Please help with this finance problem, I have attached the balance and income statement from JPS for 2015.

Part 1. Choose a publicly traded company and find their most recent annual earnings (10-K) report on the SEC website. Copy the balance sheet into the workbook labeled Common Size Balance Sheet and the income statement into the workbook labeled Common Size Income Statement. Then calculate the common size balance sheets and income statements for all the years' data provided in the 10-K.

Part 2. Calculate the financial ratios listed on the workbook labeled Ratios and Taxes.

Part 3. Find a personal income tax schedule for 2019 for the category of filing you are currently in (ie. single, married filing jointly, etc.) and paste it into the designated area on the Ratios and Taxes workbook. Then calculate the taxes due and average tax rate for an individual in your filing status if their taxable income was:

$8,000

$37,000

$98,000

or

$280,000

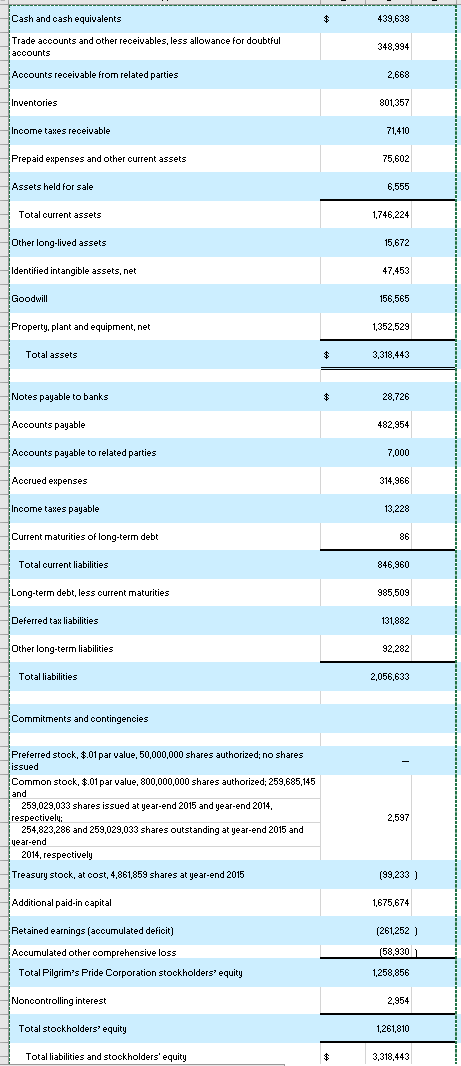

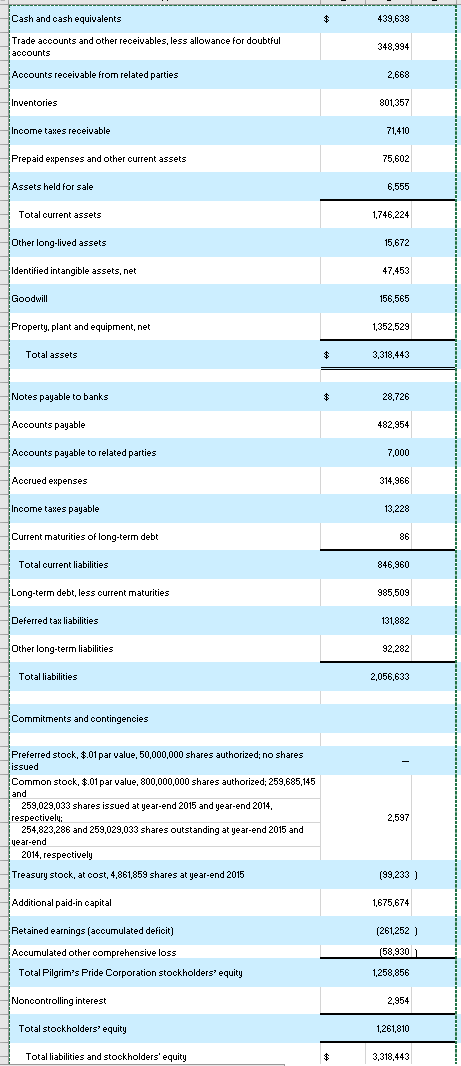

Balance sheet:

