Please help with these questions

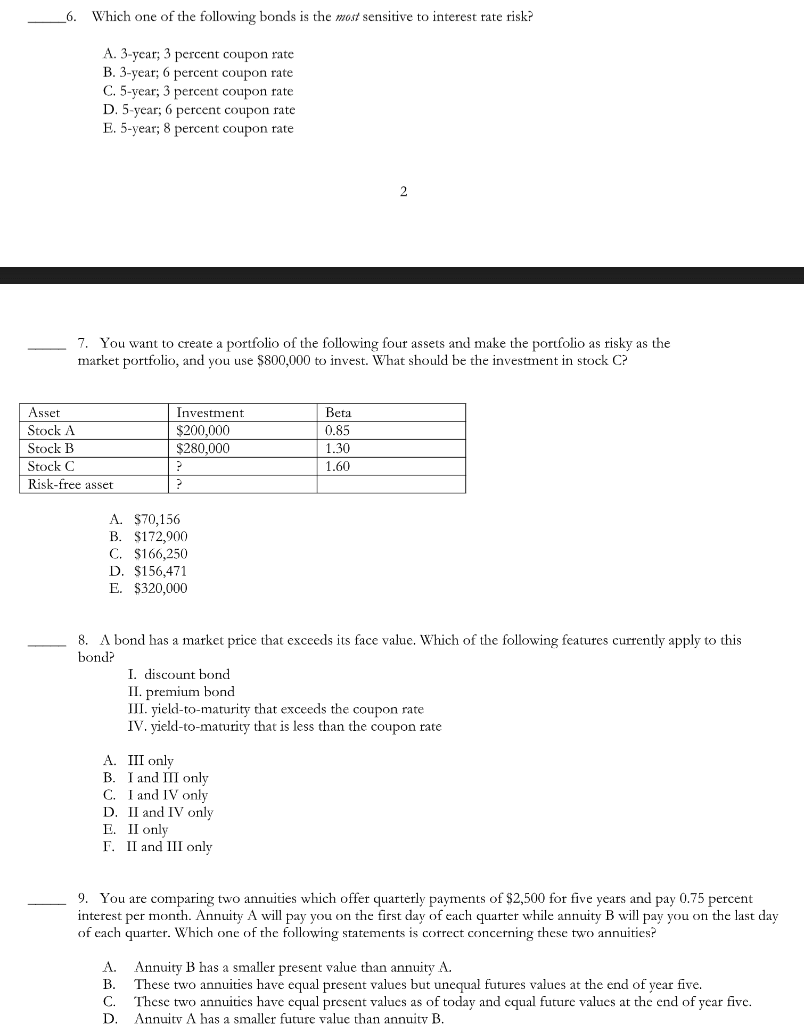

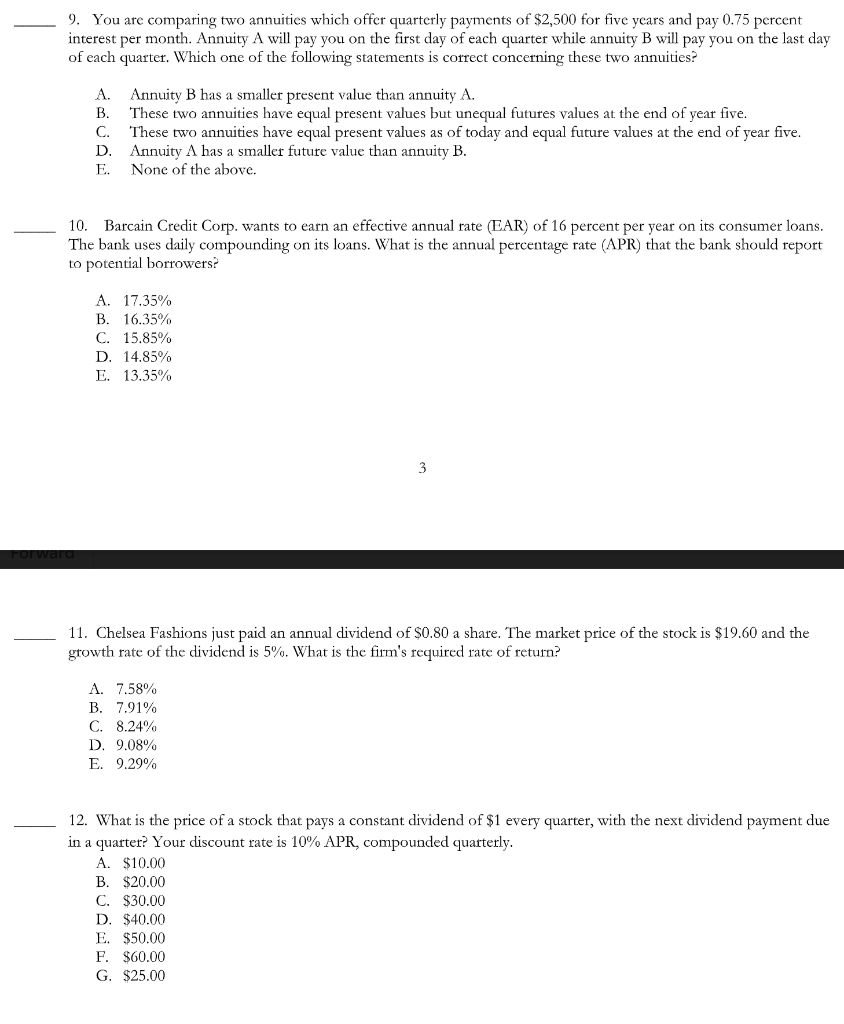

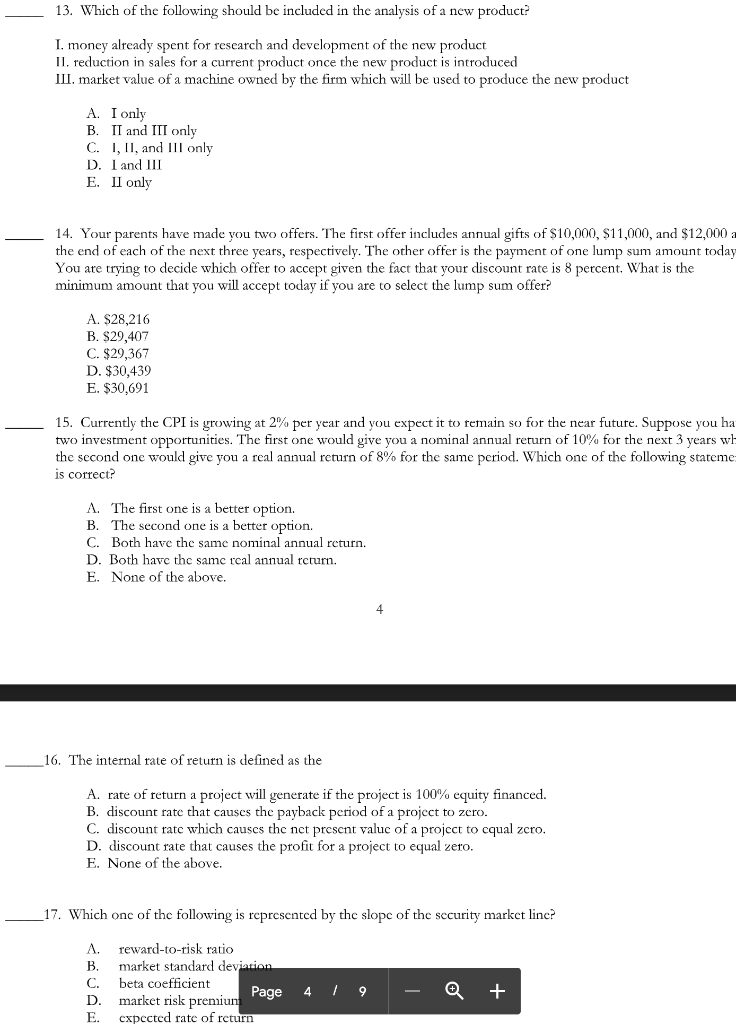

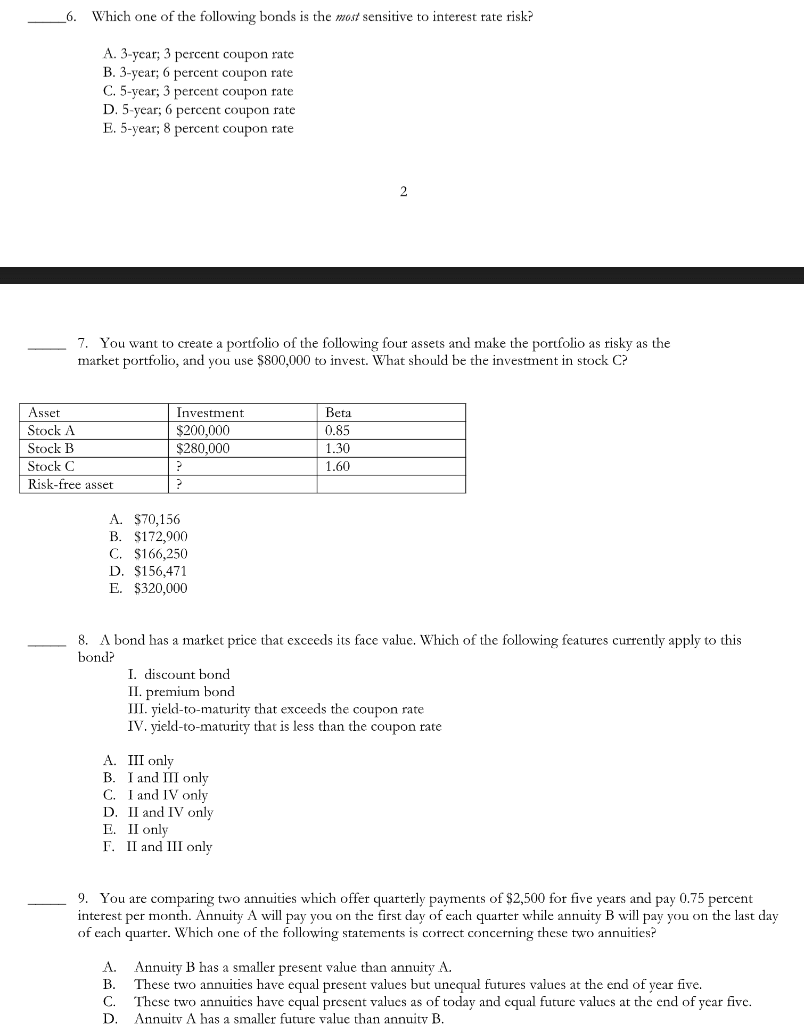

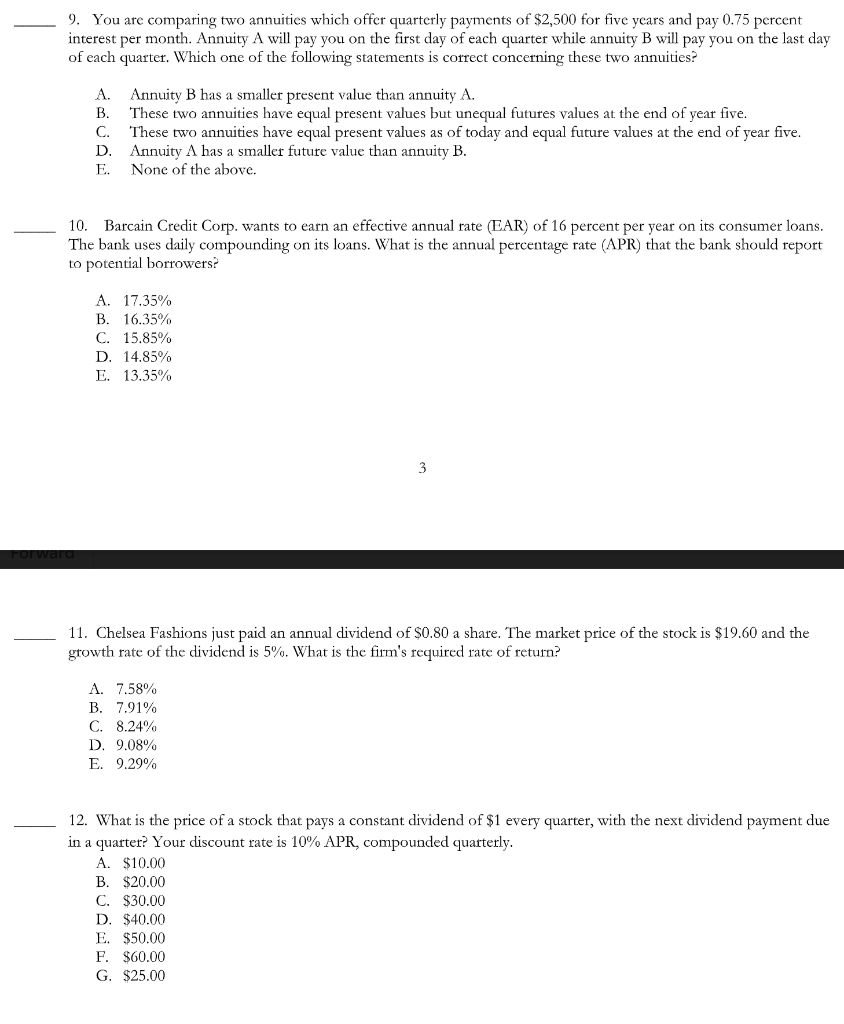

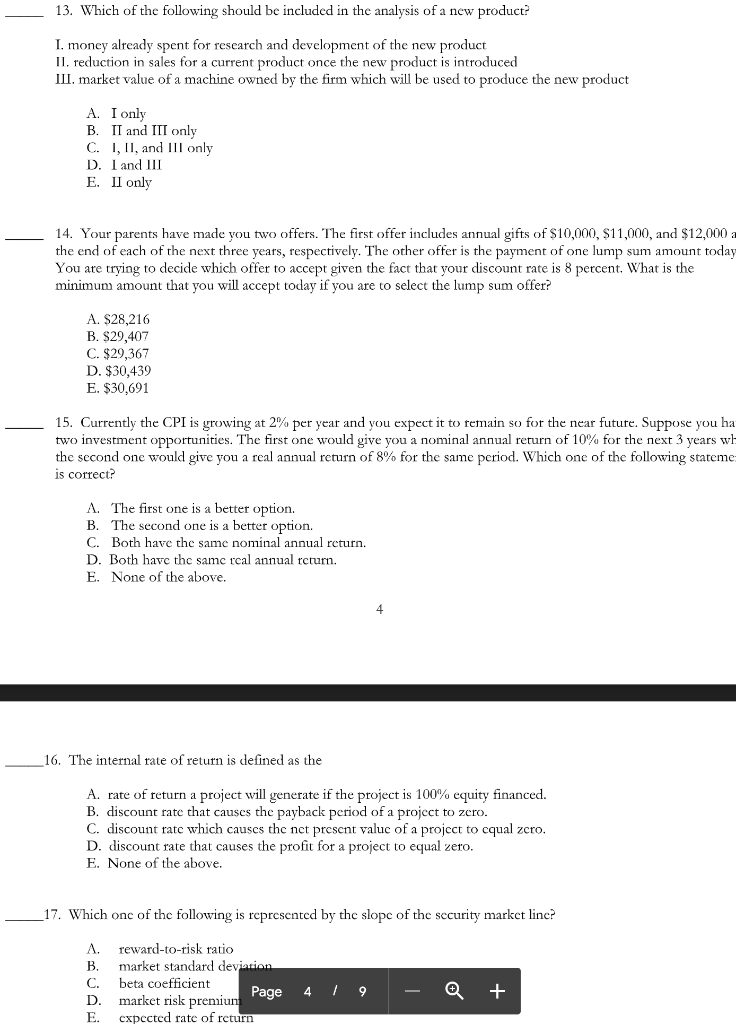

6. Which one of the following bonds is the most sensitive to interest rate risk? A. 3-year; 3 percent coupon rate B. 3-year; 6 percent coupon rate C. 5-year; 3 percent coupon rate D. 5-year; 6 percent coupon rate E. 5-year; 8 percent coupon rate 7. You want to create a portfolio of the following four assets and make the portfolio as risky as the market portfolio, and you use $800,000 to invest. What should be the investment in stock C? Asset Stock A Stock B Stock C Risk-free asset Investment $200,000 $280,000 Beta 0.85 1.30 1.60 A $70,156 B. $172,900 C. $166,250 D. $156,471 E. $320,000 8. A bond has a market price that exceeds its face value. Which of the following features currently apply to this bond? I. discount bond II. premium bond III. yield-to-maturity that exceeds the