Answered step by step

Verified Expert Solution

Question

1 Approved Answer

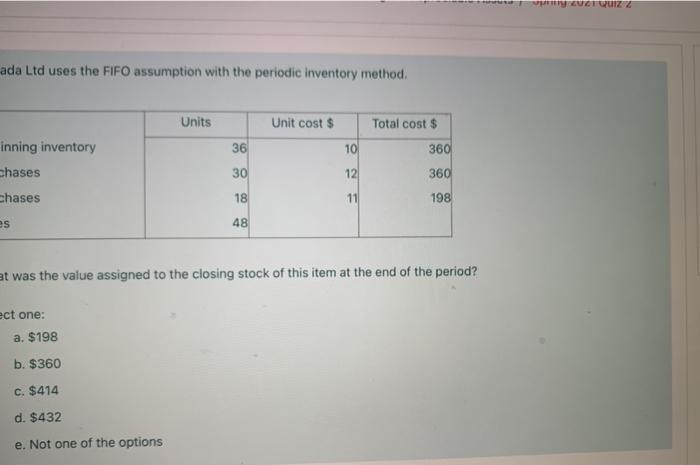

please i need answer fast ada Ltd uses the FIFO assumption with the periodic inventory method. Units Unit cost $ Total cost $ 360 36

please i need answer fast

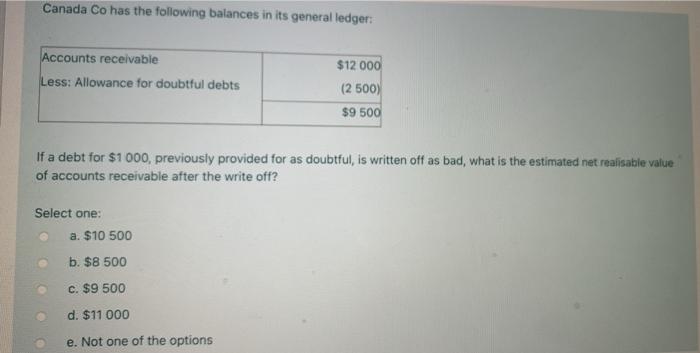

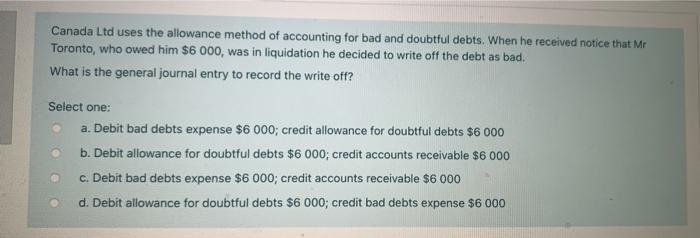

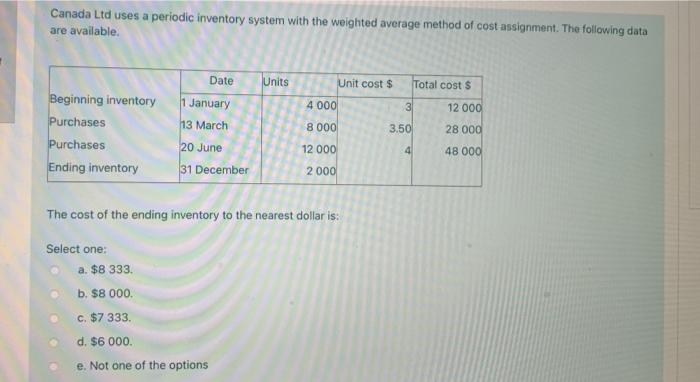

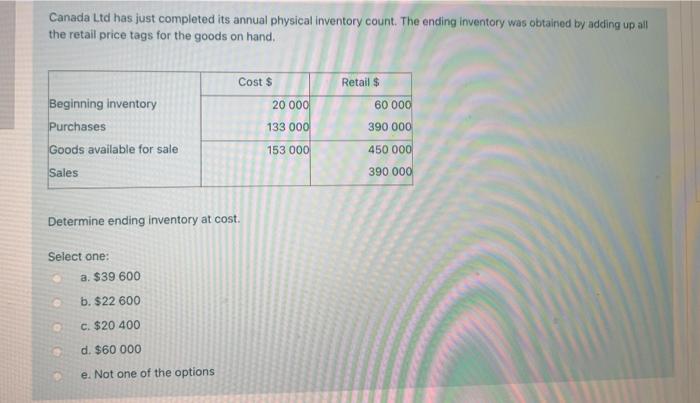

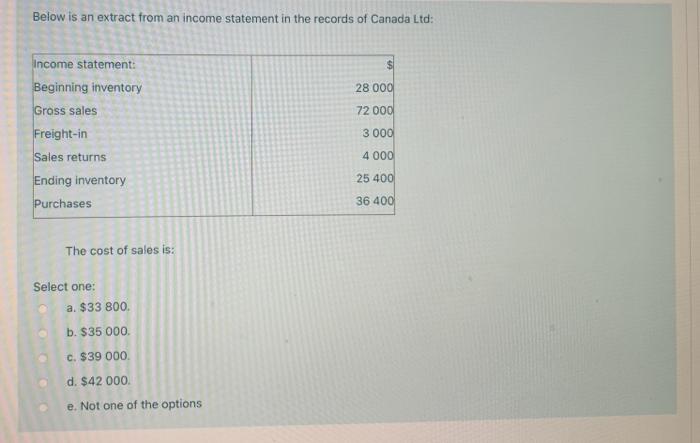

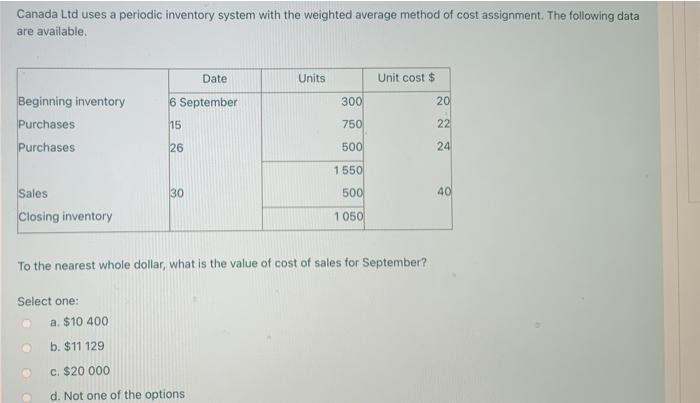

ada Ltd uses the FIFO assumption with the periodic inventory method. Units Unit cost $ Total cost $ 360 36 10 30 12 360 inning inventory chases chases es 18 11 198 48 at was the value assigned to the closing stock of this item at the end of the period? ect one: a. $198 b. $360 c. $414 d. $432 e. Not one of the options Canada Co has the following balances in its general ledger: Accounts receivable Less: Allowance for doubtful debts $12 000 (2 500) $9 500 If a debt for $1000, previously provided for as doubtful, is written off as bad, what is the estimated net realisable value of accounts receivable after the write off? Select one: a. $10 500 b. $8 500 c. $9 500 d. $11 000 e. Not one of the options Canada Ltd uses the allowance method of accounting for bad and doubtful debts. When he received notice that Mr Toronto, who owed him $6 000, was in liquidation he decided to write off the debt as bad. What is the general journal entry to record the write off? Select one: a. Debit bad debts expense $6 000; credit allowance for doubtful debts $6 000 b. Debit allowance for doubtful debts $6 000; credit accounts receivable $6 000 c. Debit bad debts expense $6 000; credit accounts receivable $6 000 d. Debit