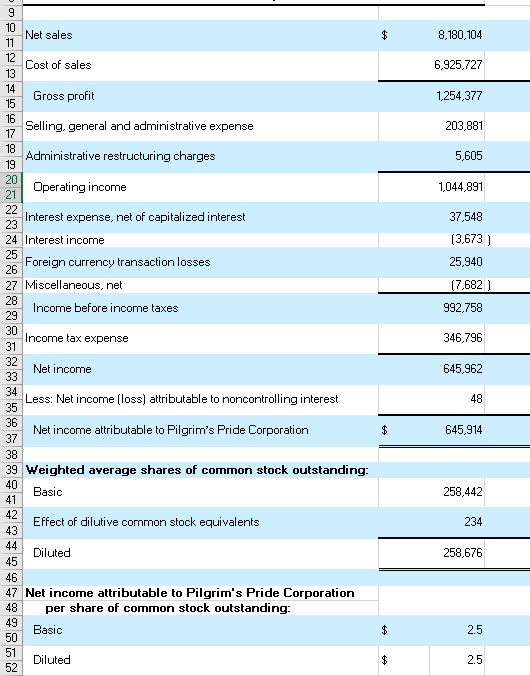

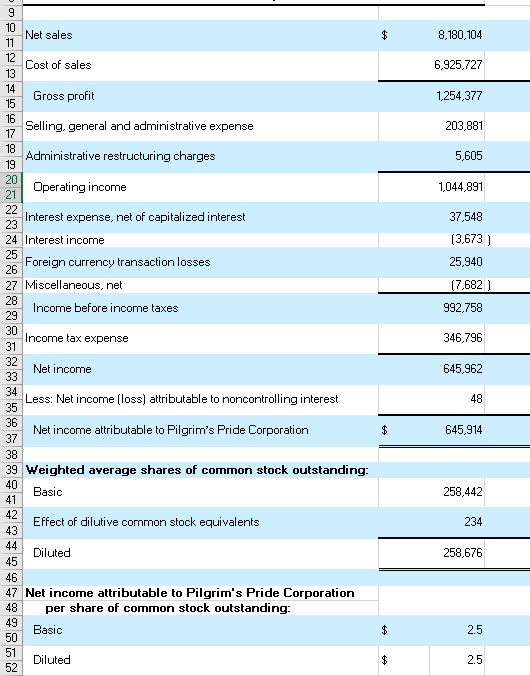

Income statement:

