please help with these homeowrk problems!

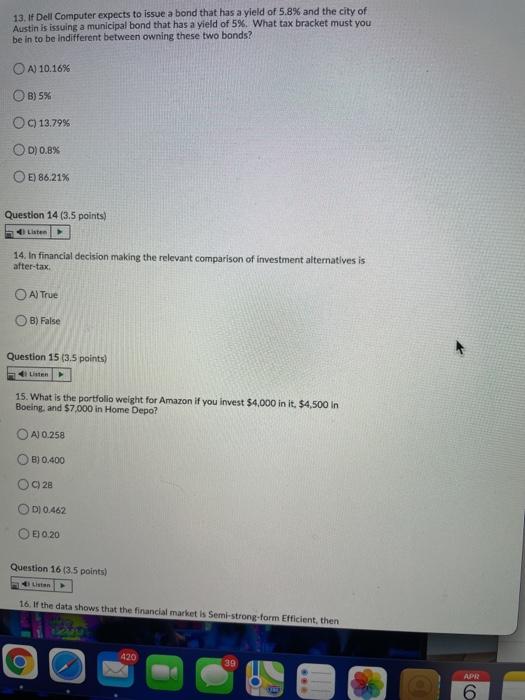

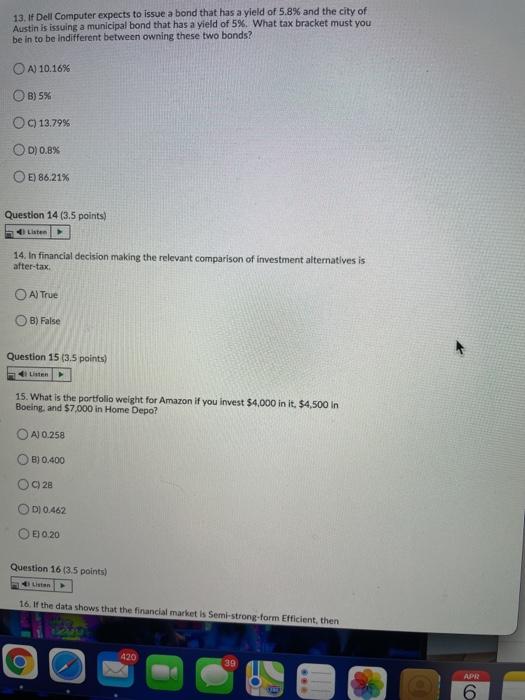

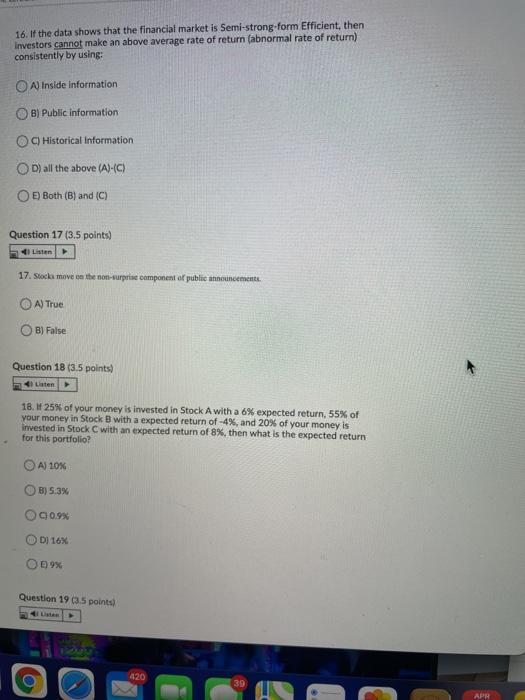

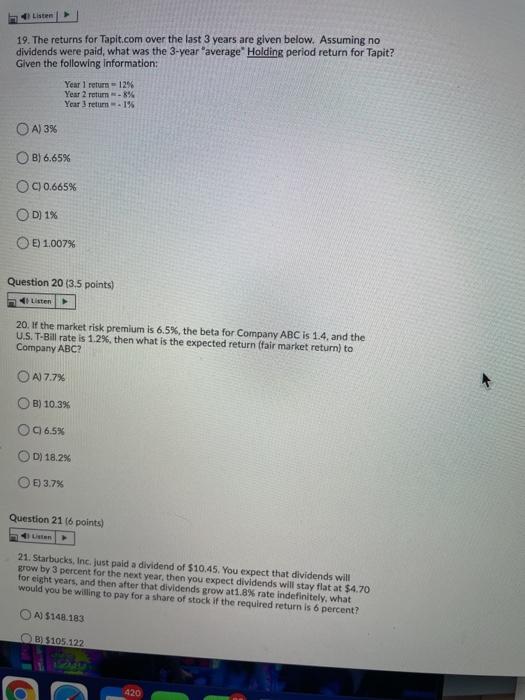

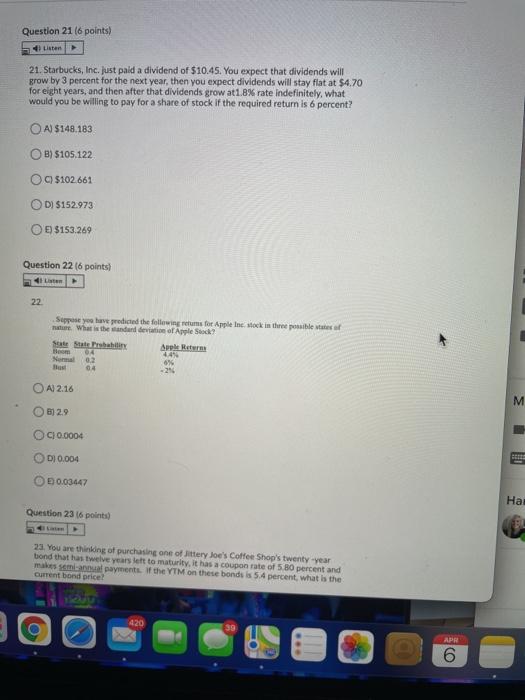

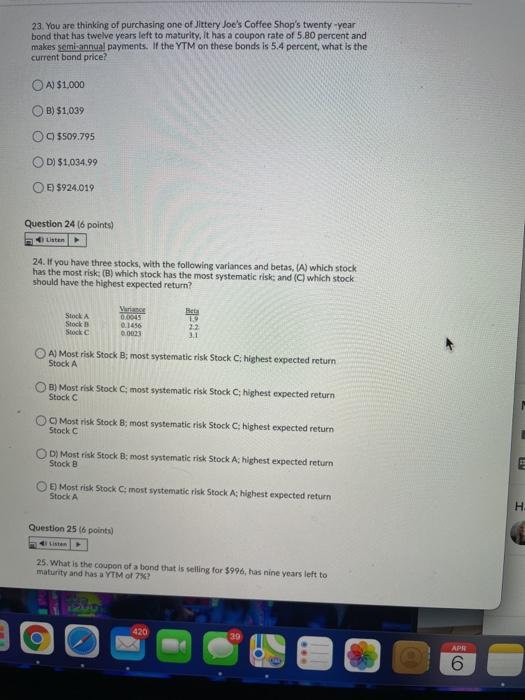

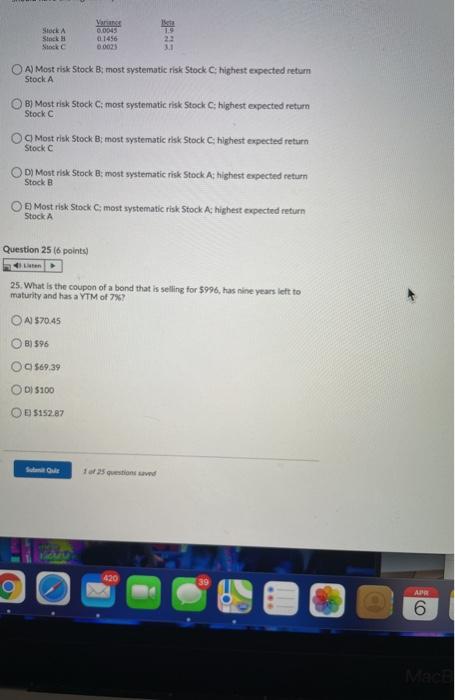

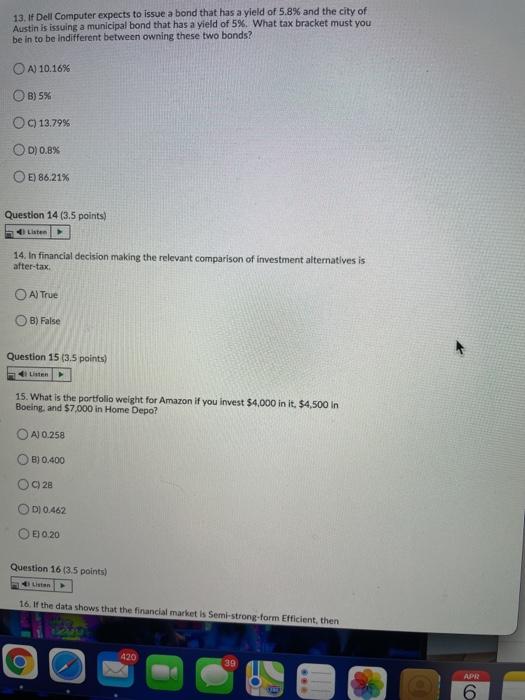

13. If Dell Computer expects to issue a bond that has a yield of 5.8% and the city of Austin is issuing a municipal bond that has a vield of 5% What tax bracket must you be in to be indifferent between owning these two bonds? OA) 10.16% OB) 5% OC) 13.79% OD) 0.8% E) 86.21% Question 14 (3.5 points) Listen 14. In financial decision making the relevant comparison of investment alternatives is after-tax A) True OB) False Question 15 (3.5 points) 4. Listen 15. What is the portfolio weight for Amazon if you invest $4,000 in it. $4,500 In Boeing, and $7.000 in Home Depo? AJ 0.258 B) 0.400 28 DI 0.462 E) 0.20 Question 16 (35 points) Lista 16. If the data shows that the financial market is Semi-strong-form Efficient, then 420 O 39 APR 6 16. If the data shows that the financial market is Semi-strong-form Efficient, then Investors cannot make an above average rate of return (abnormal rate of return) consistently by using: A) Inside Information OB) Public information C) Historical Information D) all the above (A)-(C) E) Both (B) and (C) Question 17 (3.5 points) Listen 17. Stock move on the non-surprise component of public announcements O A True OB) False Question 18 (3.5 