Answered step by step

Verified Expert Solution

Question

1 Approved Answer

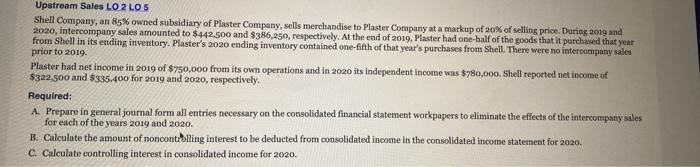

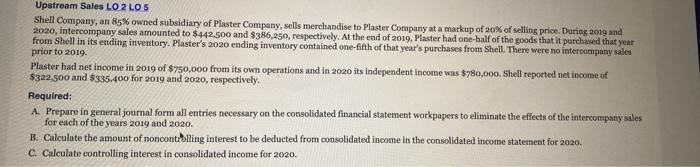

Please I need an answer Upstream Sales LO 2 LO 5 Shell Company, an 85% owned subsidiary of Plaster Company, sells merchandise to Plaster Company

Please I need an answer

Upstream Sales LO 2 LO 5 Shell Company, an 85\% owned subsidiary of Plaster Company, sells merchandise to Plaster Company at a markup of 20% of selling price. Daring 2019 and 2020 , intercompany sales amounted to $442,500 and $386,250, respectively. At the end of zo19, Plaster had one-half of the goods that it purchased that year from Shell in its ending inyentory. Plaster's 2020 ending inventory contained one-fifth of that year's purchases from Shell. There were no intercompany sales prior to 2019. Plaster had net income in 2019 of $750,000 from its own operations and in 2020 its independent income was $780,000, Shell reported net inconse of $322,500 and $335,400 for 2019 and 2020 , respectively, Required: A. Prepare in general journal form all entries necessary on the consolidated financial statement workpapers to eliminate the effects of the intercompany sales for each of the years 2019 and 2020 . B. Calculate the amount of noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2020 . C. Calculate controlling interest in consolidated income for 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started