coupon rate IV. yield-to-maturity that is less than the coupon rate A. III only B. I and III only C. I and IV only D. II and IV only E. II only F. II and III only 9. You are comparing two annuities which offer quarterly payments of $2,500 for five years and pay 0.75 percent interest per month. Annuity A will pay you on the first day of each quarter while annuity B will pay you on the last day of each quarter. Which one of the following statements is correct concerning these two annuities? A. Annuity B has a smaller present value than annuity A. B. These two annuities have equal present values but unequal futures values at the end of year five. C. These two annuities have cqual present values as of today and equal future values at the end of year five. D. Annuity A has a smaller future value than annuity B. 9. You are comparing two annuities which offer quarterly payments of $2,500 for five years and pay 0.75 percent interest per month. Annuity A will pay you on the first day of each quarter while annuity B will pay you on the last day of each quarter. Which one of the following statements is correct concerning these two annuities? A. Annuity B has a smaller present value than annuity A. B. These two annuities have equal present values but unequal futures values at the end of year five. C. These two annuities have equal present values as of today and equal future values at the end of year five D. Annuity A has a smaller future value than annuity B. E. None of the above. 10. Barcain Credit Corp. wants to earn an effective annual rate (EAR) of 16 percent per year on its consumer loans. The bank uses daily compounding on its loans. What is the annual percentage rate (APR) that the bank should report to potential borrowers? A. 17.35% B. 16.35% C. 15.85% D. 14.85% E. 13.35% 11. Chelsea Fashions just paid an annual dividend of $0.80 a share. The market price of the stock is $19.60 and the growth rate of the dividend is 5%. What is the firm's required rate of return? A. 7.58% B. 7.91% C. 8.24% D. 9.08% E. 9.29% 12. What is the price of a stock that pays a constant dividend of $1 every quarter, with the next dividend payment