Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need help I need help with the adjusting trail balance questions. I mean adjusting journal entrees Prepare the 12/31/22 AJEs necessary in the

please I need help

I need help with the adjusting trail balance questions.

I mean adjusting journal entrees

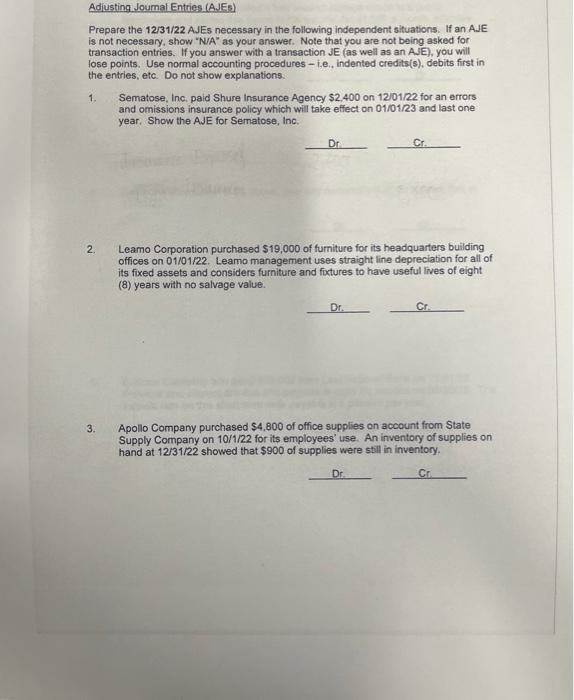

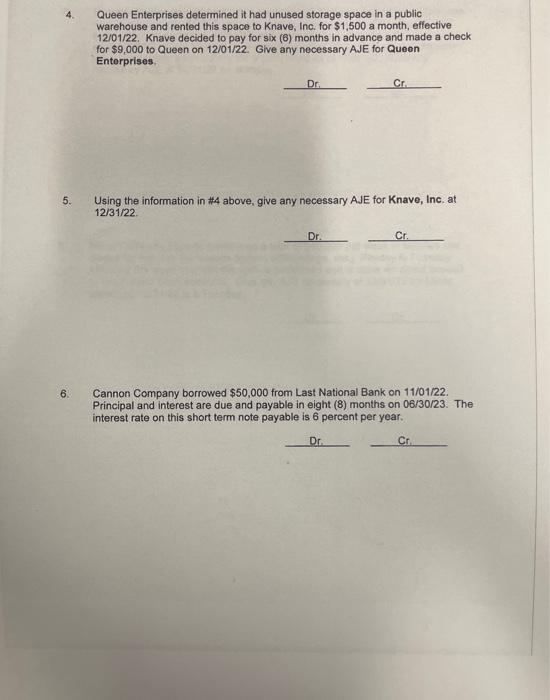

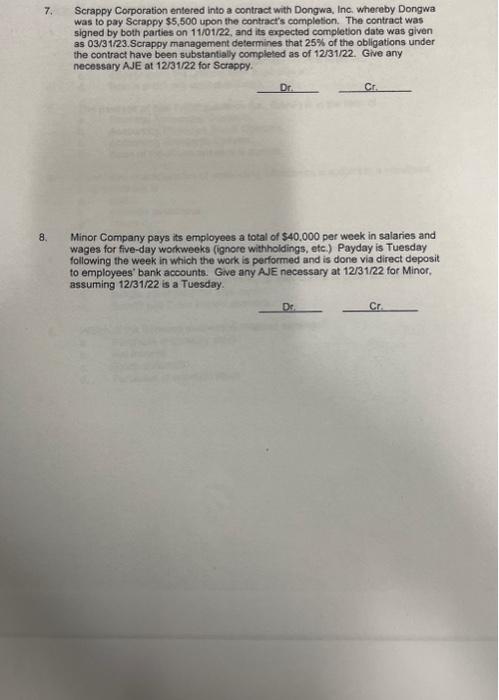

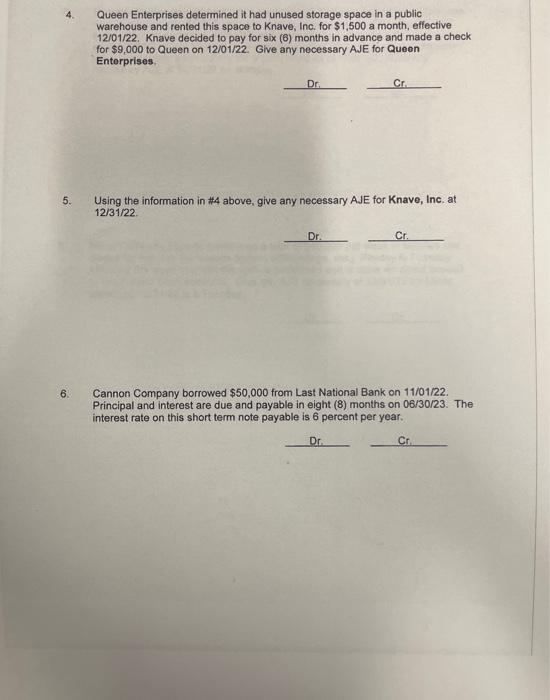

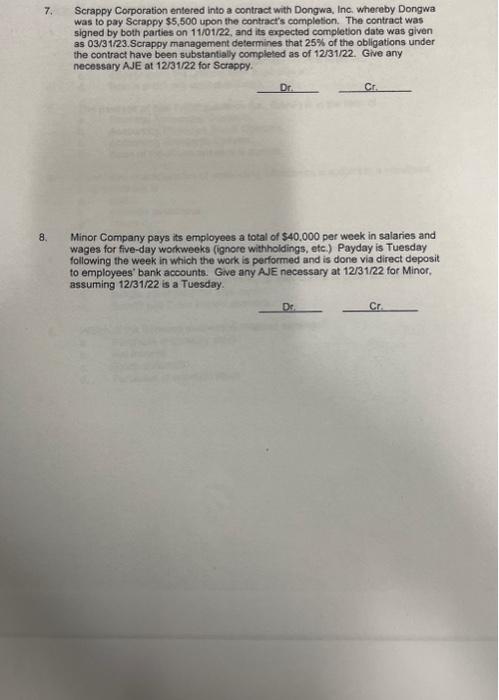

Prepare the 12/31/22 AJEs necessary in the following independent situations. If an A.J is not necessary, show "N/A" as your answer. Note that you are not being asked for transaction entries. If you answer with a transaction JE (as well as an AJE), you will lose points. Use normal accounting procedures - i,e., indented credits(s), debits first in the entries, etc. Do not show explanations. 1. Sematose, Inc. paid Shure Insurance Agency $2,400 on 1201/22 for an errors and omissions insurance policy which will take effect on 01/01/23 and last one year. Show the AJE for Sematose, Inc. DrCr. 2. Leamo Corporation purchased $19,000 of furniture for its headquarters building offices on 01/01/22. Leamo management uses straight line depreciation for all of its fixed assets and considers furniture and fixtures to have useful lives of eight (8) years with no salvage value. 3. Apollo Company purchased $4,800 of office supplies on account from State Supply Company on 10/1/22 for its employees' use. An inventory of supplies on hand at 12/31/22 showed that $900 of supplies were still in inventory. 