Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i need the answer of all the questions SET LO2 Exercises EGN 3203 engineering economics 22, Construct a cash fl ow diagram that represents

please i need the answer of all the questions

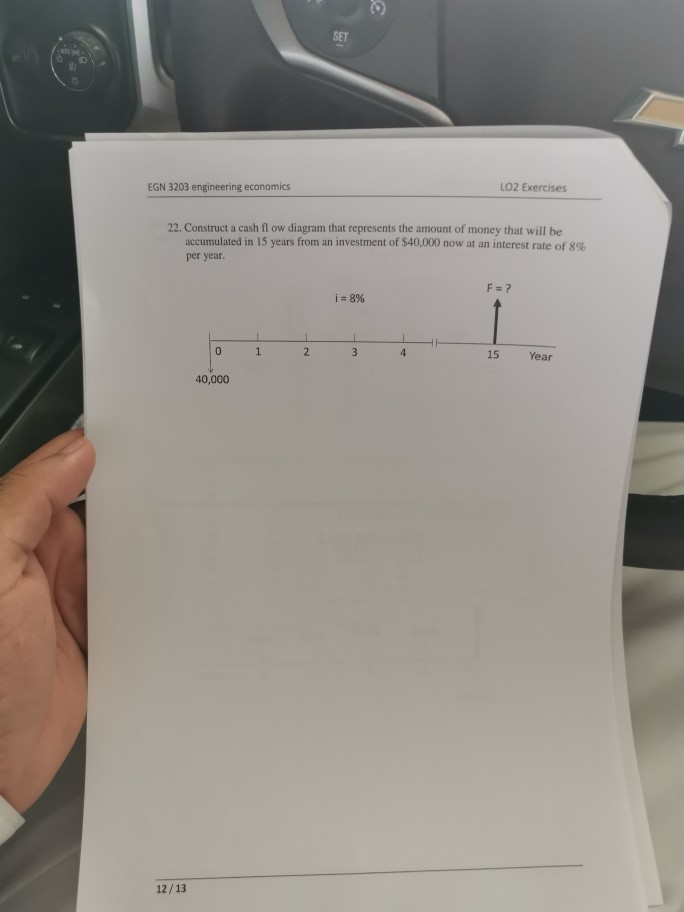

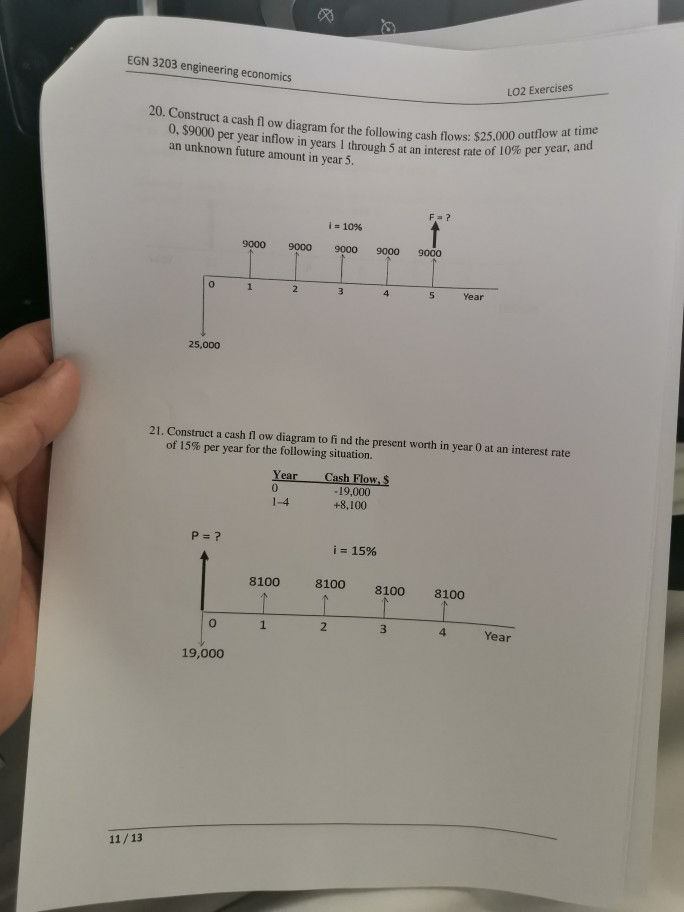

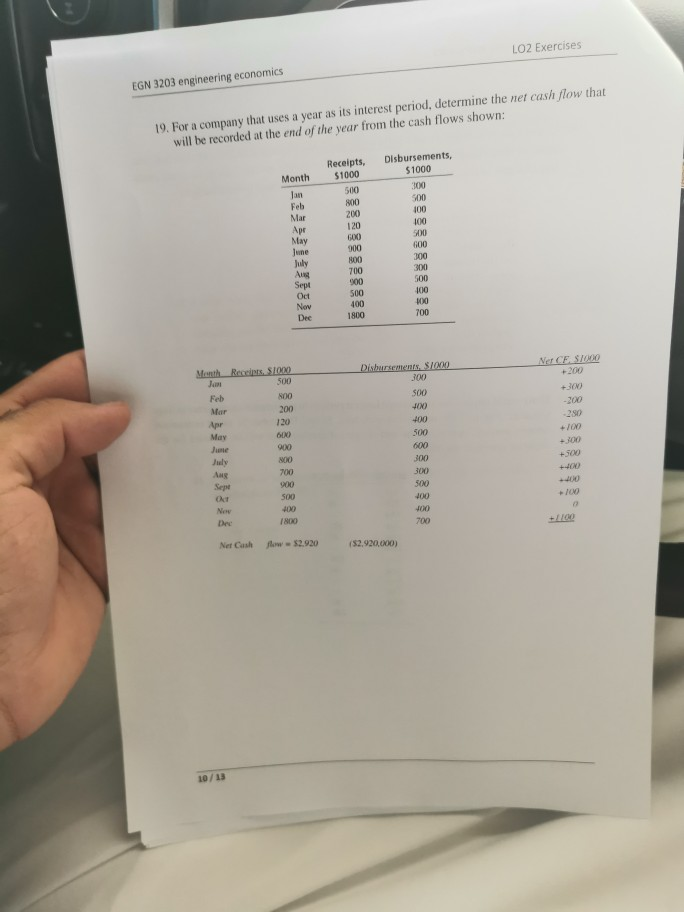

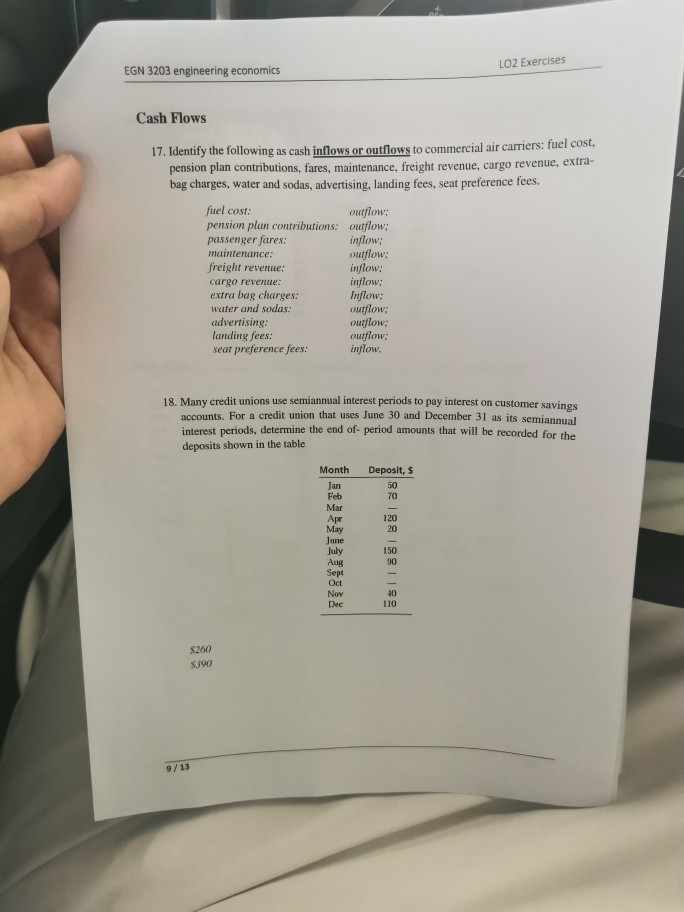

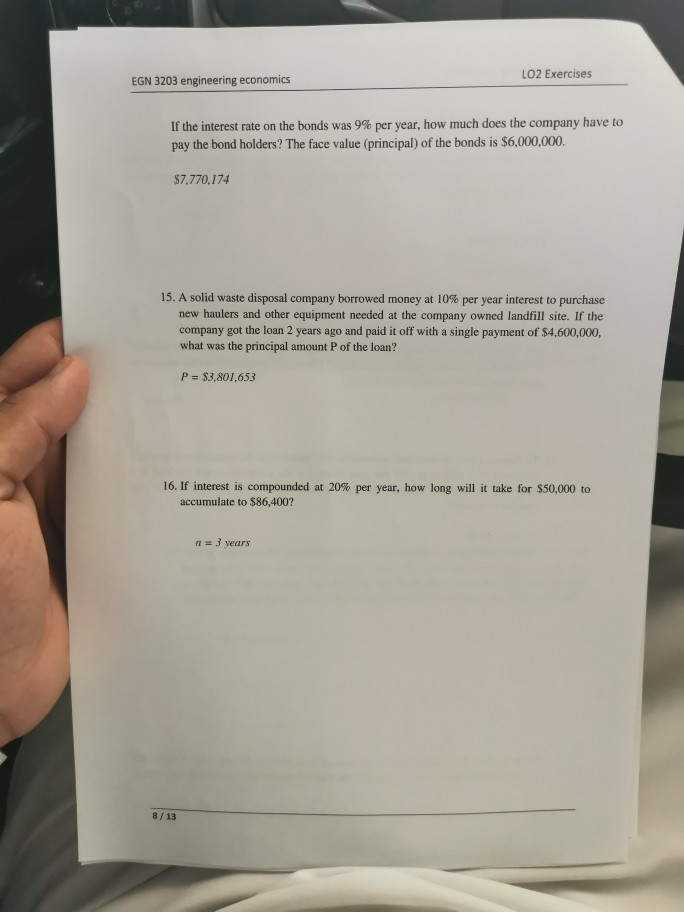

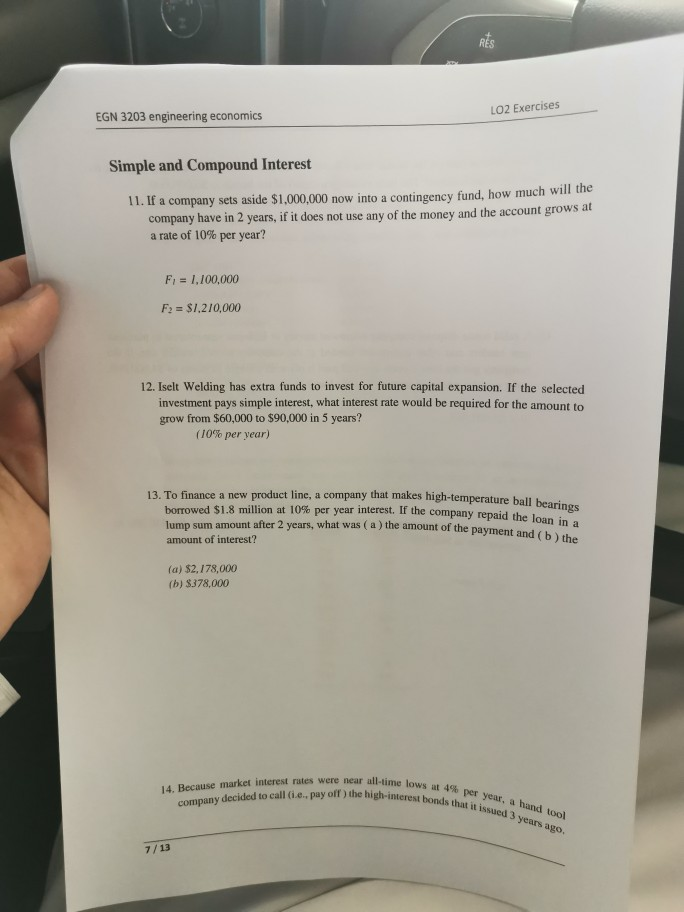

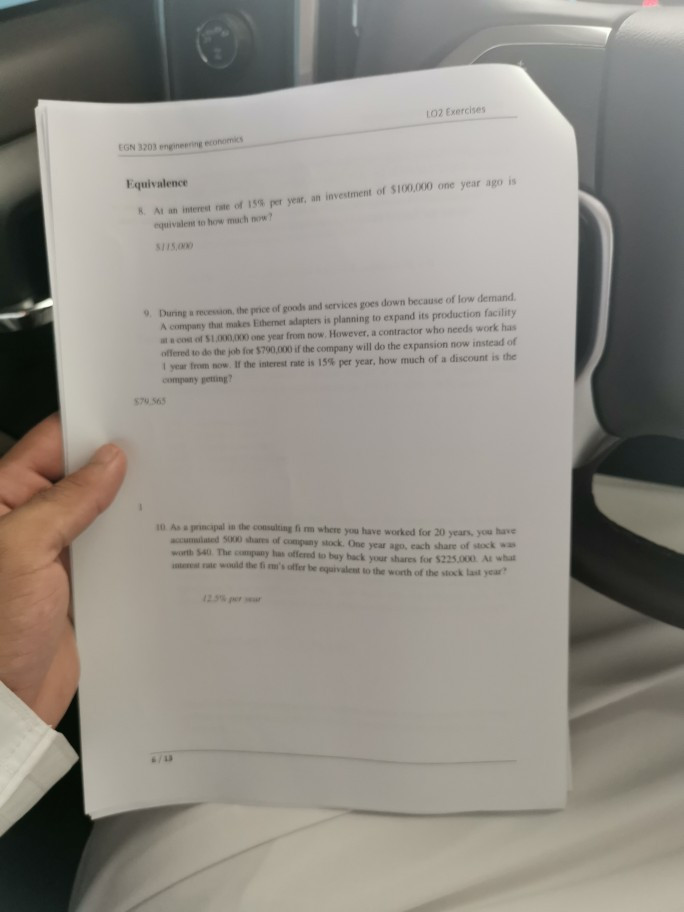

SET LO2 Exercises EGN 3203 engineering economics 22, Construct a cash fl ow diagram that represents the amount of money that will be accumulated in 15 years from an investment of $40,000 now at an interest rate of 8% per year. F ? i 8% 0 1 2 4 15 Year 40,000 12/13 EGN 3203 engineering economics LO2 Exercises 20. Construct a cash fl ow diagram for the following cash flows: $25,000 outflow at time 0, $9000 per year inflow in years I through 5 at an interest rate of 10% per year, and an unknown future amount in year 5. F ? i- 10% 9000 9000 9000 9000 9000 1 4 5 Year 25,000 21. Construct a cash fl ow diagram to fi nd the present worth in year 0 at an interest rate of 15% per year for the following situation. Year Cash Flow, $ -19,000 +8,100 1-4 P ? i= 15% 8100 8100 8100 8100 1 2 Year 19,000 11/13 LO2 Exercises EGN 3203 engineering economics 19. For a company that uses a year as its interest period, determine the net cash flow that will be recorded at the end of the year from the cash flows shown: Disbursements, $1000 Receipts, $1000 Month 300 500 800 200 120 GOO Jan Feb S00 400 Mar 400 Apr May June July Aug Sept S00 G00 900 300 800 300 700 900 S00 400 500 Oct 400 400 Nov 700 1800 Dec Net CF. $1000 +200 Month Receipts, S1000 Jan Dishursemenrs, $1000 300 500 +3000 500 Feb 800 -200 400 Mar 200 - 280 120 400 Apr +100 500 May 600 +300 June 900 600 July 800 +500 300 Aug Sept 700 +400 300 900 +400 500 +/00 Oct 500 400 Nov 400 400 Dec 1800 700 +/100 low $2.920 Net Cash ($2,920,000) 10/13 LO2 Exercises EGN 3203 engineering economics Cash Flows 17. Identify the following as cash inflows or outflows to commercial air carriers: fuel cost, pension plan contributions, fares, maintenance, freight revenue, cargo revenue, extra- bag charges, water and sodas, advertising, landing fees, seat preference fees. fuel cost: outflow; pension plan contributions: outflow; inflow; outflow; inflow: inflow: Inflow: outflow; outflow: outflow; inflow. passenger fares: maintenance: freight revenue: cargo revenue: extra bag charges: water and sodas: advertising: landing fees: seat preference fees: 18. Many credit unions use semiannual interest periods to pay interest on customer savings accounts. For a credit union that uses June 30 and December 31 as its semiannual interest periods, determine the end of- period amounts that will be recorded for the deposits shown in the table Month Deposit, $ Jan 50 70 Feb Mar Apr May 120 20 June July 150 00 Aug Sept Oct Nov 40 110 Dec $260 $390 9/13 I LO2 Exercises EGN 3203 engineering economics If the interest rate on the bonds was 9% per year, how much does the company have to pay the bond holders? The face value (principal) of the bonds is $6,000,000. $7,770,174 15. A solid waste disposal company borrowed money at 10% per year interest to purchase new haulers and other equipment needed at the company owned landfill site. If the company got the loan 2 years ago and paid it off with a single payment of $4,600,000, what was the principal amount P of the loan? P $3,801,653 16. If interest is compounded accumulate to $86,400? at 20% per year, how long will it take for $50,000 to n=3 years 8/13 RES LO2 Exercises EGN 3203 engineering economics Simple and Compound Interest 11. If a company sets aside $1,000,000 now into a contingency fund, how much will the company have in 2 years, if it does not use any of the money and the account grows at a rate of 10% per year? F 1,100,000 F2 $1,210,000 12. Iselt Welding has extra funds to invest for future capital expansion. If the selected investment pays simple interest, what interest rate would be required for the amount to grow from $60,000 to $90,000 in 5 years? (10% per year) 13. To finance a new product line, a company that makes high-temperature ball bearings borrowed $1.8 million at 10%% per year interest. If the company repaid the loan in a sum amount after 2 years, what was (a ) the amount of the payment and ( b ) the lump amount of interest? (a) $2,178,000 (b) $378,000 14. Because market interest rates were near all-time lows at 4% per year, a hand tool company decided to call (i.e., pay off ) the high-interest bonds that it issued 3 years ago. 7/13 LO2 Exercises EGN 3203 enineering economics Equivalence KAt an interest rate of 15S per year, an investment of $100,000 one year ago is equivalent to how mach now? S115,000 9 During a recession, the price of goods and services goes down