Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comet operates solely within the United States. It owns two subsidiaries conducting business in the United States and several foreign countries. Both subsidiaries are U.S.

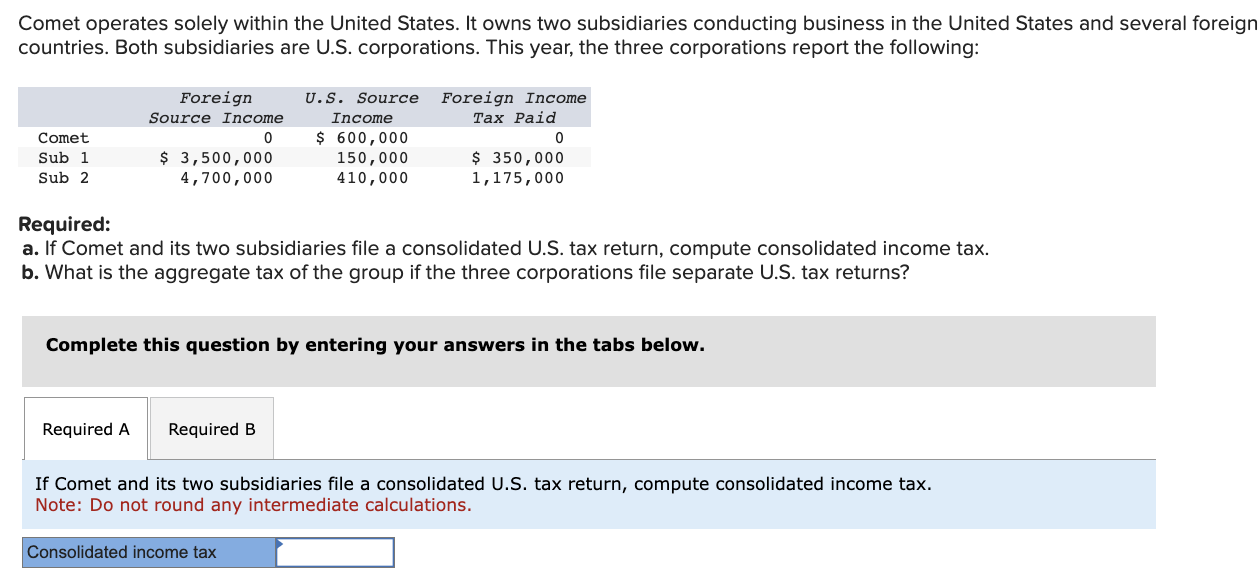

Comet operates solely within the United States. It owns two subsidiaries conducting business in the United States and several foreign countries. Both subsidiaries are U.S. corporations. This year, the three corporations report the following: Required: a. If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax. b. What is the aggregate tax of the group if the three corporations file separate U.S. tax returns? Complete this question by entering your answers in the tabs below. If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax. Note: Do not round any intermediate calculations

Comet operates solely within the United States. It owns two subsidiaries conducting business in the United States and several foreign countries. Both subsidiaries are U.S. corporations. This year, the three corporations report the following: Required: a. If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax. b. What is the aggregate tax of the group if the three corporations file separate U.S. tax returns? Complete this question by entering your answers in the tabs below. If Comet and its two subsidiaries file a consolidated U.S. tax return, compute consolidated income tax. Note: Do not round any intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started