Answered step by step

Verified Expert Solution

Question

1 Approved Answer

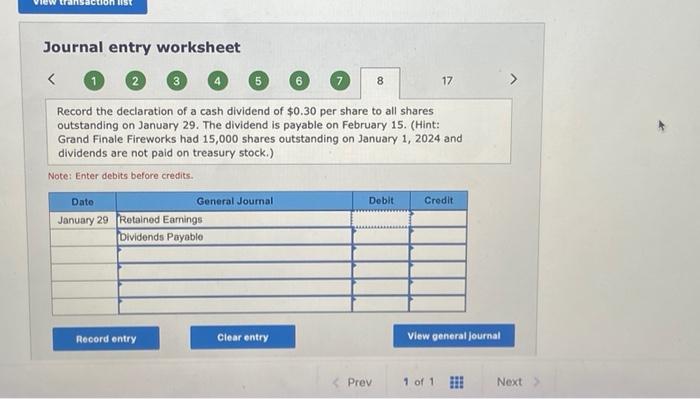

please help with the following journal entries for question #1 Journal entry worksheet 1 (2) 3 (4) (5) 6 7 17 Record the declaration of

please help with the following journal entries for question #1

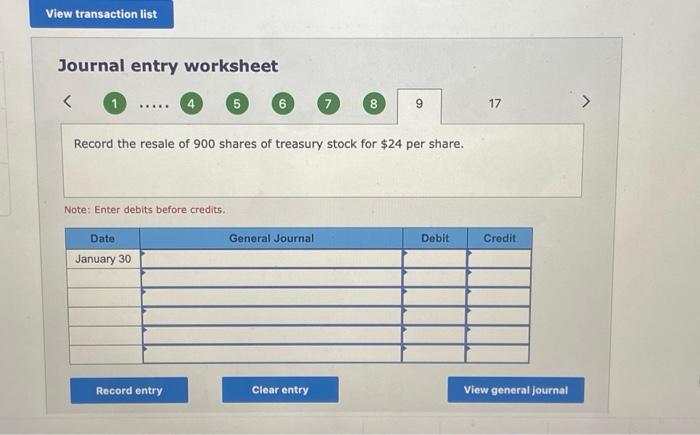

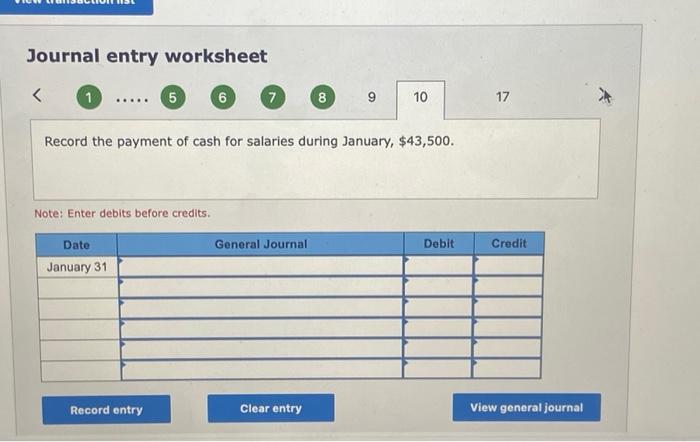

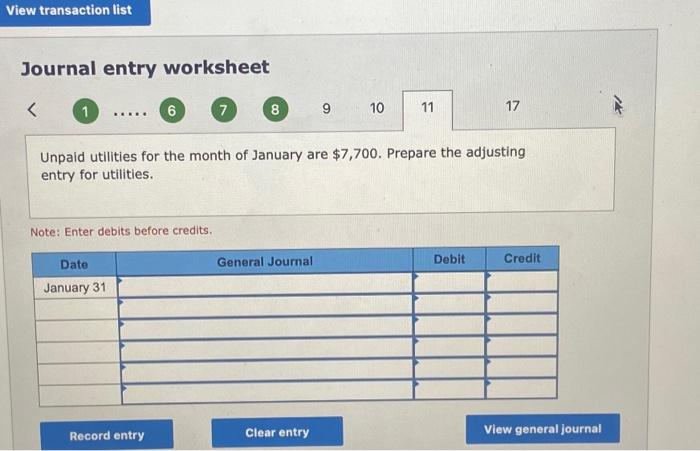

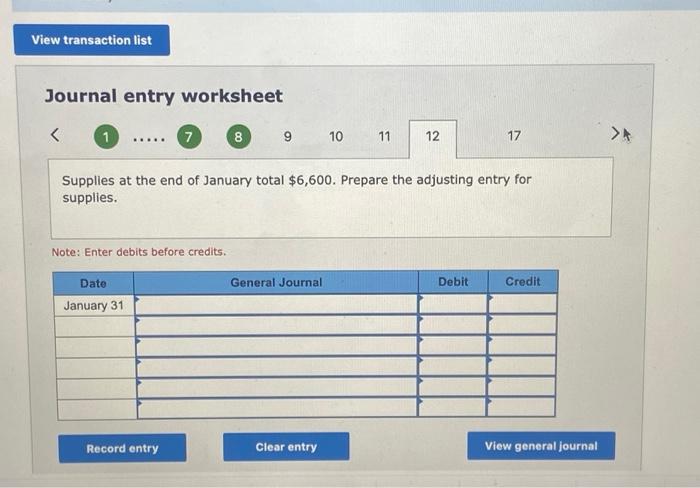

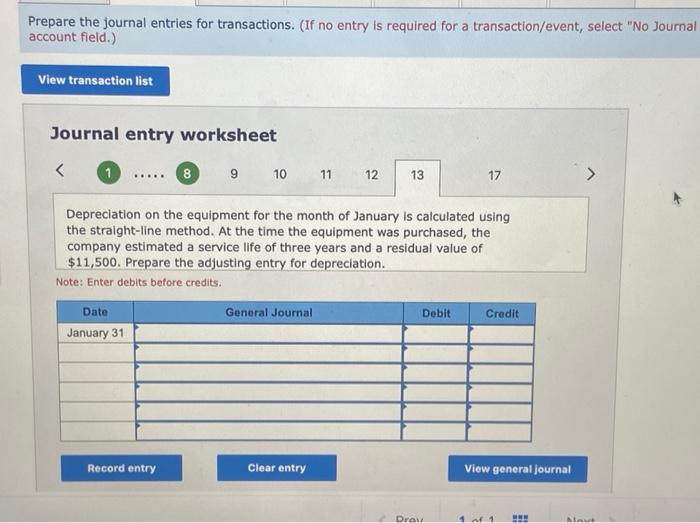

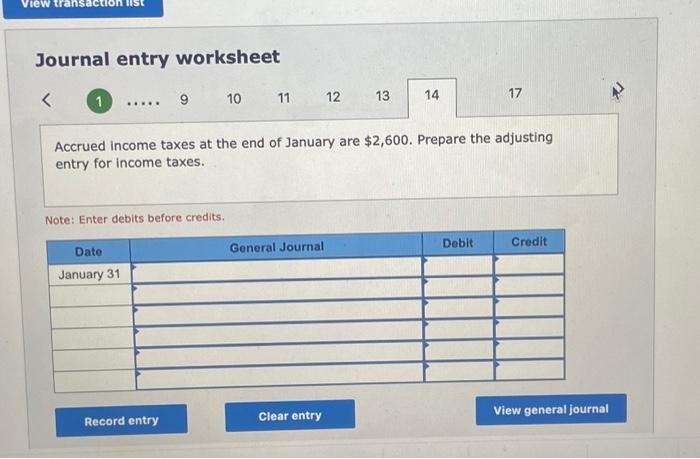

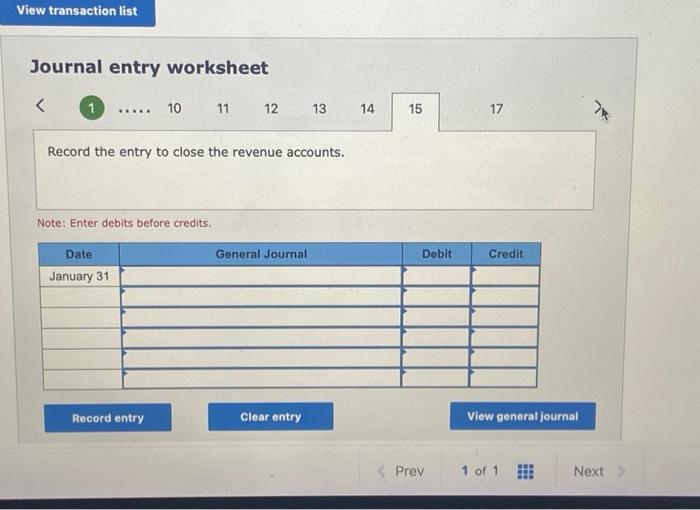

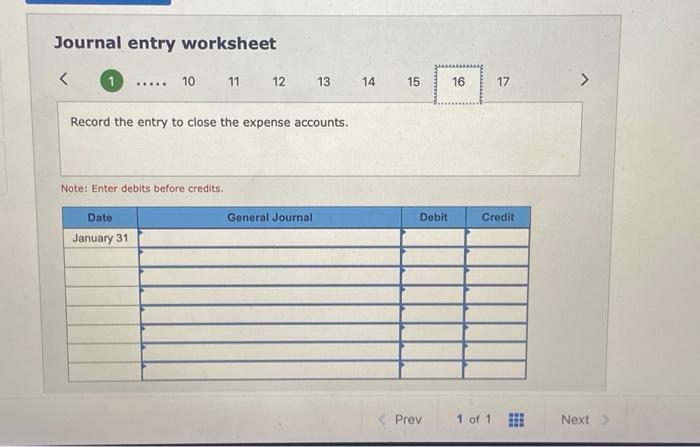

