Answered step by step

Verified Expert Solution

Question

1 Approved Answer

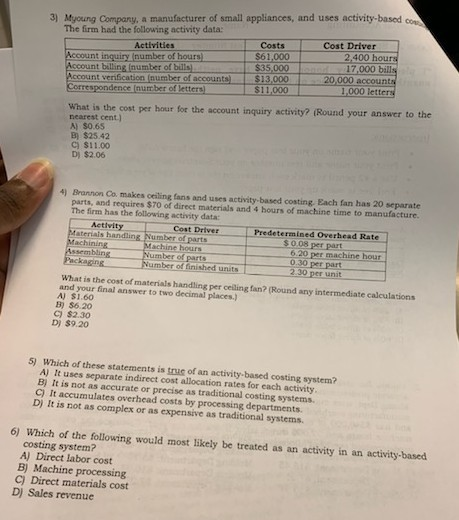

please help with these accounting questions 3) Myoung Company, a manufacturer of small appliances, and uses activity-based co The firm had the following activity data:

please help with these accounting questions

3) Myoung Company, a manufacturer of small appliances, and uses activity-based co The firm had the following activity data: Cost Driver Costs $61,000 $35,000 Activities 2,400 hou inquiry number of hours nt veriication (number of accounts)$13,000 20,000 accoun 17,000 bill ant billing number of buls $11,000 1,000 let pondence Inumber of letters What is the cost per hour for the account inquiry activity? (Round your answer to the nearest cent) A) s0.65 B) $25.42 C) $11.00 D) $2.06 4) Brannon Co. makes ceiling fans and uses activity-based costing. Each fan has 20 separate parts, and requires $70 of direct materials and 4 hours of machine time to manufacture. The firm has the following activity data: Activity Cost Driver Predetermined Overhead Rate fateriais handling Number of parts s 0. 08 per part achining achine umber of parts 6.20 per machine hour 0.30 per part 2.30 per unit kagingNumber of finished units What is the cost of materials handling per celing fan? (Round any intermediate calculations and your final answer to two decimal places.) A) $1.60 B) $6.20 C) $2.30 D) $9.20 5) Which of these statements is trus of an activity-based costing system? A) It uses separate indirect cost allocation rates for each activity B) It is not as accurate or precise as traditional costing systems. C) It accumulates overhead costs by processing departments. D) It is not as complex or as expensive as traditional systems. 6) Which of the following would most likely be treated as an activity in an activity-based costing system? A) Direct labor cost B) Machine processing C) Direct materials cost D) Sales revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started