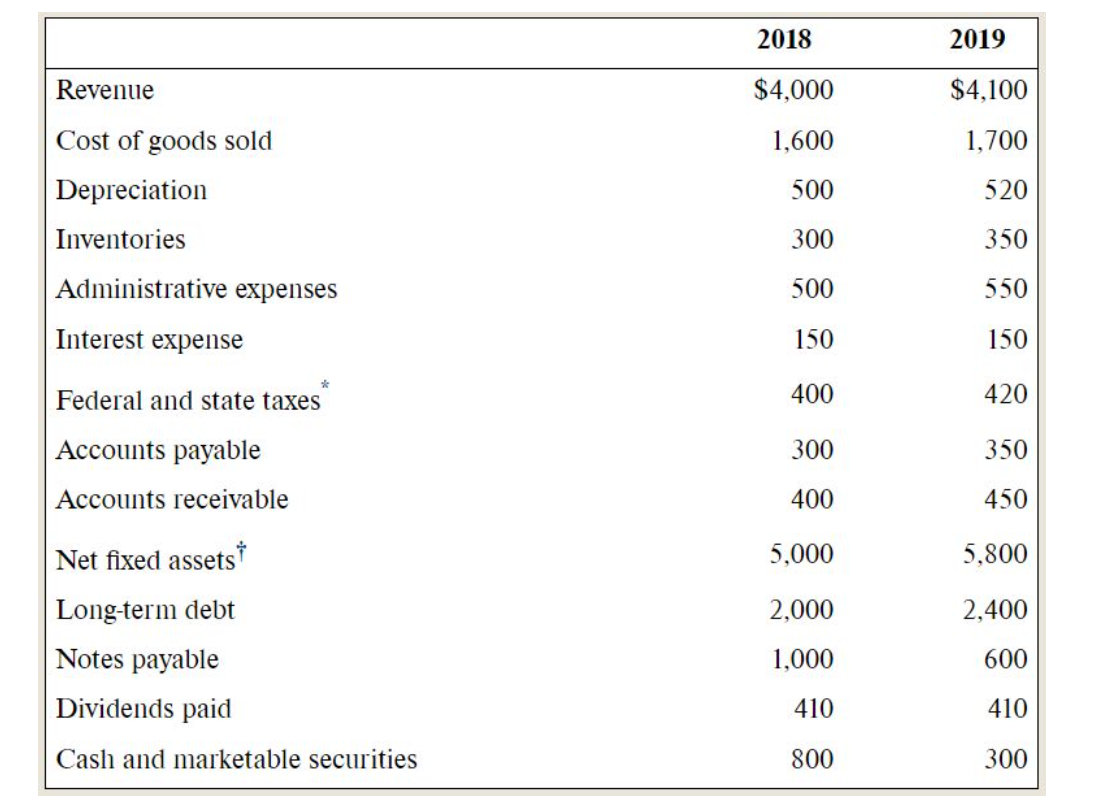

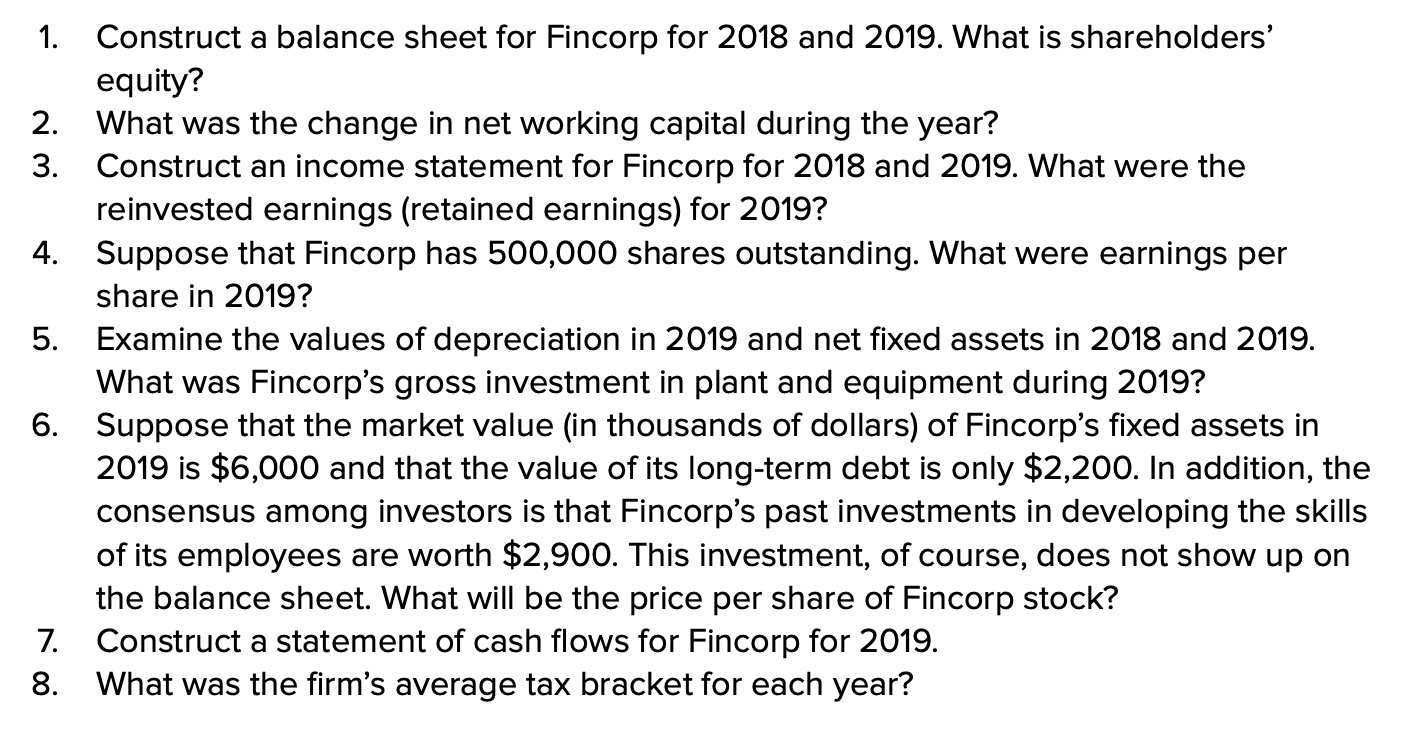

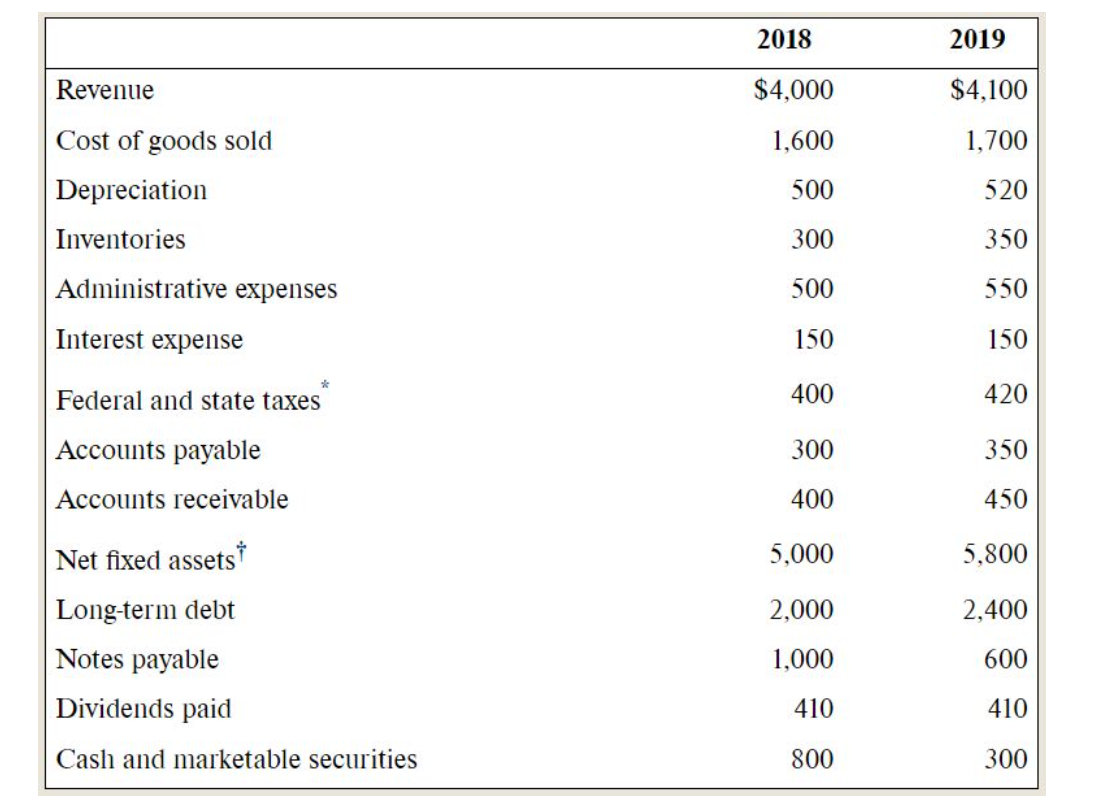

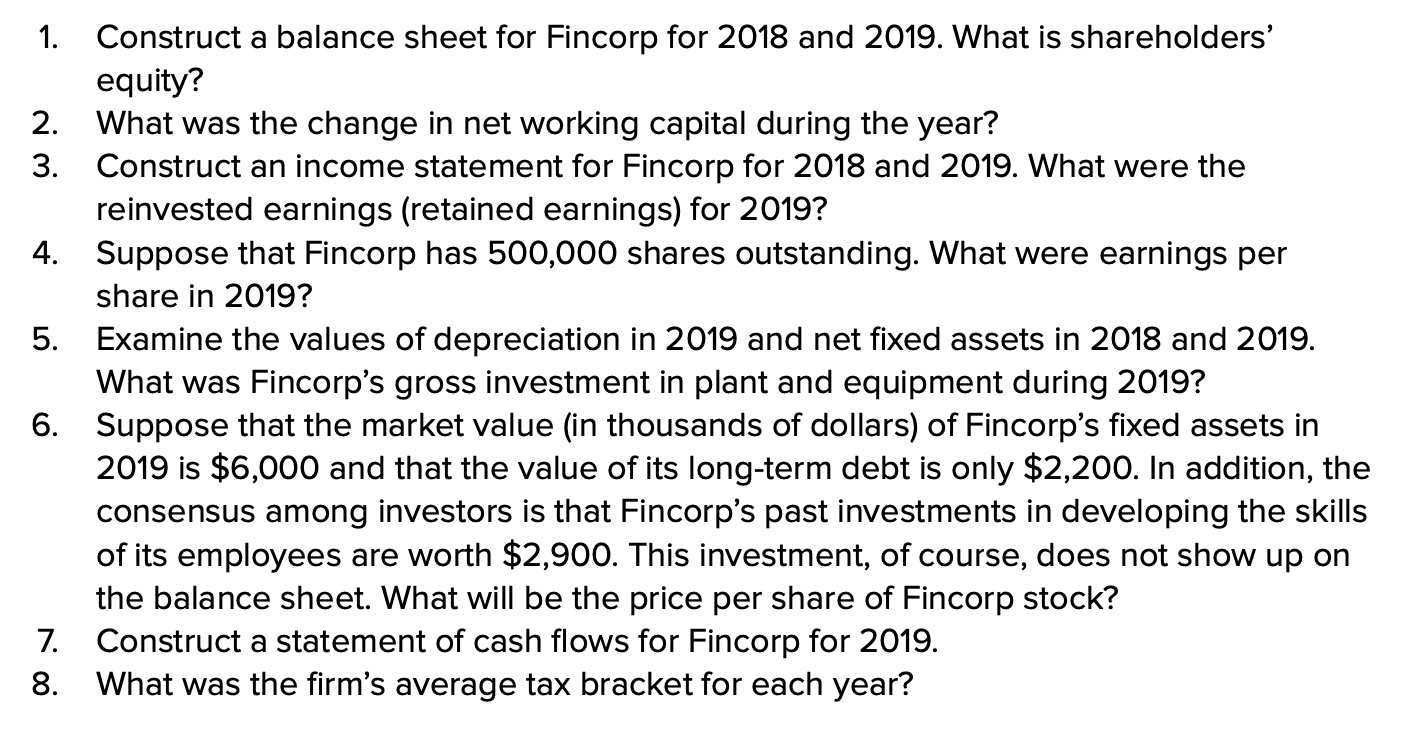

The table in the next page contains data on Fincorp Inc. that you should use for problems that follow. The balance sheet corresponds to values at year-end 2018 and 2019, while the income statement items correspond to revenues or expenses during the year ending in either 2018 or 2019 . All values are in thousands of dollars. \begin{tabular}{|lrr|} \hline & 2018 & 2019 \\ \hline Revenue & $4,000 & $4,100 \\ Cost of goods sold & 1,600 & 1,700 \\ Depreciation & 500 & 520 \\ Inventories & 300 & 350 \\ Administrative expenses & 500 & 550 \\ Interest expense & 150 & 150 \\ Federal and state taxes & 400 & 420 \\ Accounts payable & 300 & 350 \\ Accounts receivable & 400 & 450 \\ Net fixed assets & 5,000 & 5,800 \\ Long-term debt & 2,000 & 2,400 \\ Notes payable & 1,000 & 600 \\ Dividends paid & 410 & 410 \\ Cash and marketable securities & 800 & 300 \\ \hline \end{tabular} 1. Construct a balance sheet for Fincorp for 2018 and 2019. What is shareholders' equity? 