Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with the requirements !! In its annual report, WRM Athletic Supply, Inc. includes the following five-year financial summary: (Click the icon to view

please help with the requirements !!

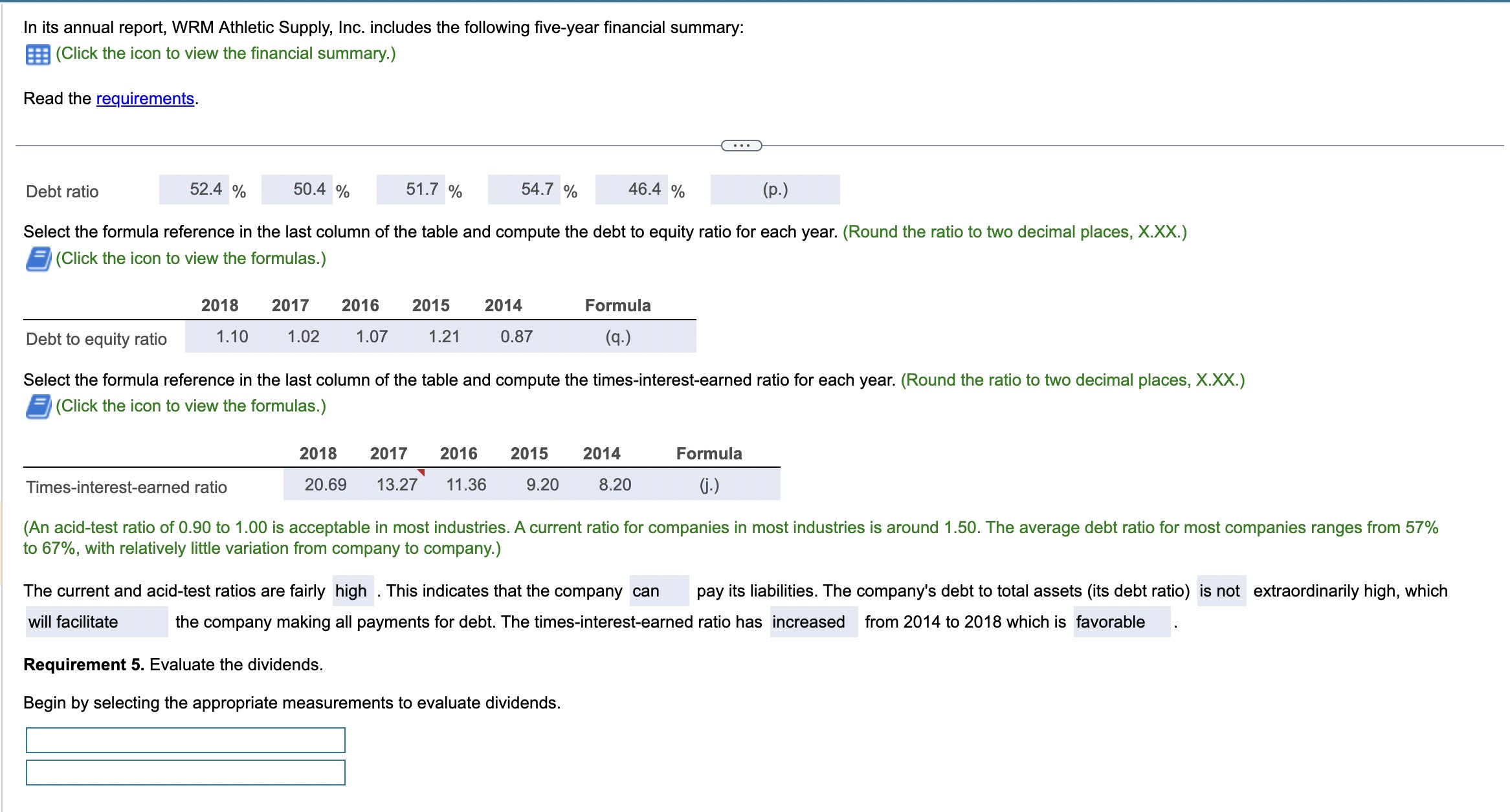

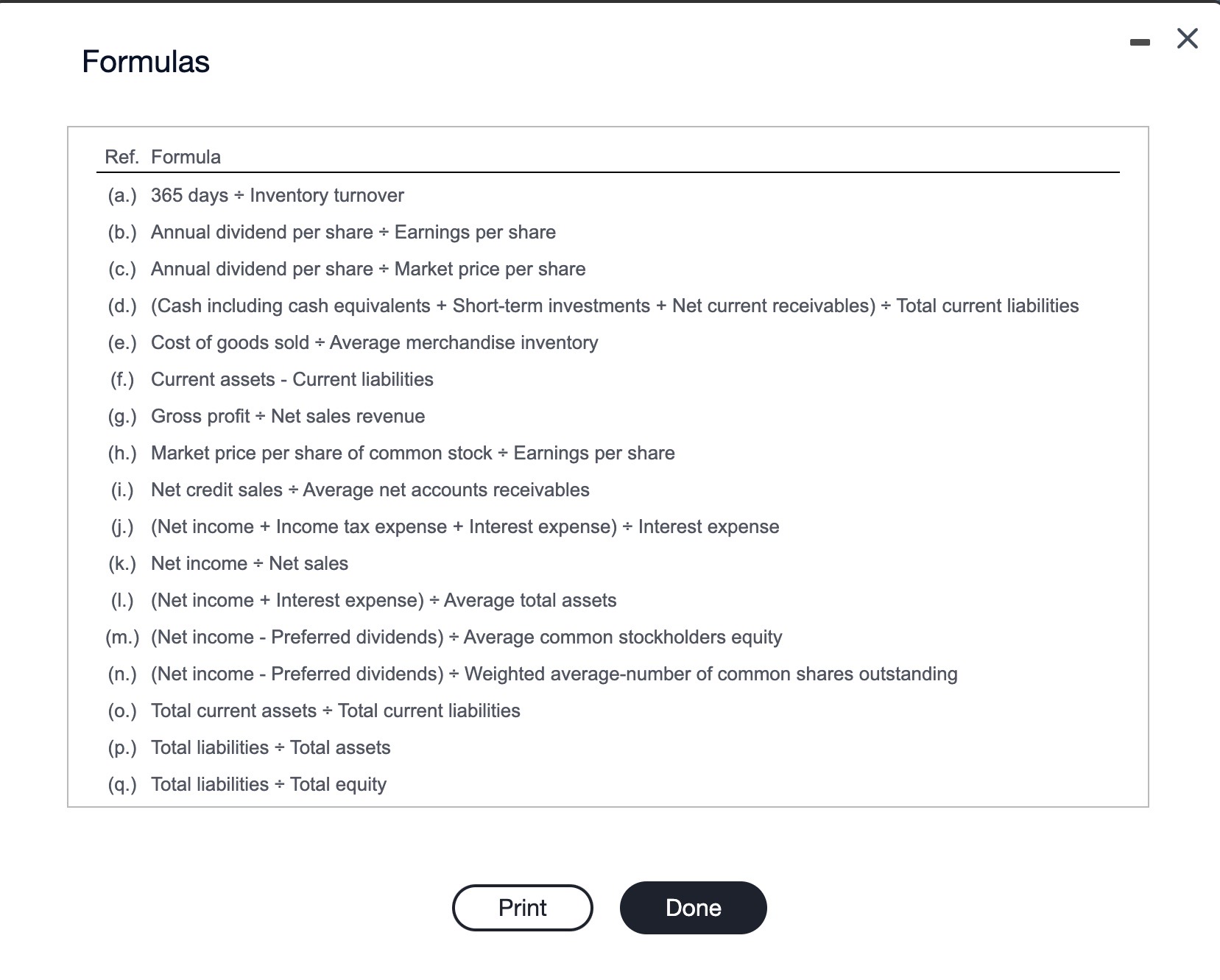

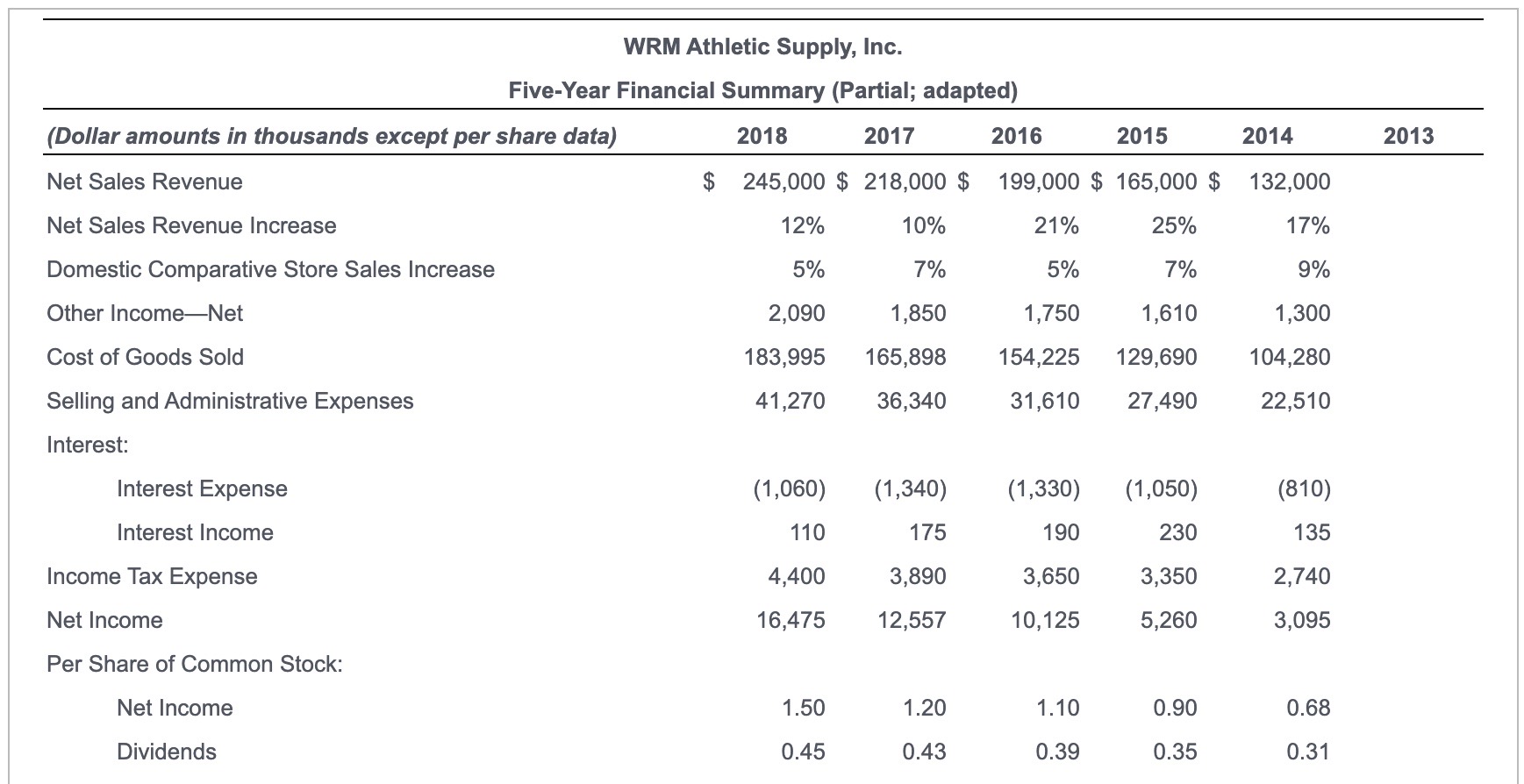

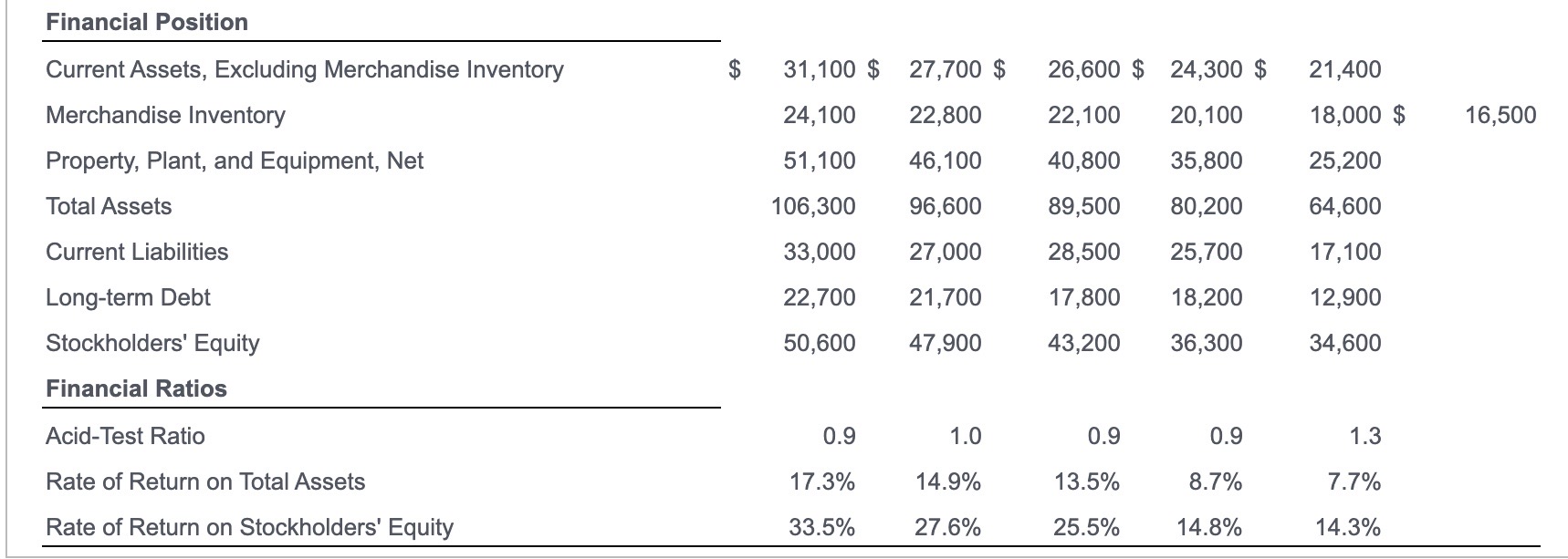

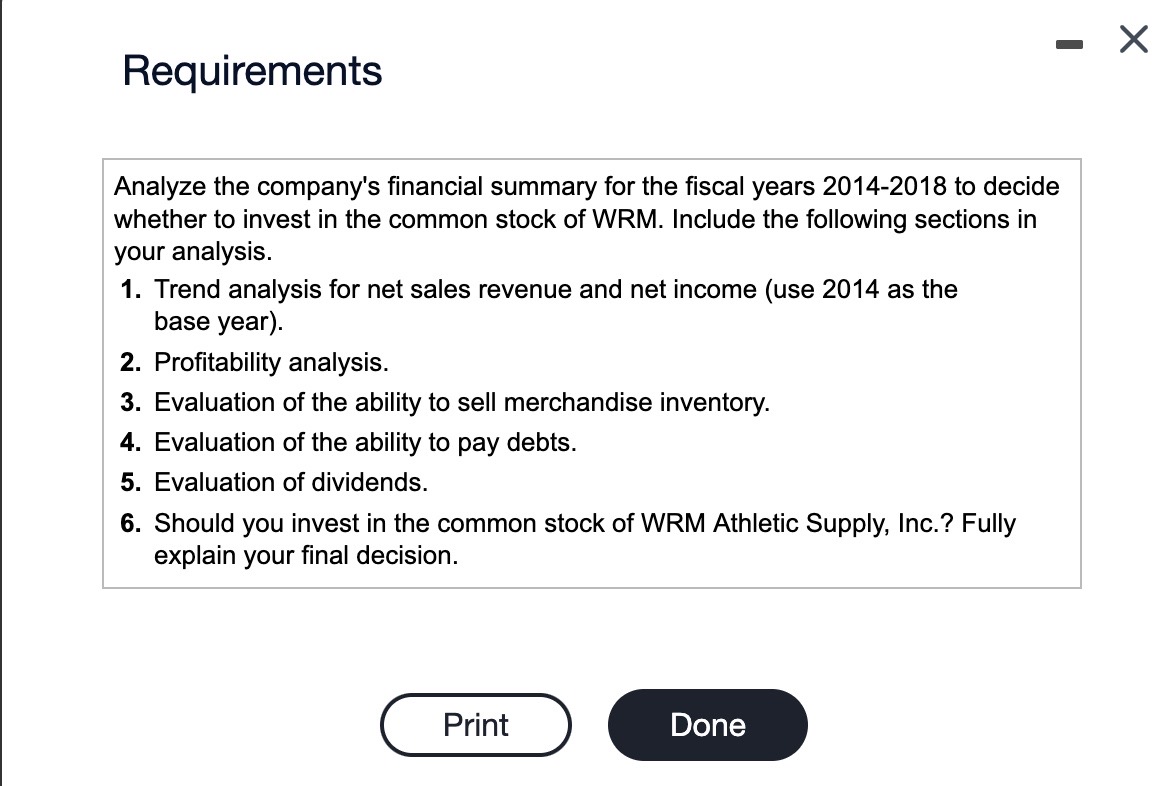

In its annual report, WRM Athletic Supply, Inc. includes the following five-year financial summary: (Click the icon to view the financial summary.) Read the requirements. Select the formula reference in the last column of the table and compute the debt to equity ratio for each year. (Round the ratio to two decimal places, X.XX.) (Click the icon to view the formulas.) Select the formula reference in the last column of the table and compute the times-interest-earned ratio for each year. (Round the ratio to two decimal places, X.XX.) (Click the icon to view the formulas.) to 67%, with relatively little