Answered step by step

Verified Expert Solution

Question

1 Approved Answer

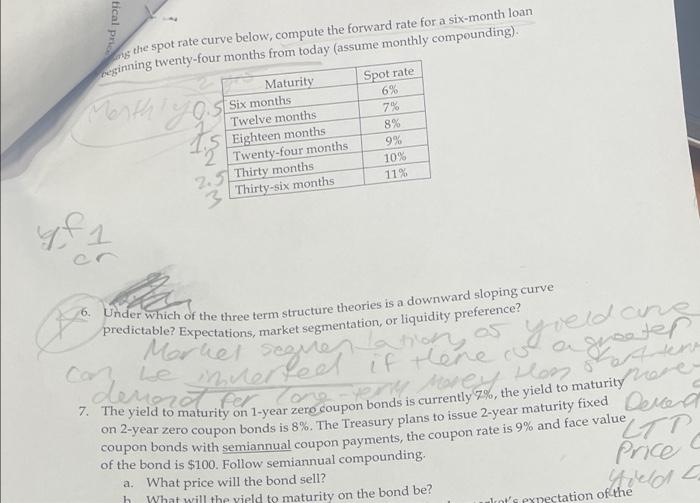

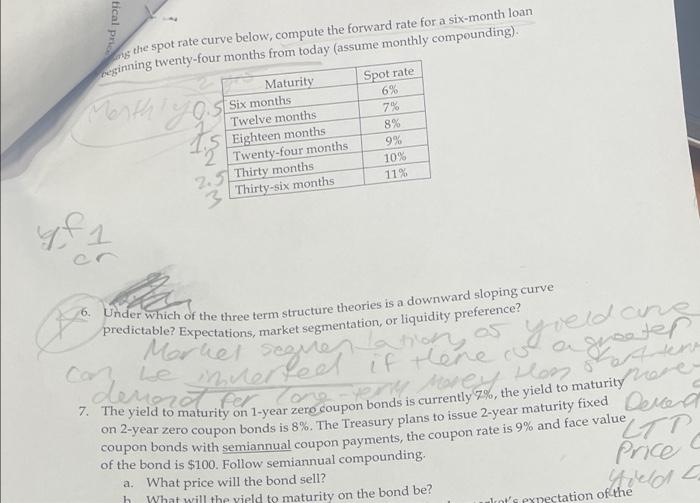

please just do 5 and 6, not 7 tical pre aus the spot rate curve below, compute the forward rate for a six-month loan reginning

please just do 5 and 6, not 7

tical pre aus the spot rate curve below, compute the forward rate for a six-month loan reginning twenty-four months from today (assume monthly compounding). Maturity Spot rate Six months 6% Twelve months 7% 5 Eighteen months 8% 2 Twenty-four months 9% Thirty months 10% 3 Thirty-six months Morth gost 11% yfi 6. Under Which of the three term structure theories is a downward sloping curve predictable? Expectations, market segmentation, or liquidity preference? yreldane can be muer denonton Lahlon Mornet stoel if there cue a grooter on 2-year zero coupon bonds is 8%. The Treasury plans to issue 2-year maturity fixed The vield to maturity on 1-year zero soupon bonds is currently12%, the yield to maturity vores coupon bonds with semiannual coupon payments, the coupon rate is 9% and face value " of the bond is $100. Follow semiannual compounding. Price a. What price will the bond sell? What will the yield to maturity on the bond be? of the da a b. let's expectation of the tical pre aus the spot rate curve below, compute the forward rate for a six-month loan reginning twenty-four months from today (assume monthly compounding). Maturity Spot rate Six months 6% Twelve months 7% 5 Eighteen months 8% 2 Twenty-four months 9% Thirty months 10% 3 Thirty-six months Morth gost 11% yfi 6. Under Which of the three term structure theories is a downward sloping curve predictable? Expectations, market segmentation, or liquidity preference? yreldane can be muer denonton Lahlon Mornet stoel if there cue a grooter on 2-year zero coupon bonds is 8%. The Treasury plans to issue 2-year maturity fixed The vield to maturity on 1-year zero soupon bonds is currently12%, the yield to maturity vores coupon bonds with semiannual coupon payments, the coupon rate is 9% and face value " of the bond is $100. Follow semiannual compounding. Price a. What price will the bond sell? What will the yield to maturity on the bond be? of the da a b. let's expectation of the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started