Answered step by step

Verified Expert Solution

Question

1 Approved Answer

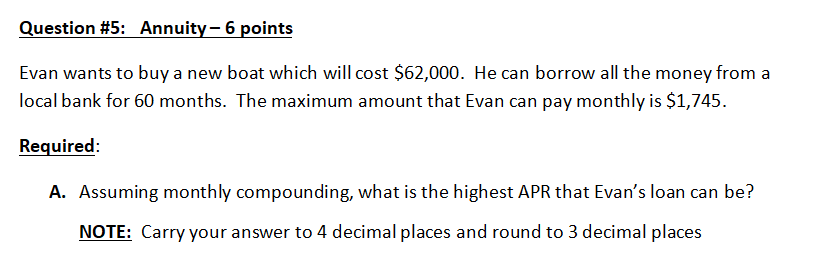

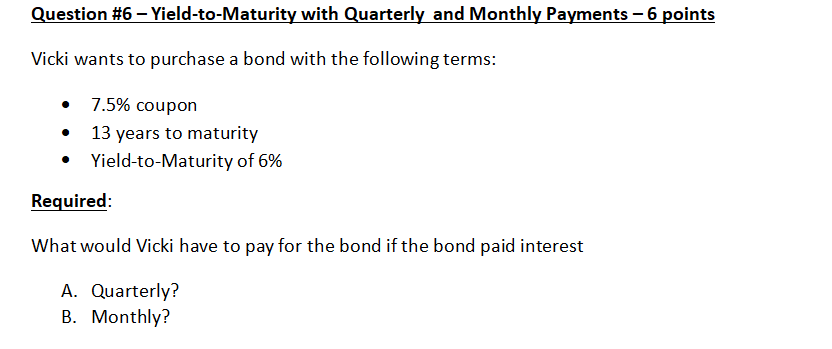

How to calculate it with a BA II Plus Texas Instruments calculator? Please show the detailed steps for problem like N, PV, FV, PMT, I.

How to calculate it with a BA II Plus Texas Instruments calculator? Please show the detailed steps for problem like N, PV, FV, PMT, I. I don't know how to do. Thank you so much!!!

Question #5: Annuity-6 points Evan wants to buy a new boat which will cost $62,000. He can borrow all the money from a local bank for 60 months. The maximum amount that Evan can pay monthly is $1,745. Required: A. Assuming monthly compounding, what is the highest APR that Evan's loan can be? NOTE: Carry your answer to 4 decimal places and round to 3 decimal places Question #6 Yield-to-Maturity with Quarterly and Monthly Payments 6 points Vicki wants to purchase a bond with the following terms: 7.5% coupon 13 years to maturity Yield-to-Maturity of 6% . Required: What would Vicki have to pay for the bond if the bond paid interest A. Quarterly? B. MonthlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started