please help with this quesion. Also put drop down boxes for the top and bottom to show what my options are.

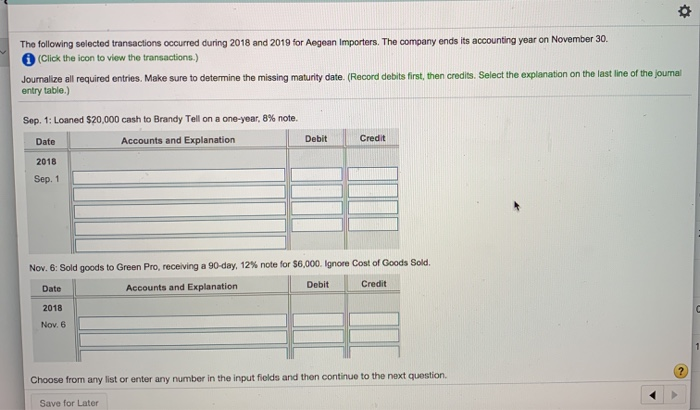

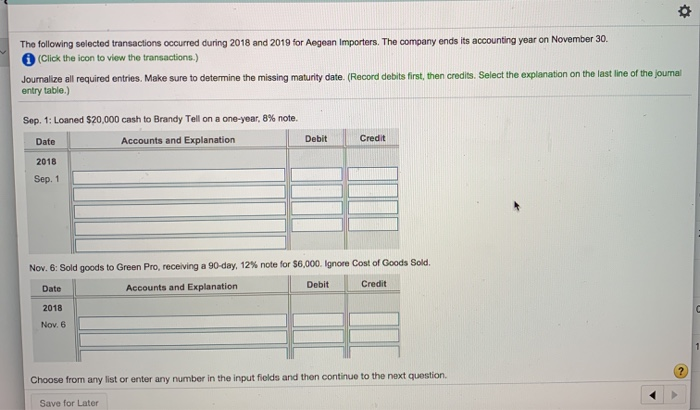

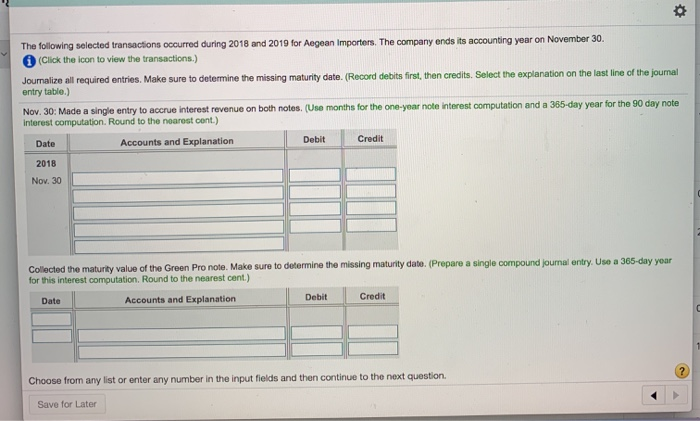

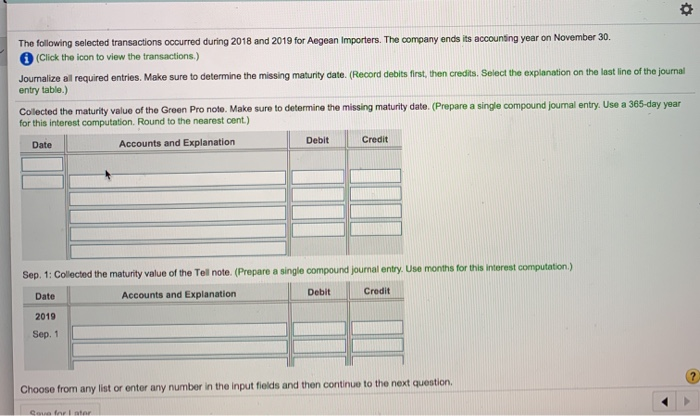

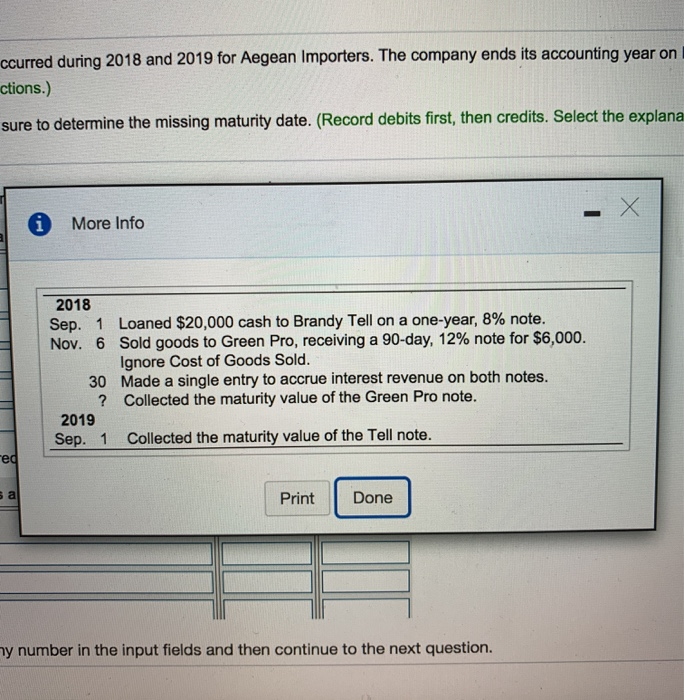

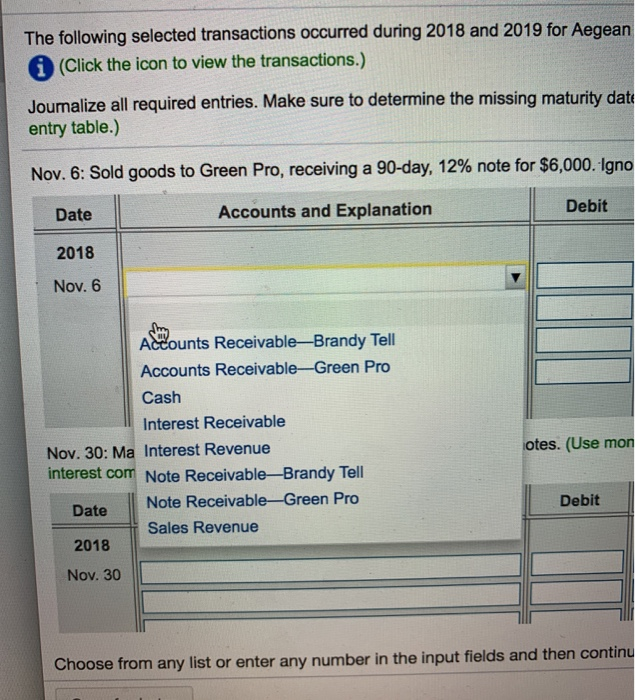

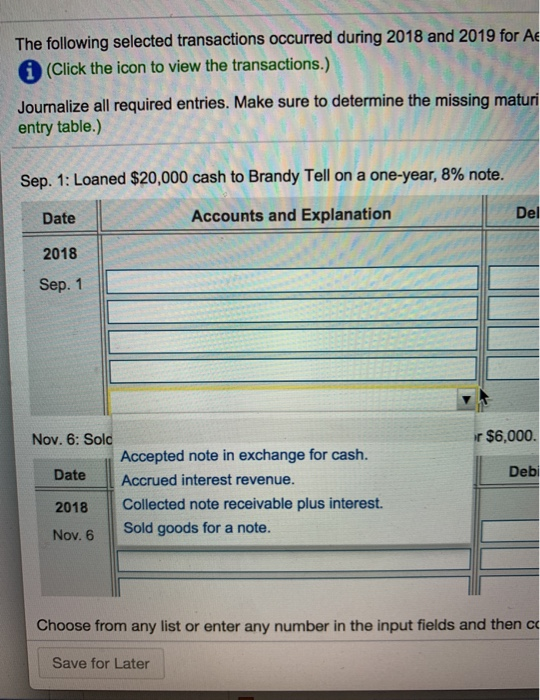

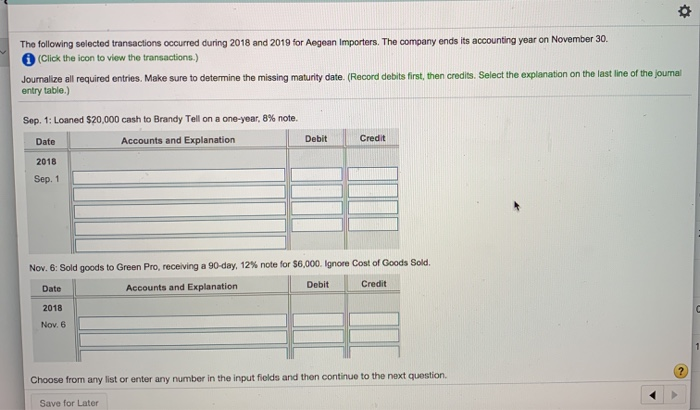

The following selected transactions occurred during 2018 and 2019 for Aegean Importers. The company ends its accounting year on November 30. (Click the icon to view the transactions.) Joumalize all required entries. Make sure to determine the missing maturity date. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Sep. 1: Loaned $20,000 cash to Brandy Tell on a one-year, 8% note. Date Accounts and Explanation Debit Credit 2018 Sep. 1 Nov. 6: Sold goods to Green Pro, receiving a 90-day, 12% note for $6,000. Ignore Cost of Goods Sold Date Accounts and Explanation Debit Credit 2018 Nov. 6 Choose from any list or enter any number in the input fields and then continue to the next question Save for Later The following selected transactions occurred during 2018 and 2019 for Aegean Importers. The company ends its accounting year on November 30. (Click the icon to view the transactions.) Joumalize all required entries. Make sure to determine the missing maturity date. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Nov. 30: Made a single entry to accrue interest revenue on both notes. (Use months for the one-year note interest computation and a 365-day year for the 90 day note interest computation. Round to the nearest cont.) Date Accounts and Explanation Debit Credit 2018 Nov. 30 Collected the maturity value of the Green Pro note. Make sure to determine the missing maturity date. (Prepare a single compound journal entry. Use a 365-day year for this interest computation. Round to the nearest cont.) Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question Save for Later The following selected transactions occurred during 2018 and 2019 for Aegean Importers. The company ends its accounting year on November 30. (Click the icon to view the transactions.) Joumalize al required entries. Make sure to determine the missing maturity date. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Collected the maturity value of the Green Pro note. Make sure to determine the missing maturity date. (Prepare a single compound journal entry. Use a 365-day year for this interest computation. Round to the nearest cont.) Accounts and Explanation Debit Credit Date Sep. 1: Collected the maturity value of the Tel note. (Prepare a single compound journal entry. Use months for this interest computation.) Date Accounts and Explanation Debit Credit 2019 Sep. 1 Choose from any list or enter any number in the input fields and then continue to the next question ccurred during 2018 and 2019 for Aegean Importers. The company ends its accounting year on ctions.) sure to determine the missing maturity date. (Record debits first, then credits. Select the explana More Info 2018 Sep. 1 Loaned $20,000 cash to Brandy Tell on a one-year, 