please hurry up

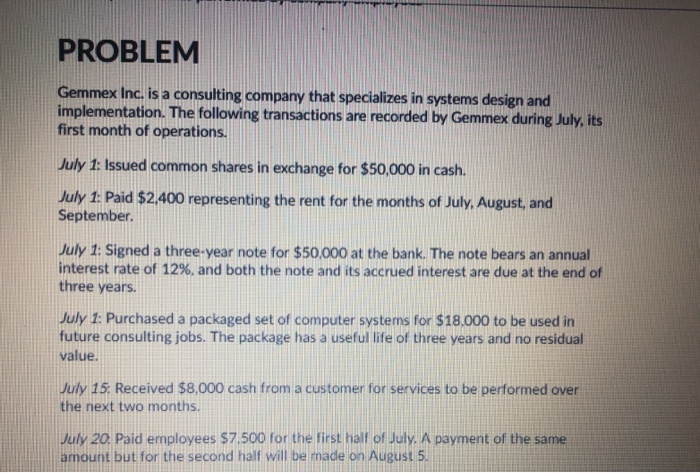

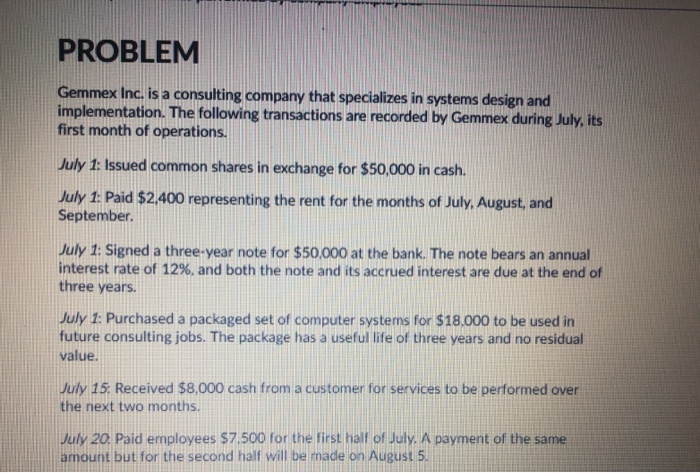

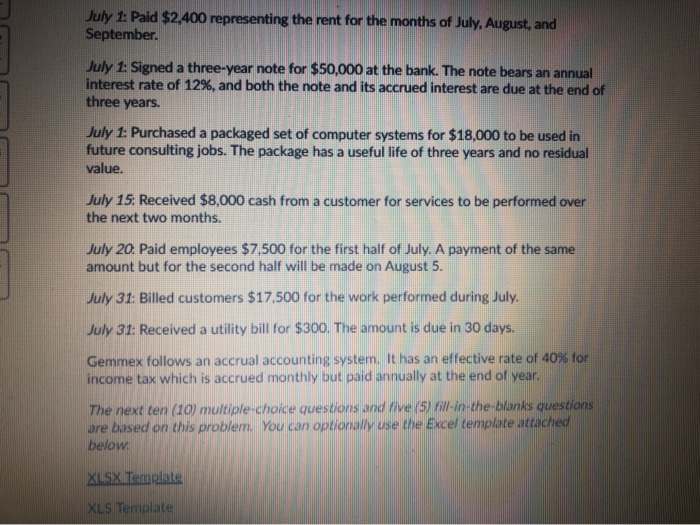

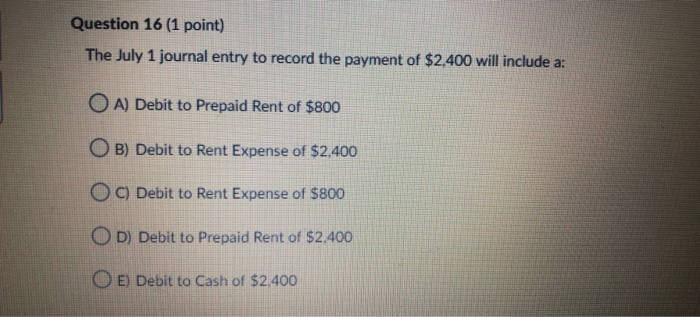

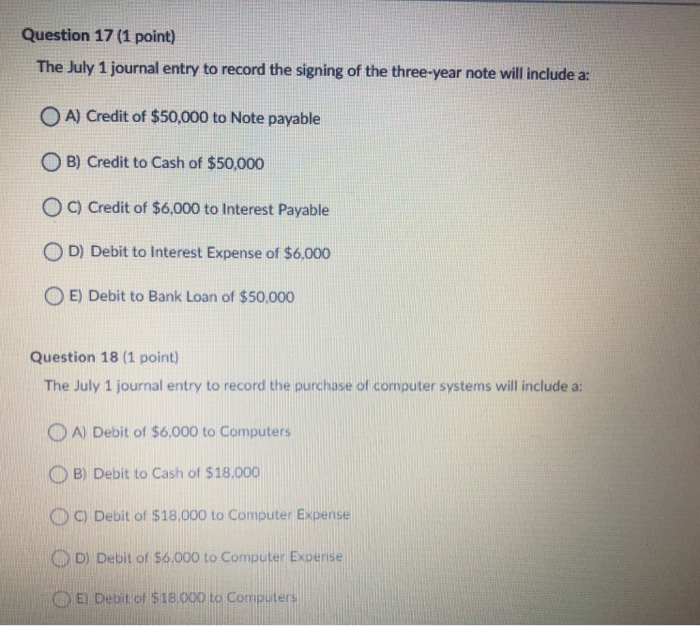

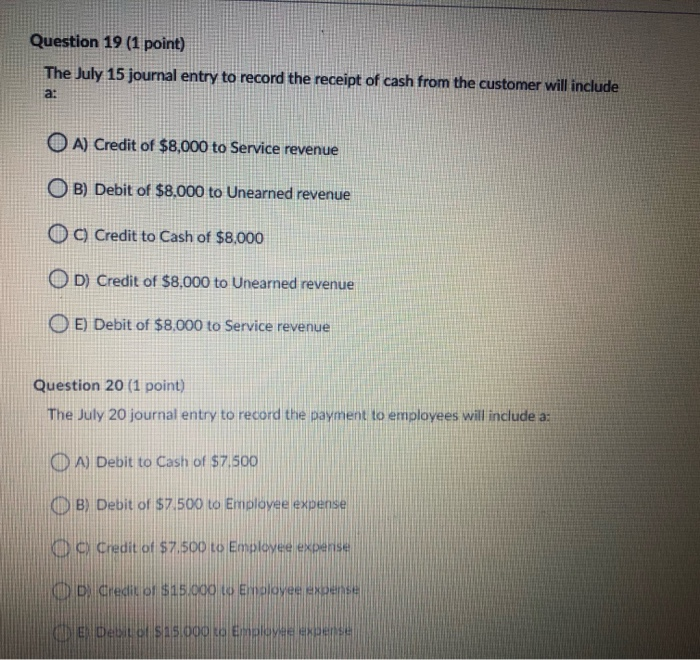

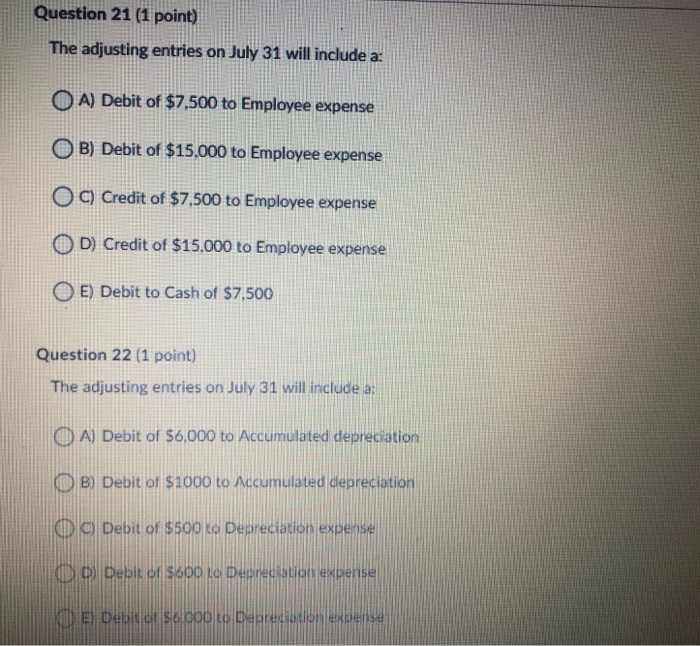

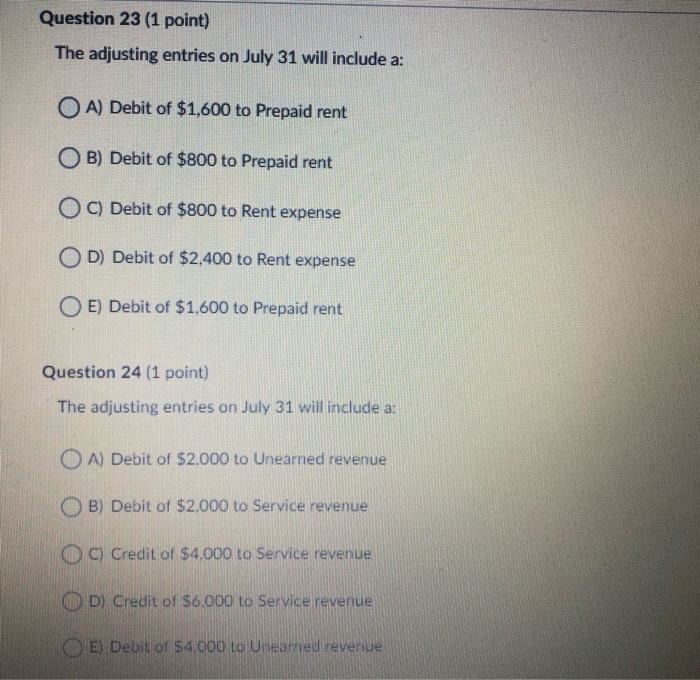

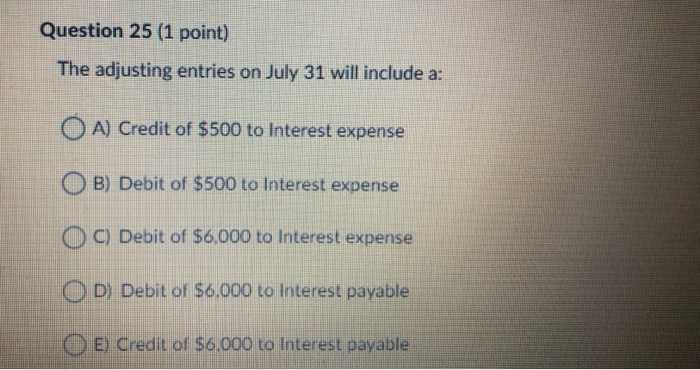

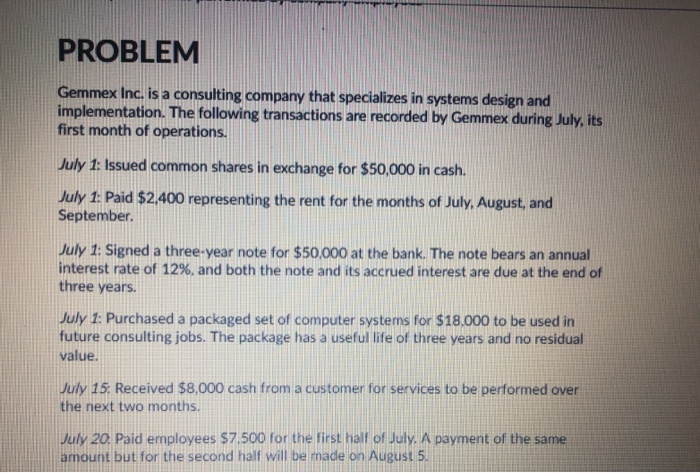

PROBLEM Gemmex Inc. is a consulting company that specializes in systems design and implementation. The following transactions are recorded by Gemmex during July, its first month of operations. July 1: Issued common shares in exchange for $50,000 in cash. July 1: Paid $2.400 representing the rent for the months of July, August, and September. July 1: Signed a three-year note for $50,000 at the bank. The note bears an annual interest rate of 12%, and both the note and its accrued interest are due at the end of three years. July 1: Purchased a packaged set of computer systems for $18,000 to be used in future consulting jobs. The package has a useful life of three years and no residual value. July 15: Received $8,000 cash from a customer for services to be performed over the next two months. July 20. Paid employees $7.500 for the first half of July. A payment of the same amount but