Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with Qestions (1-3) on the second page. (See page 2) Fancy Millwork has a factory that produces custom kitchen cabinets. It has multiple

Please help with Qestions (1-3) on the second page. (See page 2)

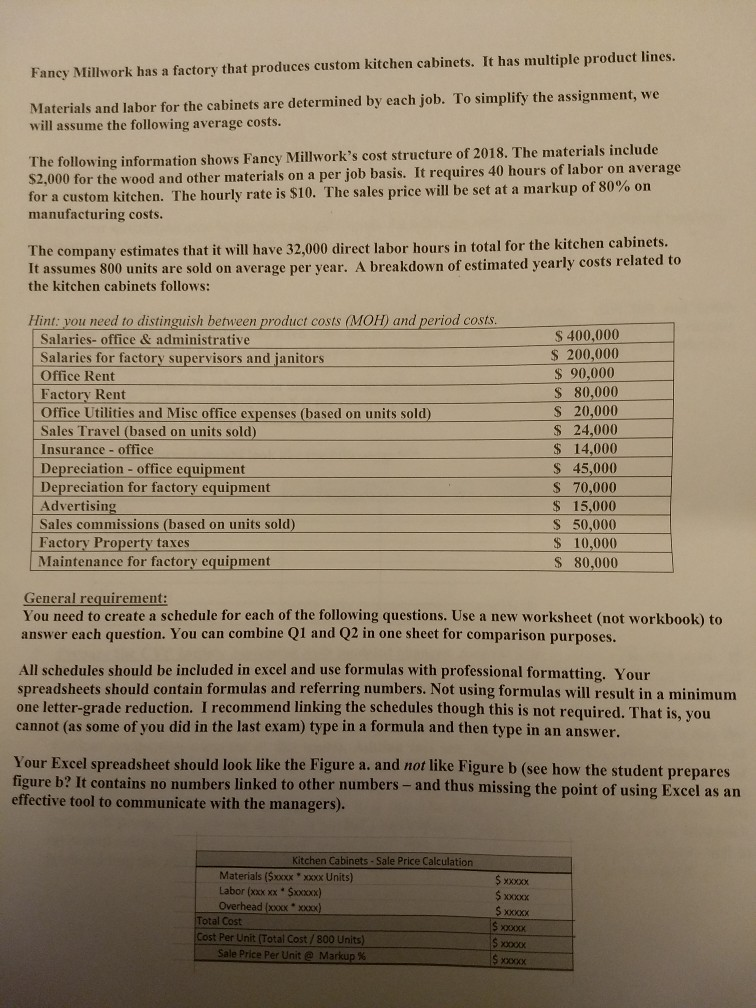

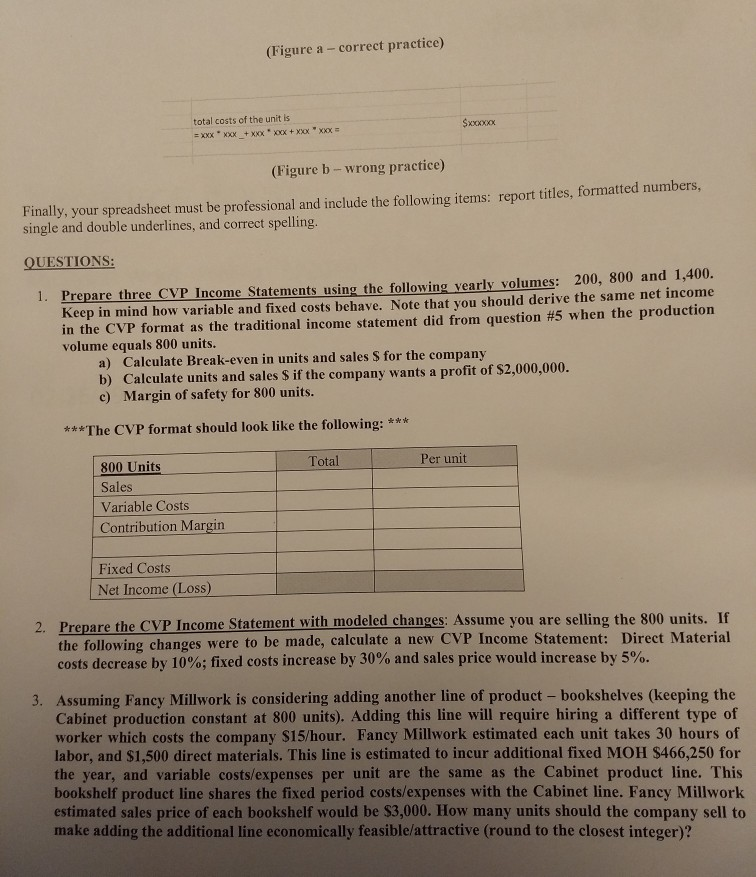

Fancy Millwork has a factory that produces custom kitchen cabinets. It has multiple product lines ment, we Materials and labor for the cabinets are determined by each job. To simplify the assign ill assume the following average costs e following information shows Fancy Millwork's cost structure of 2018. The materials include S2,000 for a custom kitchen. The hourly rate is $10. T manufacturing costs Th for the wood and other materials on a per job basis. It requires 40 hours of labor on average he sales price will be set at a markup of 80% on The company estimates that it will have 32,000 direct labor hours in total for the kitchen cabinets It assumes 800 units are sold on average per year. A breakdown of estimated yearly costs related to the kitchen cabinets follows: Hint: vou need to distinguish between product costs (MOH) and period costs Salaries- office & administrative Salaries for factory supervisors and janitor Office Rent Factory Rent Office Utilities and Misc office expenses (based on units sold) Sales Travel (based on units sold Insurance office Depreciation - office equipment Depreciation for factory equipment S 400,000 S 200,000 90,000 S 80,000 S 20,000 S 24,000 14,000 45,000 S 70,000 S 15,000 S 50,000 10,000 S 80,000 dvertising Sales commissions (based on units sold Factory Property taxes Maintenance for factorv equipment General requirement: You need to create a schedule for each of the following questions. Use a new worksheet (not workbook) to answer each question. You can combine Q1 and Q2 in one sheet for comparison purposes. All schedules should be included in excel and use formulas with professional formatting, Your spreadsheets should contain formulas and referring numbers. Not using formulas will result in a minimum one letter-grade reduction. I recommend linking the schedules though this is not required. That is, you cannot (as some of you did in the last exam) type in a formula and then type in an answer Your Excel spreadsheet should look like the Figure a. and not like figure b? It cont