Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with the following proble, the journal entries should be correct, need help with the numbers! The Bradford Company issued 6% bonds, dated January

Please help with the following proble, the journal entries should be correct, need help with the numbers!

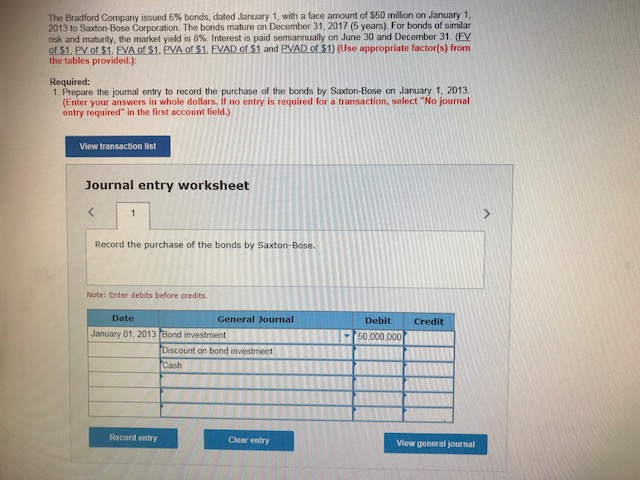

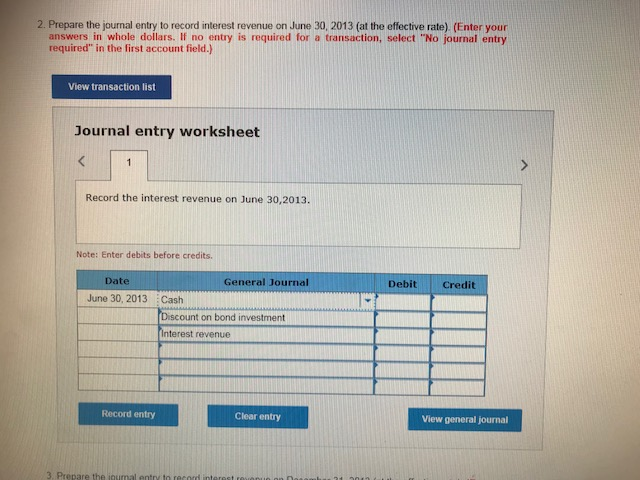

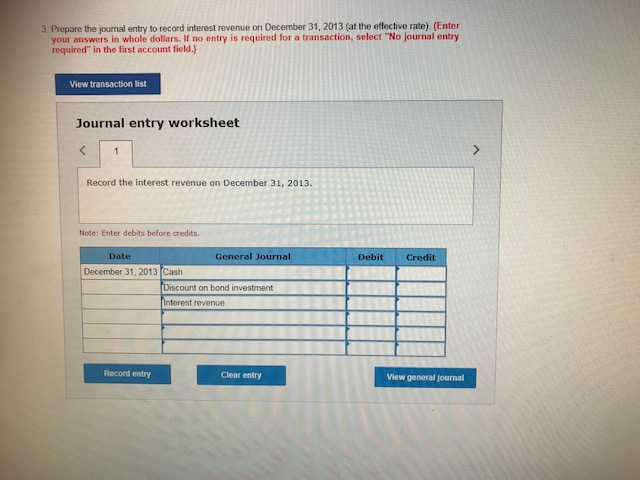

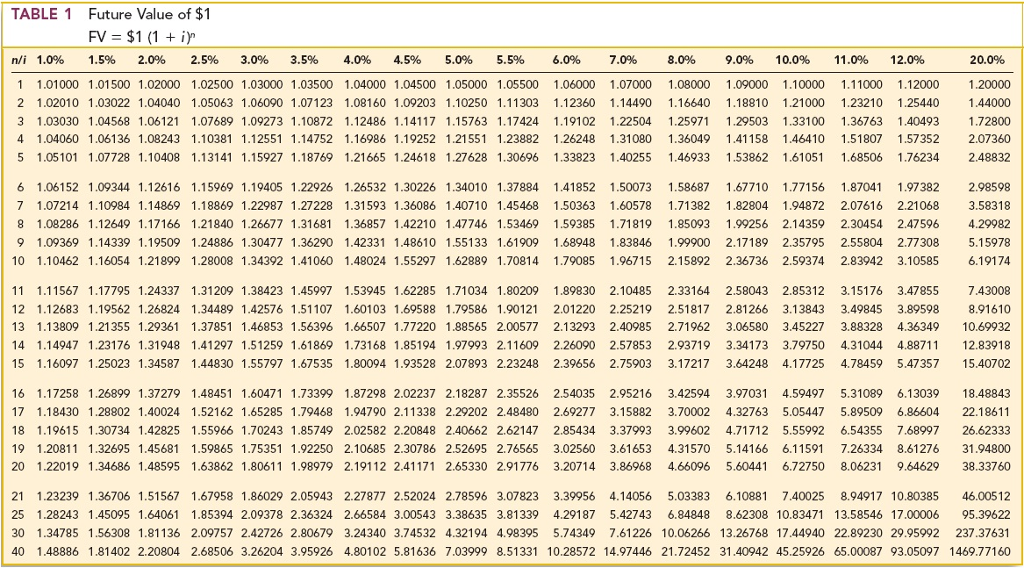

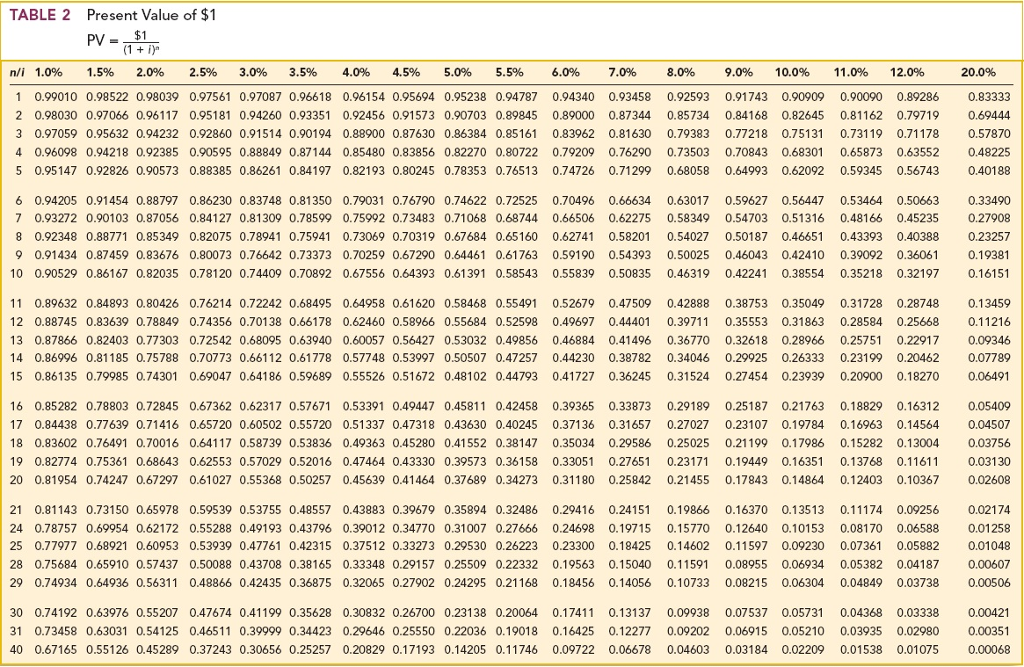