variation from company to company.) The current and acid-test ratios are fairly . This indicates that the company pay its liabilities. The company's debt to total assets (its debt ratio) extraordinarily high, which the company making all payments for debt. The times-interest-earned ratio has from 2014 to 2018 which is Requirement 5. Evaluate the dividends. Begin by selecting the appropriate measurements to evaluate dividends. Formulas Ref. Formula (a.) 365 days Inventory turnover (b.) Annual dividend per share Earnings per share (c.) Annual dividend per share Market price per share (d.) (Cash including cash equivalents + Short-term investments + Net current receivables) Total current liabilities (e.) Cost of goods sold Average merchandise inventory (f.) Current assets - Current liabilities (g.) Gross profit Net sales revenue (h.) Market price per share of common stock Earnings per share (i.) Net credit sales Average net accounts receivables (j.) (Net income + Income tax expense + Interest expense) Interest expense (k.) Net income Net sales (I.) (Net income + Interest expense) Average total assets (m.) (Net income - Preferred dividends) Average common stockholders equity (n.) (Net income - Preferred dividends) Weighted average-number of common shares outstanding (o.) Total current assets Total current liabilities (p.) Total liabilities Total assets (q.) Total liabilities Total equity \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|c|}{\begin{tabular}{l} WRM Athletic Supply, Inc. \\ Five-Year Financial Summary (Partial; adapted) \\ \end{tabular}} \\ \hline (Dollar amounts in thousands except per share data) & & 2018 & 2017 & 2016 & 2015 & 2014 & 2013 \\ \hline Net Sales Revenue & $ & 245,000$ & 218,000$ & 199,000 & 165,000$ & 132,000 & \\ \hline Net Sales Revenue Increase & & 12% & 10% & 21% & 25% & 17% & \\ \hline Domestic Comparative Store Sales Increase & & 5% & 7% & 5% & 7% & 9% & \\ \hline Other IncomeNet & & 2,090 & 1,850 & 1,750 & 1,610 & 1,300 & \\ \hline Cost of Goods Sold & & 183,995 & 165,898 & 154,225 & 129,690 & 104,280 & \\ \hline Selling and Administrative