please help with the remaining parts

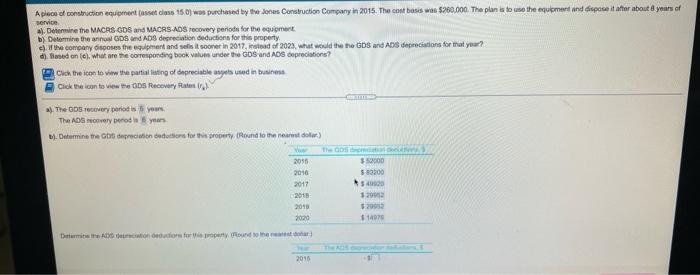

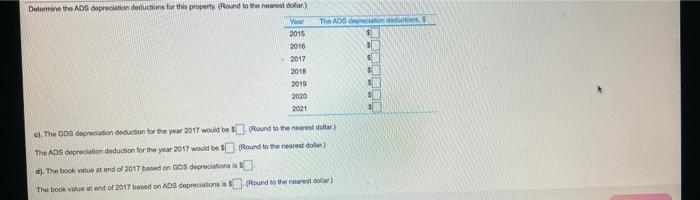

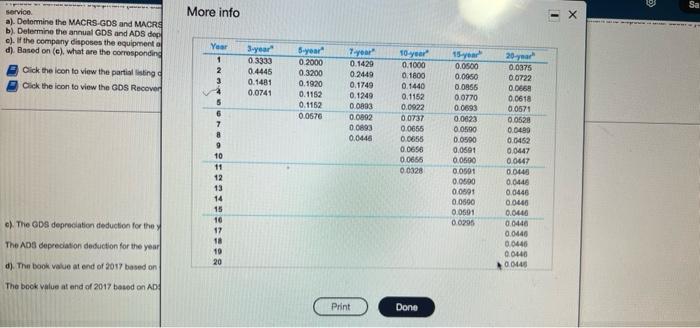

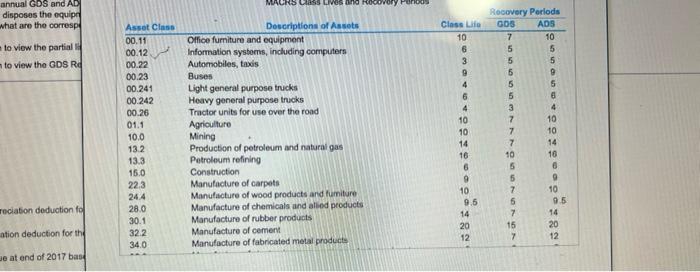

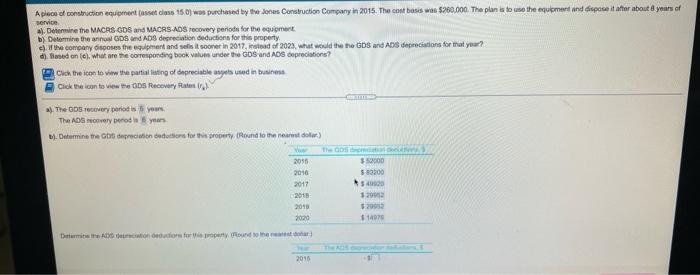

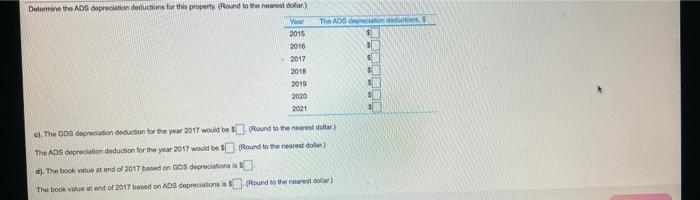

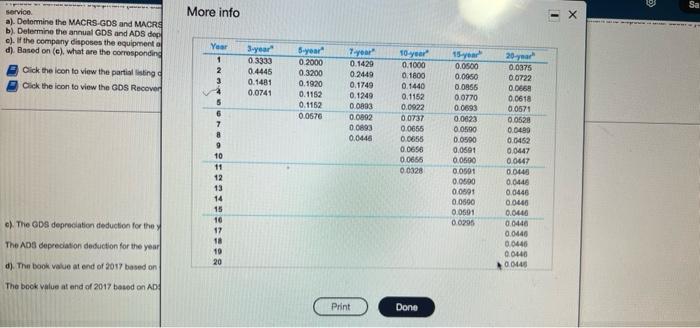

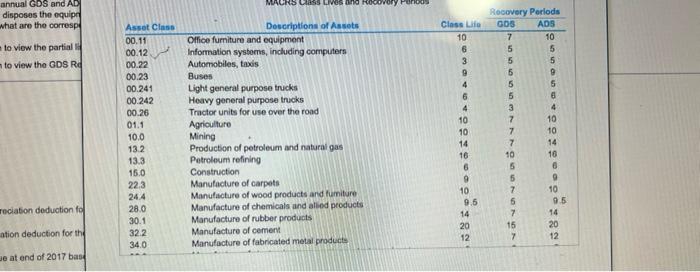

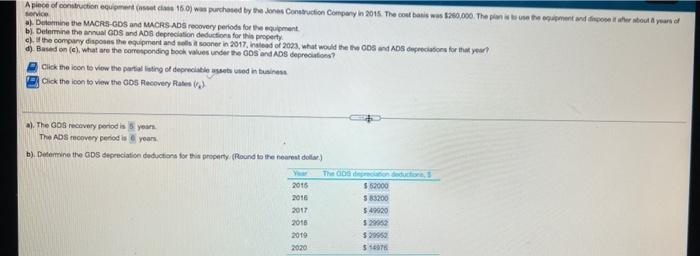

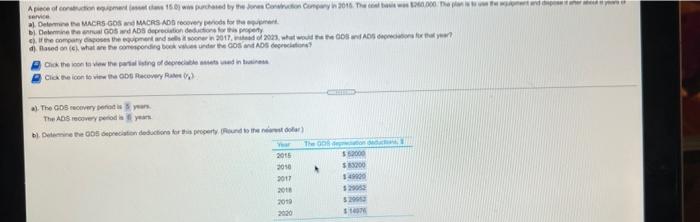

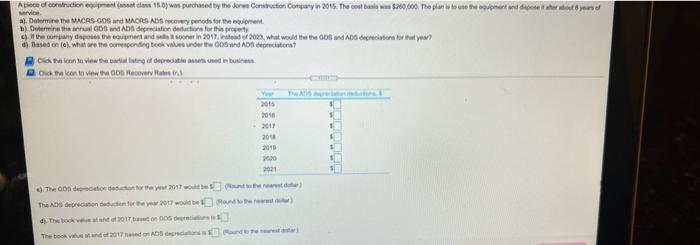

service Aplece of construction equipment fusset clans 150) was purchased by the Seas Construction Company in 2015. The cont basis was $200.000. The plan is to use the equipment and dispose it afar about your of A). Determine the MACRS GOS and MACRS ADS recovery periods for the equipment b) Determine the annual GS and ADS depreciation deductions for this property a company opores the eodpmart and selleksooner in 2017, instead of 2020, what would the GDS and ADS depreciations for that you? d) med en le), who are the corresponding book values under the GDS and ADS depreciations? Click the icon to viw the partial loting of depreciable as used in business Click the icon to view Recovery Rates 10 The recovery period is your The Avery Derod in yours j. Determine the pretendere for this property Pound to the nearest) Theo 2015 2010 2017 2018 2018 2020 35000 52000 4000 3292 52001 14074 Dem ADS foron found the 2015 The ADS Grond Delamine the ADS depreciation defutions for this property (Round to the nearest door) Your 2015 2010 2017 2018 2019 2020 2001 The GDS depreciation deduction for the year 2017 would be 5. Round to the nearest delar) The ADS depreciation deduction for the year 2017 would be found to the nearest dollar) 4). The book value at end of 2017 based on GOS depreciation The book value at end of 2017 based on os depreciation (Round to the nearest dow) Sa More info service al. Determine the MACRS-GDS and MACR b). Determine the annual GDS and ADS dep c). If the company disposes the equipment d). Based on (c), what are the corresponding Click the icon to view the partial listing Click the icon to view the GDS Recover 3year 0.3333 0.4445 0.1481 0.0741 Byear" 0.2000 0.3200 0.1920 0.1152 0.1152 0.0676 Year 1 2 3 2 5 6 7 8 9 10 11 12 13 14 15 10 year" 0.1429 0.2449 0.1749 0.1249 00893 0.0992 0 0893 0.0446 10 year 0.1000 0.1800 0.1440 0.1152 0.0922 0.0737 0.0656 0.0655 0.0656 0.0665 0.0328 15-year 0.0500 0.0050 0.0956 0.0770 0.0093 0.0823 0.0590 0.0500 0.0591 0.0690 0.0591 0.0500 0.0691 0.0000 0.0591 00205 20-year 0.0375 0.0722 00868 0,0618 