due in a quarter? Your discount rate is 10% APR, compounded quarterly. A. $10.00 B. $20.00 C. $30.00 D. $40.00 E. $50.00 F. $60.00 G. $25.00 13. Which of the following should be included in the analysis of a new product? I. money already spent for research and development of the new product II. reduction in sales for a current product once the new product is introduced III. market value of a machine owned by the firm which will be used to produce the new product A. I only B. II and III only C. I,II, and III only D. I and III E. II only 14. Your parents have made you two offers. The first offer includes annual gifts of $10,000, $11,000, and $12,000 a the end of each of the next three years, respectively. The other offer is the payment of one lump sum amount today You are trying to decide which offer to accept given the fact that your discount rate is 8 percent. What is the minimum amount that you will accept today if you are to select the lump sum offer? A. $28,216 B. $29,407 C. $29,367 D. $30,439 E. $30,691 15. Currently the CPI is growing at 2% per year and you expect it to remain so for the near future. Suppose you ha two investment opportunities. The first one would give you a nominal annual return of 10% for the next 3 years wl the second one would give you a real annual return of 8% for the same period. Which one of the following stateme is correct? A. The first one is a better option. B. The second one is a better option. C. Both have the same nominal annual return. D. Both have the same real annual return E. None of the above. 16. The internal rate of return is defined as the A. rate of return a project will generate if the project is 100% equity financed. B. discount rate that causes the payback period of a project to zero. C. discount rate which causes the net present value of a project to cqual zero. D. discount rate that causes the profit for a project to equal zero. E. None of the above. Which one of the following is represented by the slope of the security market linc? A reward-to-risk ratio B. market standard deviation C. beta coefficient pa D. market risk premiun Page E. cxpected rate of return 4 9 - +