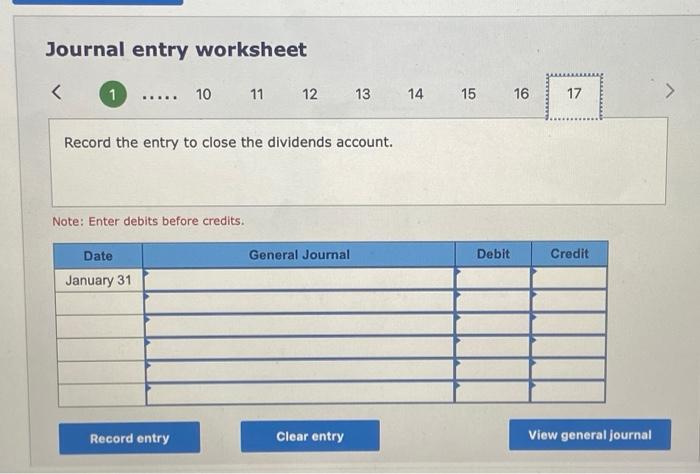

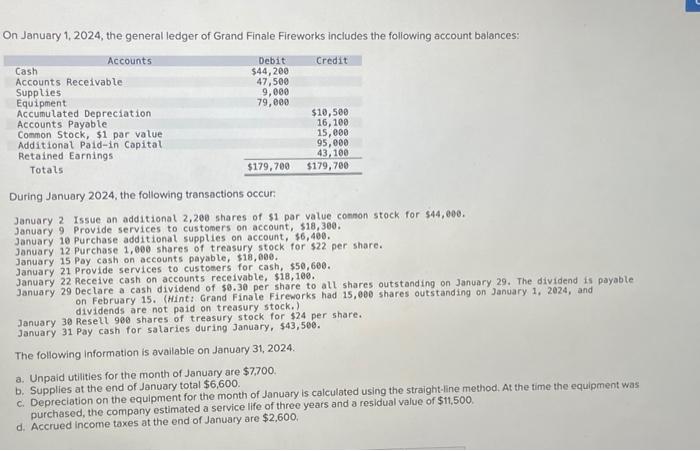

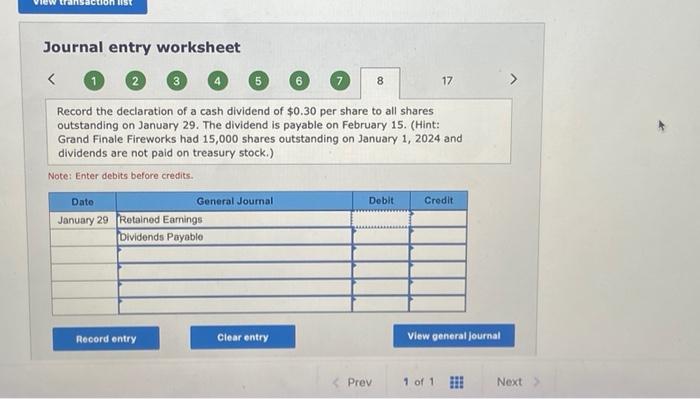

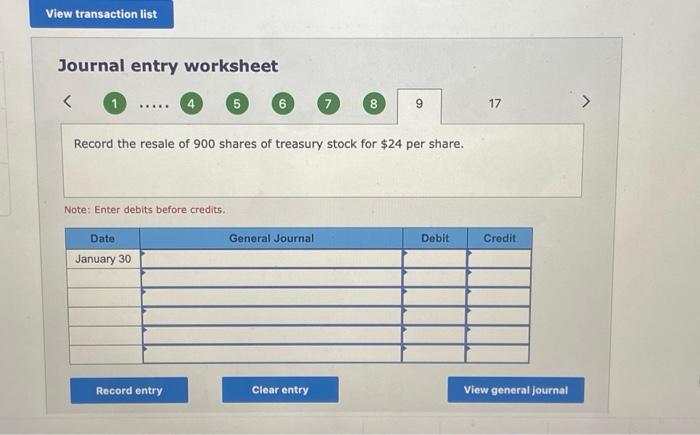

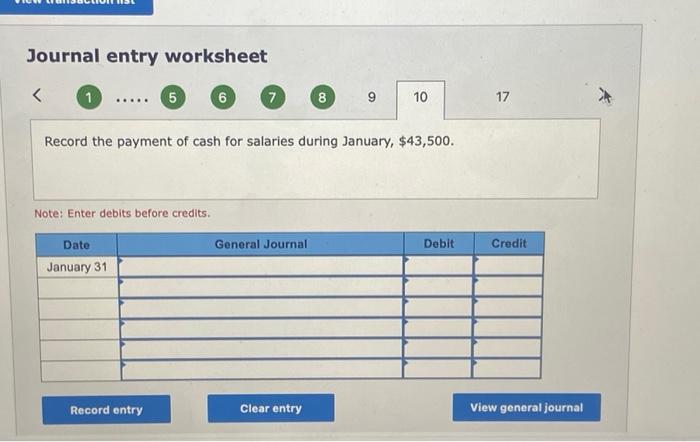

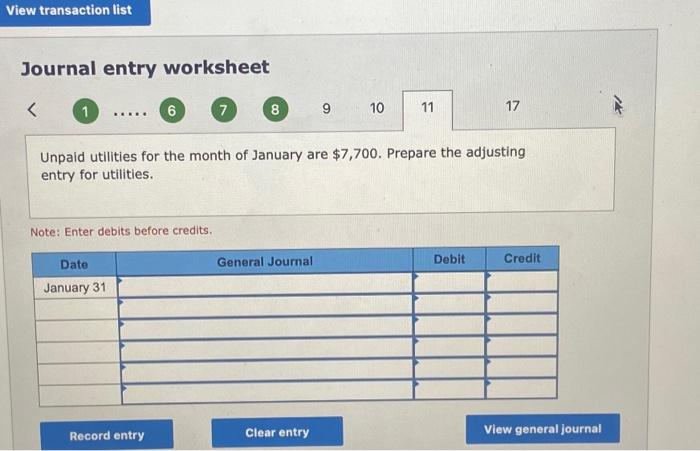

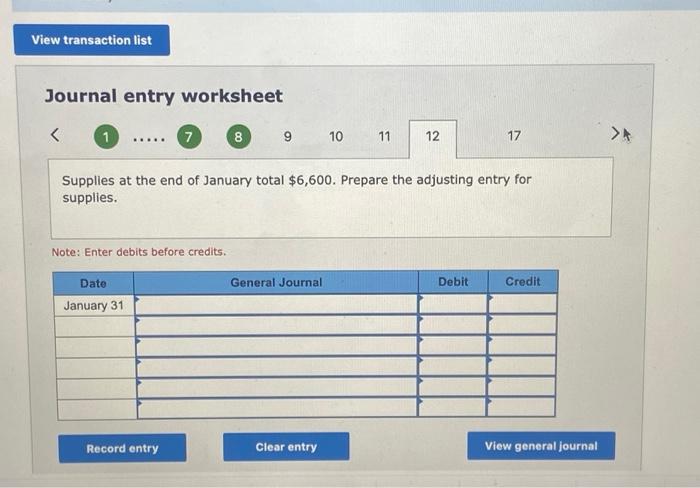

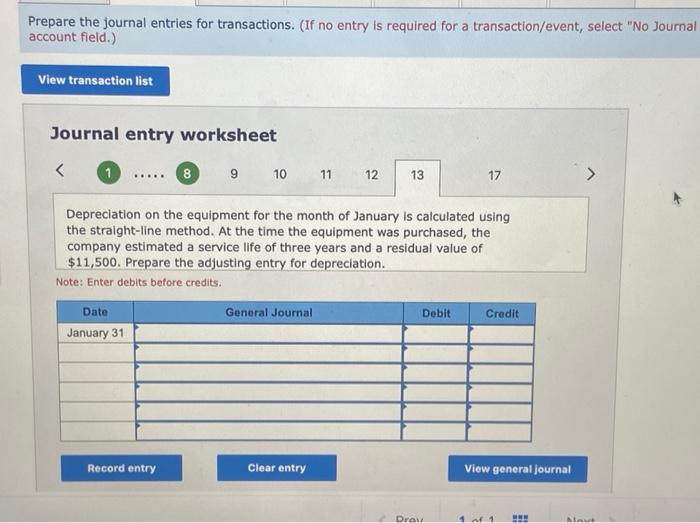

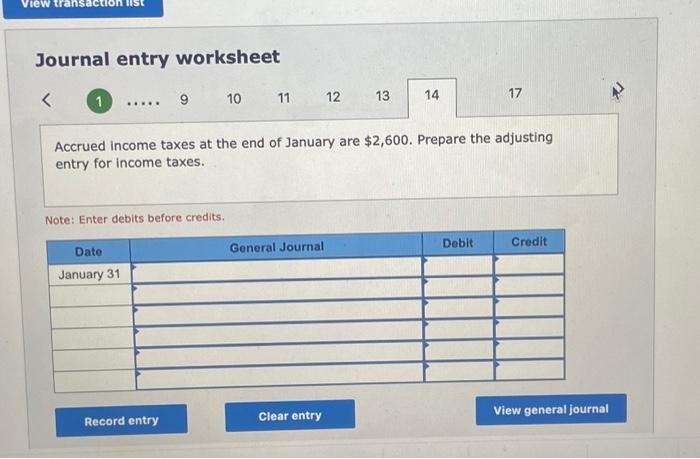

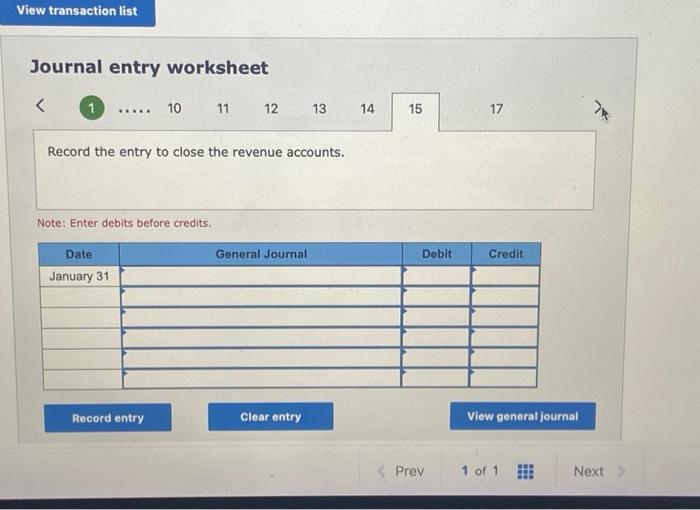

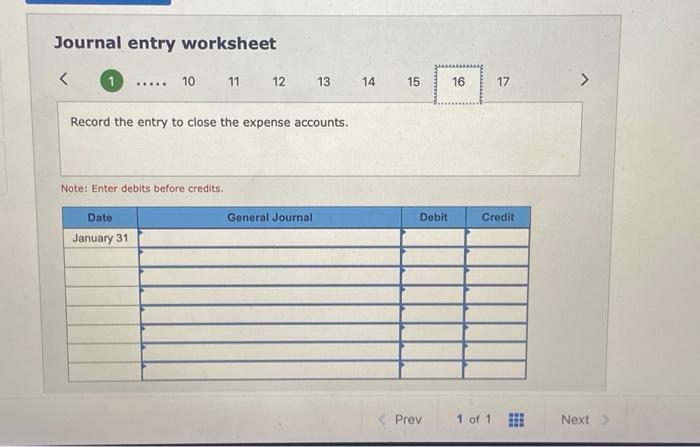

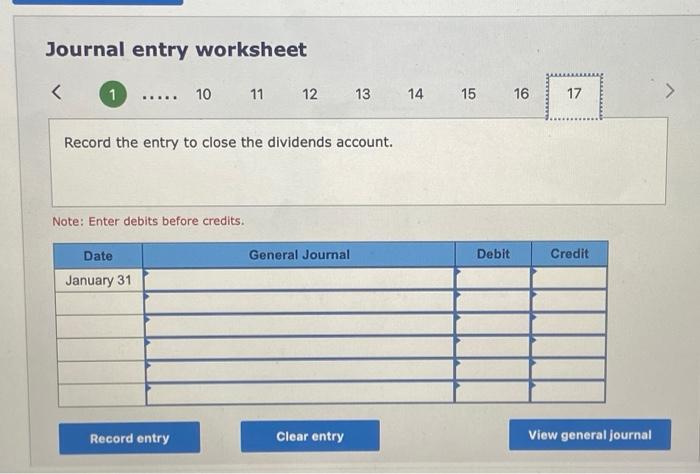

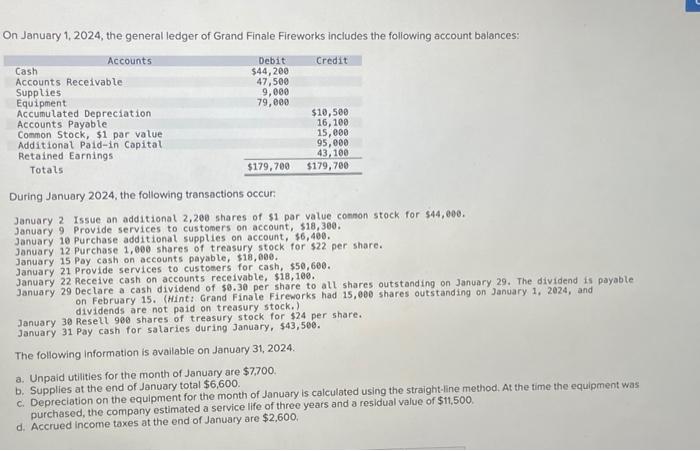

Journal entry worksheet 1 (2) 3 (4) (5) 6 7 17 Record the declaration of a cash dividend of $0.