Answered step by step

Verified Expert Solution

Question

1 Approved Answer

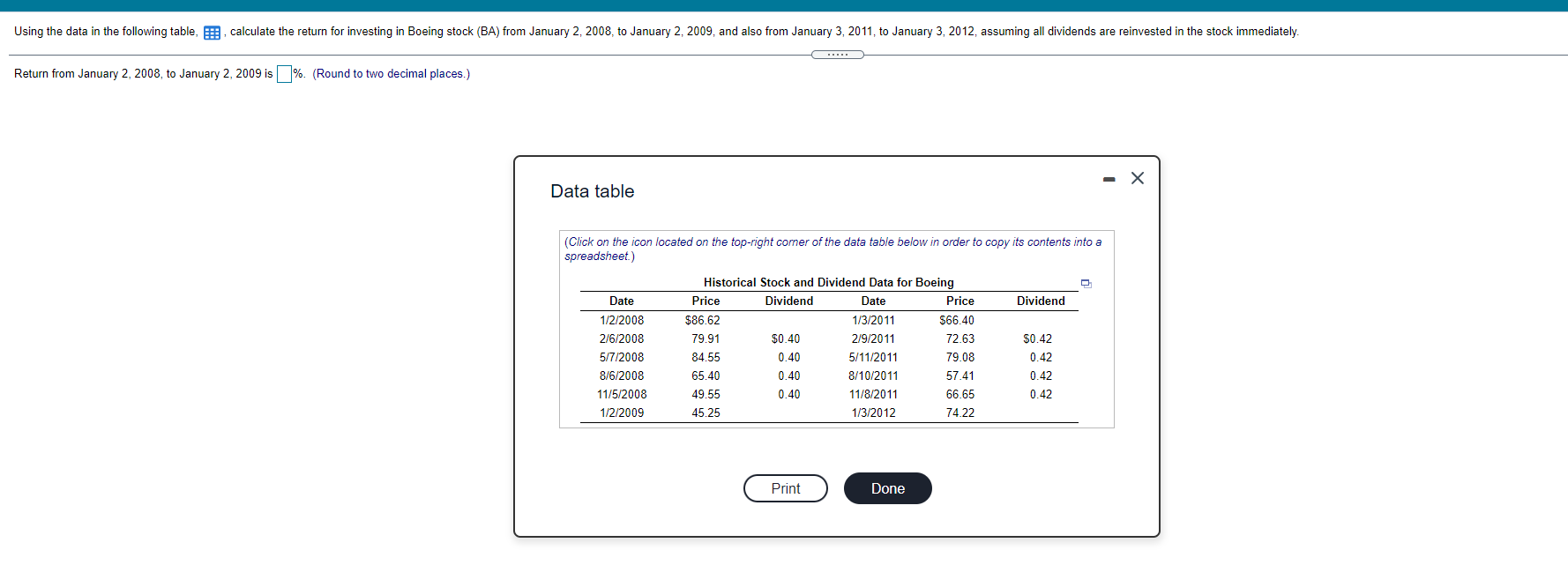

Please help with this question. calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from

Please help with this question.

Please help with this question.

calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately.

Using the data in the following table, :, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately C. Return from January 2, 2008, to January 2, 2009 is%. (Round to two decimal places.) Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Historical Stock and Dividend Data for Boeing Date Price Dividend Date Price Dividend 1/2/2008 $86.62 1/3/2011 S66.40 2/6/2008 79.91 $0.40 2/9/2011 72.63 5/7/2008 84.55 0.40 5/11/2011 79.08 0.42 8/6/2008 65.40 0.40 8/10/2011 57.41 0.42 11/5/2008 49.55 0.40 11/8/2011 66.65 0.42 1/2/2009 45.25 1/3/2012 74.22 $0.42 Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started