please let me know what numbers to fill in.

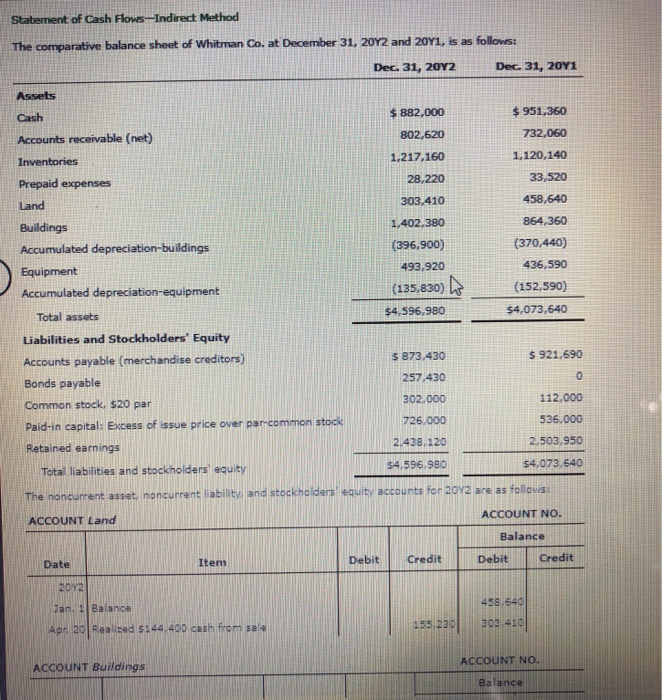

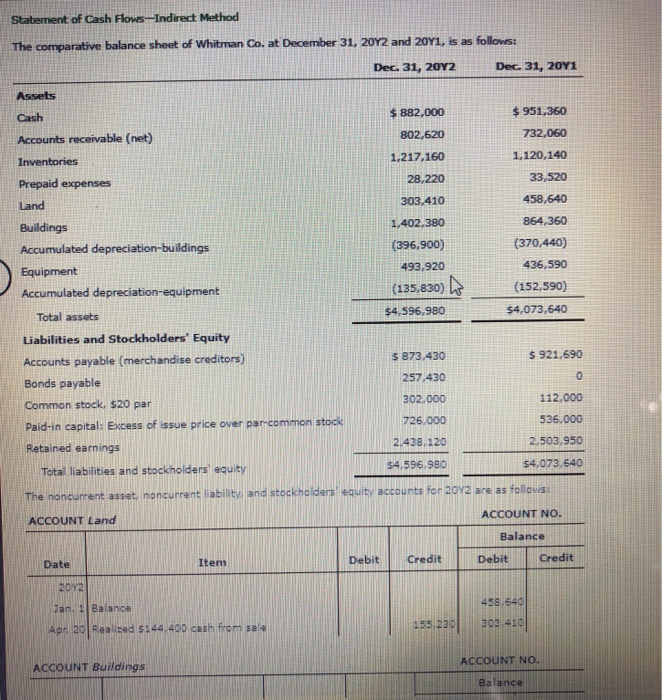

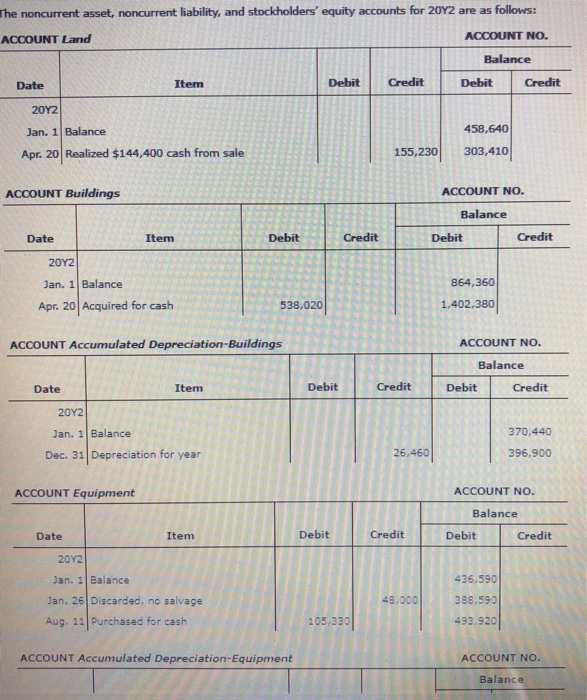

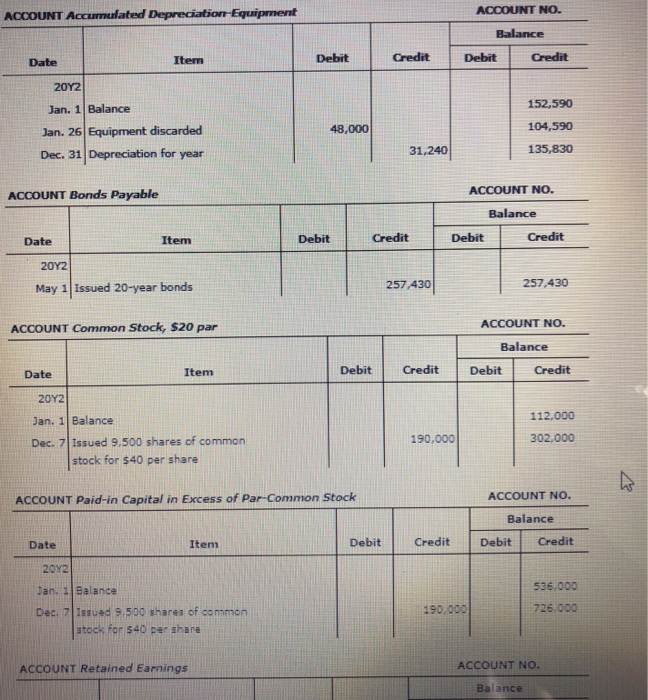

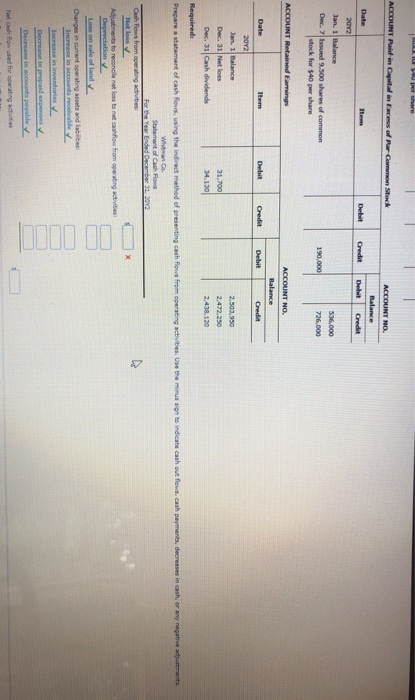

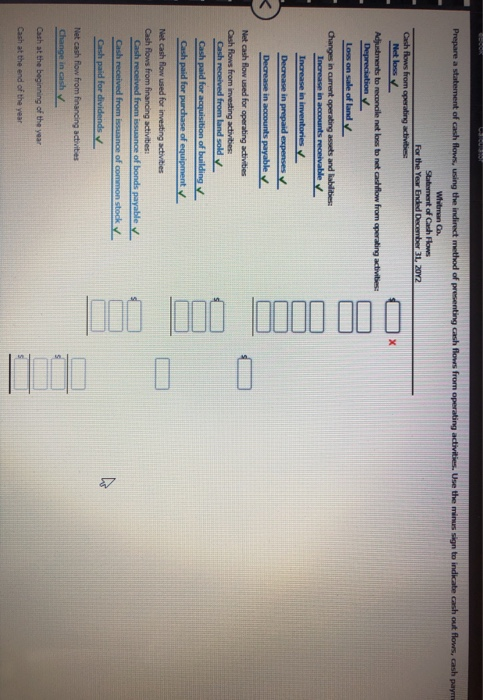

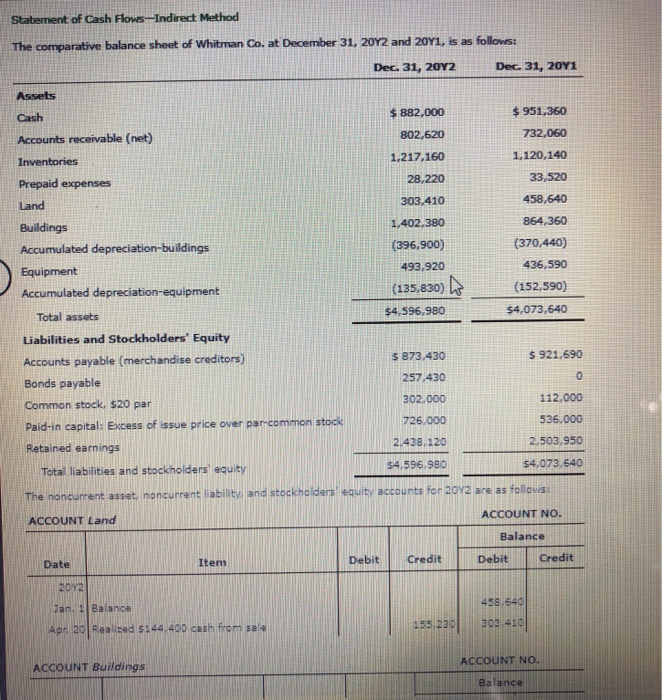

Statement of Cash Flows-Indirect Method The comparative balance sheet of Whitman Co. at December 31, 2012 and 2041, is as follows: Dec. 31, 2012 Dec. 31, 2011 Assets $ 951,360 Cash 732,060 Accounts receivable (net) $ 882,000 802,620 1,217,160 28,220 1,120,140 Inventories 33,520 303,410 458,640 1,402,380 864,360 Prepaid expenses Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment (396,900) 493,920 (135,830) W $4,596,980 (370,440) 436,590 (152,590) $4,073,640 $ 873.430 $921,690 257,430 0 Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Bonds payable Common stock, $20 par Paid-in capital: Excess of issue price over par common stock Retained earnings Total liabilities and stockholders equity 302.000 112.000 726.000 536.000 2.438.120 2.503.950 $4,596,980 $4.073.640 The noncurrent asset, noncurrent liability and stockholders equity accounts for 2012 are as follows: ACCOUNT NO. ACCOUNT Land Balance Date Item Debit Credit Debit Credit 2012 458.640 Jan 1 Balance Apr 20 Resized 5144 400 cash from sale 155.2001 303 410 ACCOUNT NO. ACCOUNT Buildings Balance The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 20Y2 are as follows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 458,640 