Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please kindly provide the missing values. thank you Seattle, Inc., planned and actually manufactured 260,000 units of its single product in 2017, its first year

Please kindly provide the missing values. thank you

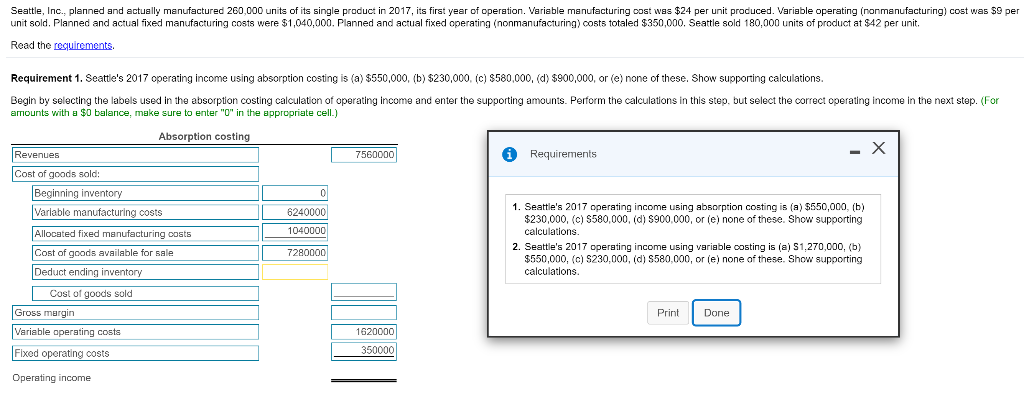

Seattle, Inc., planned and actually manufactured 260,000 units of its single product in 2017, its first year of operation. Variable manufacturing cost was $24 per unit produced. Variable operating inonmanufacturing) cost was $9 per unit sold. Planned and actual fixed manufacturing costs were $1,040,000. Planned and actual fixed operating (nonmanufacturing) costs totaled $350,000. Seattle sold 180,000 units of product at $42 per unit. Read the requirements Requirement 1. Seattle's 2017 operating income using absorption costing is (a) $550,000, (b) $230,000. (c) $580,000, (d) $900,000, or (e) none of these. Show supporting calculations. Begin by selecting the labels used in the absorption costing calculation of operating income and enter the supporting amounts. Perform the calculations in this step, but select the correct operating income in the next step. (For amounts with a $0 balance, make sure to enter "O" in the appropriate cell.) Absorption costing Revenues x 7560000 * Requirements Cost of goods sold: Beginning inventory Variable manufacturing costs 6240000 1. Seattle's 2017 operating income using absorption costing is (a) $550,000, (b) $230,000. (C) S580,000, (d) $900.000, or le) none of these. Show supporting Allocated fixed manufacturing costs 1040000 calculations. Cost of goods available for sale 7280000 2. Seattle's 2017 operating income using variable costing is (a) S1,270,000, (b) $550,000, (c) S230,000,(d) S580,000, or (e) none of these. Show supporting Deduct ending inventory calculations. Cost of goods sold Print Done Variable operating costs 1620000 Fixed operating costs 350000 Gross margin Operating incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started