Cash and oash equivalents $ 439,638 Trade accounts and other receivables, less allowance for doubtful accounts 348,994 Accounts receivable from related parties 2,668 Inventories 801,357 Income taxes receivable 71,410 Prepaid expenses and other ourrent assets 75,602 Assets held for sale 6,555 Total current assets 1,746,224 Other long-lived assets 15,672 Identified intangible assets, net 47.453 Goodwill 156,565 Property, plant and equipment, net 1352,529 Total assets $ 3,318,443 Notes payable to banks $ 28,726 Accounts payable 482,954 Accounts payable to related parties 7,000 Acorued expenses 314,966 Income taxes payable 13,228 Current maturities of long-term debt 86 Total current liabilities 846,960 Long-term debt, less current maturities 985,509 Deferred tax liabilities 131,882 Other long-term liabilities 92,282 Total liabilities 2,056,633 Commitments and contingencies Preferred stock, $.01 par value, 50,000,000 shares authorized; no shares issued Common stock, $.01 par value, 800,000,000 shares authorized: 259,685,145 and 259,029,033 shares issued at year-end 2015 and year-end 2014, respectively: 254,823,286 and 259,029,033 shares outstanding at year-end 2015 and fuear-end 2014, respectively Treasury stock, at cost. 4,861,859 shares at year-end 2015 2,597 (99,233 ) Additional paid-in capital 1,675,674 (261,252) Retained earnings (accumulated deficit) Accumulated other comprehensive loss Total Pilgrim's Pride Corporation stockholders' equity (58,930 1,258,856 Noncontrolling interest 2,954 Total stockholders' equity 1,261,810 Total liabilities and stockholders' equity 3,318,443 $ 8,180,104 6,925,727 1,254,377 203,881 5,605 1,044,891 37,548 (3,673 ) 25,940 (7,682 ) 992,758 9 10 Net sales 11 12 Cost of sales 13 14 Gross profit 15 16 Selling, general and administrative expense 17 18 Administrative restructuring charges 19 20 Operating income 21 22 Interest expense, net of capitalized interest 23 24 Interest income 25 Foreign currency transaction losses 26 27 Miscellaneous, net 28 Income before income taxes 29 30 Income tax expense 31 32 Net income 33 34 Less: Net income (loss) attributable to noncontrolling interest 35 36 Net income attributable to Pilgrim's Pride Corporation 37 38 39 Weighted average shares of common stock outstanding: 40 Basic 41 42 Effect of dilutive common stock equivalents 43 Diluted 45 46 47 Net income attributable to Pilgrim's Pride Corporation 48 per share of common stock outstanding: 49 Basic 50 51 Diluted 52 346,796 645,962 48 $ 645,914 258,442 234 258,676 $ 2.5 $ 2.5 Cash and oash equivalents $ 439,638 Trade accounts and other receivables, less allowance for doubtful accounts 348,994 Accounts receivable from related parties 2,668 Inventories 801,357 Income taxes receivable 71,410 Prepaid expenses and other ourrent assets 75,602 Assets held for sale 6,555 Total current assets 1,746,224 Other long-lived assets 15,672 Identified intangible assets, net 47.453 Goodwill 156,565 Property, plant and equipment, net 1352,529 Total assets $ 3,318,443 Notes payable to banks $ 28,726 Accounts payable 482,954 Accounts payable to related parties 7,000 Acorued expenses 314,966 Income taxes payable 13,228 Current maturities of long-term debt 86 Total current liabilities 846,960 Long-term debt, less current maturities 985,509 Deferred tax liabilities 131,882 Other long-term liabilities 92,282 Total liabilities 2,056,633 Commitments and contingencies Preferred stock, $.01 par value, 50,000,000 shares authorized; no shares issued Common stock, $.01 par value, 800,000,000 shares authorized: 259,685,145 and 259,029,033 shares issued at year-end 2015 and year-end 2014, respectively: 254,823,286 and 259,029,033 shares outstanding at year-end 2015 and fuear-end 2014, respectively Treasury stock, at cost. 4,861,859 shares at year-end 2015 2,597 (99,233 ) Additional paid-in capital 1,675,674 (261,252) Retained earnings (accumulated deficit) Accumulated other comprehensive loss Total Pilgrim's Pride Corporation stockholders' equity (58,930 1,258,856 Noncontrolling interest 2,954 Total stockholders' equity 1,261,810 Total liabilities and stockholders' equity 3,318,443 $ 8,180,104 6,925,727 1,254,377 203,881 5,605 1,044,891 37,548 (3,673 ) 25,940 (7,682 ) 992,758 9 10 Net sales 11 12 Cost of sales 13 14 Gross profit 15 16 Selling, general and administrative expense 17 18 Administrative restructuring charges 19 20 Operating income 21 22 Interest expense, net of capitalized interest 23 24 Interest income 25 Foreign currency transaction losses 26 27 Miscellaneous, net 28 Income before income taxes 29 30 Income tax expense 31 32 Net income 33 34 Less: Net income (loss) attributable to noncontrolling interest 35 36 Net income attributable to Pilgrim's Pride Corporation 37 38 39 Weighted average shares of common stock outstanding: 40 Basic 41 42 Effect of dilutive common stock equivalents 43 Diluted 45 46 47 Net income attributable to Pilgrim's Pride Corporation 48 per share of common stock outstanding: 49 Basic 50 51 Diluted 52 346,796 645,962 48 $ 645,914 258,442 234 258,676 $ 2.5 $ 2.5