Answered step by step

Verified Expert Solution

Question

1 Approved Answer

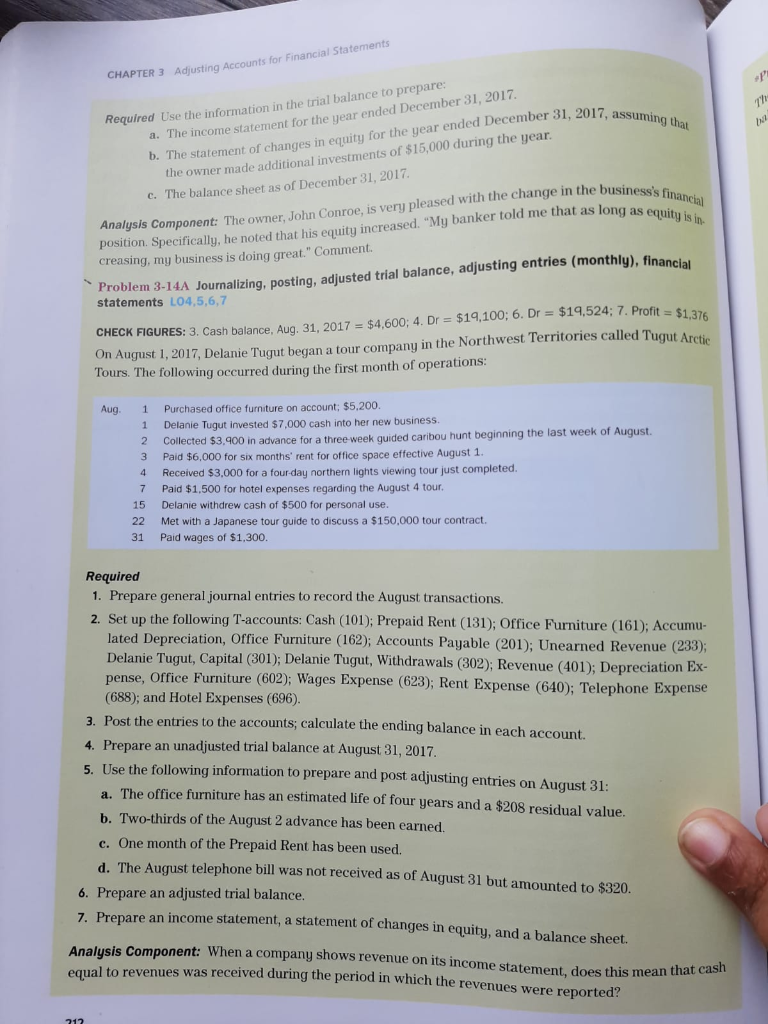

please include all steps CHAPTER 3 Adjusting Accounts for Financial Statements 2017, assuming that ha Required Use the information in the trial balance to prepare:

please include all steps

CHAPTER 3 Adjusting Accounts for Financial Statements 2017, assuming that ha Required Use the information in the trial balance to prepare: a. The income statement for the year ended December 31, 2017 b. The statement of changes in equity for the year ended December 31, 2017. a the owner made additional investments of $15,000 during the year. C. The balance sheet as of December 31, 2017 usiness's financial as long as equity is in Analysis Component: The owner, John Conroe, is very pleased with the change in the business position. Specifically, he noted that his equity increased. "My banker told me that as long as e creasing, my business is doing great." Comment. Problem 3-14A Journalizing, posting, adjusted trial balance, adjusting entries (monthly), financia statements L04,5,6,7 CHECK FIGURES: 3. Cash balance, Aug. 31, 2017 = $4,600; 4. Dr = $19,100; 6. Dr = $19,524; 7. Profit = $1 On August 1, 2017, Delanie Tugut began a tour company in the Northwest Territories called Tugut Art Tours. The following occurred during the first month of operations: Aug. 1 1 2 3 4 7 15 22 31 Purchased office furniture on account: $5,200. Delanie Tugut invested $7,000 cash into her new business. Collected $3.900 in advance for a three week quided caribou hunt beginning the last week of August. Paid $6,000 for six months' rent for office space effective August 1. Received $3,000 for a four-day northern lights viewing tour just completed. Paid $1,500 for hotel expenses regarding the August 4 tour. Delanie withdrew cash of $500 for personal use. Met with a Japanese tour guide to discuss a $150,000 tour contract. Paid wages of $1,300. Required 1. Prepare general journal entries to record the August transactions. 2. Set up the following T-accounts: Cash (101); Prepaid Rent (131): Office Furniture (161): Accumu- lated Depreciation, Office Furniture (162); Accounts Payable (201); Unearned Revenue (233); Delanie Tugut, Capital (301); Delanie Tugut, Withdrawals (302); Revenue (401); Depreciation Ex- pense, Office Furniture (602); Wages Expense (623); Rent Expense (640); Telephone Expense (688); and Hotel Expenses (696). 3. Post the entries to the accounts; calculate the ending balance in each account. 4. Prepare an unadjusted trial balance at August 31, 2017 5. Use the following information to prepare and post adjusting entries on August 31: a. The office furniture has an estimated life of four years and a $208 residual value. b. Two-thirds of the August 2 advance has been earned. c. One month of the Prepaid Rent has been used. d. The August telephone bill was not received as of August 31 but amounted to $320. 6. Prepare an adjusted trial balance. 7. Prepare an income statement, a statement of changes in equity, and a balance sheet. Analusis Component: When a company shows revenue on its income sta equal to revenues was received during the per to revenues was received during the period in which the revenues were reported? he statement, does this mean that cash 212Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started