Jan. 1 Balance Apr. 20 Realized $144,400 cash from sale 155,230 303,410 ACCOUNT Buildings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 Jan. 1 Balance 864,360 Apr. 20Acquired for cash 538,020 1,402,380 ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 Jan. 1 Balance 370,440 Dec. 31 Depreciation for year 26,460 396,900 ACCOUNT Equipment ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 436,590 Jan. 1 Balance Jan. 26 Discarded, no salvage Aug. 11 Purchased for cash 48,000 388,590 493,920 105,330 ACCOUNT Accumulated Depreciation-Equipment ACCOUNT NO. Balance ACCOUNT NO. ACCOUNT Accumulated Depreciation Equipment Balance Item Date Debit Credit Debit Credit 152,590 20Y2 Jan. 1 Balance Jan. 26 Equipment discarded Dec. 31 Depreciation for year 48,000 104,590 31,240 135,830 ACCOUNT Bonds Payable ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 257,430 257,430 May 1 Issued 20-year bonds ACCOUNT Common Stock, $20 par ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 112,000 Jan. 1 Balance Dec. 7 Issued 9.500 shares of common stock for 540 per share 190,000 302.000 ACCOUNT Paid-in Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 536.000 Jan, Balance Dec. 7 issued 9.500 shares of common stock for $40 per share 190,000 726,000 ACCOUNT Retained Earnings ACCOUNT NO. Balance Ihre ACCOUNT Pald-in Caitlin Excess of Rar Common Stock ACCOUNT NO. Balance Date Debut Credit Debat Credit 2012 lan. 1 Balance Dec. 7 Issued 9.500 shares of common stock for $40 per share 536,000 726,000 190.000 ACCOUNT Retained Earnings ACCOUNT NO Balance Debit Credit Date Item Debit Credit 2012 Jan. 1 Balance 2.503.950 Dec. 31 Netloss 31.700 2,472,250 Dec 31 Cash dividends 34.130 2.438.120 Required: Prepare a statement of cash flows, using the Indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustment Whitman Statement of Cash Flows Cash Flows from operating activities . Adjustments to reconcile nettons to net cash flow from rating activities Depreciation Loss on sale of land Changes in current operating and abilities Increase in controlable Increase in inventories Decrease in prepaid expenses Decrease in capable et cash flowed for operating activities Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash paym Wat C Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities Met loss Adjustments to reconcile net loss to net cash flow from operating activities: Depreciation Loss on sale of land Changes in current operating assets and abilities: Increase in accounts receivable Increase in inventories Decrease in prepaid expenses Decrease in accounts payable y Net cash flow used for operating activities Cash flows from investing activities Cash received from and sold Cash paid for acquisition of building Cash paid for purchase of equipment O II bill Q 100 Net cash flow used for investing activities Cash flows from financing activities Cash received from issuance of bonds payable Cash received from issuance of common stock Cash paid for dividends Net cash flow from financing activities Change in cash Cash at the beginning of the year Cash at the end of the year