0.0571 0.0628 0.0489 0.0462 0.0447 0.0447 00440 c) The ODS depreciation deduction for the 0.0446 0.0446 0.0446 0.0440 0.0448 0.0440 0.0446 0.0440 0.0145 The ADS depreciation deduction for the year d). The book value at end of 2017 based on 18 10 20 The book value at end of 2017 based on AD Print Done MACRS Lives and Recovery on annual GDS and AD disposes the equip what are the correspe to view the partial to view the GDS Rd Assot Class 00.11 00.12 00.22 00.23 00.241 00.242 00.26 01.1 10.0 13.2 13.3 15.0 223 244 28.0 30.1 322 340 Descriptions of Assets Office furniture and equipment Information systems, including computers Automobiles, taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Class Lila 10 6 3 9 4 6 4 10 10 14 16 6 9 10 9.6 14 20 12 Recovery Periods GOS ADS 7 10 5 5 5 5 6 9 5 5 5 3 4 7 10 7 10 7 14 10 10 5 6 5 9 7 10 6 9.5 7 14 15 20 7 12 . reciation deduction to ation deduction for the de at end of 2017 basd Service Apince of construction equipment (want el 16.0) was purchased by the Jones Construction Company in 2015. The contais wa $200,000. The para un terment and decom ter tout yourself Determine the MACRS GDS and MACRS ADS recovery periods for the equipment bj. Determine the GDS and ADS depreciation deduction for this property the company does the gapment and toile sooner in 2017. named of 2003, what would the ed ADS concretes for that you? d) Based on (e) What are the corresponding book values under the Go and ADS depreciations? Click the icon to view the partial ating of deprecatesses used in business Click the icon to view the GOS Recovery Restra) a). The Grecovery period is your The ADS recovery period is yours b). Determine the GDS depreciation deductions for this property (Roond to the nearest dollar) The coconut 2015 $ 52000 2016 583200 2017 549920 2018 529052 2019 529952 2020 $105 Apiece of crime 15.6 inched by the Company in 2016. The whole Determ MACRS GOS MACRS ADD recovery for the Celine hd ADS deprecation for property Seconocer de 2017. ***Scar? di Based on what we necording to underton ADS democionet Chick then to view the progredine Click the icon to view the Recovery) $5.2000 a) The Gover 5 years The ADS cod yn Dette erection duction for this perty Round to her The 2015 2010 2017 2016 2010 2030 3400 2005 A of construction (1) was purchased by the Joros Convition Company in 2015. The colonie w 5.200.000. The photos and yes a) Dimine the VACAS GO and MACRS ADS cowy periods for the equipment Dina Tha 005 and Abdecretion date for this property the wydag the owner and one 2017/2020, what would the