because of low demand A company that makes Ethenet adapters is planning to expand its production facility ata cod of SL000,000 one year from now. However, a contractor who needs work has offered to de the job for $790,000 if the company will do the expansion now instead of 1 year from sow. If the interest rate is 15% per year, how much of a discount is the company getting $79.565 10 As a principal in the consulting fi m whee you have worked for 20 years, you have accumulated S000 shares of company stock. One vear ago, each share of stock was worth 540 The company has offered to buy hack your shares for $225.000 Al Wha tert rate would the fi 's offer be equivalent to the worth of the stock lasl year 12.5% perr /13 EGN 3203 engineering economics LO2 Exercises Green algae, Chlamydomonas reinhardtii, can produce hydrogen when temporarily deprived of sulfur for up to 2 days at a time. A small company needs to purchase equipment costing $3.4 million to commercialize the process. If the company wants to earn a rate of return of 10% per year and recover its investment in 8 years, what must be the net value of the hydrogen produced each year? P = $3.4 million: A = 2: i= 10%: n = 8 LO2 Exercises EGN 3203 engineering economics 4. A new engineering graduate who started a consulting business borrowed money for I year to furnish the office. The amount of the loan was $23,800, and it had an interest rate of 10% per year. However, because the new graduate had not built up a credit history, the bank made him buy loan-default insurance that cost 5% of the loan amount. In addition, the bank charged a loan setup fee of $300. What was the effective interest rate the engineer paid for the loan? 16.3% Terms and Symbols 5. The symbol P represents an amount of money at a time designated following symbols also represent a present amount of money and require similar calculations. Explain what each symbol stands for: PW, PV, NPV, DCF, and CC. as present. The present worth: =present value; =net presenr value =discounted cash flow =capitalized cost PW PV NPV DCF CC 6. Identify the four engineering economy symbols and their values from the following problem statement. Use a question mark with the symbol whose value is to be determined. Thompson Mechanical Products is planning to set aside $150,000 now for possibly replacing its large synchronous refiner motors whenever it becomes necessary. If the replacement is not needed for 7 years, how much will the company have in its investment set-aside account, provided it achieves a rate of return of 119% per year? P $150,000: F- : i # 1/%; n = 7 7. Identify the four engineering economy symbols and their values from the following problem statement. Use a question mark with the symbol whose value is to be determined. 