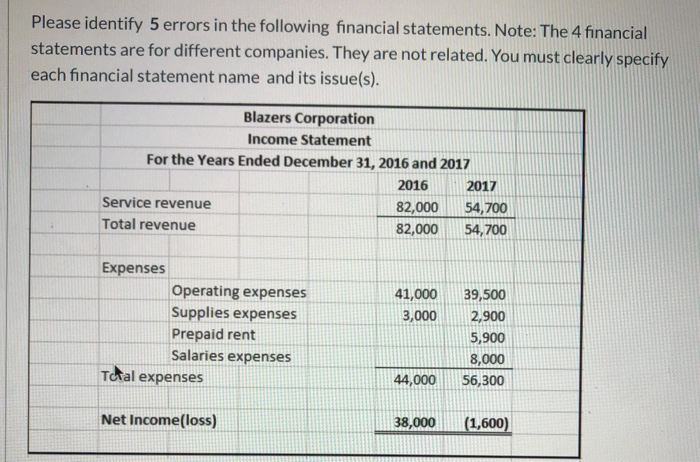

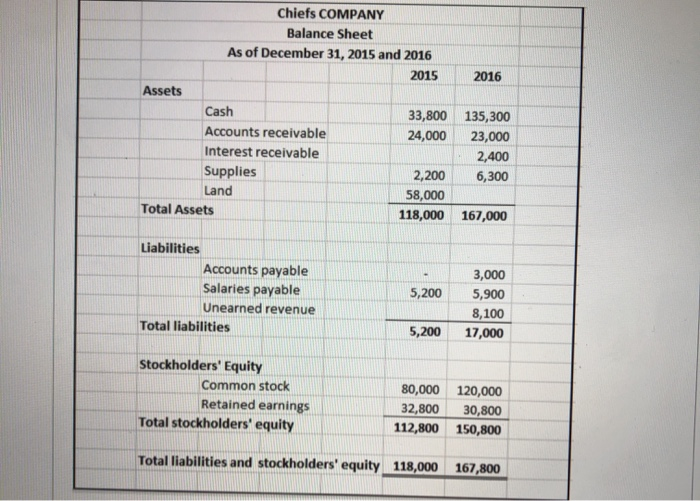

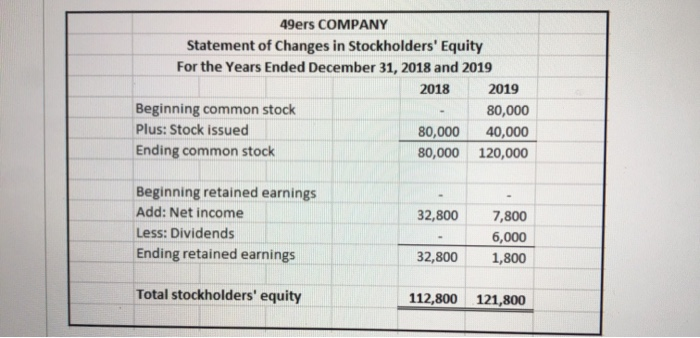

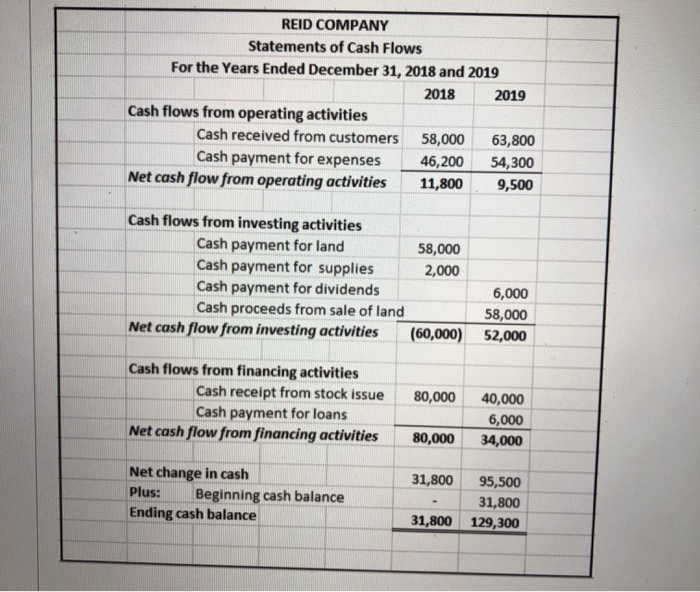

Please identify 5 errors in the following financial statements. Note: The 4 financial statements are for different companies. They are not related. You must clearly specify each financial statement name and its issue(s). Blazers Corporation Income Statement For the Years Ended December 31, 2016 and 2017 2016 2017 Service revenue 82,000 54,700 Total revenue 82,000 54,700 41,000 3,000 Expenses Operating expenses Supplies expenses Prepaid rent Salaries expenses Tcal expenses 39,500 2,900 5,900 8,000 56,300 44,000 Net Income(loss) 38,000 (1,600) 2016 Chiefs COMPANY Balance Sheet As of December 31, 2015 and 2016 2015 Assets Cash 33,800 Accounts receivable 24,000 Interest receivable Supplies 2,200 Land 58,000 Total Assets 118,000 135,300 23.000 2,400 6,300 167,000 Liabilities Accounts payable Salaries payable Unearned revenue Total liabilities 5,200 3,000 5,900 8,100 17,000 5,200 Stockholders' Equity Common stock Retained earnings Total stockholders' equity 80,000 32,800 112,800 120,000 30,800 150,800 Total liabilities and stockholders' equity 118,000 167,800 49ers COMPANY Statement of Changes in Stockholders' Equity For the Years Ended December 31, 2018 and 2019 2018 2019 Beginning common stock 80,000 Plus: Stock issued 80,000 40,000 Ending common stock 80,000 120,000 32,800 Beginning retained earnings Add: Net income Less: Dividends Ending retained earnings 7,800 6,000 1,800 32,800 Total stockholders' equity 112,800 121,800 REID COMPANY Statements of Cash Flows For the Years Ended December 31, 2018 and 2019 2018 2019 Cash flows from operating activities Cash received from customers 58,000 63,800 Cash payment for expenses 46,200 54,300 Net cash flow from operating activities 11,800 9,500 Cash flows from investing activities Cash payment for land 58,000 Cash payment for supplies Cash payment for dividends Cash proceeds from sale of land Net cash flow from investing activities (60,000) 6,000 58,000 52,000 80,000 Cash flows from financing activities Cash receipt from stock issue Cash payment for loans Net cash flow from financing activities 40,000 6,000 34,000 80,000 31,800 Net change in cash Plus: Beginning cash balance Ending cash balance 95,500 31,800 129,300 31,800