8% note. Nov. 6 Sold goods to Green Pro, receiving a 90-day, 12% note for $6,000. Ignore Cost of Goods Sold. 30 Made a single entry to accrue interest revenue on both notes. ? Collected the maturity value of the Green Pro note. 2019 Sep. 1 Collected the maturity value of the Tell note. ed Print Done y number in the input fields and then continue to the next question. The following selected transactions occurred during 2018 and 2019 for Aegean A (Click the icon to view the transactions.) Joumalize all required entries. Make sure to determine the missing maturity dat entry table.) Nov. 6: Sold goods to Green Pro, receiving a 90-day, 12% note for $6,000. Igno Date Accounts and Explanation Debit 2018 Nov. 6 Accounts Receivable-Brandy Tell Accounts Receivable-Green Pro Cash Interest Receivable Nov. 30: Ma Interest Revenue interest com Note ReceivableBrandy Tell Date Note Receivable-Green Pro Sales Revenue 2018 Nov. 30 otes. (Use mon Debit Choose from any list or enter any number in the input fields and then continu The following selected transactions occurred during 2018 and 2019 for A A (Click the icon to view the transactions.) Journalize all required entries. Make sure to determine the missing matur entry table.) Sep. 1: Loaned $20,000 cash to Brandy Tell on a one-year, 8% note. Date Accounts and Explanation Del 2018 Sep. 1 $6,000. Deb Nov. 6: Sold Accepted note in exchange for cash. Date Accrued interest revenue. 2018 Collected note receivable plus interest. Nov. 6 Sold goods for a note. Choose from any list or enter any number in the input fields and then ce Save for Later