Answered step by step

Verified Expert Solution

Question

1 Approved Answer

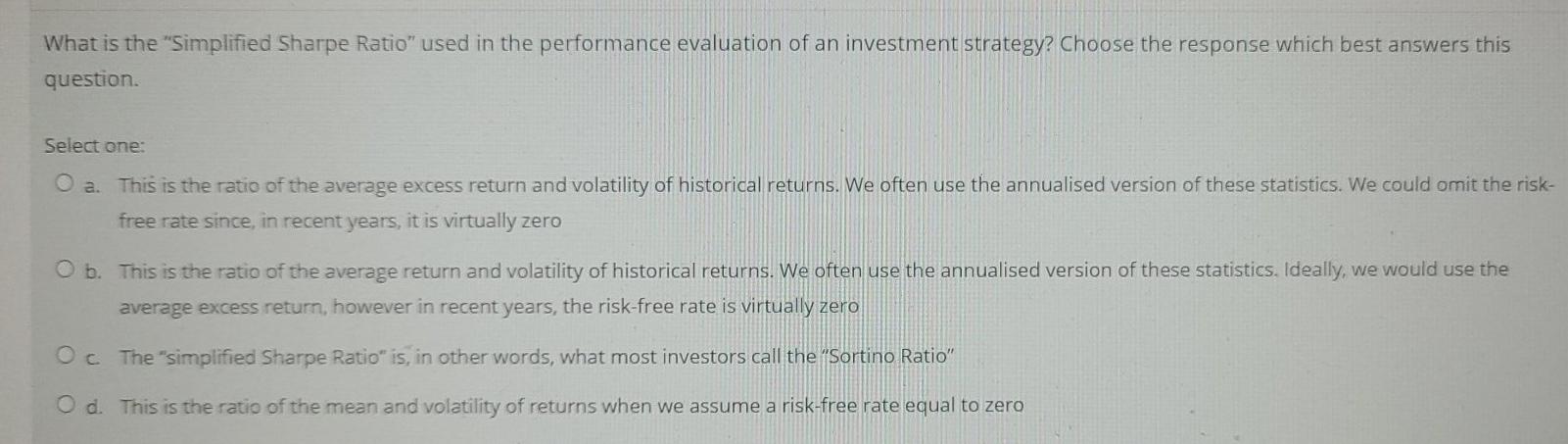

What is the Simplified Sharpe Ratio used in the performance evaluation of an investment strategy? Choose the response which best answers this question Select one:

What is the "Simplified Sharpe Ratio" used in the performance evaluation of an investment strategy? Choose the response which best answers this question Select one: O a. This is the ratio of the average excess return and volatility of historical returns. We often use the annualised version of these statistics. We could omit the risk- free rate since, in recent years, it is virtually zero O b. This is the ratio of the average return and volatility of historical returns. We often use the annualised version of these statistics. Ideally, we would use the average excess return, however in recent years, the risk-free rate is virtually zero O c The "simplified Sharpe Ratio" is, in other words, what most investors call the "Sortino Ratio" Od. This is the ratio of the mean and volatility of returns when we assume a risk-free rate equal to zero

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started