2. What was the change in net working capital during the year? 3. Construct an income statement for Fincorp for 2018 and 2019. What were the reinvested earnings (retained earnings) for 2019? 4. Suppose that Fincorp has 500,000 shares outstanding. What were earnings per share in 2019? 5. Examine the values of depreciation in 2019 and net fixed assets in 2018 and 2019. What was Fincorp's gross investment in plant and equipment during 2019 ? 6. Suppose that the market value (in thousands of dollars) of Fincorp's fixed assets in 2019 is $6,000 and that the value of its long-term debt is only $2,200. In addition, the consensus among investors is that Fincorp's past investments in developing the skills of its employees are worth $2,900. This investment, of course, does not show up on the balance sheet. What will be the price per share of Fincorp stock? 7. Construct a statement of cash flows for Fincorp for 2019. 8. What was the firm's average tax bracket for each year? The table in the next page contains data on Fincorp Inc. that you should use for problems that follow. The balance sheet corresponds to values at year-end 2018 and 2019, while the income statement items correspond to revenues or expenses during the year ending in either 2018 or 2019 . All values are in thousands of dollars. \begin{tabular}{|lrr|} \hline & 2018 & 2019 \\ \hline Revenue & $4,000 & $4,100 \\ Cost of goods sold & 1,600 & 1,700 \\ Depreciation & 500 & 520 \\ Inventories & 300 & 350 \\ Administrative expenses & 500 & 550 \\ Interest expense & 150 & 150 \\ Federal and state taxes & 400 & 420 \\ Accounts payable & 300 & 350 \\ Accounts receivable & 400 & 450 \\ Net fixed assets & 5,000 & 5,800 \\ Long-term debt & 2,000 & 2,400 \\ Notes payable & 1,000 & 600 \\ Dividends paid & 410 & 410 \\ Cash and marketable securities & 800 & 300 \\ \hline \end{tabular} 1. Construct a balance sheet for Fincorp for 2018 and 2019. What is shareholders' equity? 2. What was the change in net working capital during the year? 3. Construct an income statement for Fincorp for 2018 and 2019. What were the reinvested earnings (retained earnings) for 2019? 4. Suppose that Fincorp has 500,000 shares outstanding. What were earnings per share in 2019? 5. Examine the values of depreciation in 2019 and net fixed assets in 2018 and 2019. What was Fincorp's gross investment in plant and equipment during 2019 ? 6. Suppose that the market value (in thousands of dollars) of Fincorp's fixed assets in 2019 is $6,000 and that the value of its long-term debt is only $2,200. In addition, the consensus among investors is that Fincorp's past investments in developing the skills of its employees are worth $2,900. This investment, of course, does not show up on the balance sheet. What will be the price per share of Fincorp stock? 7. Construct a statement of cash flows for Fincorp for 2019. 8. What was the firm's average tax bracket for each year