Answered step by step

Verified Expert Solution

Question

1 Approved Answer

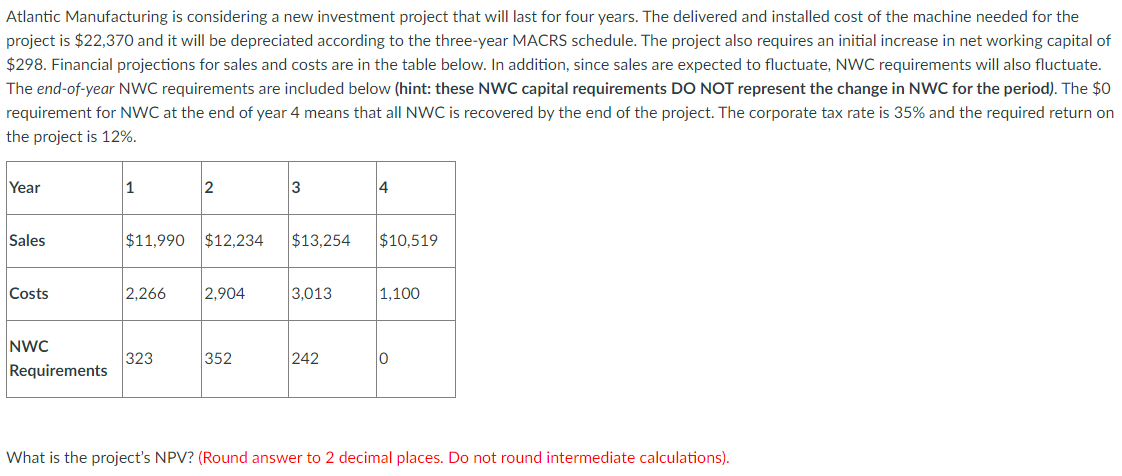

Please Help!Atlantic Manufacturing is considering a new investment project that will last for four years. The delivered and installed cost of the machine needed for

Please Help!Atlantic Manufacturing is considering a new investment project that will last for four years. The delivered and installed cost of the machine needed for the

project is $ and it will be depreciated according to the threeyear MACRS schedule. The project also requires an initial increase in net working capital of

$ Financial projections for sales and costs are in the table below. In addition, since sales are expected to fluctuate, NWC requirements will also fluctuate.

The endofyear NWC requirements are included below hint: these NWC capital requirements DO NOT represent the change in NWC for the period The $

requirement for NWC at the end of year means that all NWC is recovered by the end of the project. The corporate tax rate is and the required return on

the project is

What is the project's NPVRound answer to decimal places. Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started