4/13 EGN 3203 engineering economics LO2 Exercises Interest Rate and Rate of Return 1. RKI Instruments borrowed $3,500,000 from a private equity firm for expansion of its manufacturing facility for making carbon monoxide monitors/ controllers. The company repaid the loan after 1 year with the interest rate on the loan? single payment of $3,885,000. What was a 11% per year Emerson Processing borrowed $900,000 for installing energy-efficient lighting and safety equipment in its La Grange manufacturing facility. The terms of the loan were such that the company could pay interest only at the end of each year for up to 5 years, after which the company would have to pay the entire amount due. If the interest rate on the loan was 12% per year and the company paid only the interest for 4 years, determine the following: a. The amount of each of the four interest payments b. The amount of the fi nal payment at the end of year 5 2. a) $108,000 b) $1.008,000 3. Which of the following 1-year investments has the highest rate of return? a. $12,500 that yields $1125 in interest, b. $56,000 that yields $6160 in interest, c. $95,000 that yields $7600 in interest. SET LO2 Exercises EGN 3203 engineering economics 22, Construct a cash fl ow diagram that represents the amount of money that will be accumulated in 15 years from an investment of $40,000 now at an interest rate of 8% per year. F ? i 8% 0 1 2 4 15 Year 40,000 12/13 EGN 3203 engineering economics LO2 Exercises 20. Construct a cash fl ow diagram for the following cash flows: $25,000 outflow at time 0, $9000 per year inflow in years I through 5 at an interest rate of 10% per year, and an unknown future amount in year 5. F ? i- 10% 9000 9000 9000 9000 9000 1 4 5 Year 25,000 21. Construct a cash fl ow diagram to fi nd the present worth in year 0 at an interest rate of 15% per year for the following situation. Year Cash Flow, $ -19,000 +8,100 1-4 P ? i= 15% 8100 8100 8100 8100 1 2 Year 19,000 11/13 LO2 Exercises EGN 3203 engineering economics 19. For a company that uses a year as its interest period, determine the net cash flow that will be recorded at the end of the year from the cash