Please help with steps

Please help with steps

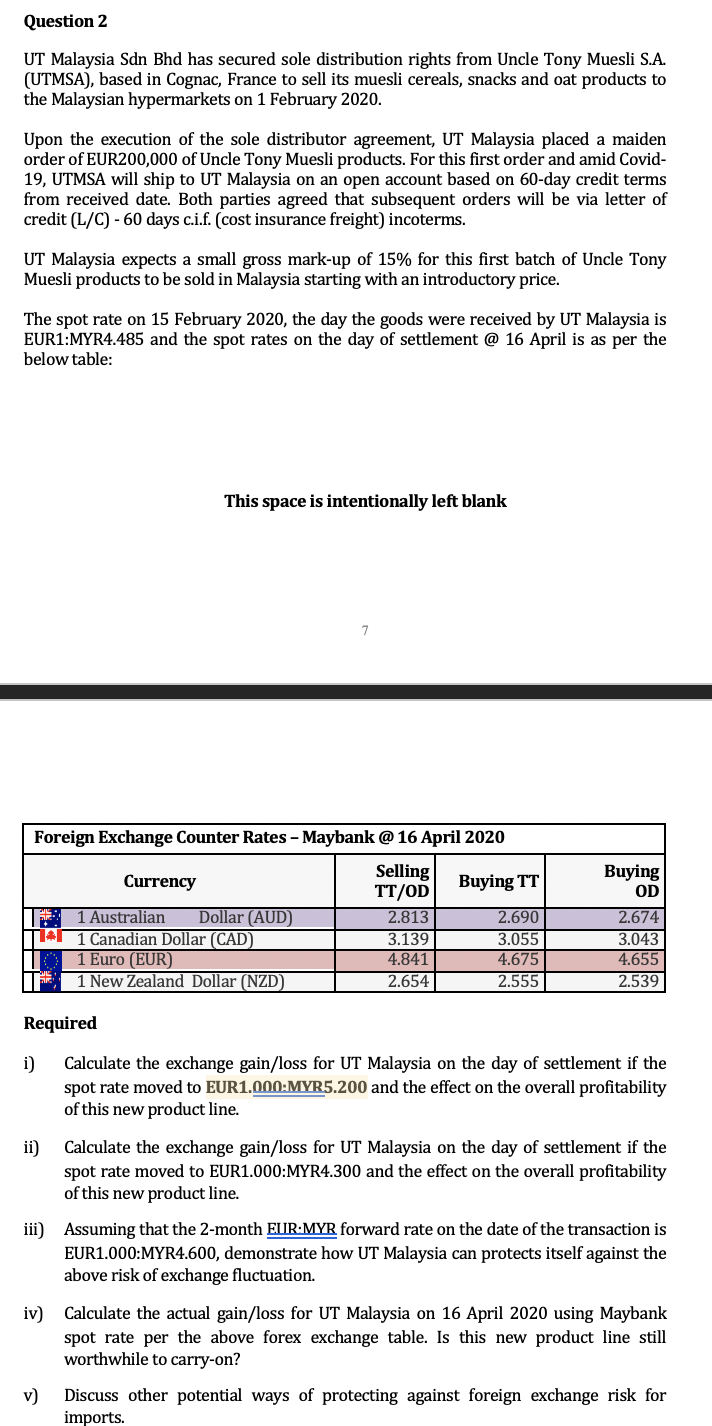

Question 2 UT Malaysia Sdn Bhd has secured sole distribution rights from Uncle Tony Muesli S.A. (UTMSA), based in Cognac, France to sell its muesli cereals, snacks and oat products to the Malaysian hypermarkets on 1 February 2020. Upon the execution of the sole distributor agreement, UT Malaysia placed a maiden order of EUR200,000 of Uncle Tony Muesli products. For this first order and amid Covid- 19, UTMSA will ship to UT Malaysia on an open account based on 60-day credit terms from received date. Both parties agreed that subsequent orders will be via letter of credit (L/C) - 60 days c.i.f. (cost insurance freight) incoterms. UT Malaysia expects a small gross mark-up of 15% for this first batch of Uncle Tony Muesli products to be sold in Malaysia starting with an introductory price. The spot rate on 15 February 2020, the day the goods were received by UT Malaysia is EUR1:MYR4.485 and the spot rates on the day of settlement @ 16 April is as per the below table: This space is intentionally left blank 7 Foreign Exchange Counter Rates - Maybank @ 16 April 2020 Currency Buying TT 1 Australian Dollar (AUD) 141 Canadian Dollar (CAD) 1 Euro (EUR) 1 New Zealand Dollar (NZD) Selling TT/OD 2.813 3.139 4.841 2.654 2.690 3.055 4.675 2.555 Buying OD 2.674 3.043 4.655 2.539 Required i) Calculate the exchange gain/loss for UT Malaysia on the day of settlement if the spot rate moved to EUR1.000:MYR5.200 and the effect on the overall profitability of this new product line. ii) Calculate the exchange gain/loss for UT Malaysia on the day of settlement if the spot rate moved to EUR1.000:MYR4.300 and the effect on the overall profitability of this new product line. iii) Assuming that the 2-month EUR:MYR forward rate on the date of the transaction is EUR1.000:MYR4.600, demonstrate how UT Malaysia can protects itself against the above risk of exchange fluctuation. iv) Calculate the actual gain/loss for UT Malaysia on 16 April 2020 using Maybank spot rate per the above forex exchange table. Is this new product line still worthwhile to carry-on? Discuss other potential ways of protecting against foreign exchange