Expenses & & 41,270 & 36,340 & 31,610 & 27,490 & 22,510 & \\ \hline \multicolumn{8}{|l|}{ Interest: } \\ \hline Interest Expense & & (1,060) & (1,340) & (1,330) & (1,050) & (810) & \\ \hline Interest Income & & 110 & 175 & 190 & 230 & 135 & \\ \hline Income Tax Expense & & 4,400 & 3,890 & 3,650 & 3,350 & 2,740 & \\ \hline Net Income & & 16,475 & 12,557 & 10,125 & 5,260 & 3,095 & \\ \hline \multicolumn{8}{|l|}{ Per Share of Common Stock: } \\ \hline Net Income & & 1.50 & 1.20 & 1.10 & 0.90 & 0.68 & \\ \hline Dividends & & 0.45 & 0.43 & 0.39 & 0.35 & 0.31 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Financial Position & & & & & & \\ \hline Current Assets, Excluding Merchandise Inventory & 31,100$ & 27,700$ & 26,600$ & 24,300$ & 21,400 & \\ \hline Merchandise Inventory & 24,100 & 22,800 & 22,100 & 20,100 & 18,000$ & 16,500 \\ \hline Property, Plant, and Equipment, Net & 51,100 & 46,100 & 40,800 & 35,800 & 25,200 & \\ \hline Total Assets & 106,300 & 96,600 & 89,500 & 80,200 & 64,600 & \\ \hline Current Liabilities & 33,000 & 27,000 & 28,500 & 25,700 & 17,100 & \\ \hline Long-term Debt & 22,700 & 21,700 & 17,800 & 18,200 & 12,900 & \\ \hline Stockholders' Equity & 50,600 & 47,900 & 43,200 & 36,300 & 34,600 & \\ \hline Financial Ratios & & & & & & \\ \hline Acid-Test Ratio & 0.9 & 1.0 & 0.9 & 0.9 & 1.3 & \\ \hline Rate of Return on Total Assets & 17.3% & 14.9% & 13.5% & 8.7% & 7.7% & \\ \hline Rate of Return on Stockholders' Equity & 33.5% & 27.6% & 25.5% & 14.8% & 14.3% & \\ \hline \end{tabular} Requirements Analyze the company's financial summary for the fiscal years 2014-2018 to decide whether to invest in the common stock of WRM. Include the following sections in your analysis. 1. Trend analysis for net sales revenue and net income (use 2014 as the base year). 2. Profitability analysis. 3. Evaluation of the ability to sell merchandise inventory. 4. Evaluation of the ability to pay debts. 5. Evaluation of dividends. 6. Should you invest in the common stock of WRM Athletic Supply, Inc.? Fully explain your final decisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started