Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please helpbme explain the correct answer of these questions, thank you! Give Kudos! Incorrect Question 7 0/3.35 pts You started a tee-shirt company and can

please helpbme explain the correct answer of these questions, thank you! Give Kudos!

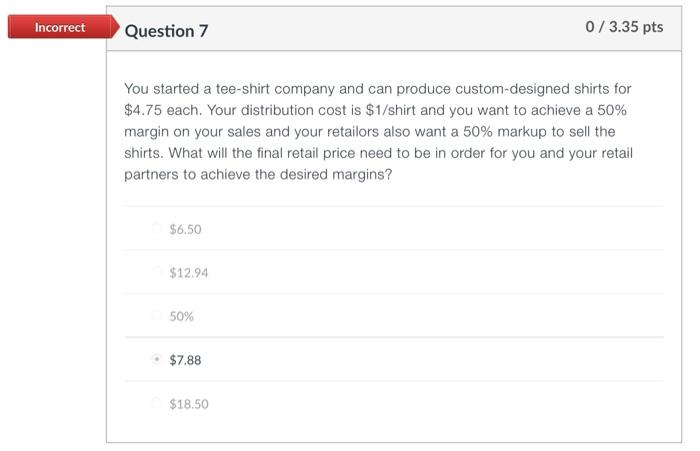

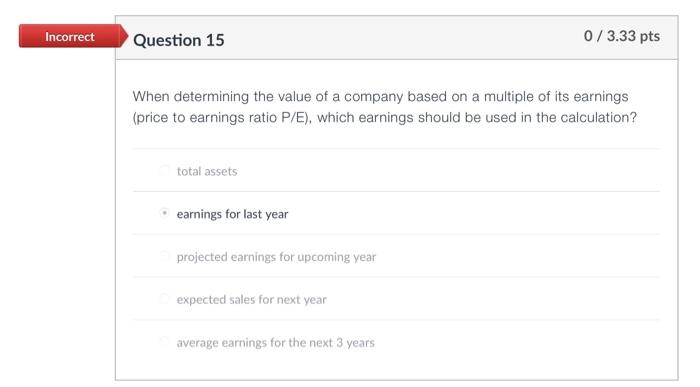

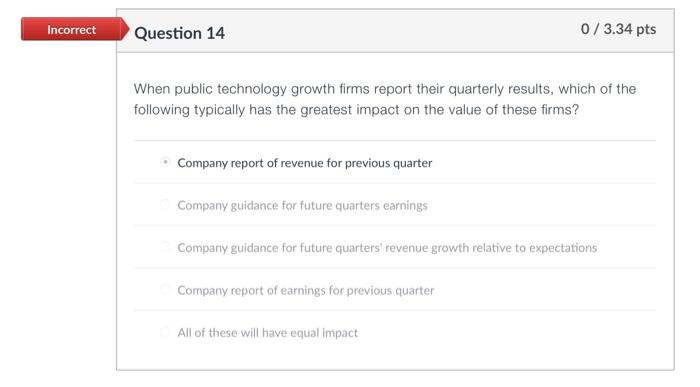

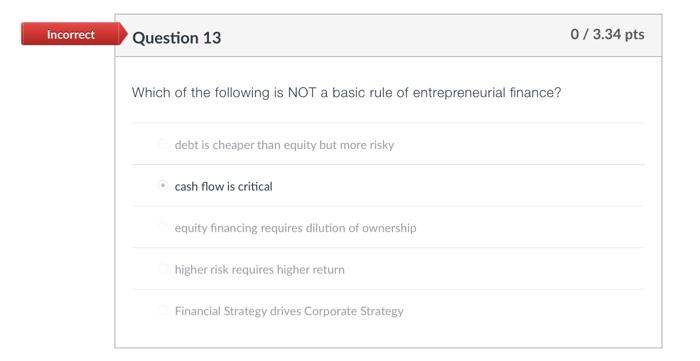

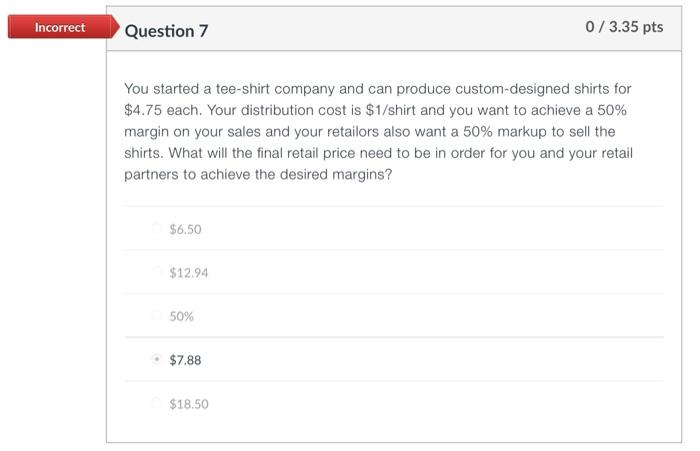

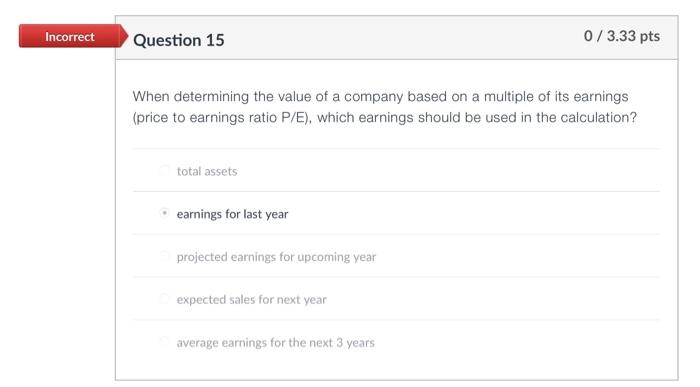

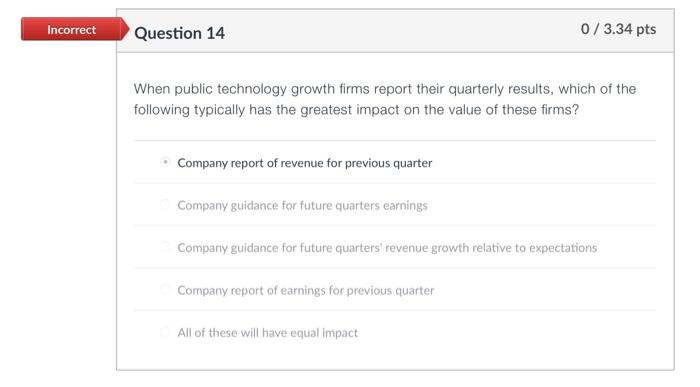

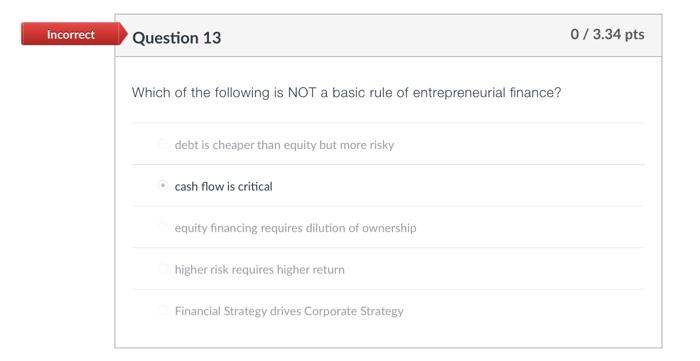

Incorrect Question 7 0/3.35 pts You started a tee-shirt company and can produce custom-designed shirts for $4.75 each. Your distribution cost is $1/shirt and you want to achieve a 50% margin on your sales and your retailors also want a 50% markup to sell the shirts. What will the final retail price need to be in order for you and your retail partners to achieve the desired margins? $6.50 $12.94 50% $7.88 $18.50 Incorrect Question 15 0/3.33 pts When determining the value of a company based on a multiple of its earnings (price to earnings ratio P/E), which earnings should be used in the calculation? total assets earnings for last year projected earnings for upcoming year expected sales for next year average earnings for the next 3 years Incorrect Question 14 0/3.34 pts When public technology growth firms report their quarterly results, which of the following typically has the greatest impact on the value of these firms? Company report of revenue for previous quarter Company guidance for future quarters earnings Company guidance for future quarters' revenue growth relative to expectations Company report of earnings for previous quarter All of these will have equal impact Incorrect Question 13 0/3.34 pts Which of the following is NOT a basic rule of entrepreneurial finance? debt is cheaper than equity but more risky cash flow is critical equity financing requires dilution of ownership higher risk requires higher return Financial Strategy drives Corporate Strategy Incorrect Question 12 0/3.33 pts Total venture capital invested in new ventures in the U.S. was at the highest level in which of the following years? 1999 2000 2019 2018 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started