Answered step by step

Verified Expert Solution

Question

1 Approved Answer

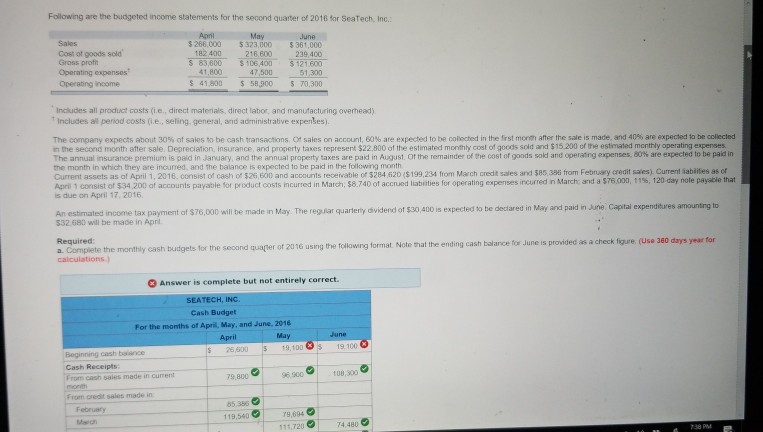

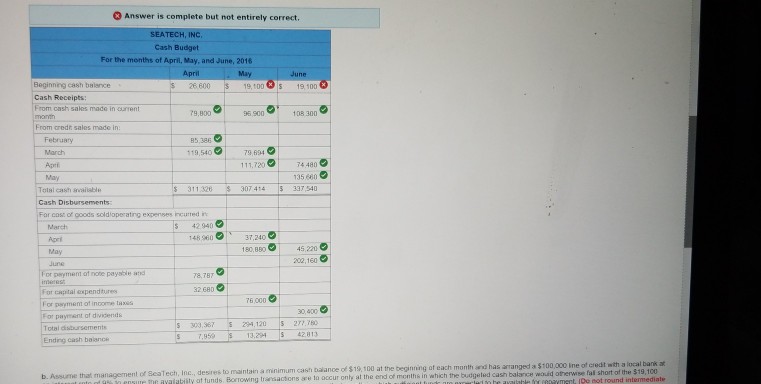

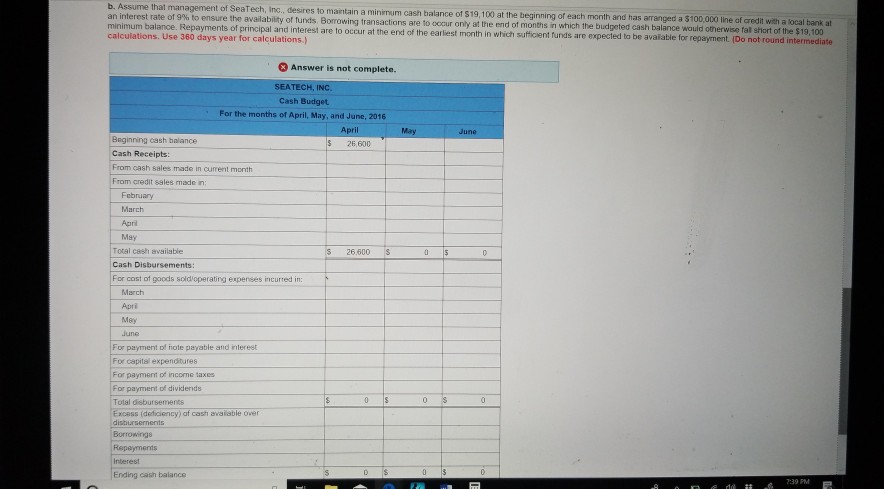

please help with part 1 that are wrong and part B Following are the budgeted income statements for the second quarter of 2016 for SeaTech,

please help with part 1 that are wrong and part B

Following are the budgeted income statements for the second quarter of 2016 for SeaTech, Inc. May 3 266,000 $323,000 $361,000 216,600 83600 $106400, $121.600 41,80047.50051.300 s41.800 58,900 70,300 Apil Sales Cost of goods sold Gross prof Operating expenses Operating income 182 400 239,400 Includes all product costs (i.e, direct materials, direct labor, and manufacturing overhead) Includes all period costs (.e., seling. general, and administrative expenkes). The cor any expect at out 0% of sales to be cash transactions. O sales on acco nt, 60% are expected to be Dan h he rst r om ater e sae made an 40san expe ett tadected n the second month after sale. Depreciation, insurance, and property taxes represent $22,800 of the estimated monthly cost of goods sold and $15.200 of the estmated monthly operating expenses The annual insura e remium is pald in January, and the ann at praperty taxes are a in August r the re mai d the cestor goods so and opera n o enses. 80% a ee eed be paid in the month in which they are incurred, and the balance is expected to be paid in the following month Current assets as af April 1, 2016. consist or cash of S 26 600 and a counts re oer able ot 5284 620($ 199.234 trom March credtsaes an $853ee mom Fetit ayo at 5 es ti atiites Aprli 1 consist or 34 200 ar accounts payable for product costs in umed in Ma ch. S 740 of acc ed liabites for operating exp ses e red n March and a 7600 0 11%, t 20 day note payable that s due on April 17, 2016. An estimated income tax payment af $76,000 will be made in May. The regular qua 532 680 will be made in Apri arterily dvidend of $30,400 is expected to be declared in May and paid in June Capital expenditures amounting to Required: a. Complete the monthly cash budgets for the seosnd quapter of 2016 using the following calculations format. Note that the ending cash balance for June is provided as a check figure. (Use 360 days year for 3 Answer is complete but not entirely correct. SEAT TECH, I Cash Budget For the months of April, May, and June, 2016 9,100 19. 100 26,500 Cash Receipts: 79,800 96 500 cash sales made in current creait sales made in 85,386 11954079,604 111,720 74.480Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started