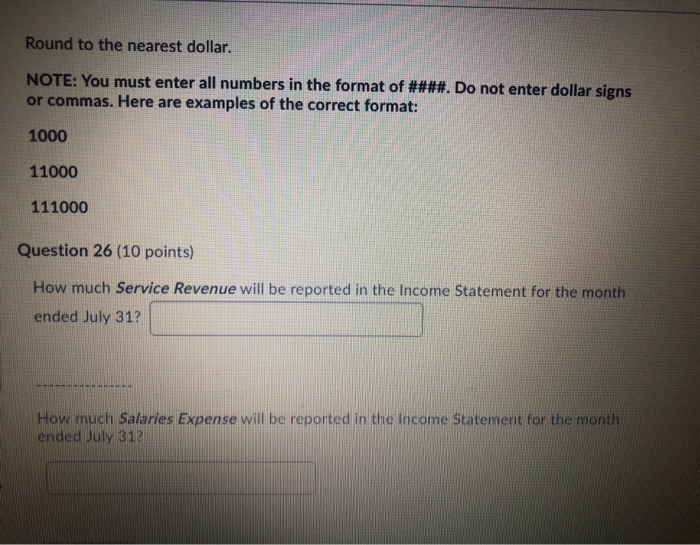

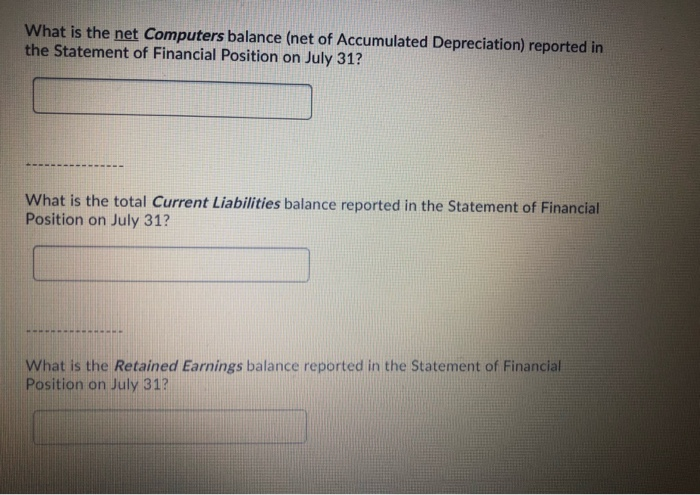

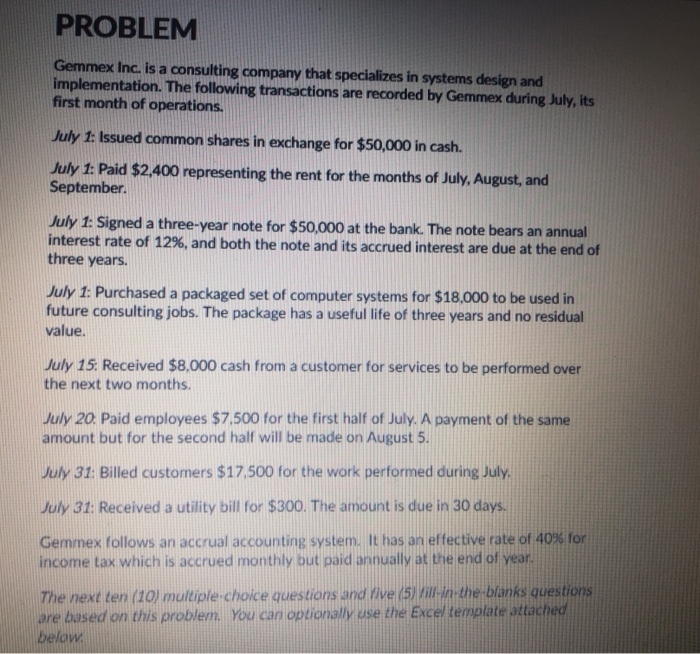

Round to the nearest dollar. NOTE: You must enter all numbers in the format of ####. Do not enter dollar signs or commas. Here are examples of the correct format: 1000 11000 111000 Question 26 (10 points) How much Service Revenue will be reported in the Income Statement for the month ended July 31? How much Salaries Expense will be reported in the Income Statement for the month ended July 312 What is the net Computers balance (net of Accumulated Depreciation) reported in the Statement of Financial Position on July 31? What is the total Current Liabilities balance reported in the Statement of Financial Position on July 31? What is the Retained Earnings balance reported in the Statement of Financial Position on July 31? PROBLEM Gemmex Inc. is a consulting company that specializes in systems design and implementation. The following transactions are recorded by Gemmex during July, its first month of operations. July 1: Issued common shares in exchange for $50,000 in cash. July 1: Paid $2,400 representing the rent for the months of July, August, and September. July 1: Signed a three-year note for $50,000 at the bank. The note bears an annual interest rate of 12%, and both the note and its accrued interest are due at the end of three years. July 1: Purchased a packaged set of computer systems for $18,000 to be used in future consulting jobs. The package has a useful life of three years and no residual value. July 15. Received $8,000 cash from a customer for services to be performed over the next two months. July 20. Paid employees $7.500 for the first half of July. A payment of the same amount but for the second half will be made on August 5. July 31: Billed customers $17.500 for the work performed during July. July 31: Received a utility bill for $300. The amount is due in 30 days. Gemmex follows an accrual accounting system. It has an effective rate of 40% for income tax which is accrued monthly but paid annually at the end of year. The next ten (10) multiple choice questions and Mive (5) 7-in-the-blanks questions are based on this problem. You can optionally use the Excel template attached below