Please make organized and clear (Label 1-7) provide explanations for answers if applicable . Thanks you !

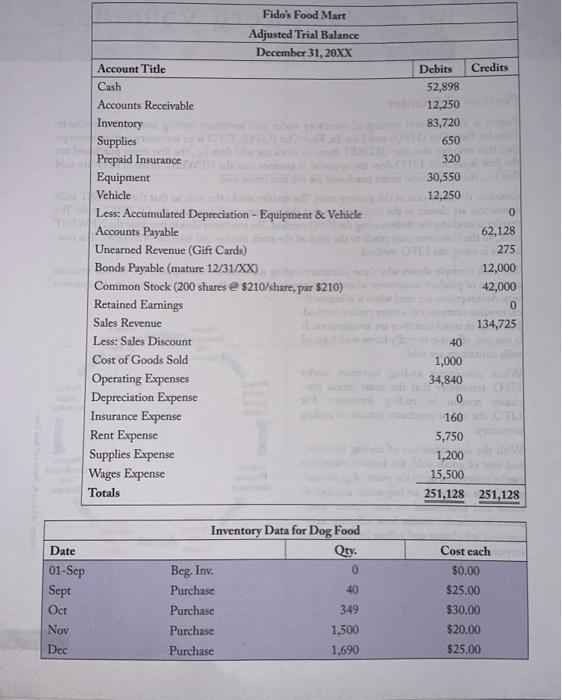

Credits Debits 52,898 12,250 83,720 650 320 30,550 12,250 Fido's Food Mart Adjusted Trial Balance December 31, 20XX Account Title Cash Accounts Receivable Inventory Supplies Prepaid Insurance Equipment Vehicle Less: Accumulated Depreciation - Equipment & Vehicle Accounts Payable Unearned Revenue (Gift Cards) Bonds Payable (mature 12/31/XX) Common Stock (200 shares @ $210/share, par $210) Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses Depreciation Expense Insurance Expense Rent Expense Supplies Expense Wages Expense Totals 62,128 275 12,000 42,000 0 134,725 40 1,000 34,840 RE 160 5,750 1,200 15,500 251,128 251,128 Inventory Data for Dog Food Qty. Beg. Inv. 0 Date 01-Sep Sept Oct Nov 40 Cost each $0.00 $25.00 $30.00 $20.00 $25.00 Purchase Purchase Purchase Purchase 349 1,500 1,690 Dec Project #6: Inventory Valuation 33 Fido, the owner's dog, ate some papers! Later, it was discovered that those were accounting records for the perpetual inventory system. Because the dog ate the records for the perpetual method, they have to resort to using a periodic method of inventory costing. A physical count showed 835 bags remaining in inventory Required: 1. Calculate cost of good available for sale. 2. Compute ending inventory and cost of goods sold using the FIFO method of inventory. 3. Compute ending inventory and cost of goods sold using the LIFO method of inventory. 4. Prepare T-Accounts showing your method of choice. 5. Prepare a new Adjusted Trial Balance using the inventory method that provides the highest cost of goods sold and highlight the accounts and amounts changed. 6. Write a full sentence statement explaining why the accountant would recommend using the inventory method that results in the highest cost of goods sold. 7. Complete a partial Multistep Income Statement up through Gross Margin. (NOTE: This is an expanded format. See examples.) FIFO First In, First Out LIFO Lost In, First Out STORAGE Castephan/Shutterstock.com STORAGE Othetenta Income Statement (multi-step) Revenue Less: Cost of Goods Sold Gross Margin (Gross Margin shows how effective management is at buying and selling its products or services). Less: Operating Expenses Net Income From Operations (Net Income shows how well management controls operating expenses)