effective tool to communicate with the managers) Figure b (see how the student prepares ains no numbers linked to other numbers- and thus missing the point of using Excel as an Kitchen Cabinets- Sale Price Calculation Materials (Sxxxxxxxx Units) Labor (xxx xx Sxxxxx) Overhead (OKxxxxx) Total Cost st Per Unit (Total Cost/ 800 U 00x Sale Price Per Unit @e Ma (Figure a - correct practice) total costs of the unit is XXX . XXX +XXX * XXX + XXX-XXX (Figure b- wrong practice) Finally, your spreadsheet must be professional and include the following items: report titles, formatted numbers, single and double underlines, and correct spelling QUESTIONS: 1. Prepare three CVP Income Statements using the following yearly volumes: 200, 800 and 1,400. ent did from question #5 when the production Keep in mind how variable and fixed costs behave. Note that vou should derive the same net income in the CVP format as the traditional income staten volume equals 800 units. a) ) c) Calculate Break-even in units and sales S for the company Calculate units and sales S if the company wants a profit of $2,000,000. Margin of safety for 800 units. ***The CVP format should look like the following: Total Per unit 800 Units Sales Variable Costs Contribution Margin Fixed Costs 2. Prepare the CVP Income Statement with modeled changes: Assume you are selling the 800 units. If the following changes were to be made, calculate a new CVP Income Statement: Direct Material costs decrease by 10%; fixed costs increase by 30% and sales price would increase by 5% 3. Assuming Fancy Millwork is considering adding another line of product - bookshelves (keeping the Cabinet production constant at 800 units). Adding this line will require hiring a different type of worker which costs the company $15/hour. Fancy Millwork estimated each unit takes 30 hours of labor, and $1,500 direct materials. This line is estimated to incur additional fixed MOH $466,250 for the year, and variable costs/expenses per unit are the same as the Cabinet product line. This bookshelf product line shares the fixed period costs/expenses with the Cabinet line. Fancy Millwork estimated sales price of each bookshelf would be $3,000. How many units should the company sell to make adding the additional line economically feasible/attractive (round to the closest integer)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started