risk for imports. v) Question 2 UT Malaysia Sdn Bhd has secured sole distribution rights from Uncle Tony Muesli S.A. (UTMSA), based in Cognac, France to sell its muesli cereals, snacks and oat products to the Malaysian hypermarkets on 1 February 2020. Upon the execution of the sole distributor agreement, UT Malaysia placed a maiden order of EUR200,000 of Uncle Tony Muesli products. For this first order and amid Covid- 19, UTMSA will ship to UT Malaysia on an open account based on 60-day credit terms from received date. Both parties agreed that subsequent orders will be via letter of credit (L/C) - 60 days c.i.f. (cost insurance freight) incoterms. UT Malaysia expects a small gross mark-up of 15% for this first batch of Uncle Tony Muesli products to be sold in Malaysia starting with an introductory price. The spot rate on 15 February 2020, the day the goods were received by UT Malaysia is EUR1:MYR4.485 and the spot rates on the day of settlement @ 16 April is as per the below table: This space is intentionally left blank 7 Foreign Exchange Counter Rates - Maybank @ 16 April 2020 Currency Buying TT 1 Australian Dollar (AUD) 141 Canadian Dollar (CAD) 1 Euro (EUR) 1 New Zealand Dollar (NZD) Selling TT/OD 2.813 3.139 4.841 2.654 2.690 3.055 4.675 2.555 Buying OD 2.674 3.043 4.655 2.539 Required i) Calculate the exchange gain/loss for UT Malaysia on the day of settlement if the spot rate moved to EUR1.000:MYR5.200 and the effect on the overall profitability of this new product line. ii) Calculate the exchange gain/loss for UT Malaysia on the day of settlement if the spot rate moved to EUR1.000:MYR4.300 and the effect on the overall profitability of this new product line. iii) Assuming that the 2-month EUR:MYR forward rate on the date of the transaction is EUR1.000:MYR4.600, demonstrate how UT Malaysia can protects itself against the above risk of exchange fluctuation. iv) Calculate the actual gain/loss for UT Malaysia on 16 April 2020 using Maybank spot rate per the above forex exchange table. Is this new product line still worthwhile to carry-on? Discuss other potential ways of protecting against foreign exchange risk for imports. v)

Please help with steps

Please help with steps