Answered step by step

Verified Expert Solution

Question

1 Approved Answer

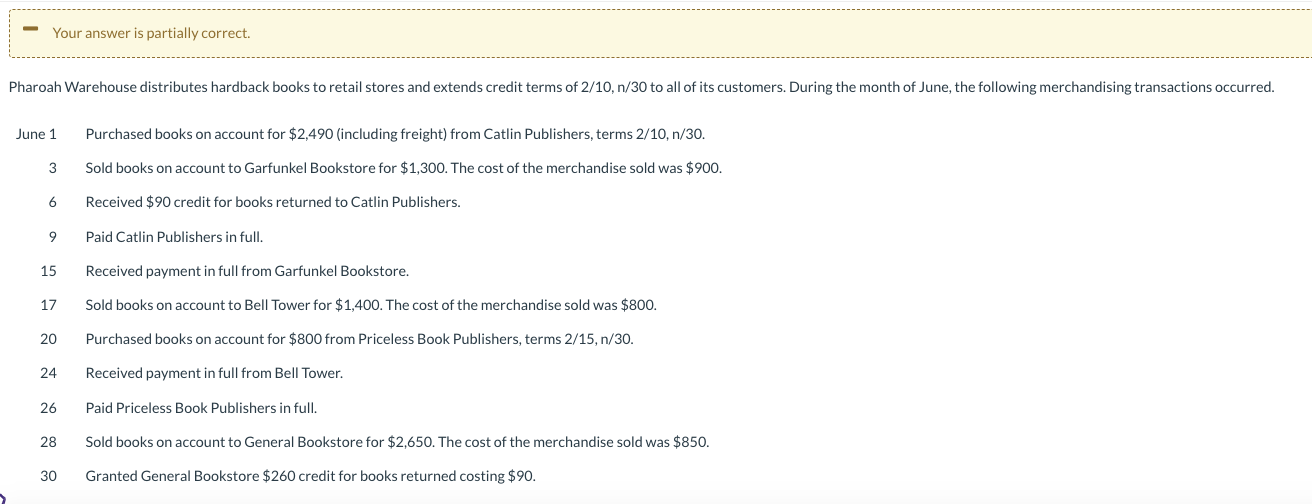

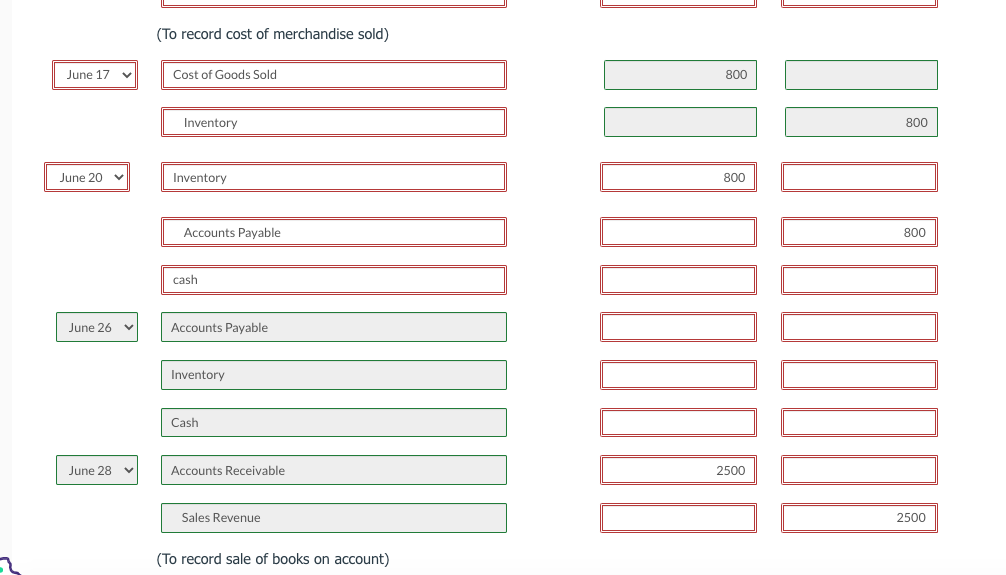

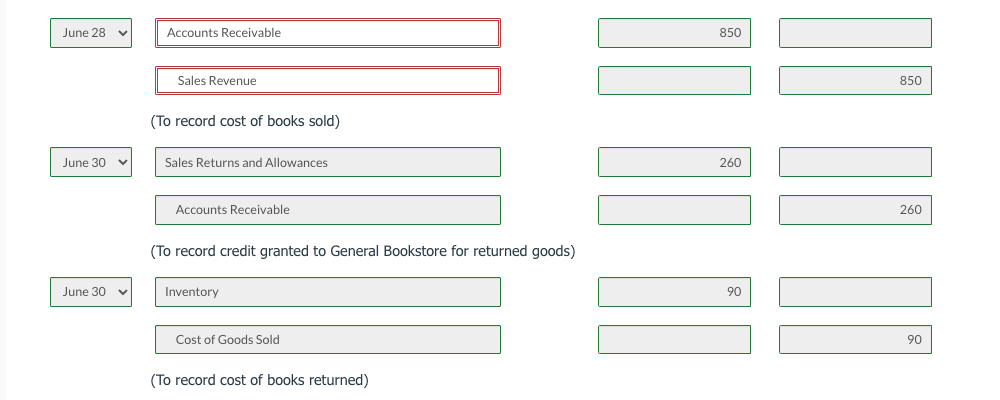

please help with the accounts on red June 1 Purchased books on account for $2,490 (including freight) from Catlin Publishers, terms 2/10, n/30. 3 Sold