bed Add capaciter let you? Based on what corresponding took her Gitte on to view listing of deprecated Od then to view Recovery Yra 2011 2018 2017 2018 2010 2000 2001 The onderhew 2017 The ADS code for the 2017 ) d. The band of 2017 The book 2017 ADS service Aplece of construction equipment fusset clans 150) was purchased by the Seas Construction Company in 2015. The cont basis was $200.000. The plan is to use the equipment and dispose it afar about your of A). Determine the MACRS GOS and MACRS ADS recovery periods for the equipment b) Determine the annual GS and ADS depreciation deductions for this property a company opores the eodpmart and selleksooner in 2017, instead of 2020, what would the GDS and ADS depreciations for that you? d) med en le), who are the corresponding book values under the GDS and ADS depreciations? Click the icon to viw the partial loting of depreciable as used in business Click the icon to view Recovery Rates 10 The recovery period is your The Avery Derod in yours j. Determine the pretendere for this property Pound to the nearest) Theo 2015 2010 2017 2018 2018 2020 35000 52000 4000 3292 52001 14074 Dem ADS foron found the 2015 The ADS Grond Delamine the ADS depreciation defutions for this property (Round to the nearest door) Your 2015 2010 2017 2018 2019 2020 2001 The GDS depreciation deduction for the year 2017 would be 5. Round to the nearest delar) The ADS depreciation deduction for the year 2017 would be found to the nearest dollar) 4). The book value at end of 2017 based on GOS depreciation The book value at end of 2017 based on os depreciation (Round to the nearest dow) Sa More info service al. Determine the MACRS-GDS and MACR b). Determine the annual GDS and ADS dep c). If the company disposes the equipment d). Based on (c), what are the corresponding Click the icon to view the partial listing Click the icon to view the GDS Recover 3year 0.3333 0.4445 0.1481 0.0741 Byear" 0.2000 0.3200 0.1920 0.1152 0.1152 0.0676 Year 1 2 3 2 5 6 7 8 9 10 11 12 13 14 15 10 year" 0.1429 0.2449 0.1749 0.1249 00893 0.0992 0 0893 0.0446 10 year 0.1000 0.1800 0.1440 0.1152 0.0922 0.0737 0.0656 0.0655 0.0656 0.0665 0.0328 15-year 0.0500 0.0050 0.0956 0.0770 0.0093 0.0823 0.0590 0.0500 0.0591 0.0690 0.0591 0.0500 0.0691 0.0000 0.0591 00205 20-year 0.0375 0.0722 00868 0,0618 0.0571 0.0628 0.0489 0.0462 0.0447 0.0447 00440 c) The ODS depreciation deduction for the 0.0446 0.0446 0.0446 0.0440 0.0448 0.0440 0.0446 0.0440 0.0145 The ADS depreciation deduction for the year d). The book value at end of 2017 based on 18 10 20 