Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please highlight answers. the last guy hand wrote it and got all journal entries wrong. thanks! Bronson Industries reported a deferred tax liability of $6.00

Please highlight answers. the last guy hand wrote it and got all journal entries wrong.

thanks!

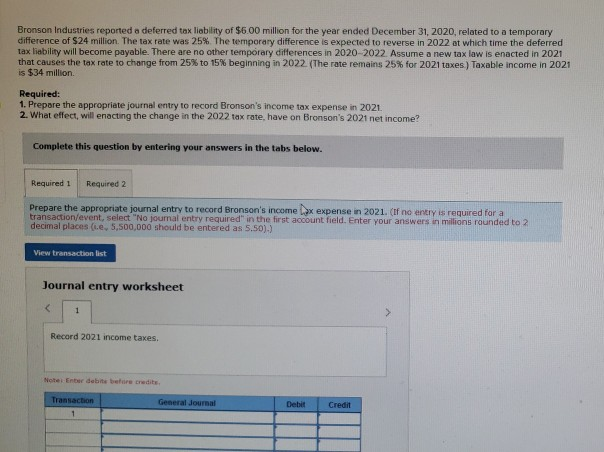

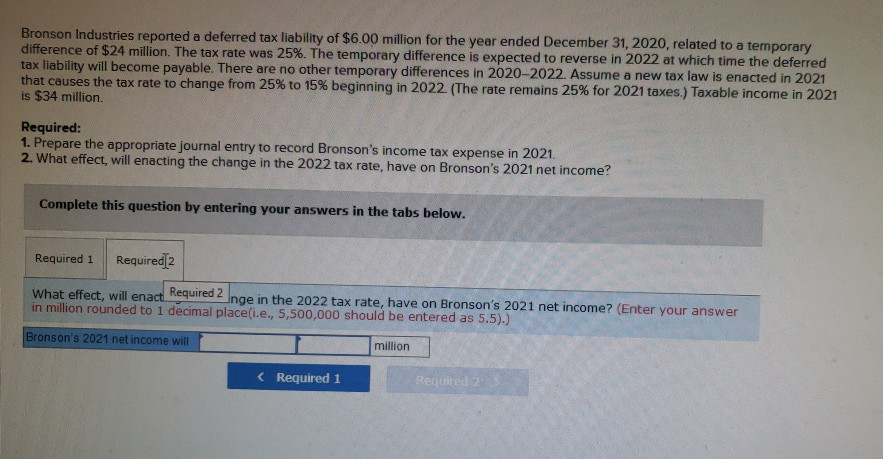

Bronson Industries reported a deferred tax liability of $6.00 million for the year ended December 31, 2020 related to a temporary difference of $24 million. The tax rate was 25%. The temporary difference is expected to reverse in 2022 at which time the deferred tax liability will become payable. There are no other temporary differences in 2020-2022. Assume a new tax law is enacted in 2021 that causes the tax rate to change from 25% to 15% beginning in 2022. (The rate remains 25% for 2021 taxes) Taxable income in 2021 is $34 million Required: 1. Prepare the appropriate journal entry to record Bronson's income tax expense in 2021 2. What effect, will enacting the change in the 2022 tax rate, have on Bronson's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate journal entry to record Bronson's income box expense in 2021. (If no any is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in million rounded to ? decimal places (ie 5.500,000 should be entered as 5.50).) View transaction list Journal entry worksheet Record 2021 income taxes. Transaction General Journal Dett Credit Bronson Industries reported a deferred tax liability of $6.00 million for the year ended December 31, 2020 related to a temporary difference of $24 million. The tax rate was 25%. The temporary difference is expected to reverse in 2022 at which time the deferred tax liability will become payable. There are no other temporary differences in 2020-2022. Assume a new tax law is enacted in 2021 that causes the tax rate to change from 25% to 15% beginning in 2022. (The rate remains 25% for 2021 taxes.) Taxable income in 2021 is $34 million. Required: 1. Prepare the appropriate journal entry to record Bronson's income tax expense in 2021. 2. What effect, will enacting the change in the 2022 tax rate, have on Bronson's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What effect, will enact Required Inge in the 2022 tax rate, have on Bronson's 2021 net income? (Enter your answer in million rounded to 1 decimal placei.e., 5,500,000 should be entered as 5.5).) Bronson's 2021 net income will I millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started