Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help!!! You are evaluating a new project for your company FINSOFT, Inc., which has developed a new financial software. As a first step, you

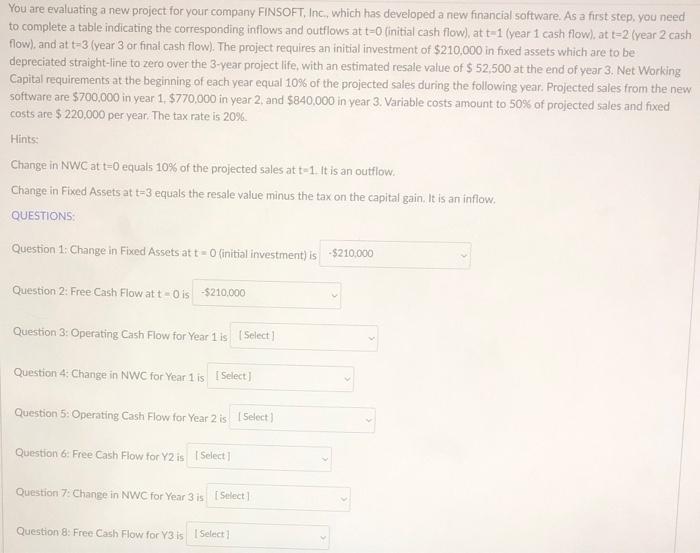

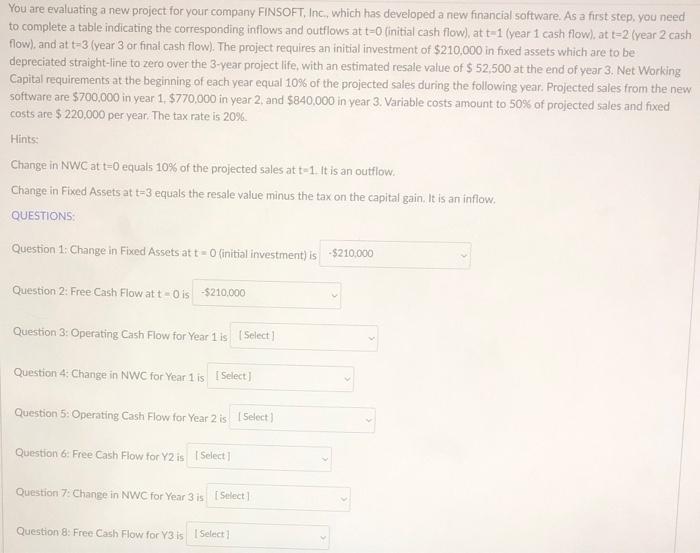

please help!!!  You are evaluating a new project for your company FINSOFT, Inc., which has developed a new financial software. As a first step, you need to complete a table indicating the corresponding inflows and outflows at t-0 (initial cash flow), at t-1 (year 1 cash flow), at t-2 (year 2 cash flow), and at t-3 (year 3 or final cash flow). The project requires an initial investment of $210,000 in fixed assets which are to be depreciated straight-line to zero over the 3-year project life, with an estimated resale value of $ 52,500 at the end of year 3. Net Working Capital requirements at the beginning of each year equal 10% of the projected sales during the following year. Projected sales from the new software are $700,000 in year 1, $770,000 in year 2, and $840,000 in year 3. Variable costs amount to 50% of projected sales and fixed costs are $ 220,000 per year. The tax rate is 20%. Hints: Change in NWC at t-0 equals 10% of the projected sales at t-1. It is an outflow. Change in Fixed Assets at t-3 equals the resale value minus the tax on the capital gain. It is an inflow. QUESTIONS: Question 1: Change in Fixed Assets at t=0 (initial investment) is $210,000 Question 2: Free Cash Flow at t - 0 is $210,000 Question 3: Operating Cash Flow for Year 1 is [Select] Question 4: Change in NWC for Year 1 is [Select] Question 5: Operating Cash Flow for Year 2 is [Select] Question 6: Free Cash Flow for Y2 is [Select] Question 7: Change in NWC for Year 3 is [Select] Question 8: Free Cash Flow for Y3 is [Select]

You are evaluating a new project for your company FINSOFT, Inc., which has developed a new financial software. As a first step, you need to complete a table indicating the corresponding inflows and outflows at t-0 (initial cash flow), at t-1 (year 1 cash flow), at t-2 (year 2 cash flow), and at t-3 (year 3 or final cash flow). The project requires an initial investment of $210,000 in fixed assets which are to be depreciated straight-line to zero over the 3-year project life, with an estimated resale value of $ 52,500 at the end of year 3. Net Working Capital requirements at the beginning of each year equal 10% of the projected sales during the following year. Projected sales from the new software are $700,000 in year 1, $770,000 in year 2, and $840,000 in year 3. Variable costs amount to 50% of projected sales and fixed costs are $ 220,000 per year. The tax rate is 20%. Hints: Change in NWC at t-0 equals 10% of the projected sales at t-1. It is an outflow. Change in Fixed Assets at t-3 equals the resale value minus the tax on the capital gain. It is an inflow. QUESTIONS: Question 1: Change in Fixed Assets at t=0 (initial investment) is $210,000 Question 2: Free Cash Flow at t - 0 is $210,000 Question 3: Operating Cash Flow for Year 1 is [Select] Question 4: Change in NWC for Year 1 is [Select] Question 5: Operating Cash Flow for Year 2 is [Select] Question 6: Free Cash Flow for Y2 is [Select] Question 7: Change in NWC for Year 3 is [Select] Question 8: Free Cash Flow for Y3 is [Select]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started