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 15,000 shares outstanding on January 1, 2024 and dividends are not paid on treasury stock.) Note: Enter debits before credits. Journal entry worksheet 1 (1) 4 5 6 7 (8) 9 Record the resale of 900 shares of treasury stock for $24 per share. Note: Enter debits before credits. Journal entry worksheet 1 (5) 6 7 (8) 9 Record the payment of cash for salaries during January, $43,500. Note: Enter debits before credits. Journal entry worksheet (1) 17 Unpaid utilities for the month of January are $7,700. Prepare the adjusting entry for utilities. Note: Enter debits before credits. Journal entry worksheet 1 7 910 11 17 Supplies at the end of January total $6,600. Prepare the adjusting entry for supplies. Note: Enter debits before credits. repare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Journa iccount field.) Journal entry worksheet (1) .8 Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $11,500. Prepare the adjusting entry for depreciation. Note: Enter debits before credits. Journal entry worksheet 1 12 17 Accrued income taxes at the end of January are $2,600. Prepare the adjusting entry for income taxes. Note: Enter debits before credits. Journal entry worksheet 1 12 13 Record the entry to close the revenue accounts. Note: Enter debits before credits. Journal entry worksheet 1 12 13 Record the entry to close the expense accounts. Note: Enter debits before credits. Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 Issue an additional 2,200 shares of $1 par value connon stock for $44,000. January 9 Provide services to customers on account, 518,300. January 10 Purchase additionat supplies on account, $6,400. January 12 Purchase 1,000 shares of treasury stock for $22 per share. January 15 Pay cash on accounts payable, $18,000. January 21 Provide services to custoters for cash, $50,600. January 22 Receive cash on accounts receivable, $18,100. January 29 Declare a cash dividend of 50.30 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 15,0ee shares outstanding on January 1, 2024, and dividends are not paid on treasury stock.) January 30 Resell 980 shares of treasury stock for $24 per share. January 31 Pay cash for salaries during January, 543,500 . The following information is available on January 31,2024. a. Unpaid utilities for the month of January are $7,700 c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was b. Supplies at the end of January total $6,600. purchased, the company estimated a service life of three years and a residual value of $11,500. d. Accrued income taxes at the end of January are $2,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started