for the second half will be made on August 5. July 1: Paid $2,400 representing the rent for the months of July, August, and September July 1: Signed a three-year note for $50,000 at the bank. The note bears an annual interest rate of 12%, and both the note and its accrued interest are due at the end of three years. July 1: Purchased a packaged set of computer systems for $18,000 to be used in future consulting jobs. The package has a useful life of three years and no residual value. July 15: Received $8,000 cash from a customer for services to be performed over the next two months. July 20. Paid employees $7.500 for the first half of July. A payment of the same amount but for the second half will be made on August 5. July 31: Billed customers $17.500 for the work performed during July July 31: Received a utility bill for $300. The amount is due in 30 days. Gemmex follows an accrual accounting system. It has an effective rate of 40% for income tax which is accrued monthly but paid annually at the end of year. The next ten (10) multiple-choice questions and live (5) fill-in-the-blanks questions are based on this problem. You can optionally use the Excel template attached below. XLSX Template XLS Template Question 16 (1 point) The July 1 journal entry to record the payment of $2,400 will include a: OA) Debit to Prepaid Rent of $800 OB) Debit to Rent Expense of $2,400 O c) Debit to Rent Expense of $800 OD) Debit to Prepaid Rent of $2.400 OE) Debit to Cash of $2.400 Question 17 (1 point) The July 1 journal entry to record the signing of the three-year note will include a: OA) Credit of $50,000 to Note payable OB) Credit to Cash of $50,000 OC) Credit of $6,000 to Interest Payable OD) Debit to Interest Expense of $6,000 OE) Debit to Bank Loan of $50,000 Question 18 (1 point) The July 1 journal entry to record the purchase of computer systems will include a: OA) Debit of $6,000 to Computers B) Debit to Cash of $18.000 c) Debit of $18,000 to Computer Expense D) Debit of $6.000 to Computer Expense El Debit of $18.000 to Computers Question 19 (1 point) The July 15 journal entry to record the receipt of cash from the customer will include a: O A) Credit of $8,000 to Service revenue OB) Debit of $8.000 to Unearned revenue O c) Credit to Cash of $8,000 OD) Credit of $8,000 to Unearned revenue E) Debit of $8,000 to Service revenue Question 20 (1 point) The July 20 journal entry to record the payment to employees will include a: O A) Debit to Cash of $7.500 B) Debit of $7.500 to Employee expense b c credit of $7.500 to Emplovee expense OD Crecio $15.000 to Employee expense De Debo sas.000 te Employee expense Question 21 (1 point) The adjusting entries on July 31 will include a: OA) Debit of $7,500 to Employee expense O B) Debit of $15.000 to Employee expense OC) Credit of $7,500 to Employee expense D) Credit of $15,000 to Employee expense E) Debit to Cash of $7,500 Question 22 (1 point) The adjusting entries on July 31 will include ar O A) Debit of $6.000 to Accumulated depre ion B) Debit of $1000 to Accumulated depreciation O o Debit of $500 to Depreciation expense D D Debit of $600 to Depreciation expense ME) Debit of $6.000 to Depreciation expense Question 23 (1 point) The adjusting entries on July 31 will include a: OA) Debit of $1,600 to Prepaid rent OB) Debit of $800 to Prepaid rent OC) Debit of $800 to Rent expense OD) Debit of $2,400 to Rent expense O E) Debit of $1,600 to Prepaid rent Question 24 (1 point) The adjusting entries on July 31 will include a: O A) Debit of $2,000 to Unearned revenue B) Debit of $2.000 to Service revenue c) Credit of $4,000 to Service revenue O D) Credit of $6.000 to Service revenue E) Debit of $4.000 to Uneared revenue Question 25 (1 point) The adjusting entries on July 31 will include a: O A) Credit of $500 to Interest expense B) Debit of $500 to Interest expense O c) Debit of $6,000 to Interest expense OD) Debit of $6.000 to Interest payable E) Credit of $6,000 to Interest payable