Answered step by step

Verified Expert Solution

Question

1 Approved Answer

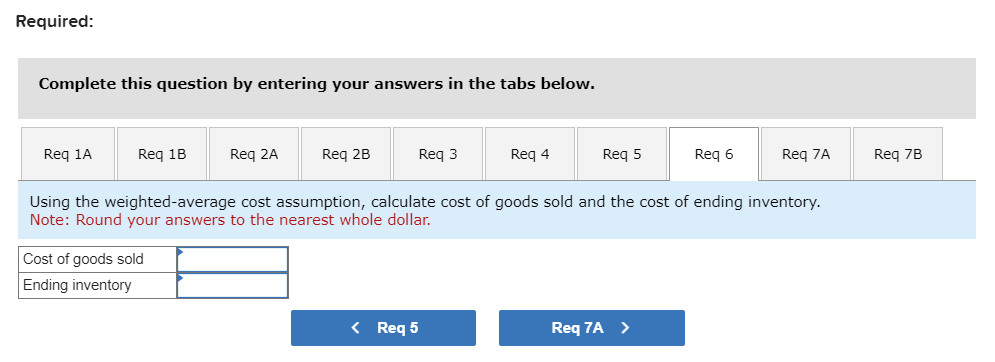

Please help with Req 6: Using the weighted-average cost assumption, calculate cost of goods sold and the cost of ending inventory. Note: Round your answers

Please help with Req 6: Using the weighted-average cost assumption, calculate cost of goods sold and the cost of ending inventory.

Note: Round your answers to the nearest whole dollar.

EDIT: More info:

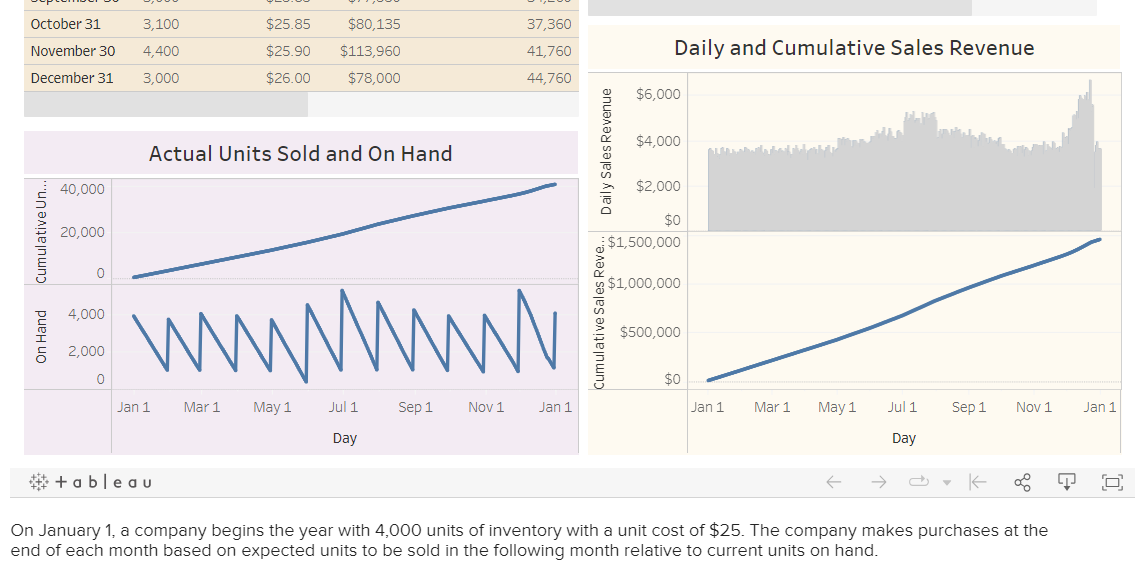

Unit Sold by Dec 31: 40712

On hand: 4048

EDIT:

Perpetual inventory system

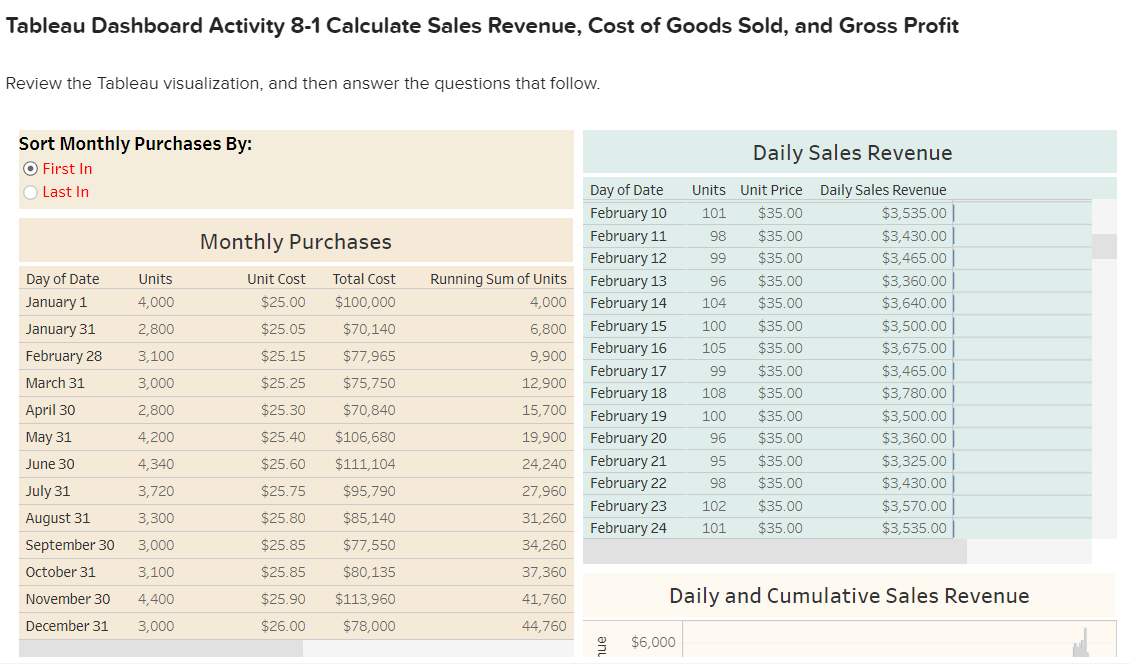

On January 1, a company begins the year with 4,000 units of inventory with a unit cost of $25. The company makes purchases at the end of each month based on expected units to be sold in the following month relative to current units on hand. Tableau Dashboard Activity 8-1 Calculate Sales Revenue, Cost of Goods Sold, and Gross Profit Review the Tableau visualization, and then answer the questions that follow. Sort Monthly Purchases By: First In Last In Required: Complete this question by entering your answers in the tabs below. Using the weighted-average cost assumption, calculate cost of goods sold and the cost of ending inventory. Note: Round your answers to the nearest whole dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the cost of goods sold COGS and the cost of ending inventory using the weightedaverage ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started