Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with these accounting problems. i have attached 3-4 photos per question, if the answers are correct i will rate highly!! thank you. !

please help with these accounting problems. i have attached 3-4 photos per question, if the answers are correct i will rate highly!! thank you.

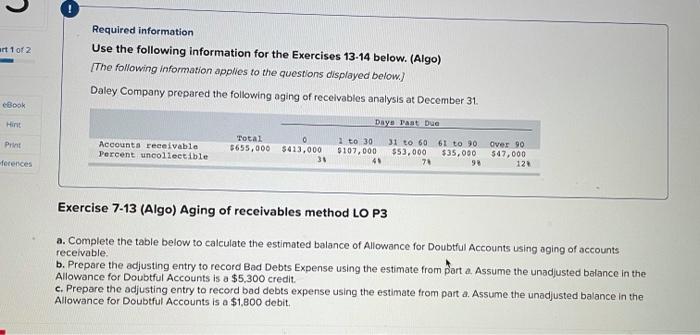

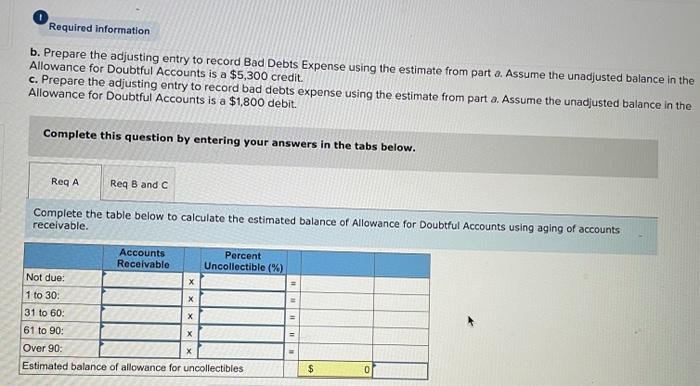

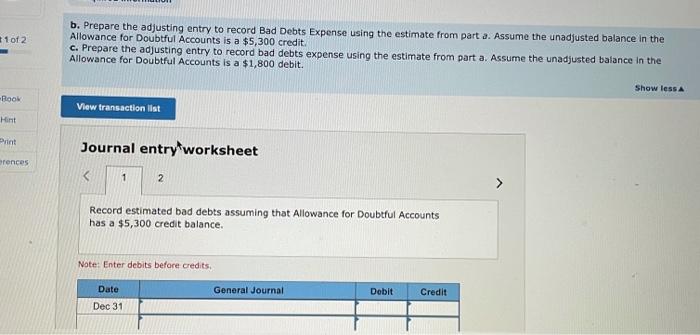

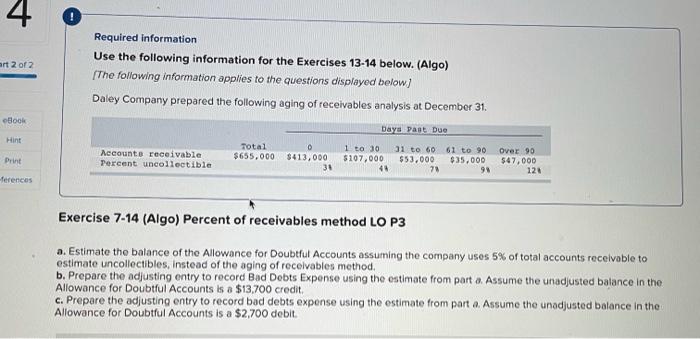

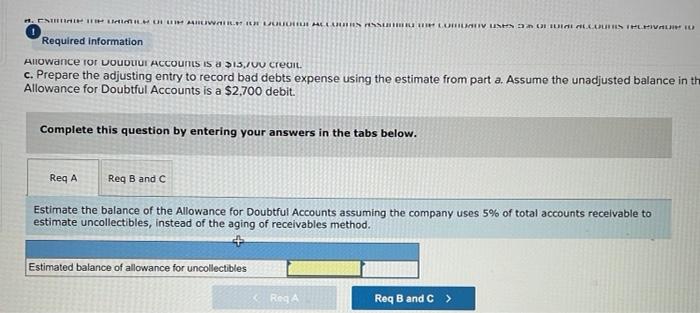

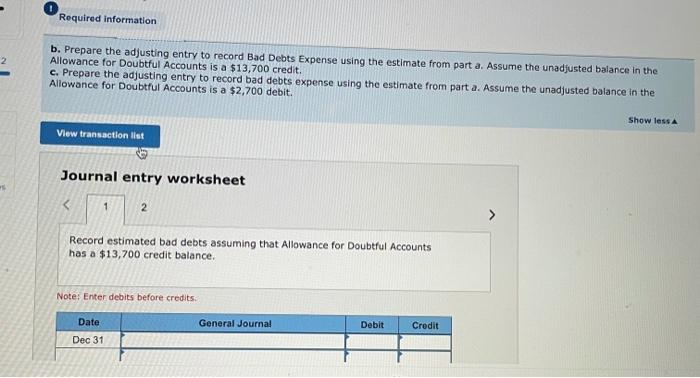

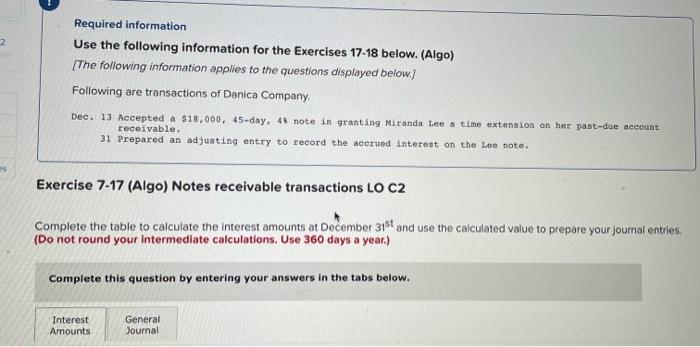

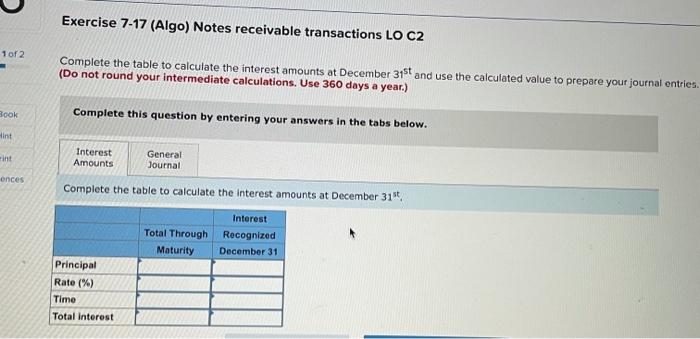

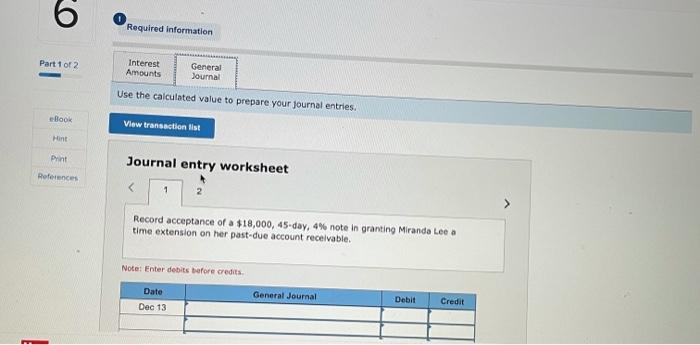

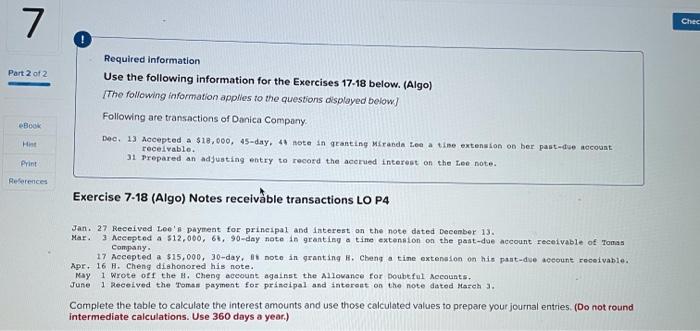

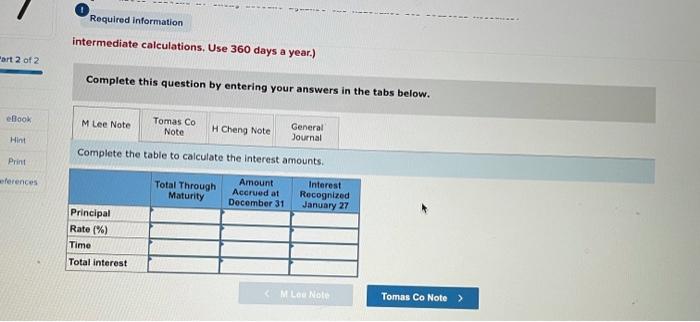

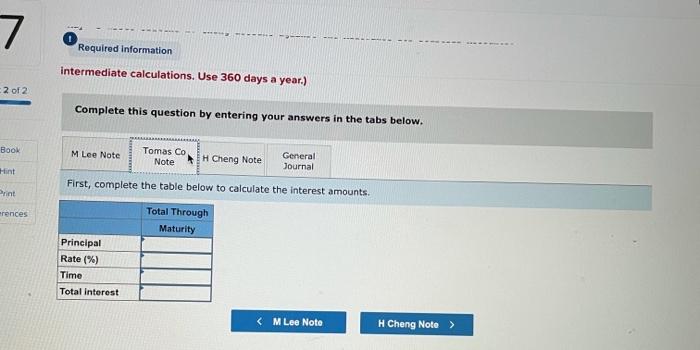

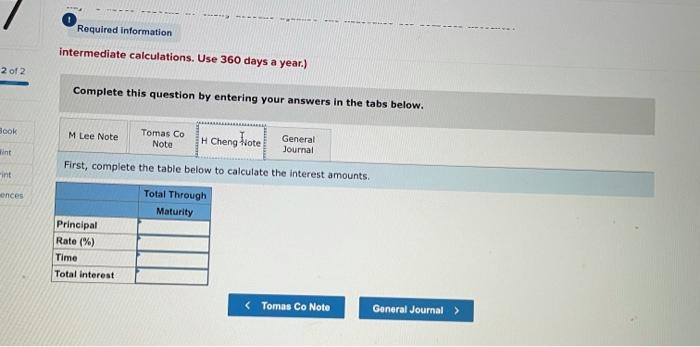

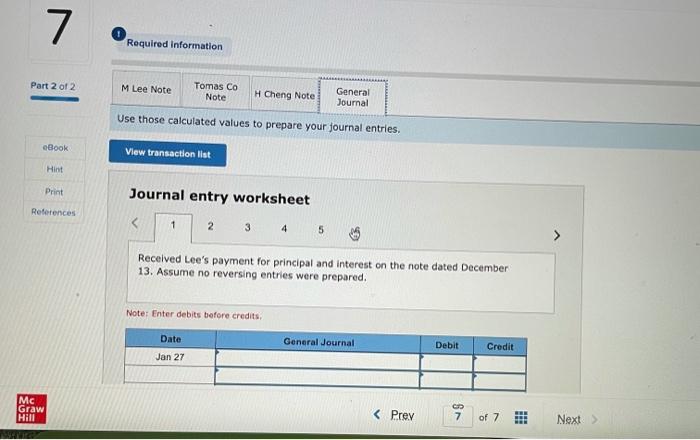

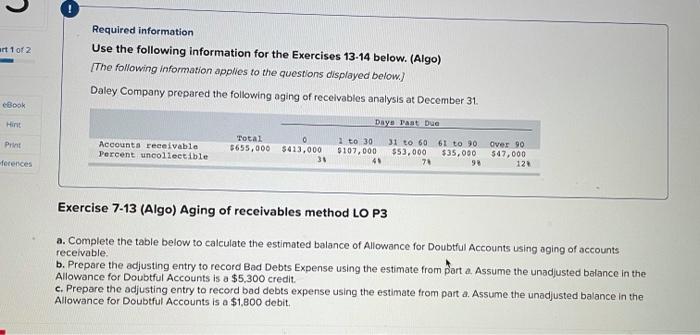