allowance for doubtful debts $6 000; credit bad debts expense $6 000 Canada Ltd uses a periodic inventory system with the weighted average method of cost assignment. The following data are available Date Units Unit cost $ Total cost $ 4 000 3 1 January 13 March 12 000 8 000 Beginning inventory Purchases Purchases Ending inventory 3.50 28 000 20 June 12 000 4 48 000 31 December 2 000 The cost of the ending inventory to the nearest dollar is: Select one: a. $8 333 b. $8 000. c. $7 333 d. $6 000 e. Not one of the options Canada Ltd has just completed its annual physical inventory count. The ending inventory was obtained by adding up all the retail price tags for the goods on hand. Retail $ Cost $ 20 000 133 000 60 000 390 000 Beginning inventory Purchases Goods available for sale Sales 153 000 450 000 390 000 Determine ending inventory at cost. Select one: a. $39 600 b. $22 600 c. $20 400 d. $60 000 e. Not one of the options Below is an extract from an income statement in the records of Canada Ltd: $ Income statement: Beginning inventory 28 000 Gross sales 72 000 3 000 Freight-in Sales returns 4 000 25 400 Ending inventory Purchases 36 400 The cost of sales is: Select one: a. $33 800 b. $35 000 c. $39 000 d. $42 000. e. Not one of the options Canada Ltd uses a periodic inventory system with the weighted average method of cost assignment. The following data are available Date Units Unit cost $ 6 September 300 20 Beginning inventory Purchases Purchases 15 750 22 26 500 24 1550 30 500 40 Sales Closing inventory 1050 To the nearest whole dollar, what is the value of cost of sales for September? Select one: a. $10 400 b. $11 129 c. $20 000 d. Not one of the options Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started