flows shown: Disbursements, $1000 Receipts, $1000 Month 300 500 800 200 120 GOO Jan Feb S00 400 Mar 400 Apr May June July Aug Sept S00 G00 900 300 800 300 700 900 S00 400 500 Oct 400 400 Nov 700 1800 Dec Net CF. $1000 +200 Month Receipts, S1000 Jan Dishursemenrs, $1000 300 500 +3000 500 Feb 800 -200 400 Mar 200 - 280 120 400 Apr +100 500 May 600 +300 June 900 600 July 800 +500 300 Aug Sept 700 +400 300 900 +400 500 +/00 Oct 500 400 Nov 400 400 Dec 1800 700 +/100 low $2.920 Net Cash ($2,920,000) 10/13 LO2 Exercises EGN 3203 engineering economics Cash Flows 17. Identify the following as cash inflows or outflows to commercial air carriers: fuel cost, pension plan contributions, fares, maintenance, freight revenue, cargo revenue, extra- bag charges, water and sodas, advertising, landing fees, seat preference fees. fuel cost: outflow; pension plan contributions: outflow; inflow; outflow; inflow: inflow: Inflow: outflow; outflow: outflow; inflow. passenger fares: maintenance: freight revenue: cargo revenue: extra bag charges: water and sodas: advertising: landing fees: seat preference fees: 18. Many credit unions use semiannual interest periods to pay interest on customer savings accounts. For a credit union that uses June 30 and December 31 as its semiannual interest periods, determine the end of- period amounts that will be recorded for the deposits shown in the table Month Deposit, $ Jan 50 70 Feb Mar Apr May 120 20 June July 150 00 Aug Sept Oct Nov 40 110 Dec $260 $390 9/13 I LO2 Exercises EGN 3203 engineering economics If the interest rate on the bonds was 9% per year, how much does the company have to pay the bond holders? The face value (principal) of the bonds is $6,000,000. $7,770,174 15. A solid waste disposal company borrowed money at 10% per year interest to purchase new haulers and other equipment needed at the company owned landfill site. If the company got the loan 2 years ago and paid it off with a single payment of $4,600,000, what was the principal amount P of the loan? P $3,801,653 16. If interest is compounded accumulate to $86,400? at 20% per year, how long will it take for $50,000 to n=3 years 8/13 RES LO2 Exercises EGN 3203 engineering economics Simple and Compound Interest 11. If a company sets aside $1,000,000 now into a contingency fund, how much will the company have in 2 years, if it does not use any of the money and the account grows at a rate of 10% per year? F 1,100,000 F2 $1,210,000 12. Iselt Welding has