Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please journalize the folowing transactions. (using the flowing accounts) Central Perk Company owns a coffee distribution company. Record the transactions for the month of May

Please journalize the folowing transactions. (using the flowing accounts)

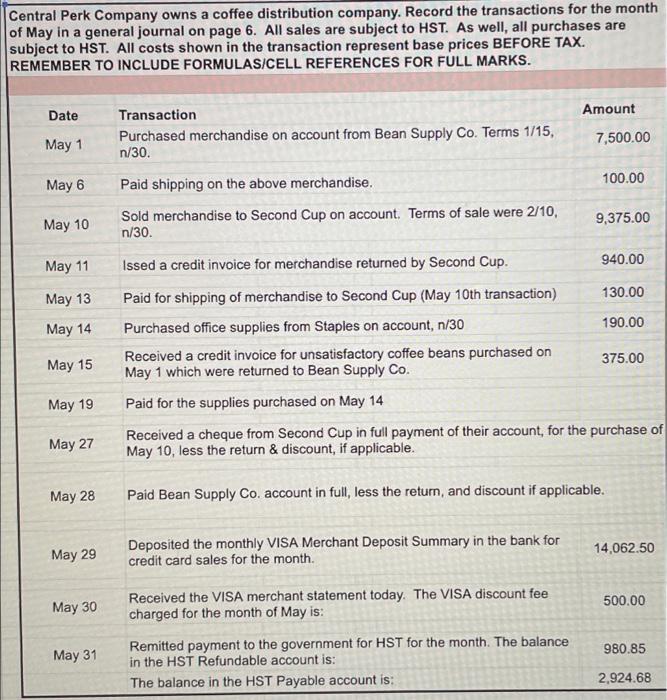

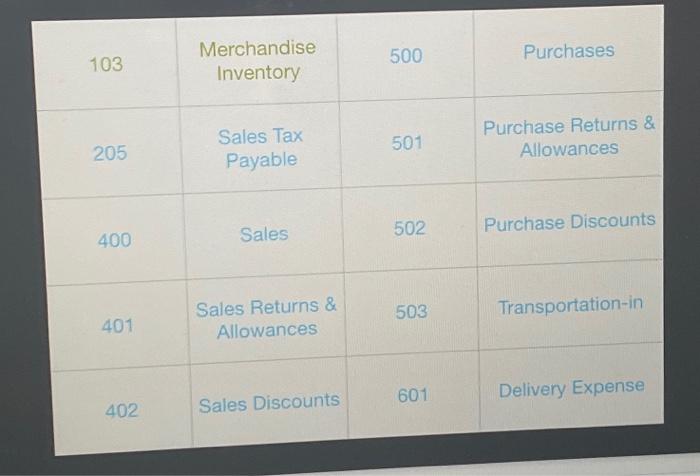

Central Perk Company owns a coffee distribution company. Record the transactions for the month of May in a general journal on page 6. All sales are subject to HST. As well, all purchases are subject to HST. All costs shown in the transaction represent base prices BEFORE TAX. REMEMBER TO INCLUDE FORMULAS/CELL REFERENCES FOR FULL MARKS. Date Transaction Amount 7,500.00 Purchased merchandise on account from Bean Supply Co. Terms 1/15, n/30. May 1 May 6 Paid shipping on the above merchandise. 100.00 May 10 Sold merchandise to Second Cup on account. Terms of sale were 2/10, n/30. 9,375.00 May 11 Issed a credit invoice for merchandise returned by Second Cup. 940.00 May 13 130.00 Paid for shipping of merchandise to Second Cup (May 10th transaction) Purchased office supplies from Staples on account, n/30 May 14 190.00 May 15 Received a credit invoice for unsatisfactory coffee beans purchased on May 1 which were returned to Bean Supply Co. 375.00 May 19 Paid for the supplies purchased on May 14 May 27 Received a cheque from Second Cup in full payment of their account, for the purchase of May 10, less the return & discount, if applicable. May 28 Paid Bean Supply Co. account in full, less the return, and discount if applicable. May 29 Deposited the monthly VISA Merchant Deposit Summary in the bank for credit card sales for the month. May 30 Received the VISA merchant statement today. The VISA discount fee charged for the month of May is: May 31 Remitted payment to the government for HST for the month. The balance in the HST Refundable account is: The balance in the HST Payable account is: 14,062.50 500.00 980.85 2,924.68 103 205 400 401 402 Merchandise Inventory Sales Tax Payable Sales Sales Returns & Allowances Sales Discounts 500 501 502 503 601 Purchases Purchase Returns & Allowances Purchase Discounts Transportation-in Delivery Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started