Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i need total cash receipts for january? $ total cash payments for january? $ what is the cash surplus / bank loan for january?

please i need total cash receipts for january? $ total cash payments for january? $ what is the cash surplus / bank loan for january? $ then total cash receipts for feburary? $ total cash payments for feburary? $ what is the cash surplus/ bank loan for feburary? $

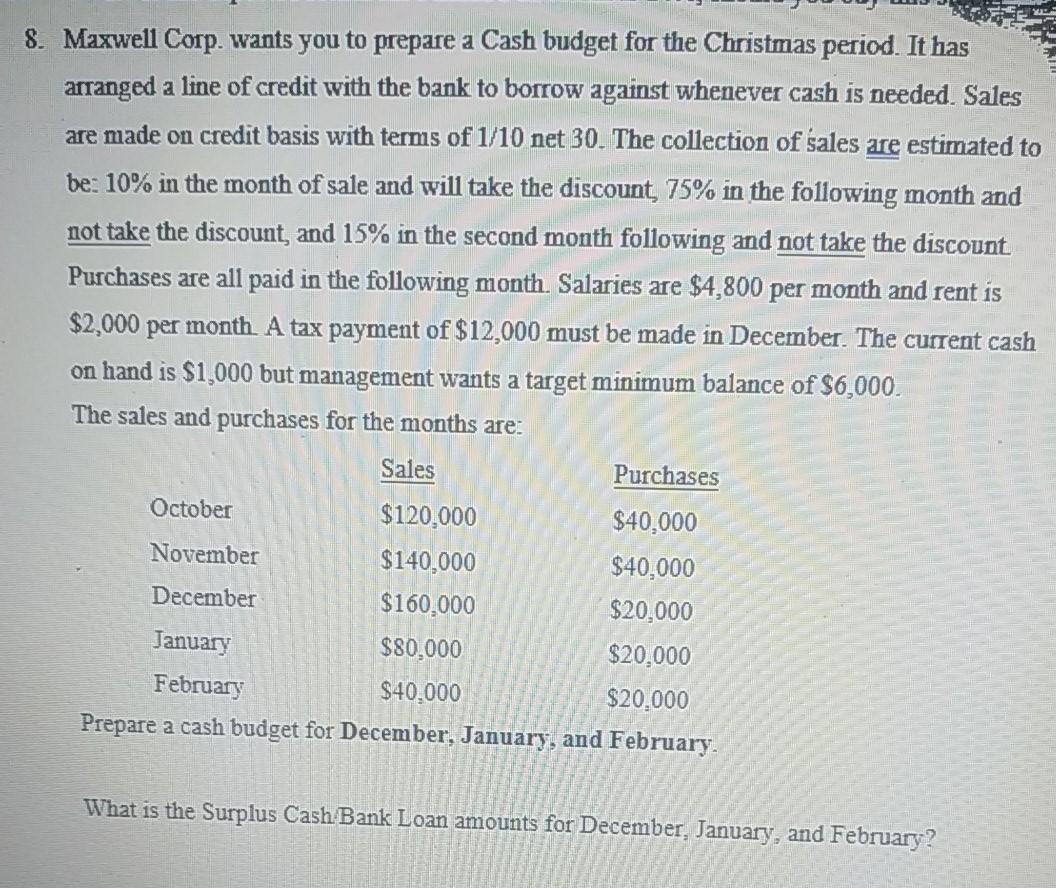

8. Maxwell Corp. wants you to prepare a Cash budget for the Christmas period. It has arranged a line of credit with the bank to borrow against whenever cash is needed. Sales are made on credit basis with terms of 1/10 net 30. The collection of sales are estimated to be: 10% in the month of sale and will take the discount, 75% in the following month and not take the discount, and 15% in the second month following and not take the discount Purchases are all paid in the following month. Salaries are $4,800 per month and rent is $2,000 per month A tax payment of $12,000 must be made in December. The current cash on hand is $1,000 but management wants a target minimum balance of $6,000. The sales and purchases for the months are: Sales Purchases October $120.000 $40,000 November $140,000 $40,000 December $160.000 $20,000 January $80,000 $20,000 February $40,000 $20,000 Prepare a cash budget for December, January, and February. What is the Surplus Cash Bank Loan amounts for December, January, and FebruaryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started