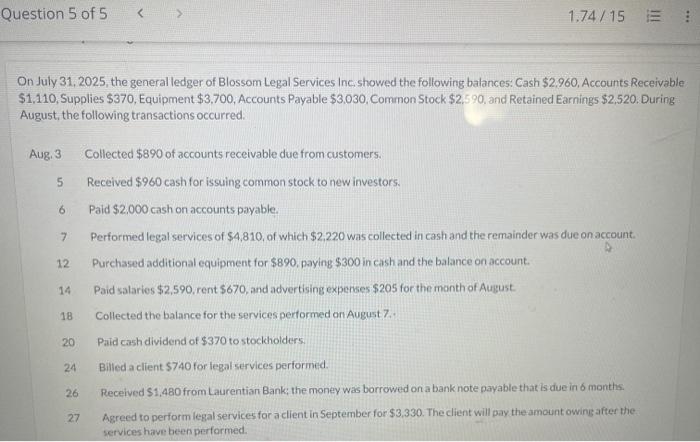

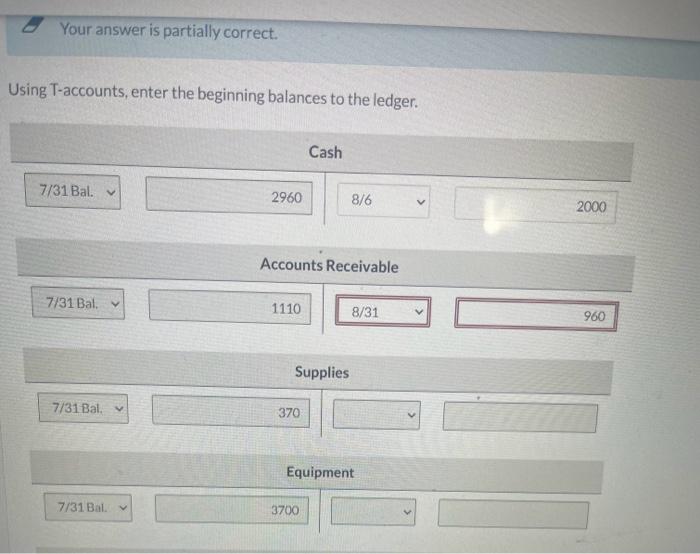

Please help with using T-accounts, journalized transactions and post the journal entries to the ledger and determine month end balances

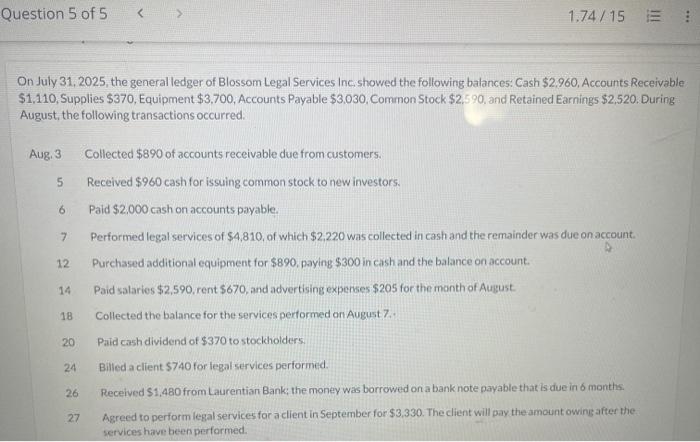

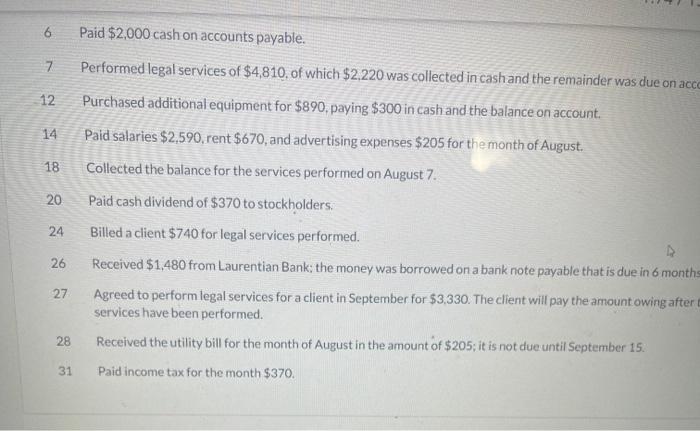

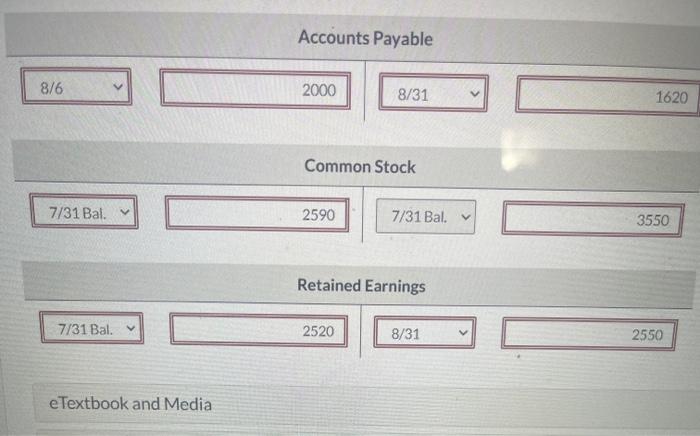

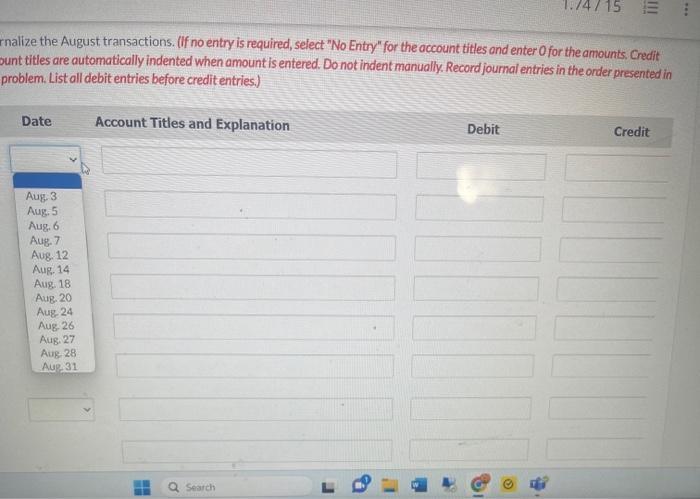

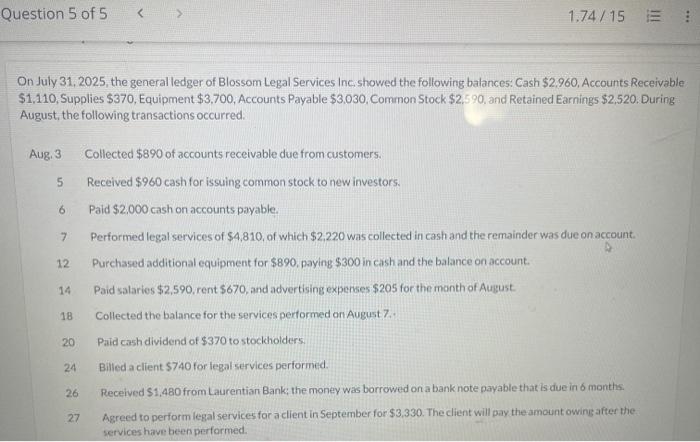

6 Paid $2,000 cash on accounts payable. 7 Performed legal services of $4,810, of which $2,220 was collected in cash and the remainder was due on acc 12 Purchased additional equipment for $890, paying $300 in cash and the balance on account. 14 Paid salaries $2,590, rent $670, and advertising expenses $205 for the month of August. 18 Collected the balance for the services performed on August 7. 20 Paid cash dividend of $370 to stockholders. 24 Billed a client $740 for legal services performed. 26 Received \$1,480 from Laurentian Bank; the money was borrowed on a bank note payable that is due in 6 month: 27. Agreed to perform legal services for a client in September for $3,330. The client will pay the amount owing after services have been performed. 28 Received the utility bill for the month of August in the amount of $205; it is not due until September 15 . 31 Paid income tax for the month $370. On July 31, 2025, the general ledger of Blossom Legal Services Inc; showed the following balances: Cash $2,960, Accounts Receivabl $1,110, Supplies $370, Equipment $3.700, Accounts Payable $3.030, Common Stock $2,590, and Retained Earnings $2,520. During August, the following transactions occurred. Aug. 3 Collected $890 of accounts receivable due from customers. 5 Received $960 cash for issuing common stock to new investors. 6 Paid $2.000 cash on accounts payable. 7 Performed tegal services of $4,810, of which $2,220 was collected in cash and the remainder was due on account. 12 Purchased additional equipment for $890, paying $300 in cash and the balance on account. 14 Pald satarios $2,590, rent $670, and advertising expenses $205 for the month of August 18 Collected the balance for the services performed on August 7 . 20 Patd cash dividend of $370 to stocholders: 24 Billed a client $740 for legal services performed. 26 Pecetved $1,180 from Laurentian Bank; the monev was borrowed on a bank note payable that is diue in 6 months. 27. Agreed to perform legal services for aclient in September for $3,330. The client will pay the amount owing after the services have been performed. nalize the August transactions. (If no entry is required, select "No Entry" for the account titles ond enter O for the amounts. Credit unt titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in problem. List all debit entries before credit entries.) Accounts Payable \begin{tabular}{|ll|} \hline 8/6 & \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline 2000 & 8/31 v \\ \hline \end{tabular} 1620 Common Stock 7/31Bal. v 2590 7/31 Bal. 3550 Retained Earnings 7/31 Bal. 2520 8/31 2550 eTextbook and Media Using T-accounts, enter the beginning balances to the ledger. 6 Paid $2,000 cash on accounts payable. 7 Performed legal services of $4,810, of which $2,220 was collected in cash and the remainder was due on acc 12 Purchased additional equipment for $890, paying $300 in cash and the balance on account. 14 Paid salaries $2,590, rent $670, and advertising expenses $205 for the month of August. 18 Collected the balance for the services performed on August 7. 20 Paid cash dividend of $370 to stockholders. 24 Billed a client $740 for legal services performed. 26 Received \$1,480 from Laurentian Bank; the money was borrowed on a bank note payable that is due in 6 month: 27. Agreed to perform legal services for a client in September for $3,330. The client will pay the amount owing after services have been performed. 28 Received the utility bill for the month of August in the amount of $205; it is not due until September 15 . 31 Paid income tax for the month $370. On July 31, 2025, the general ledger of Blossom Legal Services Inc; showed the following balances: Cash $2,960, Accounts Receivabl $1,110, Supplies $370, Equipment $3.700, Accounts Payable $3.030, Common Stock $2,590, and Retained Earnings $2,520. During August, the following transactions occurred. Aug. 3 Collected $890 of accounts receivable due from customers. 5 Received $960 cash for issuing common stock to new investors. 6 Paid $2.000 cash on accounts payable. 7 Performed tegal services of $4,810, of which $2,220 was collected in cash and the remainder was due on account. 12 Purchased additional equipment for $890, paying $300 in cash and the balance on account. 14 Pald satarios $2,590, rent $670, and advertising expenses $205 for the month of August 18 Collected the balance for the services performed on August 7 . 20 Patd cash dividend of $370 to stocholders: 24 Billed a client $740 for legal services performed. 26 Pecetved $1,180 from Laurentian Bank; the monev was borrowed on a bank note payable that is diue in 6 months. 27. Agreed to perform legal services for aclient in September for $3,330. The client will pay the amount owing after the services have been performed. nalize the August transactions. (If no entry is required, select "No Entry" for the account titles ond enter O for the amounts. Credit unt titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in problem. List all debit entries before credit entries.) Accounts Payable \begin{tabular}{|ll|} \hline 8/6 & \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline 2000 & 8/31 v \\ \hline \end{tabular} 1620 Common Stock 7/31Bal. v 2590 7/31 Bal. 3550 Retained Earnings 7/31 Bal. 2520 8/31 2550 eTextbook and Media Using T-accounts, enter the beginning balances to the ledger