4. Queen Enterprises determined it had unused storage space in a public warehouse and rented this space to Knave, Inc. for \$1,500 a month, effective 12/01/22. Knave decided to pay for six (6) months in advance and made a check for $9,000 to Queen on 12/01/22. Give any necessary AJE for Queon Enterprises. Dr.Cr. 5. Using the information in #4 above, give any necessary AJE for Knave, Inc. at 12/31/22. Dr.Cr. 6. Cannon Company borrowed $50,000 from Last National Bank on 11/01/22. Principal and interest are due and payable in eight (8) months on 06/30/23. The interest rate on this short term note payable is 6 percent per year. 7. Scrappy Corporation entered into a contract with Dongwa, Inc, whereby Dongwa was to pay Scrappy $5,500 upon the contract's complesion. The contract was signed by both parties on 11/1/R2, and its expected completion date was given as 03/31/23. Scrappy management determines that 25% of the obligations under the contract have been substantially completed as of 12/31/22. Give any necessary AJE at 12/31/22 for Scrappy. 8. Minor Company pays its employees a tolal of $40.000 per week in salaries and wages for five-day workweeks (ignore withholdings, etc.) Payday is Tuesday following the week in which the work is performed and is done via direct deposit to employees" bank accounts. Give any AJE necessary at 12/31/22 for Minor. assuming 12/31/22 is a Tuesday Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started