Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please make final answers clear Assume the same information as in the previous question. A two-year, $1,000 (i.e., face value) bond that pays an annual

please make final answers clear

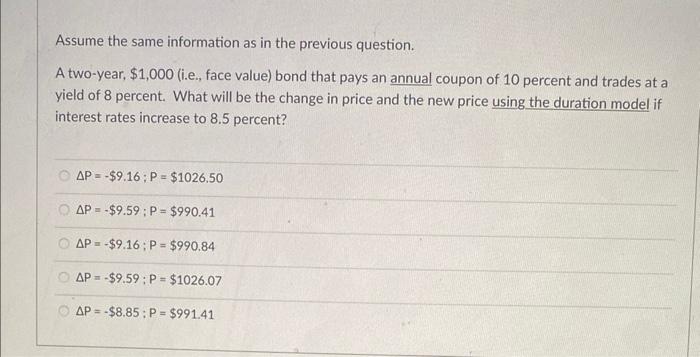

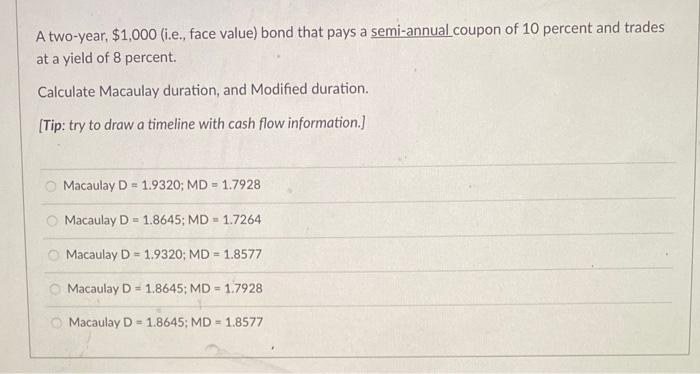

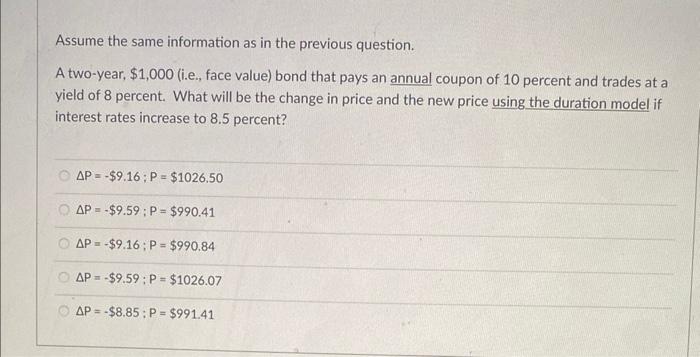

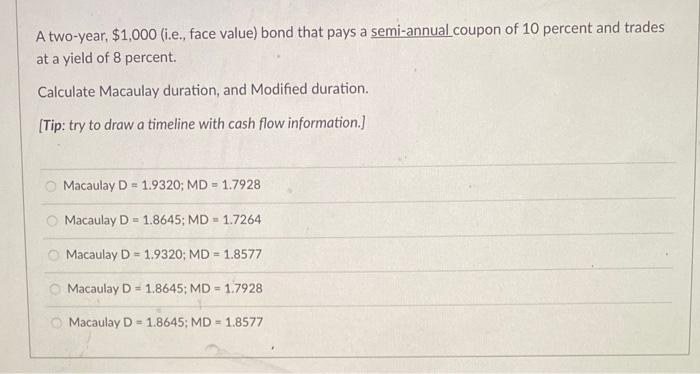

Assume the same information as in the previous question. A two-year, $1,000 (i.e., face value) bond that pays an annual coupon of 10 percent and trades at a yield of 8 percent. What will be the change in price and the new price using the duration model if interest rates increase to 8.5 percent? P=$9.16;P=$1026.50P=$9.59;P=$990.41P=$9.16;P=$990.84P=$9.59;P=$1026.07P=$8.85;P=$991.41 A two-year, $1,000 (i.e., face value) bond that pays a semi-annual coupon of 10 percent and trades at a yield of 8 percent. Calculate Macaulay duration, and Modified duration. [Tip: try to draw a timeline with cash flow information.] Macaulay D=1.9320;MD=1.7928 Macaulay D=1.8645;MD=1.7264 Macaulay D=1.9320;MD=1.8577 Macaulay D=1.8645;MD=1.7928 Macaulay D=1.8645;MD=1.8577

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started