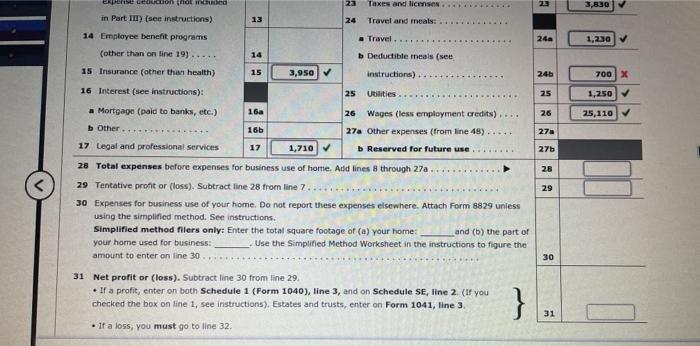

please help with Scheudle C Lines 24b, 28, 29, and 31.. thank you!!

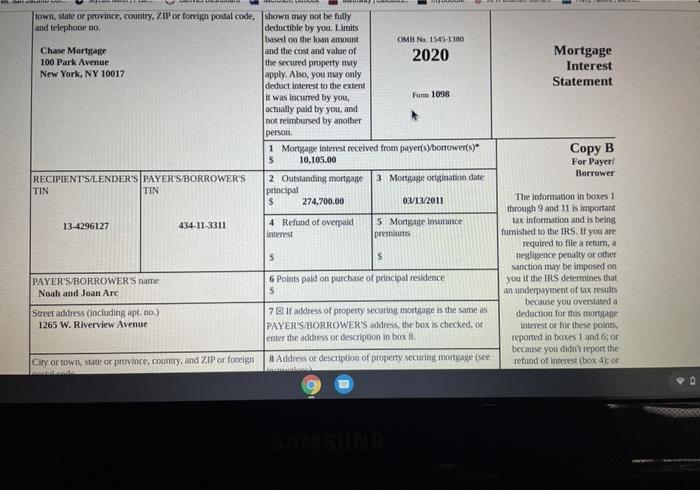

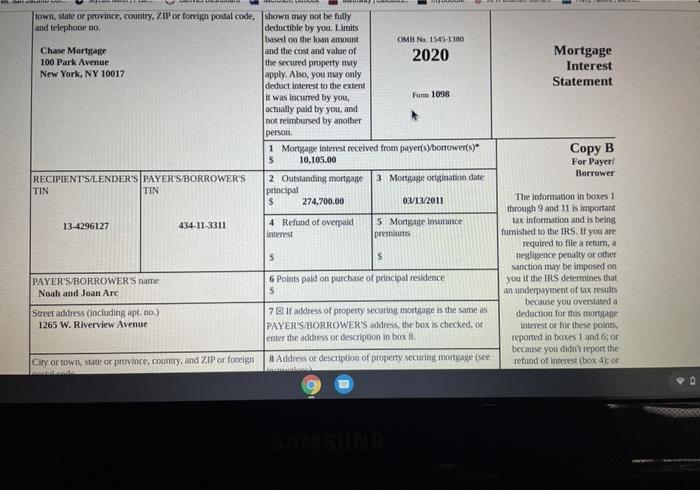

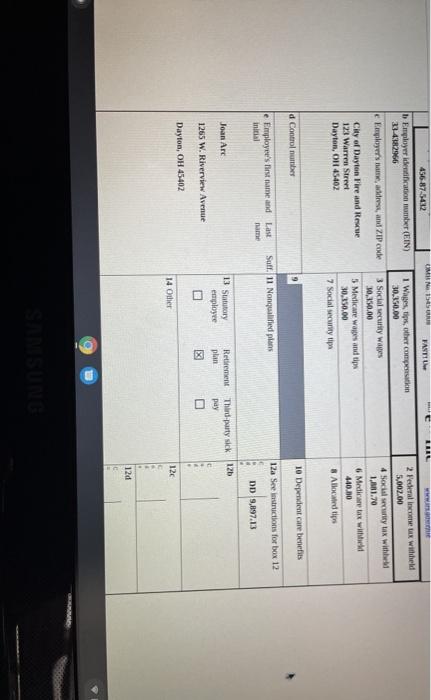

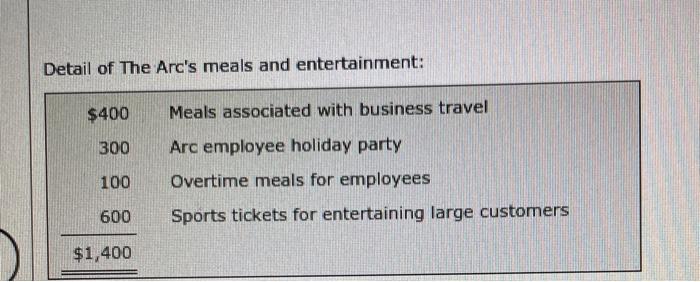

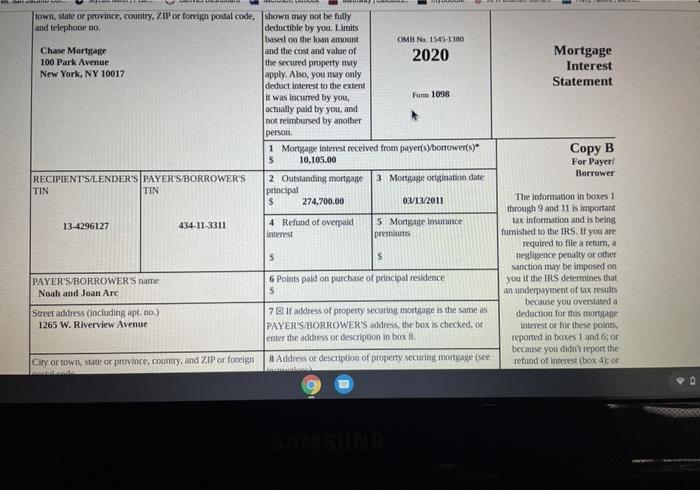

Mortgage Interest Statement town, state or province, country. ZIP or foreign postal code shown may not be fully and telephone no deductible by you. Limits based on the loan amount OMB No 1545-1380 Chase Mortgage and the cost and value of 2020 100 Park Avenue the secured property may New York, NY 10017 apply. Also, you may only deduct interest to the extent it was incurred by you, Form 1098 actually paid by you, and not reimbursed by another person 1 Mortgage Interest received from payer(sborrowers) s 10,105.00 RECIPIENTS/LENDER'S PAYER'S/BORROWER'S 2 Outstanding mortgage 3 Mortgage origination date TIN TIN principal $ 274,700.00 03/13/2011 Copy B For Payer/ Borrower 13-4296127 434-11-3311 4 Refund of overpaid interest 5 Mortgage Insurance premium $ S PAYER'S/BORROWER'S name Noah and Joan Are 6 Points paid on purchase of principal residence S The information in boxes 1 through 9 and 11 is important tax information and is being furnished to the IRS. If you are required to file a retum, a negligence penalty or other sanction may be imposed on you if the IRS determines that an underpayment of tax results because you overstated a deduction for this mortgage interest or for these points, reported in boxes 1 and 6 or because you didn't report the refund of interest (box 4) or Street address (including apt. no.) 1265 W. Riverview Avenue 7 If address of property securing mortgage is the same as PAYER'S/BORROWER'S address, the box is checked, or enter the address or description in box 8 City or town, state or province, country, and ZIP or foreign 8 Address or description of property securing mortgage (see OM OS 456-87-5412 www FANTIL D Employer identification number (EIN) 23-4382966 e Employer's name, address, and ZIP code 1 Wages, tips, other compensation 30.350.00 3 Social security wages 30,350.00 5 Medicare waites and tips 30,150.00 7 Social security 2 Federal income tax witheld 5.002.00 4 Social Security tak with 1.11.20 6 Medicare tax with 440.00 8 Allocated tips City of Dayton Fire and Rescue 123 Warren Strert Dayton, OH 45402 10 Dependent care benefits d Control number Sufl. 11 Nonqualified plans 12a Seestructions for box 12 le Employee's list name and Last initial name DD 9,897.13 Joan Are 13 SRL employee Retirement Third-party sick 126 plan pay g 1265 W. Riverview Avenue Dayton, OH 45402 120 14 Other 120 Detail of The Arc's meals and entertainment: $400 