please help with the accounts on red

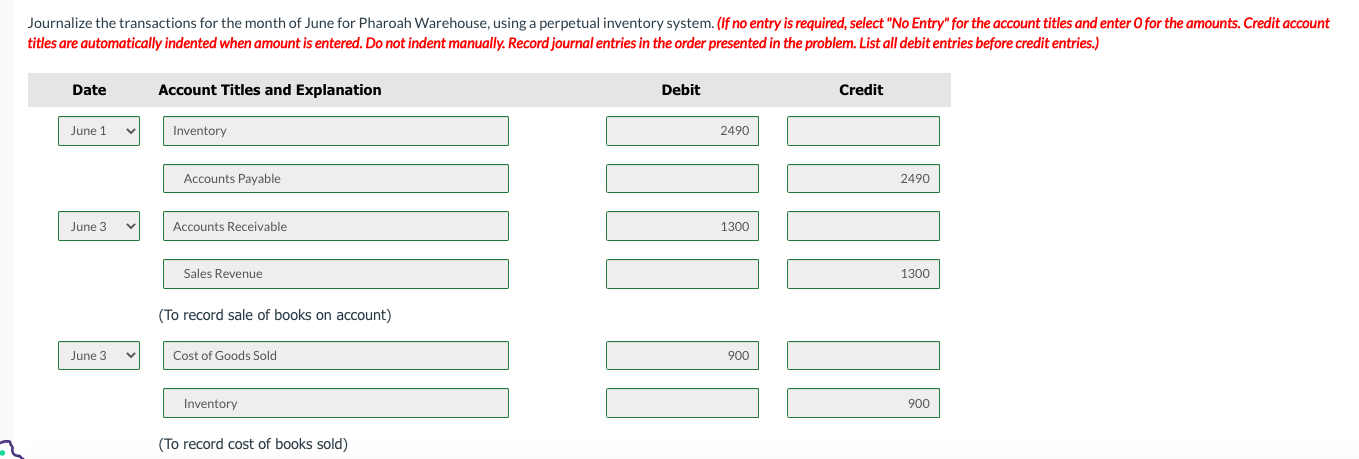

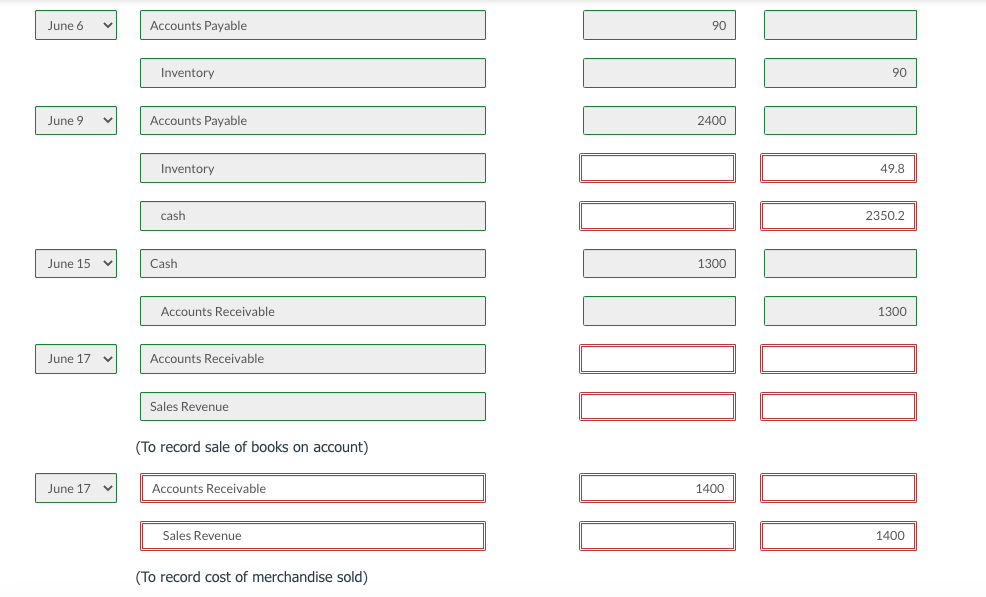

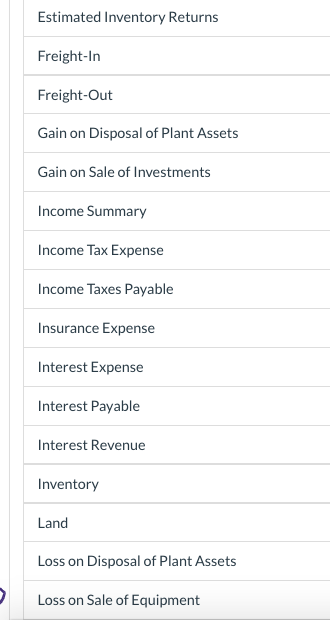

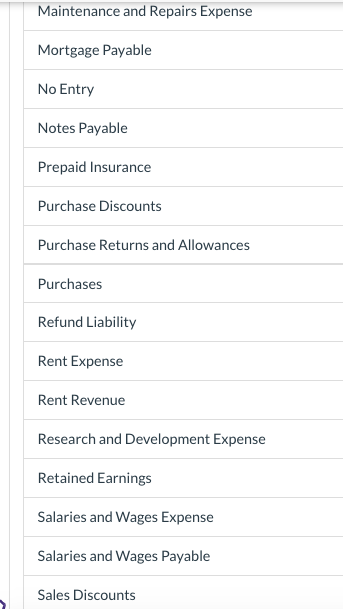

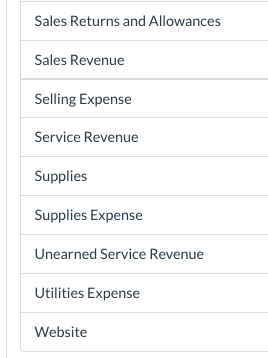

June 1 Purchased books on account for $2,490 (including freight) from Catlin Publishers, terms 2/10, n/30. 3 Sold books on account to Garfunkel Bookstore for $1,300. The cost of the merchandise sold was $900. 6 Received $90 credit for books returned to Catlin Publishers. 9 Paid Catlin Publishers in full. 15 Received payment in full from Garfunkel Bookstore. 17 Sold books on account to Bell Tower for $1,400. The cost of the merchandise sold was $800. 20 Purchased books on account for $800 from Priceless Book Publishers, terms 2/15,n/30. 24 Received payment in full from Bell Tower. 26 Paid Priceless Book Publishers in full. 28 Sold books on account to General Bookstore for $2,650. The cost of the merchandise sold was $850. 30 Granted General Bookstore $260 credit for books returned costing $90. Journalize the transactions for the month of June for Pharoah Warehouse, using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account itles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Inventory 90 Accounts Payable 2400 \begin{tabular}{|l|l|} \hline Inventory & \\ \hline \end{tabular} \begin{tabular}{|r||} \hline \hline 49.8 \\ \hline \hline \end{tabular} \begin{tabular}{|r|} \hline 2350.2 \\ \hline \end{tabular} June 15 Cash 1300 Accounts Receivable 1300 June 17 Accounts Receivable Sales Revenue (To record sale of books on account) June 17 Accounts Receivable 1400 \begin{tabular}{|l|} \hline Sales Revenue \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \hline 