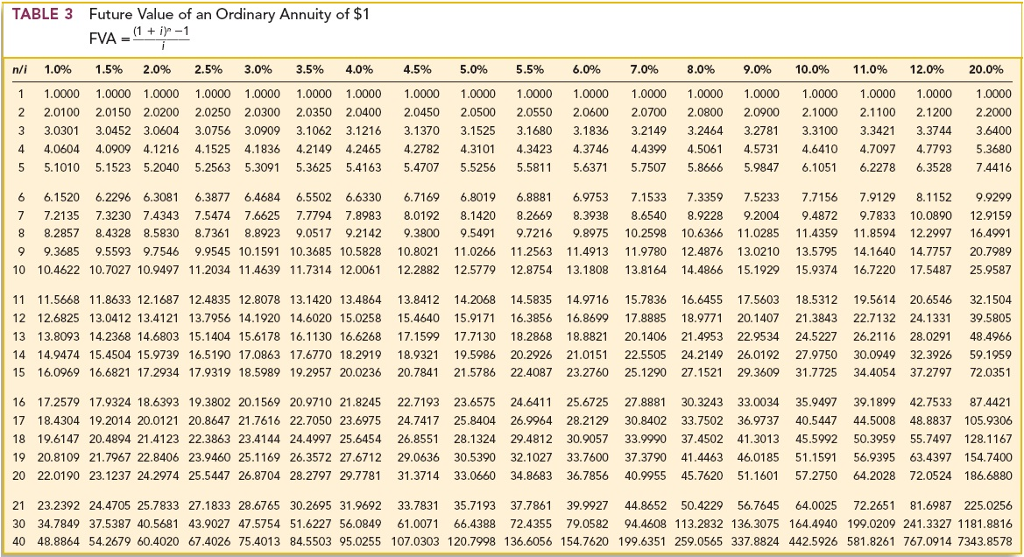

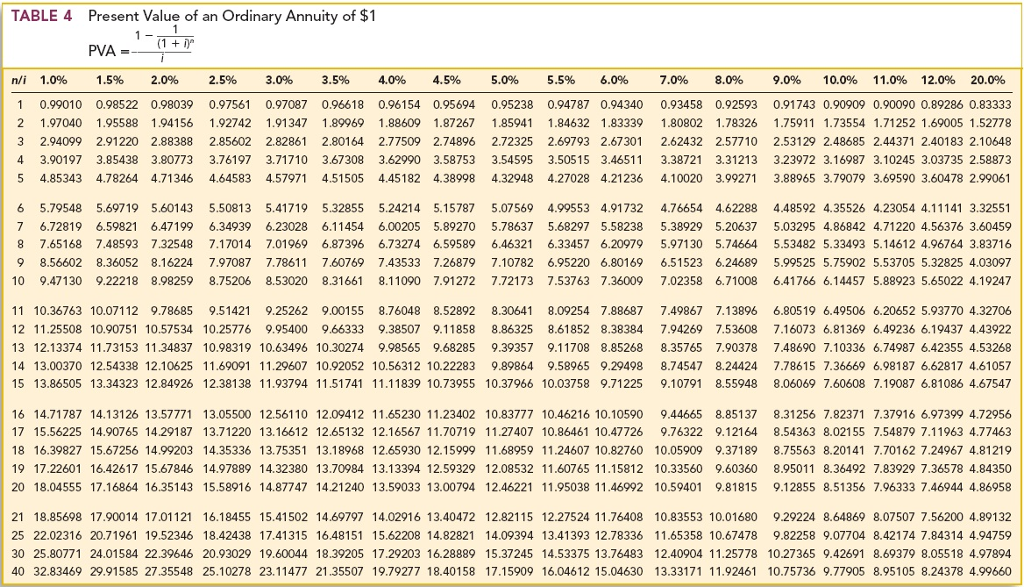

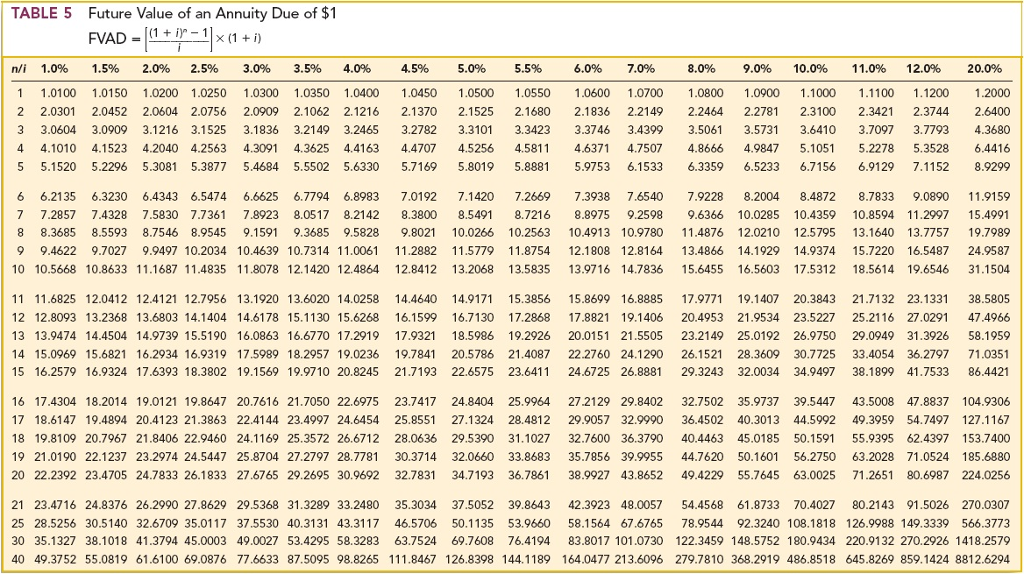

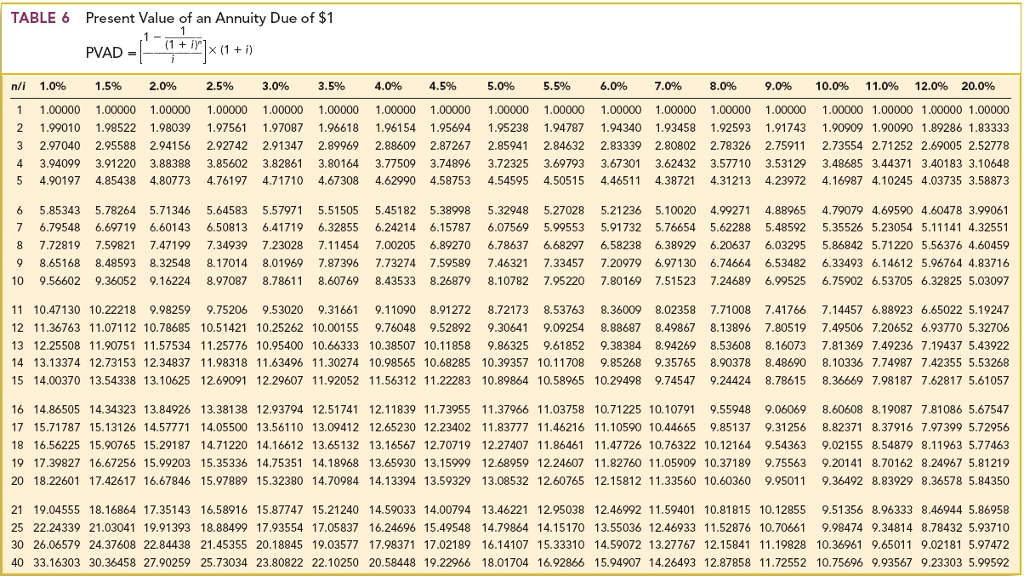

The Bradford Company issued 6% bonds, dated January 1, with a face amount of $50 million on January 1, 2013 to Saxton-Bose Corporation. The bonds mature on December 31, 2017 (5 years). For bonds of similar risk and maturity, the market yield is 8%. Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started