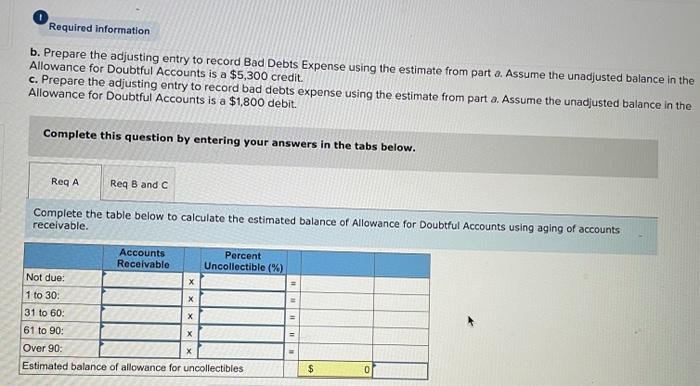

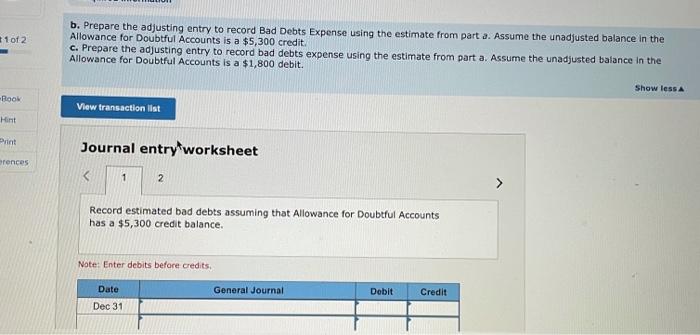

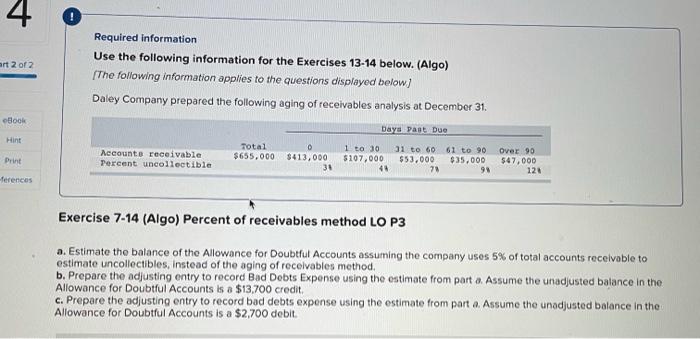

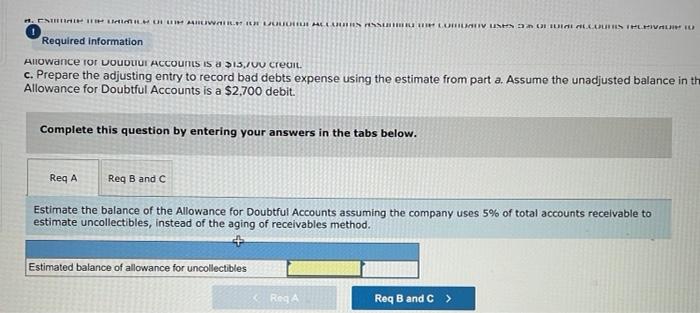

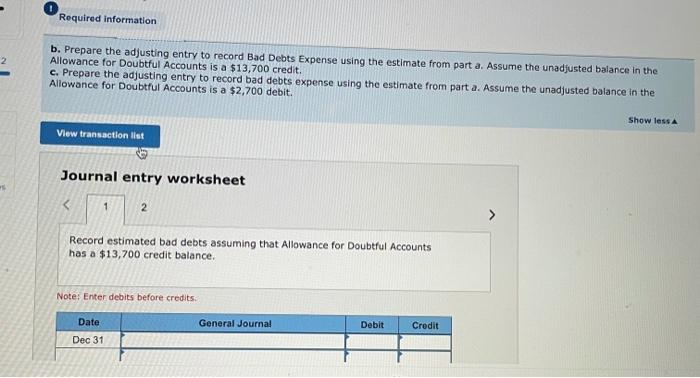

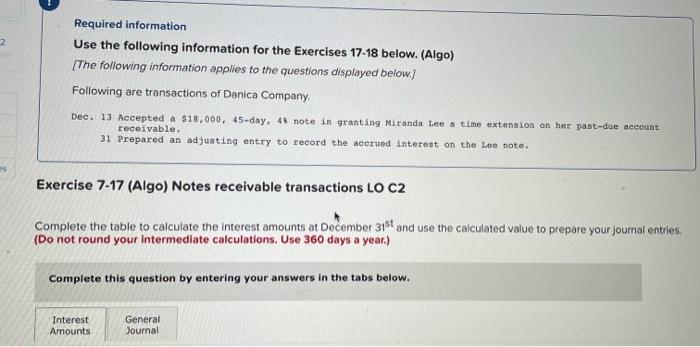

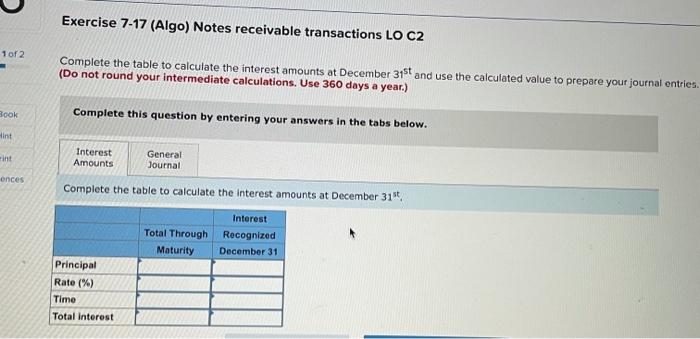

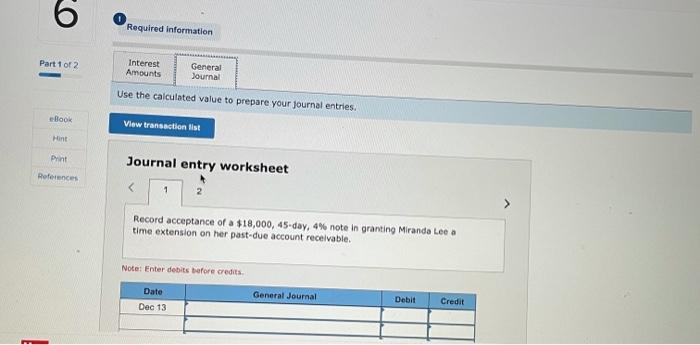

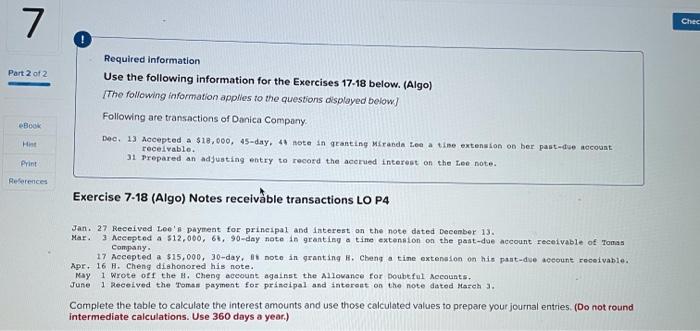

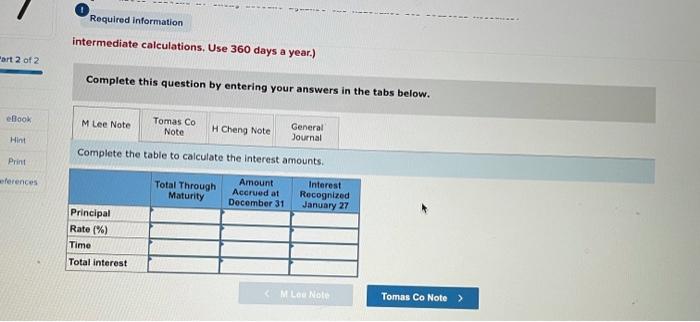

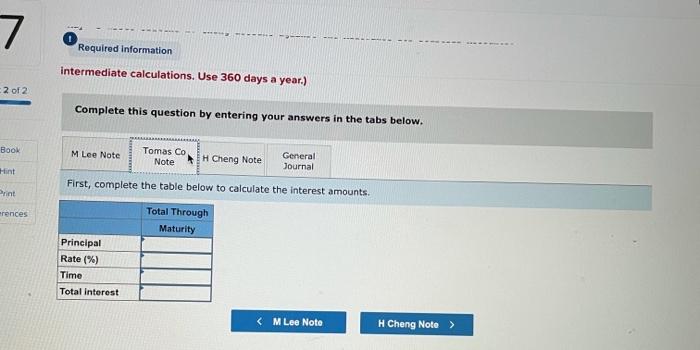

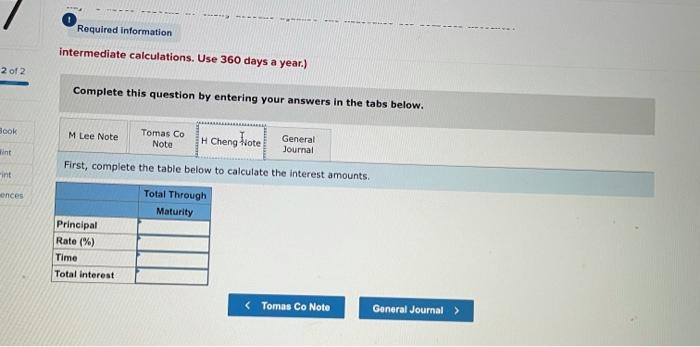

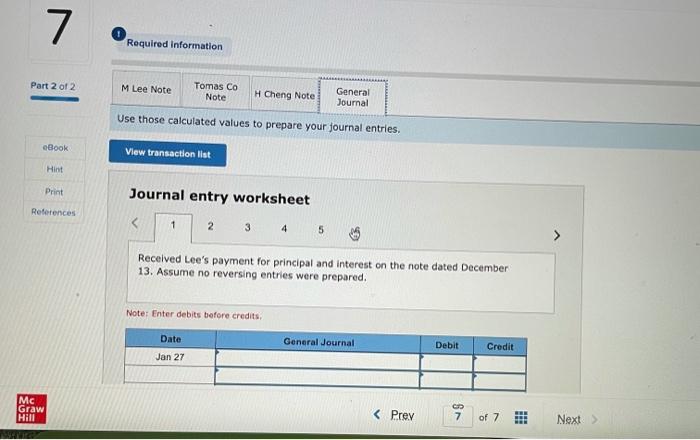

! art 1 of 2 Required information Use the following information for the Exercises 13-14 below. (Algo) The following information applies to the questions displayed below.) Daley Company prepared the following aging of receivables analysis at December 31 eBook Days Past Due Print Accounts receivable Percent uncollectible Total 3655,000 $413,000 30 2 to 30 $107.000 40 31 to 60 61 to 90 $53,000 $35,000 78 