The book value at end of 2017 based on AD Print Done MACRS Lives and Recovery on annual GDS and AD disposes the equip what are the correspe to view the partial to view the GDS Rd Assot Class 00.11 00.12 00.22 00.23 00.241 00.242 00.26 01.1 10.0 13.2 13.3 15.0 223 244 28.0 30.1 322 340 Descriptions of Assets Office furniture and equipment Information systems, including computers Automobiles, taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Class Lila 10 6 3 9 4 6 4 10 10 14 16 6 9 10 9.6 14 20 12 Recovery Periods GOS ADS 7 10 5 5 5 5 6 9 5 5 5 3 4 7 10 7 10 7 14 10 10 5 6 5 9 7 10 6 9.5 7 14 15 20 7 12 . reciation deduction to ation deduction for the de at end of 2017 basd Service Apince of construction equipment (want el 16.0) was purchased by the Jones Construction Company in 2015. The contais wa $200,000. The para un terment and decom ter tout yourself Determine the MACRS GDS and MACRS ADS recovery periods for the equipment bj. Determine the GDS and ADS depreciation deduction for this property the company does the gapment and toile sooner in 2017. named of 2003, what would the ed ADS concretes for that you? d) Based on (e) What are the corresponding book values under the Go and ADS depreciations? Click the icon to view the partial ating of deprecatesses used in business Click the icon to view the GOS Recovery Restra) a). The Grecovery period is your The ADS recovery period is yours b). Determine the GDS depreciation deductions for this property (Roond to the nearest dollar) The coconut 2015 $ 52000 2016 583200 2017 549920 2018 529052 2019 529952 2020 $105 Apiece of crime 15.6 inched by the Company in 2016. The whole Determ MACRS GOS MACRS ADD recovery for the Celine hd ADS deprecation for property Seconocer de 2017. ***Scar? di Based on what we necording to underton ADS democionet Chick then to view the progredine Click the icon to view the Recovery) $5.2000 a) The Gover 5 years The ADS cod yn Dette erection duction for this perty Round to her The 2015 2010 2017 2016 2010 2030 3400 2005 A of construction (1) was purchased by the Joros Convition Company in 2015. The colonie w 5.200.000. The photos and yes a) Dimine the VACAS GO and MACRS ADS cowy periods for the equipment Dina Tha 005 and Abdecretion date for this property the wydag the owner and one 2017/2020, what would the bed Add capaciter let you? Based on what corresponding took her Gitte on to view listing of deprecated Od then to view Recovery Yra 2011 2018 2017 2018 2010 2000 2001 The onderhew 2017 The ADS code for the 2017 ) d. The band of 2017 The book 2017 ADS