points) 18. f 25% of your money is invested in Stock A with a 6% expected return, 55% of your money in Stock B with a expected return of -4%, and 20% of your money is invested in Stock C with an expected return of 8%, then what is the expected return for this portfolio? OA) 10% B) 5.3% 90.9% Dj 16% E9% Question 1935 points) 420 39 APR Listen 19. The returns for Tapit.com over the last 3 years are given below. Assuming no dividends were paid, what was the 3-year "average Holding period return for Tapit? Given the following Information: Year 1 return 12% Year 2 return.8% Year 3 return 1% OA) 3% O B) 6,65% OC) 0.665% OD) 1% OE) 1.007% Question 20 (3.5 points) Listen 20. If the market risk premium is 6.5%, the beta for Company ABC is 1.4, and the U.S. T-Bill rate is 1.2%, then what is the expected return fair market return) to Company ABC? O A) 7.7% B) 10.3% 16.5% D) 18.2% E) 3.7% Question 21 (6 points) 21. Starbucks, Inc. just paid a dividend of $10.45. You expect that dividends will grow by 3 percent for the next year, then you expect dividends will stay flat at $4.70 for eight years, and then after that dividends grow at 1.8% rate indefinitely, what would you be willing to pay for a share of stock if the required return is 6 percent? O A $148.183 B $105.122 420 23. You are thinking of purchasing one of Jittery Joe's Coffee Shop's twenty-year bond that has twelve years left to maturity. It has a coupon rate of 5.80 percent and makes semiannual payments. If the YTM on these bonds is 5.4 percent, what is the current bond price? O A $1,000 