Please Help with Part A, B and C

Please Help with Part A, B and C

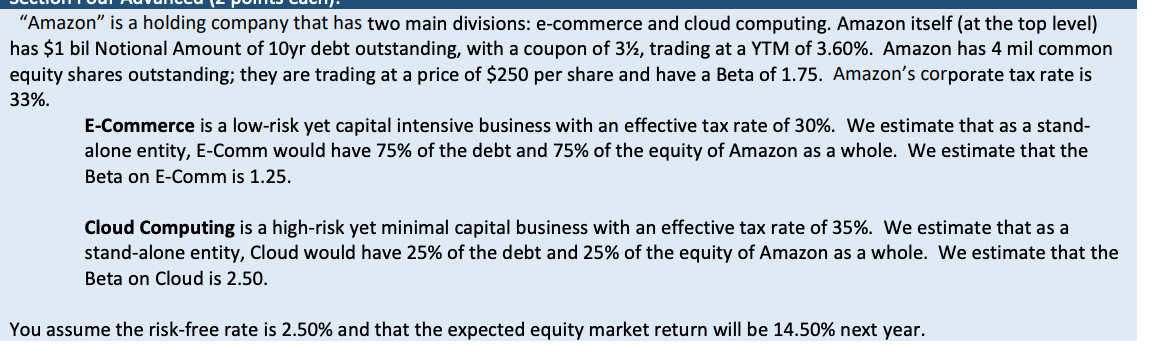

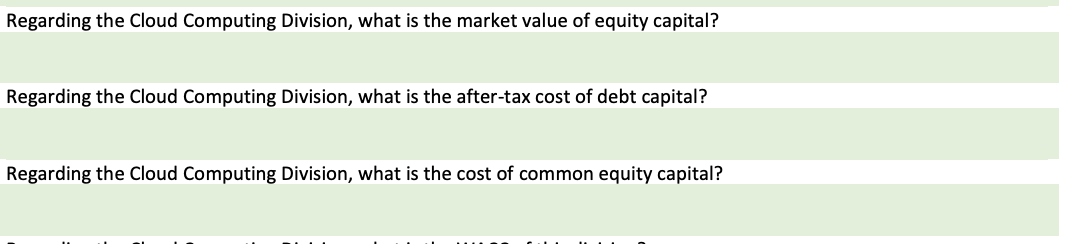

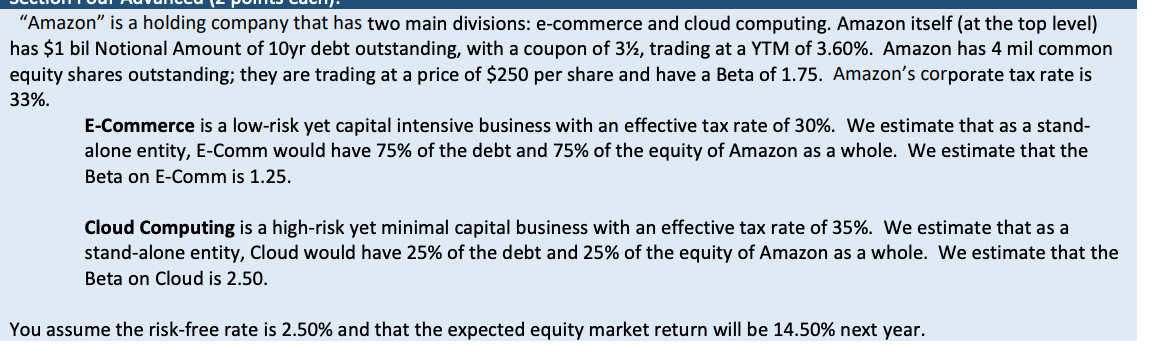

Amazon is a holding company that has two main divisions: e-commerce and cloud computing. Amazon itself (at the top level) has $1 bil Notional Amount of 10yr debt outstanding, with a coupon of 372, trading at a YTM of 3.60%. Amazon has 4 mil common a equity shares outstanding; they are trading at a price of $250 per share and have a Beta of 1.75. Amazon's corporate tax rate is 33%. E-Commerce is a low-risk yet capital intensive business with an effective tax rate of 30%. We estimate that as a stand- alone entity, E-Comm would have 75% of the debt and 75% of the equity of Amazon as a whole. We estimate that the Beta on E-Comm is 1.25. Cloud Computing is a high-risk yet minimal capital business with an effective tax rate of 35%. We estimate that as a stand-alone entity, Cloud would have 25% of the debt and 25% of the equity of Amazon as a whole. We estimate that the Beta on Cloud is 2.50. You assume the risk-free rate is 2.50% and that the expected equity market return will be 14.50% next year. Regarding the Cloud Computing Division, what is the market value of equity capital? Regarding the Cloud Computing Division, what is the after-tax cost of debt capital? Regarding the Cloud Computing Division, what is the cost of common equity capital? Amazon is a holding company that has two main divisions: e-commerce and cloud computing. Amazon itself (at the top level) has $1 bil Notional Amount of 10yr debt outstanding, with a coupon of 372, trading at a YTM of 3.60%. Amazon has 4 mil common a equity shares outstanding; they are trading at a price of $250 per share and have a Beta of 1.75. Amazon's corporate tax rate is 33%. E-Commerce is a low-risk yet capital intensive business with an effective tax rate of 30%. We estimate that as a stand- alone entity, E-Comm would have 75% of the debt and 75% of the equity of Amazon as a whole. We estimate that the Beta on E-Comm is 1.25. Cloud Computing is a high-risk yet minimal capital business with an effective tax rate of 35%. We estimate that as a stand-alone entity, Cloud would have 25% of the debt and 25% of the equity of Amazon as a whole. We estimate that the Beta on Cloud is 2.50. You assume the risk-free rate is 2.50% and that the expected equity market return will be 14.50% next year. Regarding the Cloud Computing Division, what is the market value of equity capital? Regarding the Cloud Computing Division, what is the after-tax cost of debt capital? Regarding the Cloud Computing Division, what is the cost of common equity capital

Please Help with Part A, B and C

Please Help with Part A, B and C