1400 \\ \hline \hline \end{tabular} (To record cost of merchandise sold) (To record cost of merchandise sold) June 17 Cost of Goods Sold 800 Inventory 800 June 20 Inventory 800 \begin{tabular}{||c||} \hline Accounts Payable \\ \hline \end{tabular} cash June 26 Accounts Payable Inventory Cash June 28 Accounts Receivable 2500 Sales Revenue (To record sale of books on account) \begin{tabular}{|l|l|} \hline June 28 & Accounts Receivable \\ \hline \end{tabular} 850 Sales Revenue 850 (To record cost of books sold) Sales Returns and Allowances 260 Accounts Receivable (To record credit granted to General Bookstore for returned goods) Inventory 90 Cost of Goods Sold (To record cost of books returned) List of Accounts Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Administrative Expenses Advertising Expense Amortization Expense Buildings Cash Common Stock Cost of Goods Sold Depreciation Expense Dividends Equipment Estimated Inventory Returns Freight-In Freight-Out Gain on Disposal of Plant Assets Gain on Sale of Investments Income Summary Income Tax Expense Income Taxes Payable Insurance Expense Interest Expense Interest Payable Interest Revenue Inventory Land Loss on Disposal of Plant Assets Loss on Sale of Equipment Maintenance and Repairs Expense Mortgage Payable No Entry Notes Payable Prepaid Insurance Purchase Discounts Purchase Returns and Allowances Purchases Refund Liability Rent Expense Rent Revenue Research and Development Expense Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Discounts Sales Returns and Allowances Sales Revenue Selling Expense Service Revenue Supplies Supplies Expense Unearned Service Revenue Utilities Expense Website

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started