B) $1,039 C) 5509.795 D) $1,034.99 OE) $924.019 Question 24 16 points) 24. If you have three stocks, with the following variances and betas. (A) which stock has the most risk: (B) which stock has the most systematic risk; and (C) which stock should have the highest expected return? Beta Stock Stock Stock Vurace 070015 0.1456 0.0021 3,1 A) Most risk Stock B; most systematic risk Stock Chighest expected return Stock A B) Most risk Stock C, most systematic risk Stock C, highest expected return Stock C) Most risk Stock B; most systematic risk Stock C highest expected return Stock D) Most risk Stock 8; most systematic risk Stock A highest expected return Stock B Most risk Stock C, most systematic risk Stock As highest expected return Stock A H Question 25 16 points) Lista 25. What is the coupon of a bond that is selling for $996, has nine years left to maturity and has a YTM of 7%? 420 9 APR 6 Stock Stock Stock 0.0045 0.1456 00023 22 3.1 OA) Most risk Stock B; most systematic risk Stock Chighest expected return Stock B) Most risk Stock C: most systematic risk Stock C: highest expected retum Stock OC Most rink Stock B; most systematic risk Stock C, highest expected return Stock C DI Most risk Stock 8, most systematic risk Stock As highest expected return 8) Most risk Stock C, most systematic risk Stock A highest expected return Stock Stock B Question 25 16 points 25. What is the coupon of a bond that is selling for $996, has nine years left to maturity and has a YTM of 7%? Al 570.45 B) 596 O $69.39 O 05100 OE $152.87 125 questions 420 39 O A Co