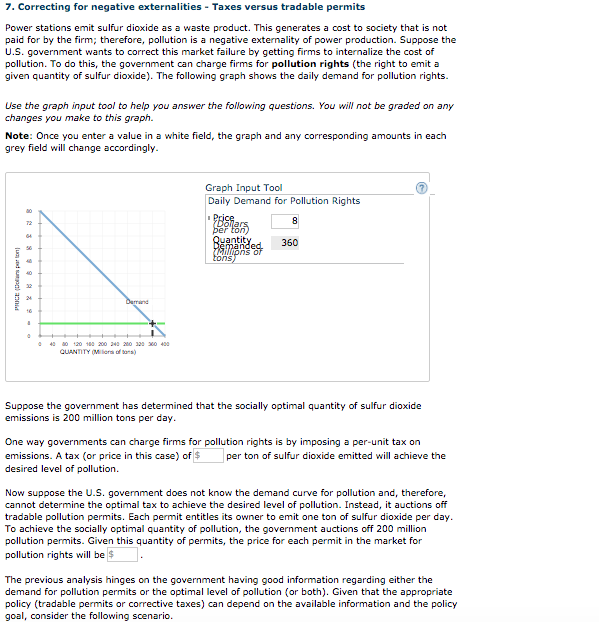

7. Correcting for negative externalities - Taxes versus tradable permits Power stations emit sulfur dioxide as a waste product. This generates a cost to society that is not paid for by the firm; therefore, pollution is a negative externality of power production. Suppose the U.S. government wants to correct this market failure by getting firms to internalize the cost of pollution. To do this, the government can charge firms for pollution rights (the right to emit a given quantity of sulfur dioxide). The following graph shows the daily demand for pollution rights. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. Graph Input Tool (7) Daily Demand for Pollution Rights Price_ DEF ton B Quantity PRICE (Dollars parr Ion) 350 42 80 130 182 200 242 280 323 200 424 QUANTITY (Miller of Bass) Suppose the government has determined that the socially optimal quantity of sulfur dioxide emissions is 200 million tons per day. One way governments can charge firms for pollution rights is by imposing a per-unit tax on emissions. A tax (or price in this case) of $ per ton of sulfur dioxide emitted will achieve the desired level of pollution. Now suppose the U.S. government does not know the demand curve for pollution and, therefore, cannot determine the optimal tax to achieve the desired level of pollution. Instead, it auctions off tradable pollution permits. Each permit entitles its owner to emit one ton of sulfur dioxide per day. To achieve the socially optimal quantity of pollution, the government auctions off 200 million pollution permits. Given this quantity of permits, the price for each permit in the market for pollution rights will be $ The previous analysis hinges on the government having good information regarding either the demand for pollution permits or the optimal level of pollution (or both). Given that the appropriate policy (tradable permits or corrective taxes) can depend on the available information and the policy joal, consider the following scenario.Suppose the government has determined that the socially optimal quantity of sulfur dioxide emissions is 200 million tons per day. One way governments can charge firms for pollution rights is by imposing a per-unit tax on emissions. A tax (or price in this case) of $ per ton of sulfur dioxide emitted will achieve the desired level of pollution. Now suppose the U.S. government does not know the demand curve for pollution and, therefore, cannot determine the optimal tax to achieve the desired level of pollution. Instead, it auctions off tradable pollution permits. Each permit entitles its owner to emit one ton of sulfur dioxide per day. To achieve the socially optimal quantity of pollution, the government auctions off 200 million pollution permits. Given this quantity of permits, the price for each permit in the market for pollution rights will be $ The previous analysis hinges on the government having good information regarding either the demand for pollution permits or the optimal level of pollution (or both). Given that the appropriate policy (tradable permits or corrective taxes) can depend on the available information and the policy goal, consider the following scenario. An environmental study conducted in a particular city suggests that if a chemical plant emits more than 10 million tons of chemicals each year, the water supply will become contaminated beyond the point where filtration techniques can make it safe for drinking. If this is all the information the government has, which solution to reduce pollution is appropriate? Check all that apply. Corrective taxes Tradable permits