please help with these two questons. ive also uploaded 2019 tax rates if needed

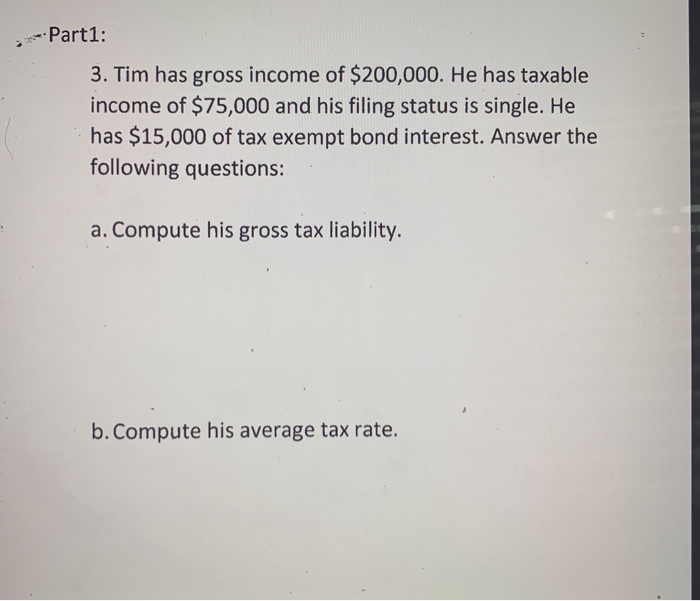

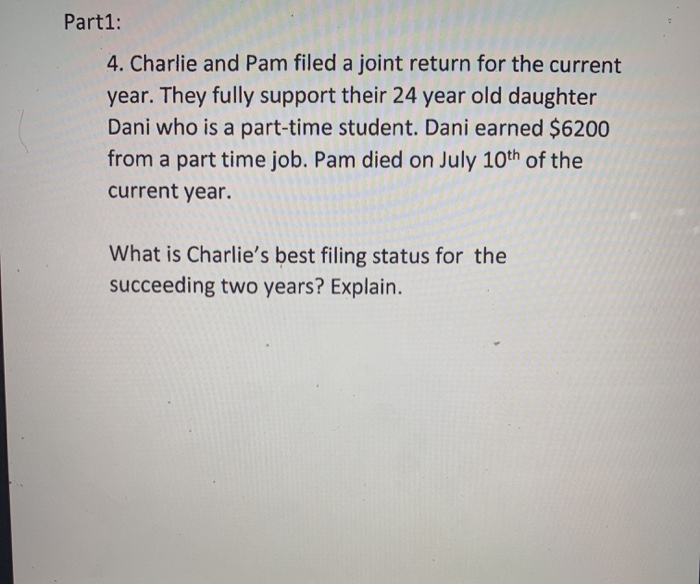

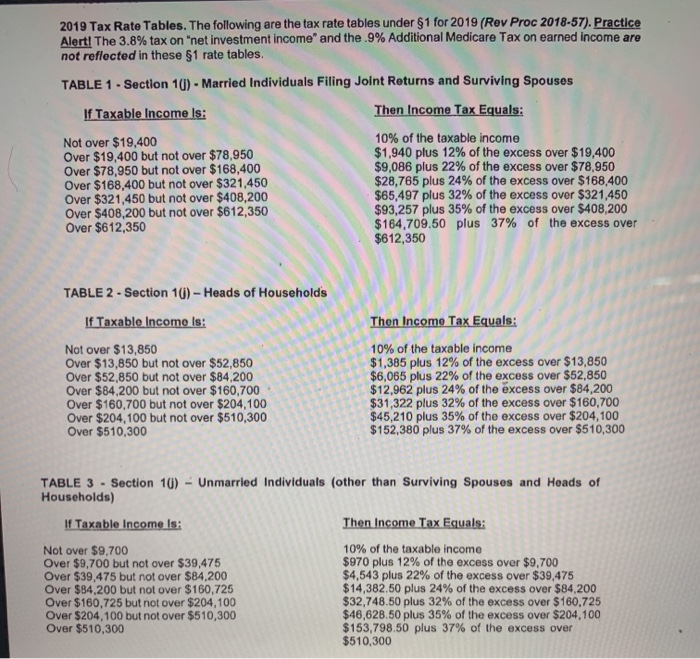

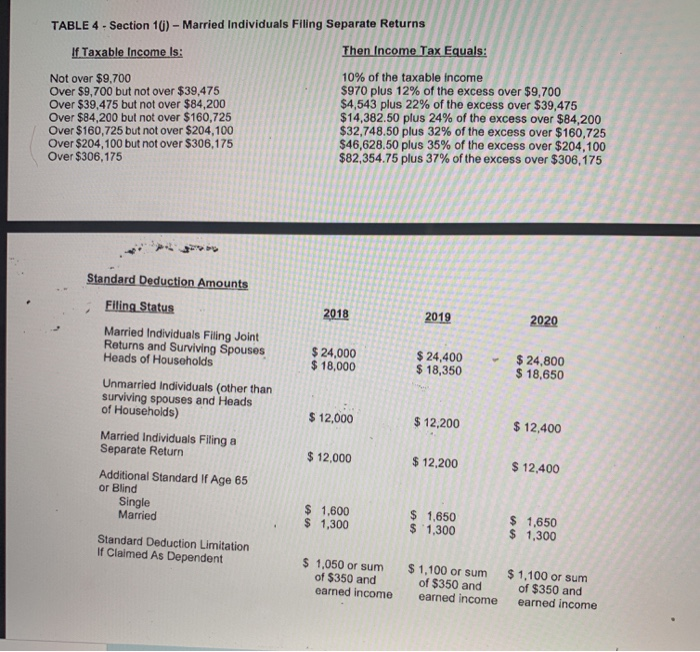

Part1: 3. Tim has gross income of $200,000. He has taxable income of $75,000 and his filing status is single. He has $15,000 of tax exempt bond interest. Answer the following questions: a. Compute his gross tax liability. b. Compute his average tax rate. Part1: 4. Charlie and Pam filed a joint return for the current year. They fully support their 24 year old daughter Dani who is a part-time student. Dani earned $6200 from a part time job. Pam died on July 10th of the current year. What is Charlie's best filing status for the succeeding two years? Explain. 2019 Tax Rate Tables. The following are the tax rate tables under $1 for 2019 (Rev Proc 2018-57). Practice Alert! The 3.8% tax on "net investment income and the.9% Additional Medicare Tax on earned income are not reflected in these $1 rate tables. TABLE 1 - Section 1() - Married Individuals Filing Joint Returns and Surviving Spouses If Taxable income is: Then Income Tax Equals: Not over $19,400 Over $19,400 but not over $78,950 Over $78,950 but not over $168,400 Over $168,400 but not over $321,450 Over $321,450 but not over $408,200 Over $408,200 but not over $612,350 Over $612,350 10% of the taxable income $1,940 plus 12% of the excess over $19,400 $9,086 plus 22% of the excess over $78,950 $28,765 plus 24% of the excess over $168.400 $65,497 plus 32% of the excess over $321,450 $93,257 plus 35% of the excess over $408,200 $164.709.50 plus 37% of the excess over $612,350 TABLE 2 - Section 10) - Heads of Households If Taxable incomo Is: Not over $13,850 Over $13,850 but not over $52,850 Over $52,850 but not over $84,200 Over $84.200 but not over $160,700 Over $160,700 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 