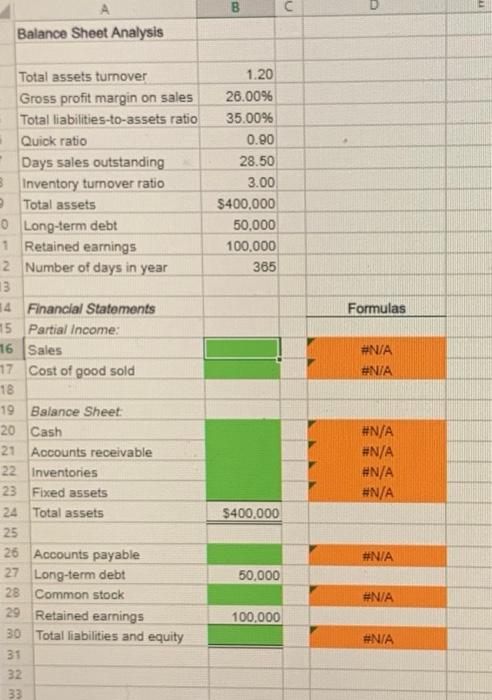

Question: please help with the solution. thank you! H Video Excel Online Structured Activity: Balance Sheet Analysis Consider the following financial data for 3. White Industrien:

H Video Excel Online Structured Activity: Balance Sheet Analysis Consider the following financial data for 3. White Industrien: Total assets turnover: 1.2 Gross profit margin on sales: (Sales - Cost of goods soldy/Sales - 26% Total liabilities-to-assets ratio: 35% Quick ratio: 0.90 Days sales outstanding (based on 365-day year): 28,5 days Inventory turnover ratio: 3.0 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. 00 C A Balance Sheet Analysis 1.20 26.00% 35.00% 0.90 28.50 3.00 $400,000 50,000 100.000 365 Total assets turnover Gross profit margin on sales Total liabilities-to-assets ratio Quick ratio Days sales outstanding Inventory turnover ratio Total assets 0 Long-term debt 1 Retained earnings 2 Number of days in year 13 14 Financial Statements 15 Partial Income: 16 Sales 17. Cost of good sold 18 19 Balance Sheet: 20 Cash 21 Accounts receivable 22 Inventories 23 Fixed assets 24 Total assets Formulas #N/A #N/A #N/A #N/A #N/A #N/A $400,000 25 #N/A 50,000 #N/A 26 Accounts payable 27 Long-term debt 28 Common stock 29 Retained earnings 30 Total liabilities and equity 31 32 33 100.000 #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts