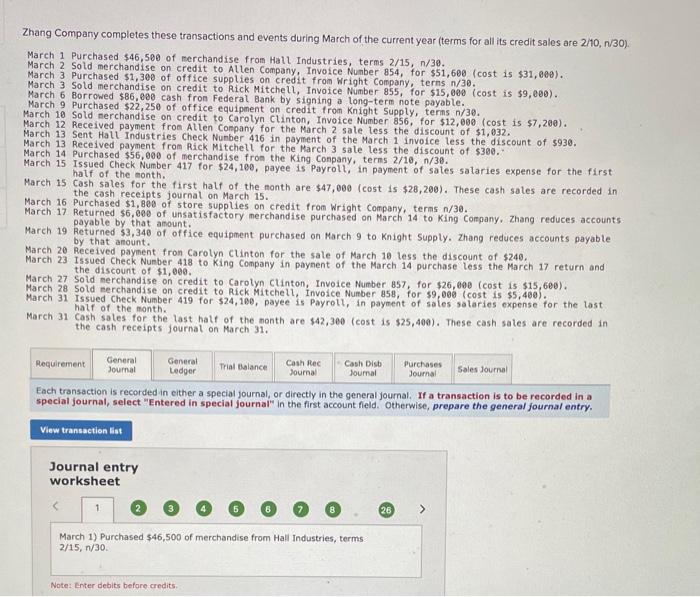

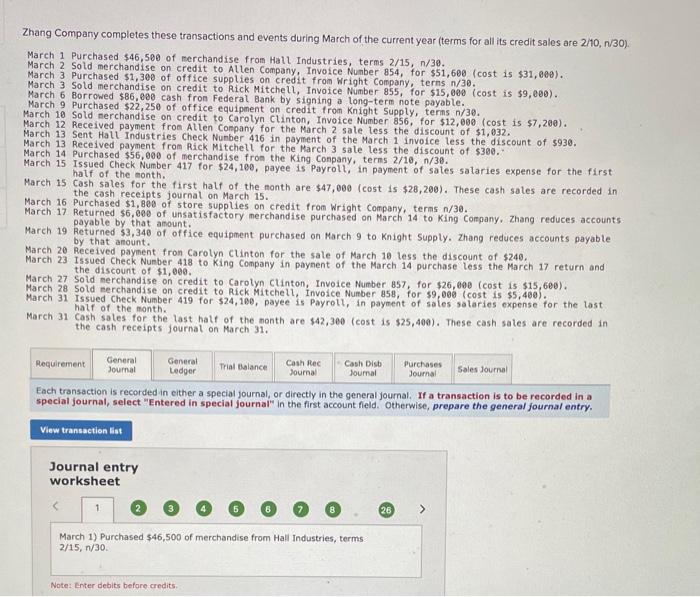

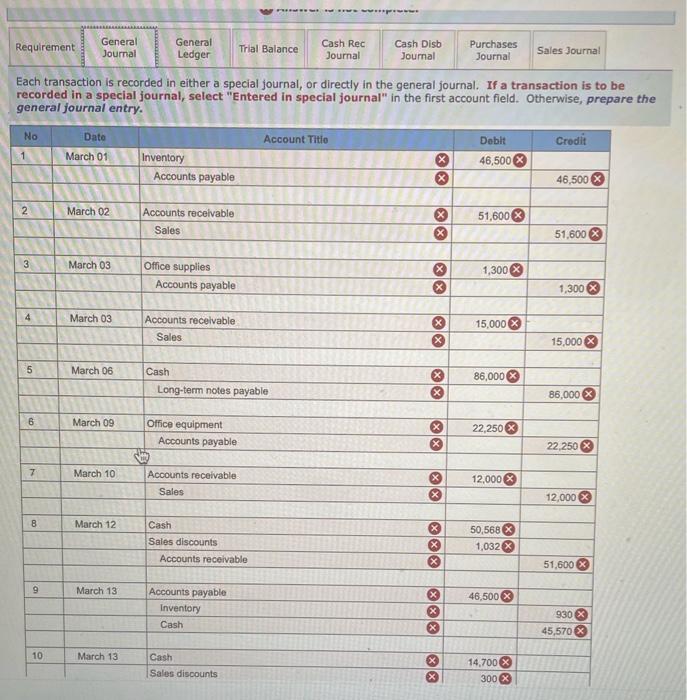

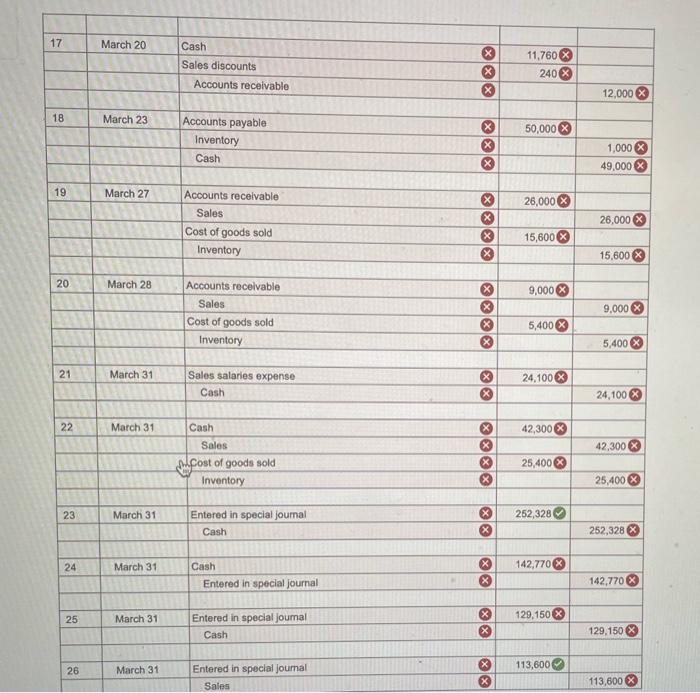

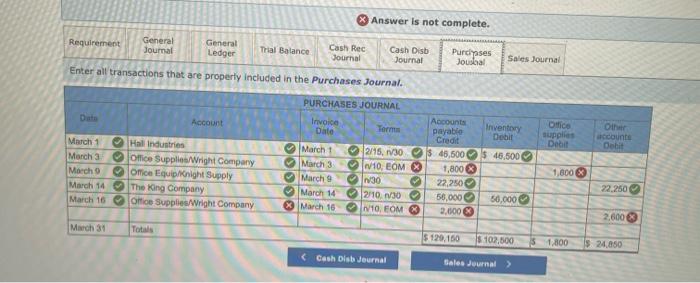

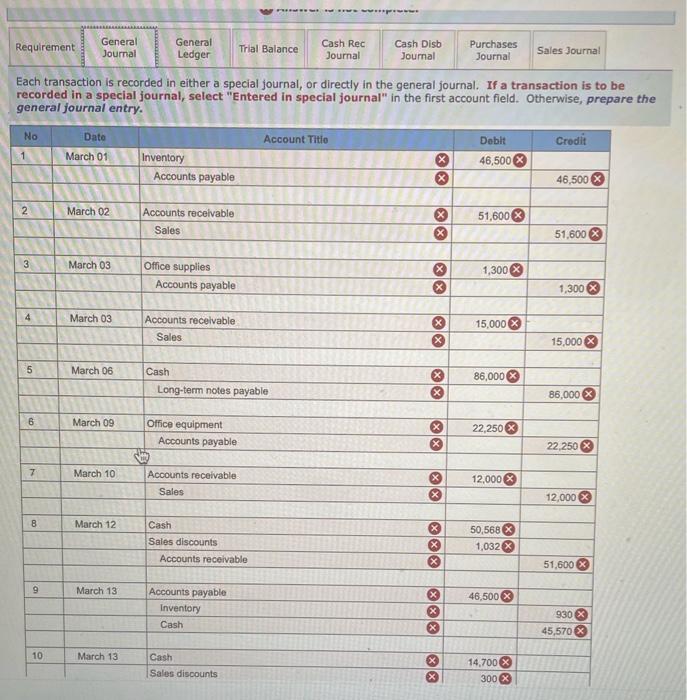

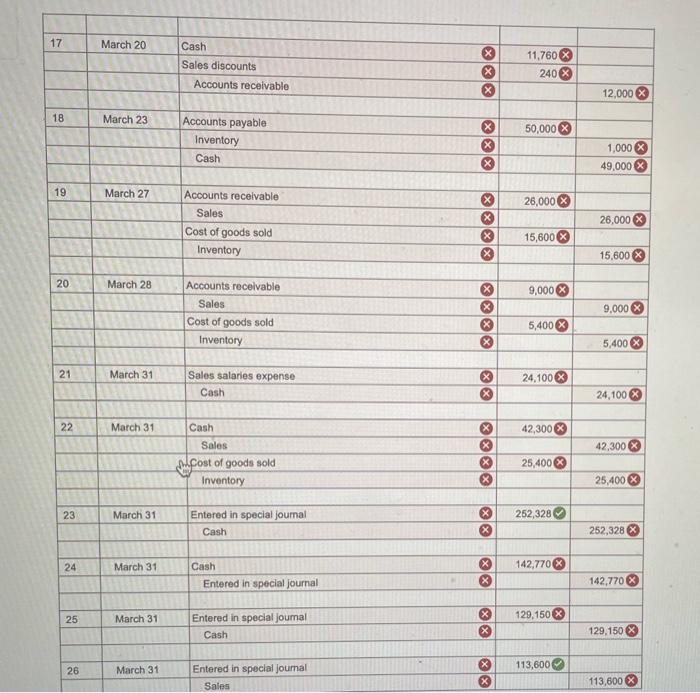

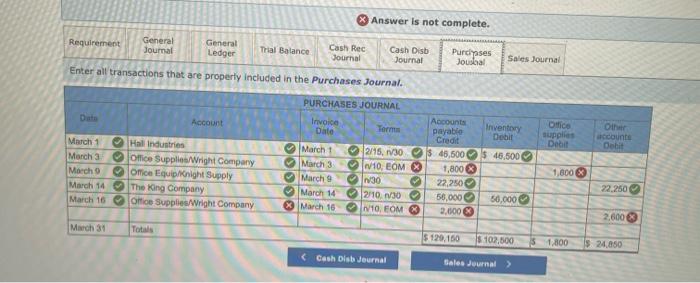

Zhang Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). March 1 Purchased $46,500 of merchandise from Hatl Industries, terms 2/15,n/30. March 2 Sold merchandise on credit to Allen Company, Invoice Nunber 854 , for $51,600(cost15$31,000). March 3 Purchased $1,300 of office supplies on credit from Wright Company, terns n/30. March 3 Sold merchandise on credit to Rick Mitchell, Invoice Number 855 , for $15,000 ( cost is $9,000). March 6 Borrowed $86,030 cash fron Federal Bank by signing a long-term note payable. March 9 Purchased $22,250 of office equipment on credit from Knight Supply, terns n/30. March 10 Sold nerchandise on credit to Carolyn Clinton, Invoice Number 856 , for $12,000(cost is $7,200). March 12 Received payment fron Atlen Conpany for the March 2 sale less the discount of $1,032. March 13 Sent Hall Industries Check Nunber 416 in payment of the March 1 involce less the discount of $930. March 13 Received payment from Rick Mitchell for the March 3 sale less the discount of $300. March 14 Purchased $56,000 of merchandise fron the King Conpany, terns 2/16,n/30. March 15 Issued Check Number 417 for $24,100, payee is Payroll, in payment of sales salaries expense for the first half of the month. March 15 Cash sales for the first half of the nonth are $47,000 (cost is $28,200). These cash sales are recorded in the cash receipts journat on March 15 . March 16 Purchased $1,800 of store supplies on credit from Wright Company, terms n/30. March 17 Returned $6,600 of unsat isfactory merchandise purchased on March 14 to King. Company, Zhang reduces accounts March 19 payable by that amount. March 19 Returned $3,340 of office equipment purchased on March 9 to Knight Supply. Zhang reduces accounts payable March 20 Received payment fron Carolyn clinton for the sale of March 10 less the discount of $240. March 23 Issued Check Number 418 to King Company in paynent of the March 14 purchase less the March 17 return and the discount of $1,000. March 27 Sold merchandise on credit to Carolyn Ctinton, Invoice Number 857, for $26,008(cost is $15,600). March 28 sold eerchandise on credit to Rick Mitcheth, Invoice Number 858 , for $9,000 (cost is $5,400 ). March 31 Is sued Check Number 419 for $24,100, payee is Payroll, in payment of sales salaries expense for the last. half of the month. March 31 Cash sales for the last hatf of the month are $42,300 (cost is $25,400). These cash sales are recorded in the cash receipts journat on March 31 . Each transaction is recorded in either a special journal, or directly in the general joumal. If a transaction is to be recorded in a special journal, select "Entered in special journal" in the first account fleld. Otherwise, prepare the general fournal entry. Each transaction is recorded in either a special journal, or directly in the general journal. If a transaction is to be rec get pare the Answer is not complete. Enter all transactions that are properfy included in the Purchases Journal