Then Income Tax Equals: 10% of the taxable income $1,385 plus 12% of the excess over $13,850 $6,065 plus 22% of the excess over $52,850 $12,962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 TABLE 3 - Section 10) - Unmarried Individuals (other than Surviving Spouses and Heads of Households) If Taxable income is: Then Income Tax Equals: Not over $9,700 10% of the taxable income Over $9,700 but not over $39,475 $970 plus 12% of the excess over $9.700 Over $39,475 but not over $84.200 $4,543 plus 22% of the excess over $39,475 Over $84.200 but not over $160,725 $14,382.50 plus 24% of the excess over $84,200 Over $160,725 but not over $204,100 $32,748.50 plus 32% of the excess over $160,725 Over $204,100 but not over $510,300 $46,628.50 plus 35% of the excess over $204,100 Over $510,300 $153,798,50 plus 37% of the excess over $510,300 TABLE 4 - Section 10) - Married Individuals Filing Separate Returns If Taxable income is: Then Income Tax Equals: Not over $9,700 Over $9,700 but not over $39,475 Over $39,475 but not over $84,200 Over $84,200 but not over $160,725 Over $160,725 but not over $204,100 Over $204,100 but not over $306,175 Over $306,175 10% of the taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $82,354.75 plus 37% of the excess over $306,175 2018 2019 2020 $ 24,000 $ 18,000 $ 24,400 $ 18,350 $ 24,800 $ 18,650 Standard Deduction Amounts Filing Status Married Individuals Filing Joint Returns and Surviving Spouses Heads of Households Unmarried individuals (other than surviving spouses and Heads of Households) Married Individuals Filing a Separate Return Additional Standard If Age 65 or Blind Single Married $ 12,000 $ 12,200 $ 12,400 $ 12,000 $ 12.200 $ 12,400 $ 1,600 $ 1,300 $ 1,650 $ 1,300 $ 1.650 $ 1,300 Standard Deduction Limitation If Claimed As Dependent $ 1,050 or sum of $350 and earned Income $ 1,100 or sum of $350 and earned income $ 1,100 or sum of $350 and earned Income