Meals associated with business travel 300 100 Arc employee holiday party Overtime meals for employees Sports tickets for entertaining large customers 600 $1,400 Mortgage Interest Statement town, state or province, country. ZIP or foreign postal code shown may not be fully and telephone no deductible by you. Limits based on the loan amount OMB No 1545-1380 Chase Mortgage and the cost and value of 2020 100 Park Avenue the secured property may New York, NY 10017 apply. Also, you may only deduct interest to the extent it was incurred by you, Form 1098 actually paid by you, and not reimbursed by another person 1 Mortgage Interest received from payer(sborrowers) s 10,105.00 RECIPIENTS/LENDER'S PAYER'S/BORROWER'S 2 Outstanding mortgage 3 Mortgage origination date TIN TIN principal $ 274,700.00 03/13/2011 Copy B For Payer/ Borrower 13-4296127 434-11-3311 4 Refund of overpaid interest 5 Mortgage Insurance premium $ S PAYER'S/BORROWER'S name Noah and Joan Are 6 Points paid on purchase of principal residence S The information in boxes 1 through 9 and 11 is important tax information and is being furnished to the IRS. If you are required to file a retum, a negligence penalty or other sanction may be imposed on you if the IRS determines that an underpayment of tax results because you overstated a deduction for this mortgage interest or for these points, reported in boxes 1 and 6 or because you didn't report the refund of interest (box 4) or Street address (including apt. no.) 1265 W. Riverview Avenue 7 If address of property securing mortgage is the same as PAYER'S/BORROWER'S address, the box is checked, or enter the address or description in box 8 City or town, state or province, country, and ZIP or foreign 8 Address or description of property securing mortgage (see OM OS 456-87-5412 www FANTIL D Employer identification number (EIN) 23-4382966 e Employer's name, address, and ZIP code 1 Wages, tips, other compensation 30.350.00 3 Social security wages 30,350.00 5 Medicare waites and tips 30,150.00 7 Social security 2 Federal income tax witheld 5.002.00 4 Social Security tak with 1.11.20 6 Medicare tax with 440.00 8 Allocated tips City of Dayton Fire and Rescue 123 Warren Strert Dayton, OH 45402 10 Dependent care benefits d Control number Sufl. 11 Nonqualified plans 12a Seestructions for box 12 le Employee's list name and Last initial name DD 9,897.13 Joan Are 13 SRL employee Retirement Third-party sick 126 plan pay g 1265 W. Riverview Avenue Dayton, OH 45402 120 14 Other 120 Detail of The Arc's meals and entertainment: $400 Meals associated with business travel 300 100 Arc employee holiday party Overtime meals for employees Sports tickets for entertaining large customers 600 $1,400