Answered step by step

Verified Expert Solution

Question

1 Approved Answer

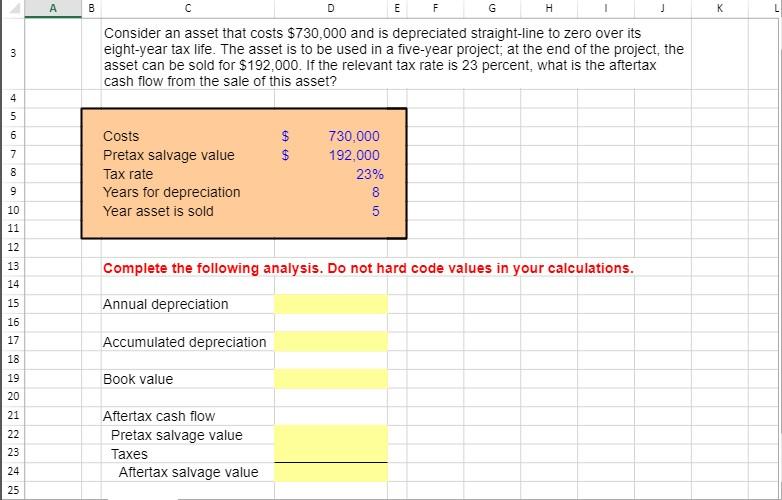

***PLEASE INCLUDE EXCEL FORMULAS FOR THUMBS UP. I'VE ADDED THE ROWS AND COLUMS FOR REFERENCE*** THANK YOU! A 00 E F G H K 3

***PLEASE INCLUDE EXCEL FORMULAS FOR THUMBS UP. I'VE ADDED THE ROWS AND COLUMS FOR REFERENCE*** THANK YOU!

A 00 E F G H K 3 Consider an asset that costs $730,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project, at the end of the project, the asset can be sold for $192.000. If the relevant tax rate is 23 percent, what is the aftertax cash flow from the sale of this asset? 4 5 6 000 $ $ 7 8 Costs Pretax salvage value Tax rate Years for depreciation Year asset is sold 730,000 192,000 23% 8 5 9 10 11 12 13 Complete the following analysis. Do not hard code values in your calculations. 14 15 Annual depreciation 16 17 Accumulated depreciation 18 19 20 Book value 21 22 23 Aftertax cash flow Pretax salvage value Taxes Aftertax salvage value 24 25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started