98 Over 90 547,000 120 ferences Exercise 7-13 (Algo) Aging of receivables method LO P3 receivable. a. Complete the table below to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from porta. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $5,300 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $1,800 debit. Required information b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $5,300 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $1,800 debit. Complete this question by entering your answers in the tabs below. Req A Req B and C Complete the table below to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts receivable. Accounts Receivable Percent Uncollectible (%) Not due: x 1 to 30 31 to 60: 61 to 90: Over 90: Estimated balance of allowance for uncollectibles $ 1 of 2 b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $5,300 credit. C. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $1,800 debit. Show less -Rook View transaction list Hint Print Journal entry worksheet rences 1 2 Record estimated bad debts assuming that Allowance for Doubtful Accounts has a $5,300 credit balance. Note: Enter debits before credits. Date General Journal Dobit Credit Dec 31 4 art 2 of 2 Required information Use the following information for the Exercises 13-14 below. (Algo) [The following information applies to the questions displayed below) Daley Company prepared the following aging of receivables analysis at December 31. Book Days Past Due Hint Total O $655.000 $413,000 38 Accounts receivable Percent uncollectible Print 1 to 30 $107.000 48 31 to 60 $53,000 70 61 to 90 $35.000 95 Over 90 $47,000 124 ferences Exercise 7-14 (Algo) Percent of receivables method LO P3 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles. Instead of the aging of receivables method b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part o. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13.700 credit c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,700 debit ENTINI HILI CHIN ARIWATER. RUIALES ENTRE LORTIV UND CLINISIPL HIVA Required information Allowance for our Accounts is a $15,700 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in th Allowance for Doubtful Accounts is a $2,700 debit. Complete this question by entering your answers in the tabs below. Req A Reg B and C Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. Estimated balance of allowance for uncollectibles Reg A Req B and C> Required information 2 b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,700 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,700 debit. Show less View transaction list Journal entry worksheet 7 Required Information intermediate calculations. Use 360 days a year.) 2 of 2 Complete this question by entering your answers in the tabs below. Book M Lee Note Tomas Co Note H Cheng Note General Journal Hint First, complete the table below to calculate the interest amounts. Print erences Total Through Maturity Principal Rate(%) Time Total interest Required information intermediate calculations. Use 360 days a year.) 2 of 2 Complete this question by entering your answers in the tabs below. cok M Lee Note Tomas Co Note HCheng Hote General Journal int First, complete the table below to calculate the interest amounts int ences Total Through Maturity Principal Rate(%) Time Total Interest 7 Required information Part 2 of 2 M Lee Note Tomas Co Note HCheng Note General Journal Use those calculated values to prepare your journal entries. Book View transaction list Hint Print Journal entry worksheet References 1 2 3 5 Received Lee's payment for principal and interest on the note dated December 13. Assume no reversing entries were prepared. Note: Enter debits before credits Date General Journal Debit Credit Jan 27 Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started