extra funds to invest for future capital expansion. If the selected investment pays simple interest, what interest rate would be required for the amount to grow from $60,000 to $90,000 in 5 years? (10% per year) 13. To finance a new product line, a company that makes high-temperature ball bearings borrowed $1.8 million at 10%% per year interest. If the company repaid the loan in a sum amount after 2 years, what was (a ) the amount of the payment and ( b ) the lump amount of interest? (a) $2,178,000 (b) $378,000 14. Because market interest rates were near all-time lows at 4% per year, a hand tool company decided to call (i.e., pay off ) the high-interest bonds that it issued 3 years ago. 7/13 LO2 Exercises EGN 3203 enineering economics Equivalence KAt an interest rate of 15S per year, an investment of $100,000 one year ago is equivalent to how mach now? S115,000 9 During a recession, the price of goods and services goes down because of low demand A company that makes Ethenet adapters is planning to expand its production facility ata cod of SL000,000 one year from now. However, a contractor who needs work has offered to de the job for $790,000 if the company will do the expansion now instead of 1 year from sow. If the interest rate is 15% per year, how much of a discount is the company getting $79.565 10 As a principal in the consulting fi m whee you have worked for 20 years, you have accumulated S000 shares of company stock. One vear ago, each share of stock was worth 540 The company has offered to buy hack your shares for $225.000 Al Wha tert rate would the fi 's offer be equivalent to the worth of the stock lasl year 12.5% perr /13 EGN 3203 engineering economics LO2 Exercises Green algae, Chlamydomonas reinhardtii, can produce hydrogen when temporarily deprived of sulfur for up to 2 days at a time. A small company needs to purchase equipment costing $3.4 million to commercialize the process. If the company wants to earn a rate of return of 10% per year and recover its investment in 8 years, what must be the net value of the hydrogen produced each year? P = $3.4 million: A = 2: i= 10%: n = 8 LO2 Exercises EGN 3203 engineering economics 4. A new engineering graduate who started a consulting business borrowed money for I year to furnish the office. The amount of the loan was $23,800, and it had an interest rate of 10% per year. However, because the new graduate had not built up a credit history, the bank made him buy loan-default insurance that cost 5% of the loan amount. In addition, the bank charged a loan setup fee of $300. What was the effective interest rate the engineer paid for the loan? 16.3% Terms and Symbols 5. The symbol P represents an amount of money at a time designated following symbols also represent a present amount of money and require similar calculations. Explain what each symbol stands for: PW, PV, NPV, DCF, and CC. as present. The present worth: =present value; =net presenr value =discounted cash flow =capitalized cost PW PV NPV DCF CC 6. Identify the four engineering economy symbols and their values from the following problem statement. Use a question mark with the symbol whose value is to be determined. Thompson Mechanical Products is planning to set aside $150,000 now for possibly replacing its large synchronous refiner motors whenever it becomes necessary. If the replacement is not needed for 7 years, how much will the company have in its investment set-aside account, provided it achieves a rate of return of 119% per year? P $150,000: F- : i # 1/%; n = 7 7. Identify the four engineering economy symbols and their values from the following problem statement. Use a question mark with the symbol whose value is to be determined. 4/13 EGN 3203 engineering economics LO2 Exercises Interest Rate and Rate of Return 1. RKI Instruments borrowed $3,500,000 from a private equity firm for expansion of its manufacturing facility for making carbon monoxide monitors/ controllers. The company repaid the loan after 1 year with the interest rate on the loan? single payment of $3,885,000. What was a 11% per year Emerson Processing borrowed $900,000 for installing energy-efficient lighting and safety equipment in its La Grange manufacturing facility. The terms of the loan were such that the company could pay interest only at the end of each year for up to 5 years, after which the company would have to pay the entire amount due. If the interest rate on the loan was 12% per year and the company paid only the interest for 4 years, determine the following: a. The amount of each of the four interest payments b. The amount of the fi nal payment at the end of year 5 2. a) $108,000 b) $1.008,000 3. Which of the following 1-year investments has the highest rate of return? a. $12,500 that yields $1125 in interest, b. $56,000 that yields $6160 in interest, c. $95,000 that yields $7600 in interestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started